This week as many as 27 Indian startups raised funding amounting to nearly $162 million. These deals consist of five growth stage deals and 22 early stage deals. The early stage deals also include four startups which kept their transaction details undisclosed.

Last week, 39 early and growth stage startups collectively raised around $240 million, including two undisclosed deals.

[Growth-stage deals]

Among the growth stage deals, five startups raised $74.2 million capital this week. B2B animal protein marketplace led the pack with $25 million funding followed by global student housing solution provider Amber and pet care product marketplace Supertails which raised $21 million and $15 million, respectively.

Further, MSMEs-focused fintech lender FlexiLoans and electric vehicle manufacturing startup Tork Motors also scooped funding this week.

[Early-stage deals]

Equivalent to 18 early-stage startups secured funding worth $87.66 million during the week. Spiritual tech platform Astrotalk spearheaded the chart followed by metals supply chain company Metalbook, mobility fintech firm Moove, risk-focused compliance automation platform Scrut Automation and agrifood fintech platform Ayekart.

The list further includes EV financing firm Ascend Capital, rewards-focused internet browser Veera, and travel-focussed social media platform Explurger among others.

During the week, consumer medical startup Arcatron Mobility, digital banking platform Freo, D2C haircare brand iluvia and D2C ice-cream brand Frubon also raised capital but did not disclose the funding amount. For more information, visit TheKredible.

[City and segment-wise deals]

