After years of stagnant growth and change in business, Hike posted a notable increase in its scale in the last fiscal year. Hike’s Rush Gaming Universe (RGU)—which hosts multiple skill-based casual games—grew nearly 8X and crossed the Rs 150 crore revenue mark in FY23. The firm’s losses, however, also stood close to Rs 150 crore in the same period.

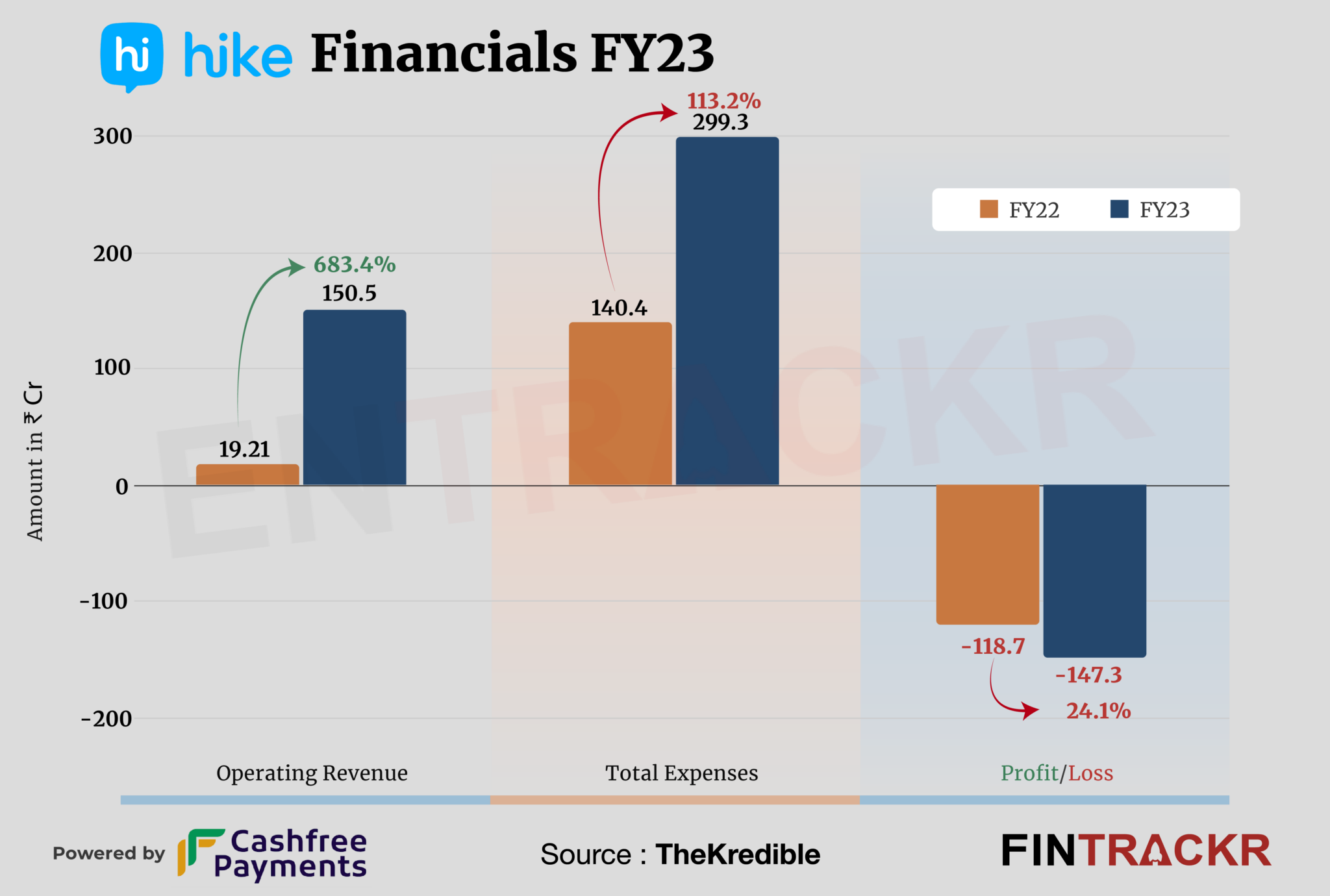

Hike’s revenue from operations skyrocketed 7.8X to Rs 150.5 crore during the fiscal year ending March 2023 as opposed to Rs 19.21 crore in FY22, according to its standalone financial statement with the RoC.

Hike generates revenue from commission on entry fees, winning amount and membership fees for joining the application as a VIP member.

Previously, Hike used to be a P2P messaging application but in January 2021 it shut down the product and switched to a different domain by introducing two new platforms Vibe and Rush. Vibe is a social media platform to watch videos together whereas Rush is a real money skill-based gaming platform which hosts multiple casual games.

The company also earned Rs 1.4 crore via interest and gain on investments and other non-operating income during the year. Including these, its overall revenue reached nearly Rs 152 crore in FY23.

As per startup data intelligence platform TheKredible, marketing expenses emerged as the largest cost element for Hike which grew 4X to Rs 142.65 crore in FY23 from Rs 35.86 crore in FY22.

Its employee benefit expenses accounted for 35% of the total expenditure and went up 46.2% to Rs 104.42 crore in FY23. Importantly, this cost also includes employee share based payment (settled in equity) of Rs 26.71 crore.

Due to the GST crackdown on real money gaming companies coupled with a challenging funding environment, Hike’s Rush Gaming Universe (RGU) had fired around 55 people or 22% of the total workforce.

Expense Breakdown

https://thekredible.com/company/hike/financials

View Full Data

https://thekredible.com/company/hike/financials

View Full Data

Hike’s expenses on server, information technology consultancy, payment gateway and other overheads catalyzed its total expenditure by over 2X to Rs 299.3 crore in FY23 as compared to Rs 140.4 crore in FY22.

Visit TheKredible for complete expense breakdown and YoY performance.

Despite rising expenses, the company’s losses didn’t increase at that pace. Its losses increased 24% to Rs 147.3 crore during FY23 as compared to Rs 118.7 crore in FY22. Moreover, its outstanding losses mounted to Rs 1,923 crore in the last fiscal year.

Hike’s cash outflows from operations, however, declined by 9.5% to Rs 94.5 crore during FY23. Its EBITDA margin improved to -93.92% during the year which can be ascribed to the rising scale.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | -525% | -93.92% |

| Expense/₹ of Op Revenue | ₹7.31 | ₹1.99 |

| ROCE | -61.20% | -136.21% |

On a unit level, the firm spent Rs 1.99 to earn a rupee of operating revenue in FY23.

Hike turned unicorn in 2016 when Temasek led a $175 million funding round at a $1.4 billion valuation. In January 2021, it shut down its chat services to enter the real money skill-based gaming space.

Since then, it has raised three undisclosed funding rounds from various investors. Its last funding round came in May 2022 led by Web3 investor Jump Crypto to develop Rush Gaming Universe (RGU) — a web3 based social gaming metaverse.

Hike’s efforts to find a perfect fit seem to have paid off as the company generated a healthy revenue — even though it took a long time to get there. The company’s losses, however, are still a point of concern.