Short-video-making app Chingari made a pivot to become a paid but private live streaming app which connects users and creators at the beginning of the ongoing fiscal year. While the impact of the pivot on its top and bottom lines will be evaluated when it reports FY24 numbers, the company’s revenue soared over two-fold in FY23.

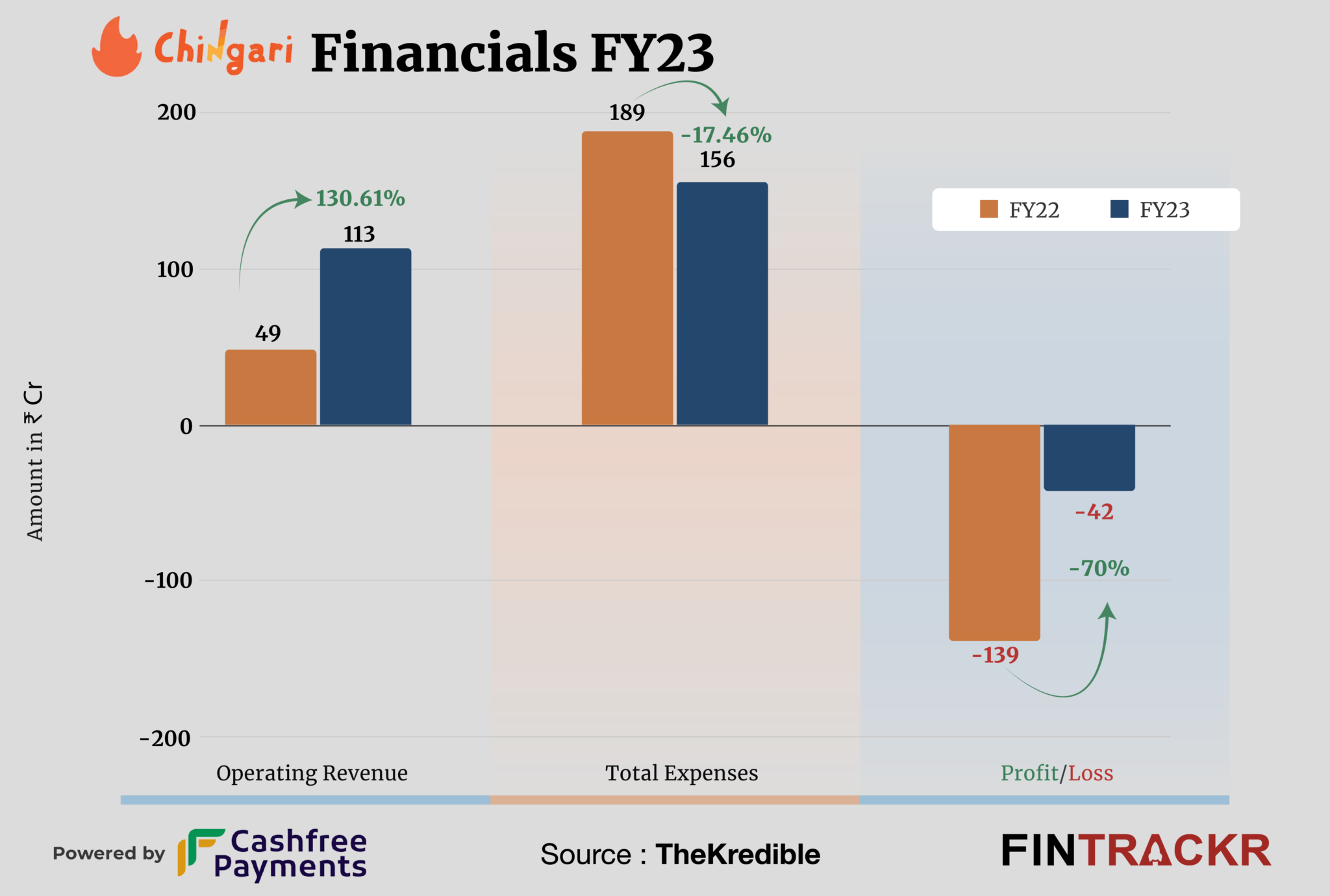

Chingari’s revenue from operations spiked 2.3X to Rs 113 crore in the fiscal year ending March 2023, its annual financial statement sourced from the Registrar of Companies (RoC) shows. Significantly, the company’s losses nosedived 70% during the last fiscal year.

Founded in November 2018, Chingari used to be a TikTok clone until FY23 when it allowed users to create and post short videos. The sale of services was the only source of revenue for Chingari in the last fiscal.

In August 2022, Chingari launched its crypto token called $GARI and was set to make a debut on six global exchange platforms – FTX, Huobi, Kucoin, OKEX, Gate.IO, and MEXC Global. The firm also roped in Bollywood actor Salman Khan to launch the NFT marketplace and reward platform.

Caveat: Chingari didn’t provide revenue break-up for FY23 but it looks like most of its collection came via advertising and crypto activities.

Moving to the cost side, application development formed 32% of the overall expenditure which increased by 16.3% to Rs 50 crore in FY23. Chingari’s employee benefits cost surged 3.8X to Rs 46 crore in FY23.

It’s worth noting that Chingari fired around 60% of its employees in the current calendar year and is only left with 50-60 people in the team as per media reports.

Chingari’s advertising cum promotional cost declined significantly to Rs 29 crore in FY23 from Rs 113 crore in FY22. The legal professional, subscription membership, rent, traveling, and other expenditures took the company’s overall cost to Rs 156 crore in the previous fiscal year.

See TheKredible for the detailed expense breakup.

Expense Breakdown

https://thekredible.com/company/chingari/financials

View Full Data

https://thekredible.com/company/chingari/financials

View Full Data

- Employee benefits

- Advertising promotional

- Legal professional charges

- Subscriptions membership

- Rent

- Travelling conveyance

- App Development

- Others

The decent scale and effective control on advertising helped Chingari to reduce its losses by 70% to Rs 42 crore in FY23 from Rs 139 crore in FY22. Meanwhile, its EBITDA margin improved to -36.3%. On a unit level, the Mumbai-based firm spent Rs 1.38 to earn a rupee in FY23.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | -284% | -36.3% |

| Expense/Rupee of ops revenue | ₹3.86 | ₹1.38 |

| ROCE | -376% | N/A |

Chingari has raised a total of Rs 360 crore across rounds while its total outstanding losses stood at Rs 223 crore until March 2023. Importantly, it had a total current assets of only Rs 24 crore at the end of FY23.

Between short videos and crypto, it’s a tough call to pick the least promising option in hand for Chingari. While FY24 figures will reflect the impact of the Crypto winter, even as FY23 probably derived some momentum from there, it certainly makes one pessimistic about the story for FY24. On the cost front, one beauty of the Crypto business (the only one, some would argue ), is that the business no longer counts on high sales and marketing costs. In many cases, the model has moved to a revenue share with its beneficiaries, a slightly evolved version of multi level marketing schemes in fact. That might have explain the lower costs as well for FY23.

Now that the firm has moved to a desi version of OnlyFans, it is anyone’s guess what kind of insights it will offer about India‘s online audiences in due course. We are betting not many would be waiting with baited breath.