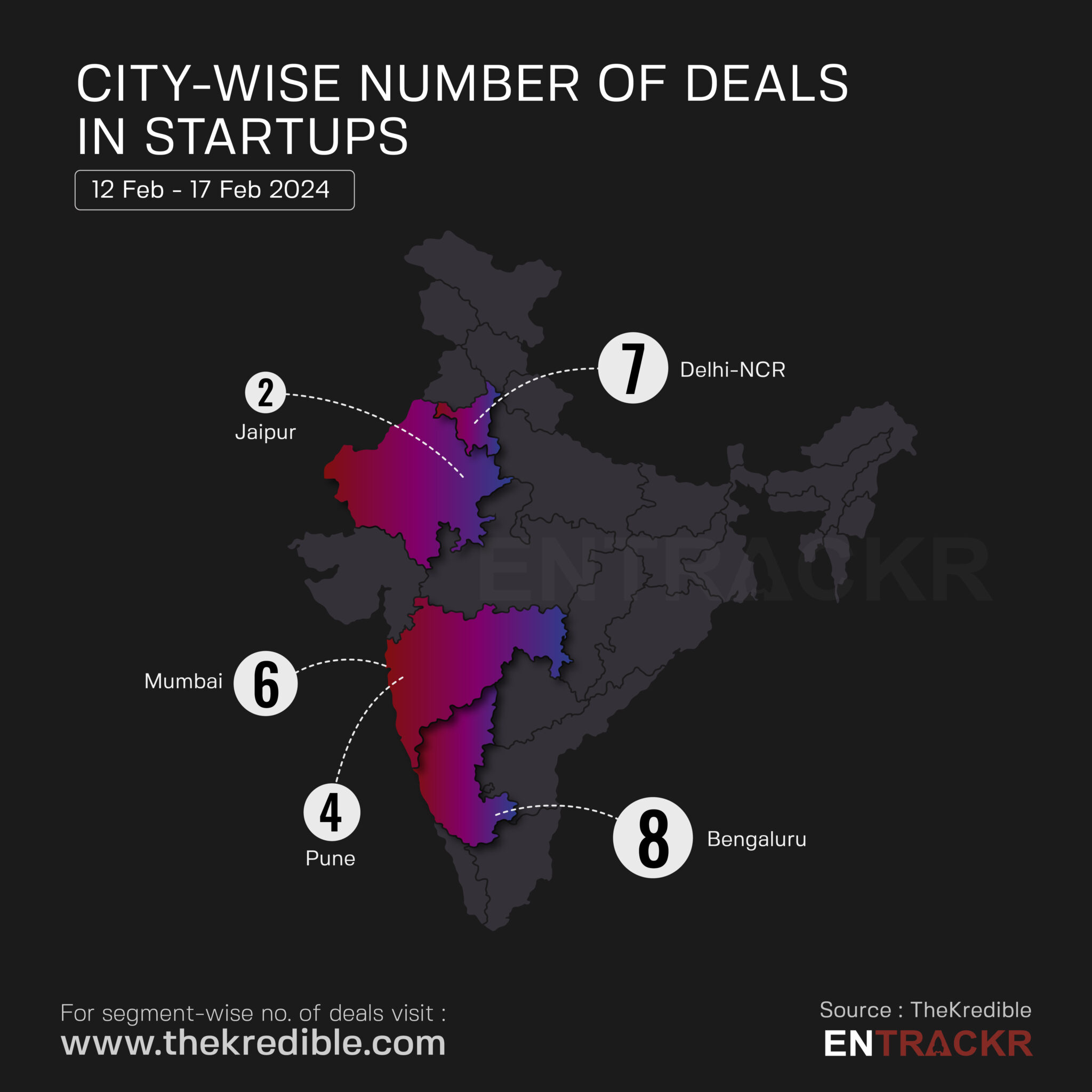

In terms of city-wise number of funding deals, Bengaluru-based startups again led the list with eight deals. This was followed by Delhi-NCR, Mumbai, Pune and Jaipur.

The complete breakdown of the city and segment can be found at TheKredible.

[Series wise deals]

