Funding infusion in the startup ecosystem surged 2.4x this week compared to the previous seven days. Of 39 startups which scooped up $240 million cumulatively this week, 29 deals belonged to the early stage startups. Remaining eight deals went to growth stage startups. Two startups did not disclose the amount it raised.

Last week, 13 early and growth stage startups collectively raised around $84.5 million, including two undisclosed deals.

[Growth-stage deals]

This week, eight growth startups raised nearly $140 million funding. Electric vehicle manufacturer River spearheaded the lot with $40 million fundraise followed by real estate consultancy firm Anarock and clean energy firm Lohum which raised $24 million and $23 million B funding, respectively.

E-commerce roll-up firm GlobalBees and electric vehicle financing platform Mufin Green Finance also raised notable funding to make it to the top five deals.

Agritech startup BigHaat, vernacular news aggregator DailyHunt’s parent Verse Innovation and D2C apparel brand Bombay Shirt Company also raised capital this week.

[Early-stage deals]

Among the early-stage startups, 29 startups secured funding worth $100 million. Smart home automation firm Keus is on top of the list with a $12 million fundraise followed by two-wheeler electric vehicle finance platform OTO, biotechnology startup Pandorum, creator-focused commerce startup Wishlink and office space provider DevX.

The list further includes SaaS startup Attentive, EV firm Vidyut, cleantech company Metafin, healthtech entity Khyaal and home appliance firm Upliance.ai.

During the week, the manufacturer of reusable rockets that bring both the stages of the rocket back into earth, EtherealX and digital infrastructure innovations startup PlanckDOT also raised capital but did not disclose the funding amount. For more information, visit TheKredible.

[City and segment-wise deals]

In terms of city-wise number of funding deals, Bengaluru-based startups again led the list with 12 deals. This was followed by Mumbai, Delhi-NCR, and Chennai. Pune, Hyderabad, Ahmedabad, Kolkata, Vadodara, Navi Mumbai and Thane are next on the list.

The complete breakdown of the city and segment can be found at TheKredible.

[Series wise deals]

