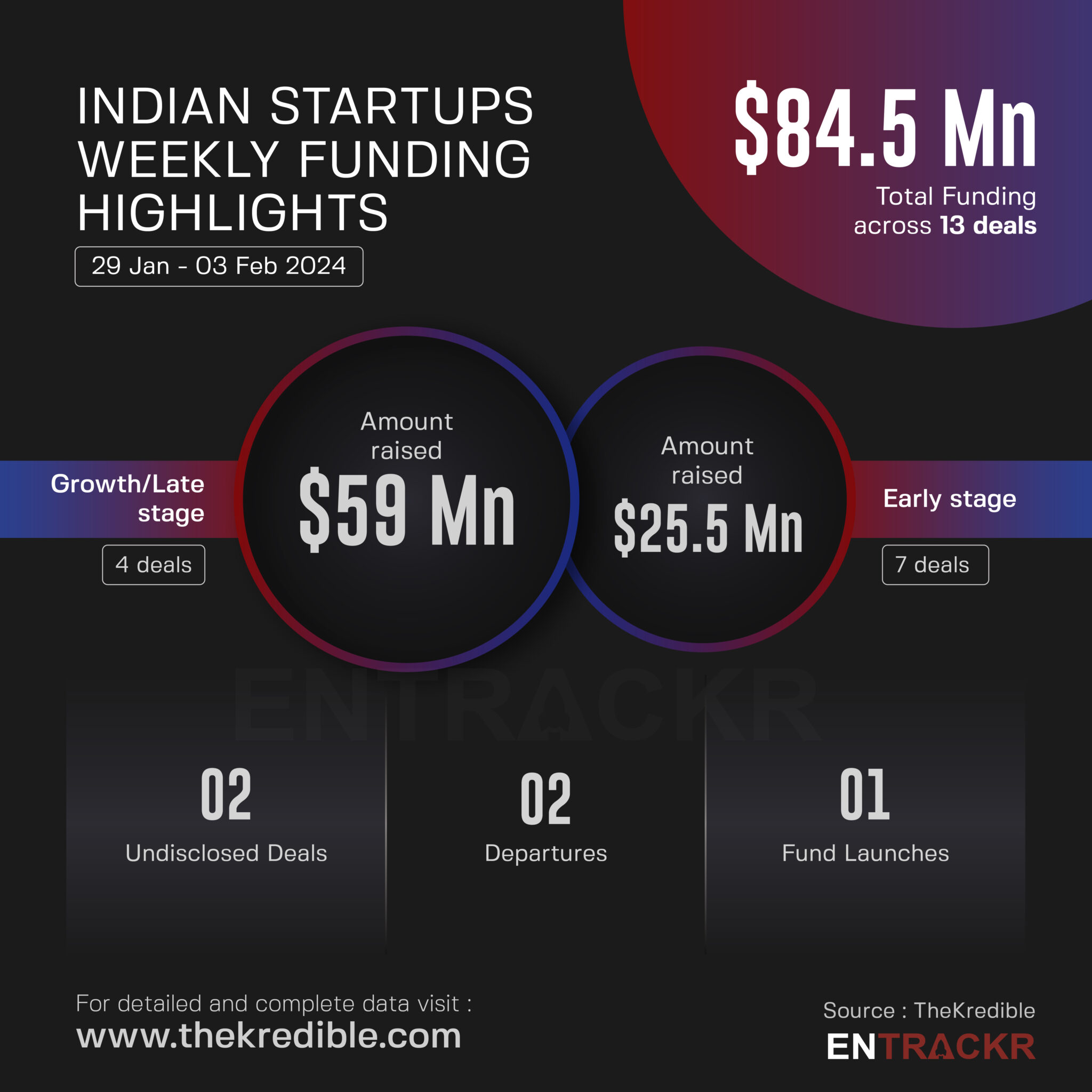

After the continuous rise in funding inflow for four weeks, the weekly funding again fell under $100 million. This week as many as 13 Indian startups raked in $84.5 million cumulatively. These transactions include four growth-stage and seven early-stage deals. The amount raised by two startups was undisclosed.