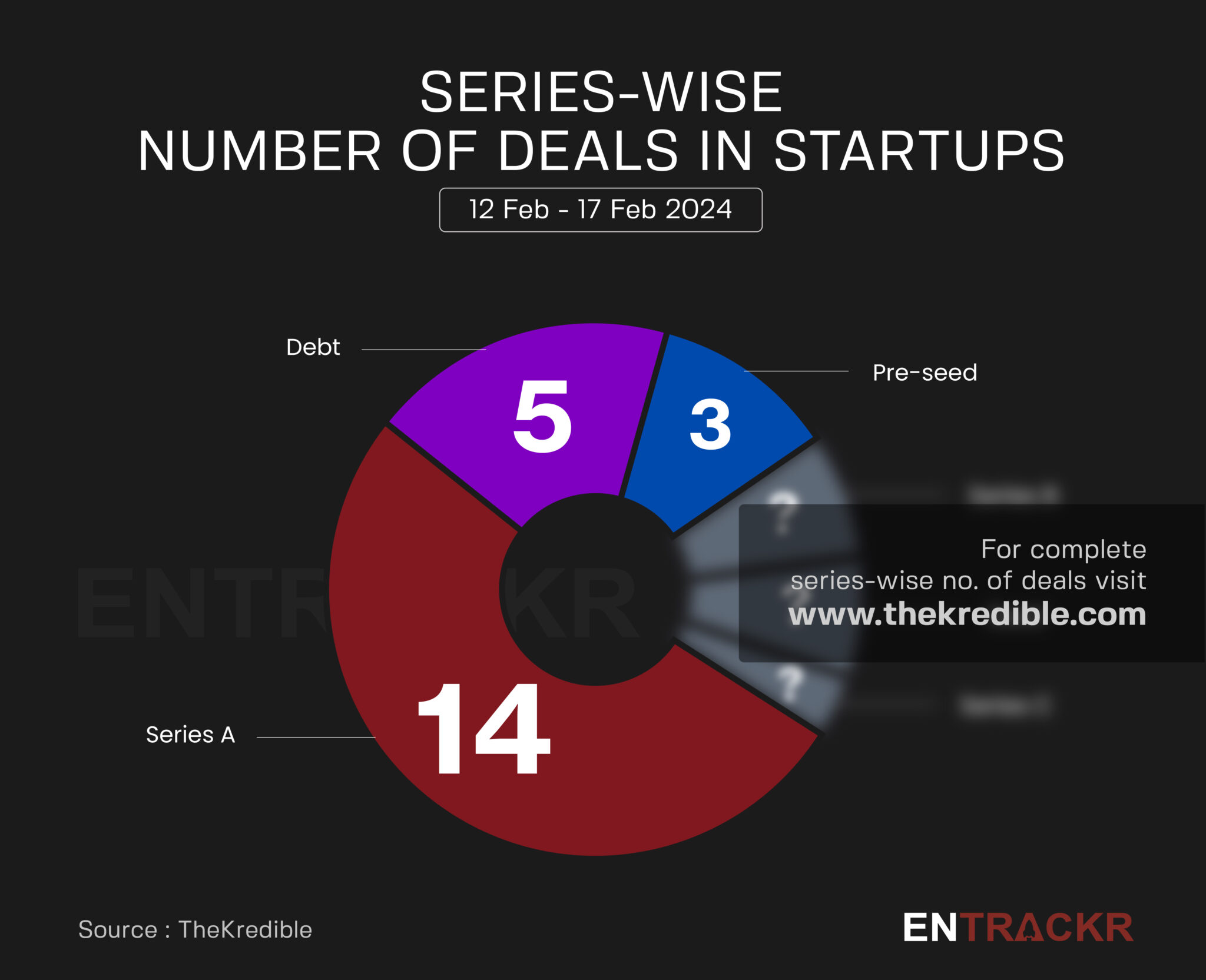

This week, around 14 startups raised funding in their Series A round followed by debt (5) and Pre-seed (3) deals. The list further includes Series B, Seed, and Series C funding deals.

[Week-on-week funding trend]

On a weekly basis, startup funding declined 32.5% to $162 million this week as compared to $240 million in the previous week.

The average funding in the last eight weeks stands around $152 million with 23 deals per week.

[ESOP buyback]

Edtech company Classplus announced employee stock ownership plan (ESOP) buyback for more than 150 employees. This is the second buyback announcement by the company in the last three years.

[Fund launches]

The week witnessed four fund launches: Hyderabad Angles Fund (HAF) announced its maiden venture capital fund with a corpus of Rs 100 crore, Endiya Partners is set to launch its third fund between Rs 800 crore and Rs 1,000 crore, PedalStart announced a $250,000 Series-2 fund for early-stage startups, and InCred Alternatives Investments launched its maiden Category II AIF in private equity.

[Layoffs/Shutdown]

Fintech startup Wint Wealth reportedly fired around 20% of its workforce in an internal restructuring exercise impacting employees across departments, including marketing, sales, and tech.

[Merger & Acquisition]

Nazara Technologies’ subsidiary Nodwin Gaming International Pte Ltd is set to acquire e-sports and gaming company Ninja Global FZCO for $3.5 million. The move aims to bolster Nodwin Gaming’s presence in Turkey and the Middle East. The transaction will be conducted using a combination of cash and stock.

Visit TheKredible to see series wise deals and amount breakup, complete details of fund launches, and more insights.

[New launches]

▪️ Unacademy to launch language learning app

▪️ Flathead founder launches a new venture, Aurm

[Financial results this week]

▪️ With over 2X growth, Miko’s revenue crosses Rs 225 Cr in FY23

▪️ Yatra churns profits in Q3 FY24, revenue crosses Rs 110 Cr

▪️ Bloom Hotels turns profitable with Rs 144 Cr revenue in FY23

▪️ Smartworks crosses Rs 700 Cr revenue in FY23; losses up 44%

▪️ Zoomcar’s scale shrinks 19% in Q3 FY24, improves bottom line

[News flash this week]

▪️ RBI asks Visa, Mastercard to suspend card-based commercial payments

▪️ NCLT accepts insolvency plea against Dream 11-parent over 7.6 Cr default

▪️ Ixigo and Ullu Digital next in line to go public, file DRHP

[Entrackr’s analysis]

After a nearly three-fold surge in funding last week, the weekly funding again shrank over 30% to $162 million this week. The week also witnessed the launch of four startup focused funds: Hyderabad Angels Fund, Endiya Partners, PedalStart and InCred.

The Reserve Bank of India (RBI) has directed Visa and Mastercard to cease card-based commercial payments, impacting fintech companies such as Enkash, and Paymate, which facilitate these transactions. Additionally, the NCLT has accepted an insolvency plea against Dream11, citing a rent default exceeding Rs 7.6 crore.

Regarding the recent developments with Paytm Payments Bank Limited (PPBL), the RBI has provided temporary relaxations for affected customers. They can make deposits, credit transactions, or top-ups in their accounts until March 15, 2024, instead of the earlier deadline of February 29, 2024. However, the nodal accounts of One97 Communications Ltd and Paytm Payments Services Ltd maintained by PPBL are to be terminated by February 29, 2024. Customers are allowed to withdraw or utilize their balances without any restrictions. In response, Paytm has shifted its nodal account to Axis Bank for merchant settlements. RBI deputy governor clarified that the crackdown on Paytm’s payments bank followed conversations and warnings. As a result, Paytm’s shares have plummeted to an all-time low.

Additionally, ixigo and Ullu Digital have filed their Draft Red Herring Prospectus (DRHP) this week, signaling their intentions to go public soon.