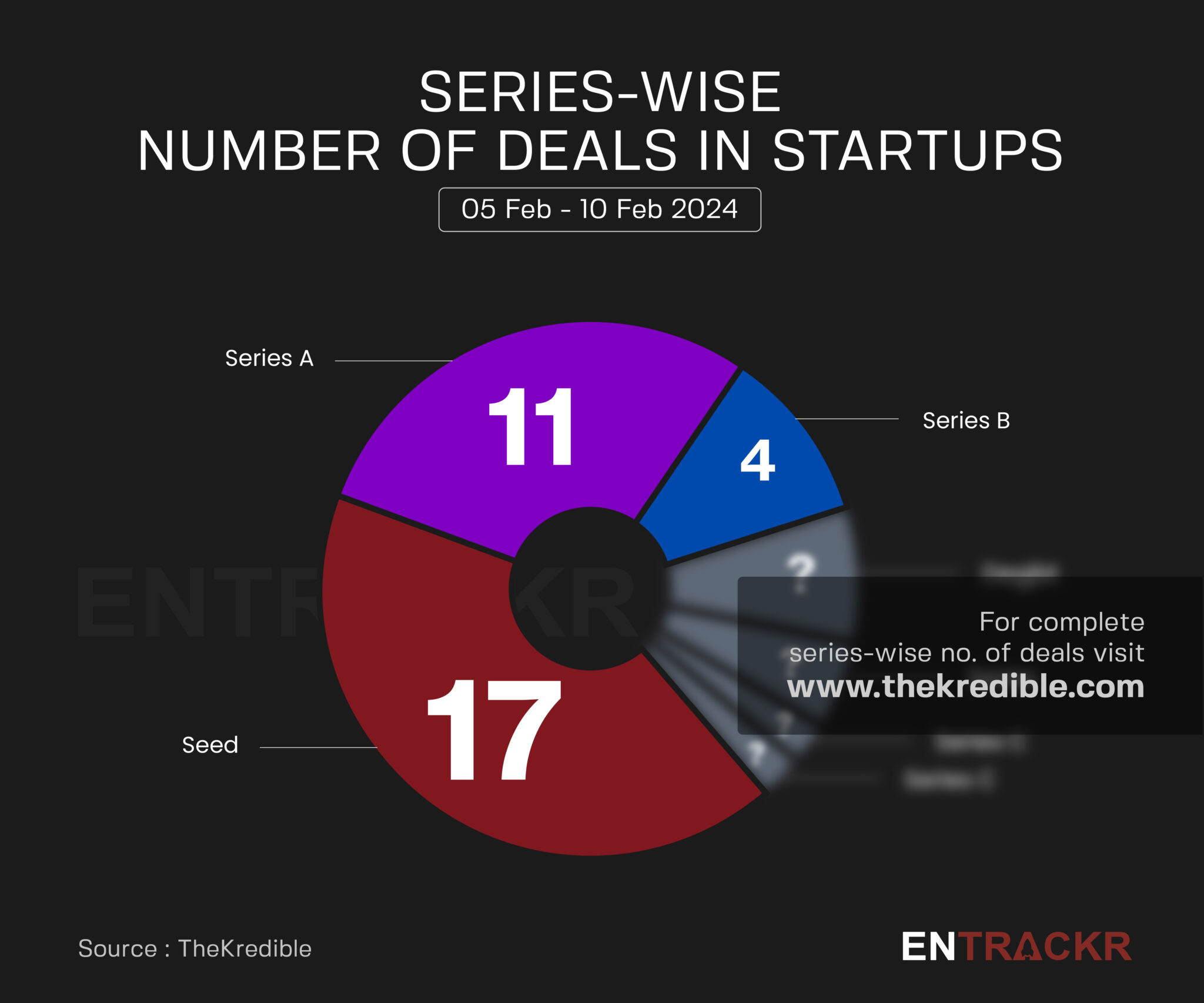

This week, equivalent to 17 startups raised funding in their seed round followed by Series A (11) and Series B (4) deals. The list also counts debt, pre-Series A, Series C and pre-Series C funding deals.

[Week-on-week funding trend]

On a weekly basis, startup funding soared 184% to $240 million as compared to $84.5 million in the previous week.

The average funding in the last eight weeks stands around $251 million with 24 deals per week.

[Departures]

The week also saw a few notable departures. Ather Energy’s CFO Deepak Jain is departing the company, with Sohil Parekh taking over his role. Swiggy’s independent director Mallika Srinivasan has resigned after a year, and Freshworks’ CRO Pradeep Rathinam is stepping down after almost four years, to be succeeded by Abe Smith as the new global field operations leader. Shinjini Kumar and Manju Agarwal have reportedly quit Paytm’s payments bank board.

[Fund launches]

Cactus Venture Partners (CVP) closed its first fund at over Rs 630 crore, while GrowthCap Ventures, led by former BharatPe executive Pratekk Agarwaal, has reached the first close of its debut fund at Rs 20 crore. Additionally, Orient Growth Ventures has closed its second fund for India and Southeast Asia (SEA) at $90 million.

[Layoffs/Shutdown]

This week, Licious and Blissclub laid off a part of their workforce, affecting 3% and 18% of employees respectively. Meanwhile, Muvin shut down operations due to RBI regulations on UPI co-branding.

[Merger & Acquisition]

The week also witnessed six M&A deals including the acquisition of Spartan Poker by OneVerse, Kuvera by CRED, LotusPay by Juspay, and Qdigi Services by Onesitego. Healthtech firm Thyrocare and logistics firm Deliver.sg also joined the list with the acquisitions of Think Health Diagnostics and BusyBee, respectively.

Visit TheKredible to see series wise deals and amount breakup, complete details of fund launches, departures and more insights.

[New launches]

▪️ Cleartrip launches Out of Office to foray into the corporate travel space

▪️ Meesho launches logistics marketplace Valmo

▪️ Flipkart introduces 3-hour fresh flower delivery service

[Financial results this week]

▪️ Leverage Edu revenue spikes 3.2X to Rs 69 Cr in FY23

▪️ Infra.Market posts Rs 11,846 Cr gross revenue in FY23; remains profitable

▪️ FabHotels reports Rs 219 Cr revenue and Rs 5 Cr loss in FY23

▪️ Chingari crosses Rs 100 Cr revenue in FY23; losses decline 70%

▪️ Hike’s revenue soars 8X to Rs 150 Cr in FY23; losses up 24%

▪️ Zomato posts Rs 3,288 Cr revenue and Rs 138 Cr profit in Q3 FY24

[News flash this week]

▪️ Vanguard marks down Ola’s valuation to $1.88 Bn

▪️ Zoho, Juspay, Decentro get RBI nod for payment aggregator biz

▪️ Orios Venture gets 45X returns in a partial exit from Country Delight

[Entrackr’s analysis]

Evident from the numbers, weekly funding has made a strong comeback with investments worth nearly $240 million. The back-to-back startup focused fund announcements also hint at the optimism in the Indian startup ecosystem. Continuous layoffs and business closures, however, give a hard reality check to the sector, which is trying to recover from the so-called funding winter.

US-based asset management company Vanguard has marked down Ola’s valuation, pegging it at less than $2 billion. This marks the third consecutive devaluation of Ola by Vanguard since February 2023.

Meanwhile, several prominent players have secured payment aggregator licenses from the central bank. This includes SaaS unicorn Zoho and fintech firms Juspay and Decentro.

Additionally, early-stage venture capital firm Orios Venture Partners took a partial exit from dairy startup Country Delight with a 45X return on the firm’s initial investment.

In a positive development, publicly traded companies such as Zomato, MamaEarth, and Nykaa have persistently remained in green, indicating their steady progress towards evolving into sustainable enterprises.