Last week, around 22 growth and early stage startups collectively raised around $249 million, including five undisclosed deals.

[Growth-stage deals]

EV ride-hailing service provider BluSmart led the pack this week with $25 million fundraise followed by warehousing and shipping management firm Wiz Freight with its $15 million Series B funding

Provider of cab-hailing services to enterprises MoveInSync also raised $15 million while aquaculture platform Aquaconnect secured $4 million from S2G Ventures.

During the week, retailer-focused digital inventory platform Arzooo and D2C consumer electronics company boAt also raised capital but did not disclose the funding amount.

[Early-stage deals]

Among the early-stage startups, seven startups got investments worth $25.5 million. Agri-marketplace Grow Indigo topped with $8 million. This was followed by AI-based security startup P0, EV asset management and leasing startup Electrifi Mobility, Asset Management company Black Opal Group (JustHomz) and Molecular testing startup Algorithmic Biologics (AlgoBio).

Further, the list includes new-age ad tracking and fraud detection platform ClearTrust and D2C sustainable baby essential startup Moms Home. For more information, visit TheKredible.

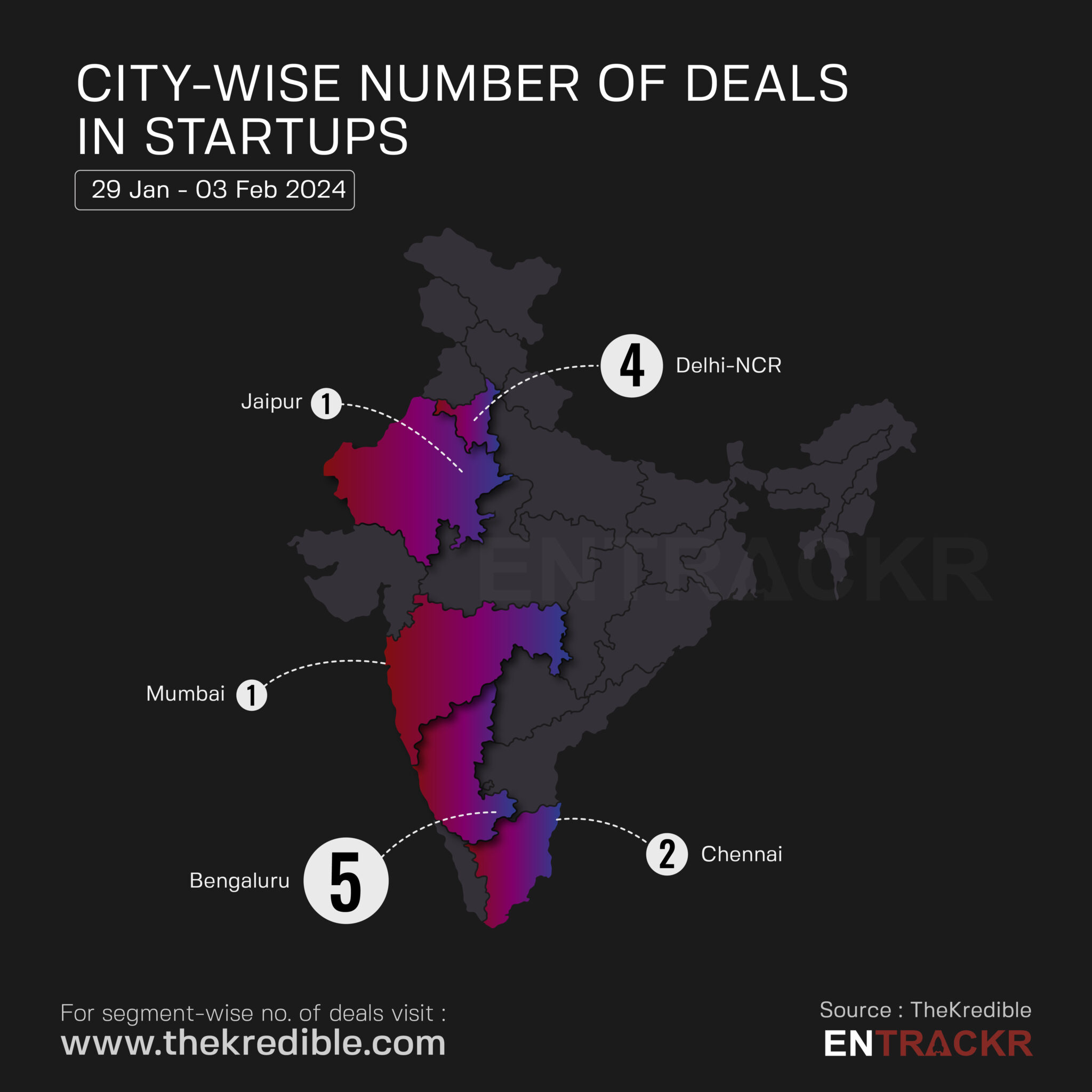

[City and segment-wise deals]

In terms of city-wise number of funding deals, Bengaluru-based startups spearheaded the list with five deals. This was followed by Delhi-NCR, Chennai, Mumbai and Jaipur-based startups with 4, 2, 1 and 3 deals, respectively.

The complete breakdown of the city and segment can be found at TheKredible.

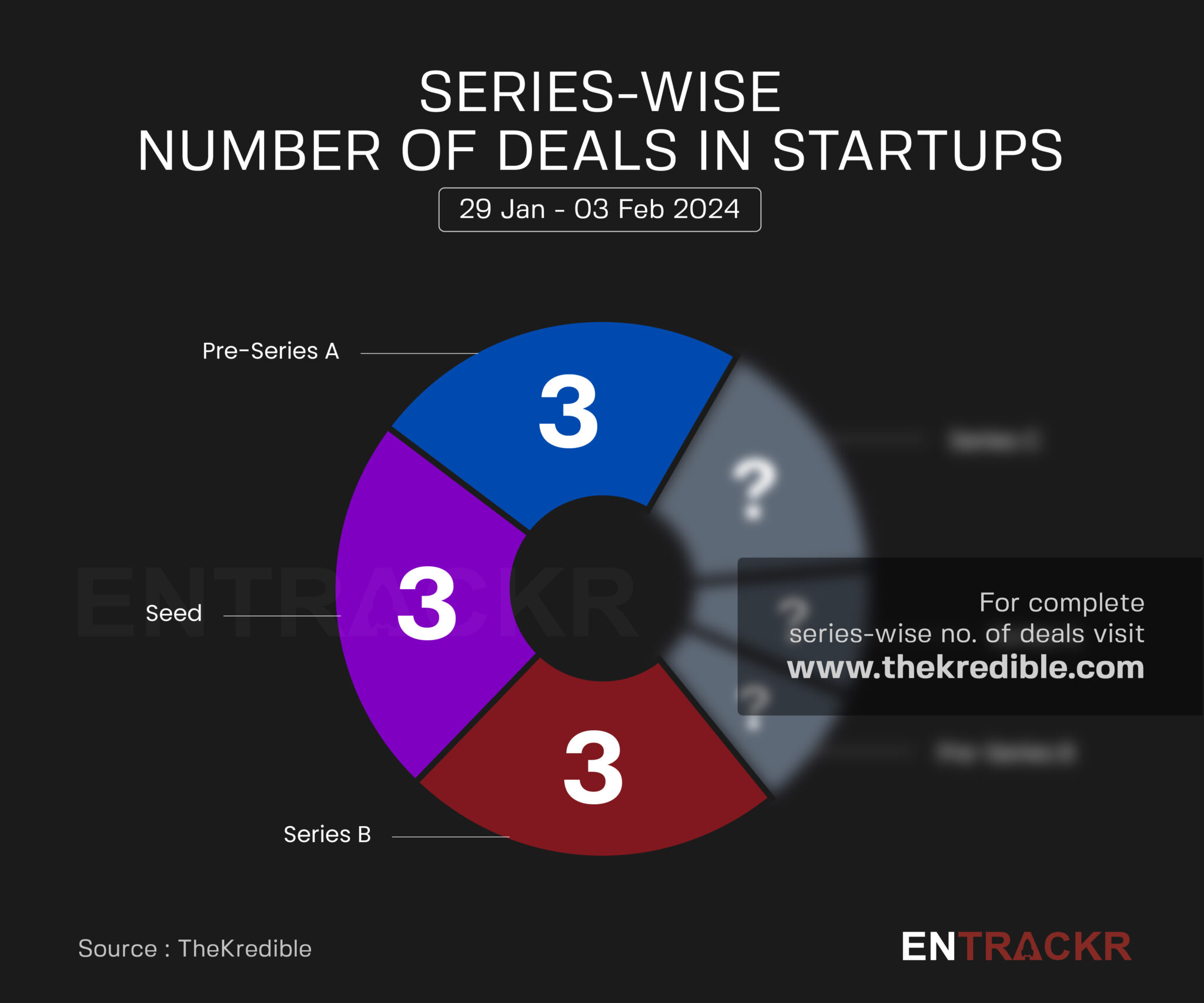

[Series wise deals]

This week, seed and pre-Series A-stage deals grabbed the top spot with three deals each while one startup raised Series A funding.

Among growth-stage deals, three startups raised Series B funding followed by Series C and Pre-Series B.

[Week-on-week funding trend]

On a weekly basis, startup funding dwindled 66% this week to $84.5 million as compared to $249.34 million in the previous week.

The average funding in the last eight weeks stands around $290 million with 21 deals per week.

[Departures]

B2B e-commerce firm Udaan saw its fourth senior exit since September last year as its FMCG business head Vinay Shrivastava has left the company. Partner at Aavishkaar Capital, Sushma Kaushik also exited the VC firm.

[Fund launches]

This week, the Karnataka government launched a Rs 20 crore worth fund to invest in the animation, visual effects, gaming and comics (AVGC) startups.

Visit TheKredible to see series wise deals and amount breakup, fund launches, departures and more insights.

[New launches]

▪️ Fashinza’s co-founder Jamil Ahmad launches a new startup, Marrfa

▪️ Shilpa Shetty launches Zip Zap Zoop, a kids’ and teenagers’ clothing vertical

[Financial results this week]

▪️ Zoho posts Rs 2,800 Cr profit in FY23, revenue up by 30%

▪️ Swiggy posts Rs 8,265 Cr revenue in FY23

▪️ PharmEasy’s scale crosses Rs 6,600 Cr in FY23; losses down 16%

▪️ Footwear brand Neeman’s posts Rs 69 Cr revenue in FY23

[News flash this week]

▪️ Rario cancels plans to shutting down its current product

▪️ Stellapps is in talks to raise $20 Mn funding

▪️ RBI bars Paytm Payments Bank from accepting deposits by Feb 29

▪️ Asianxt plans to raise $10-15 Mn funding

▪️ SEBI bans Growpital from collecting money from investors

▪️ Fidelity marks down Meesho’s valuation at $3.5 Bn

[Entrackr’s analysis]

Following a consistent upward trend since the first week of January, the weekly funding experienced a notable downturn, falling below the $100 million mark with a significant 66% dip.

In the realm of business moves, Meesho is reportedly eyeing entry into the fintech sector and plans to enhance its grocery delivery business in the upcoming fiscal year. On the other hand, troubled edtech giant Byju’s is seeking $200 million in funding through a right issue with 99% reduction in valuation.

Cricket-focused NFT startup Rario which initially announced the closure of its current product is now looking to continue with the same product.

Additionally, Paytm Payments Bank faces restrictions imposed by the Reserve Bank of India (RBI). The bank is prohibited from accepting deposits, top-ups in customer accounts, wallets, and FASTags after February 29, reportedly due to non-compliance with regulations and supervisory concerns. This development impacted Paytm’s stock price, witnessing a significant drop of over 30%, falling below Rs 500 from its previous value of Rs 760 per share.