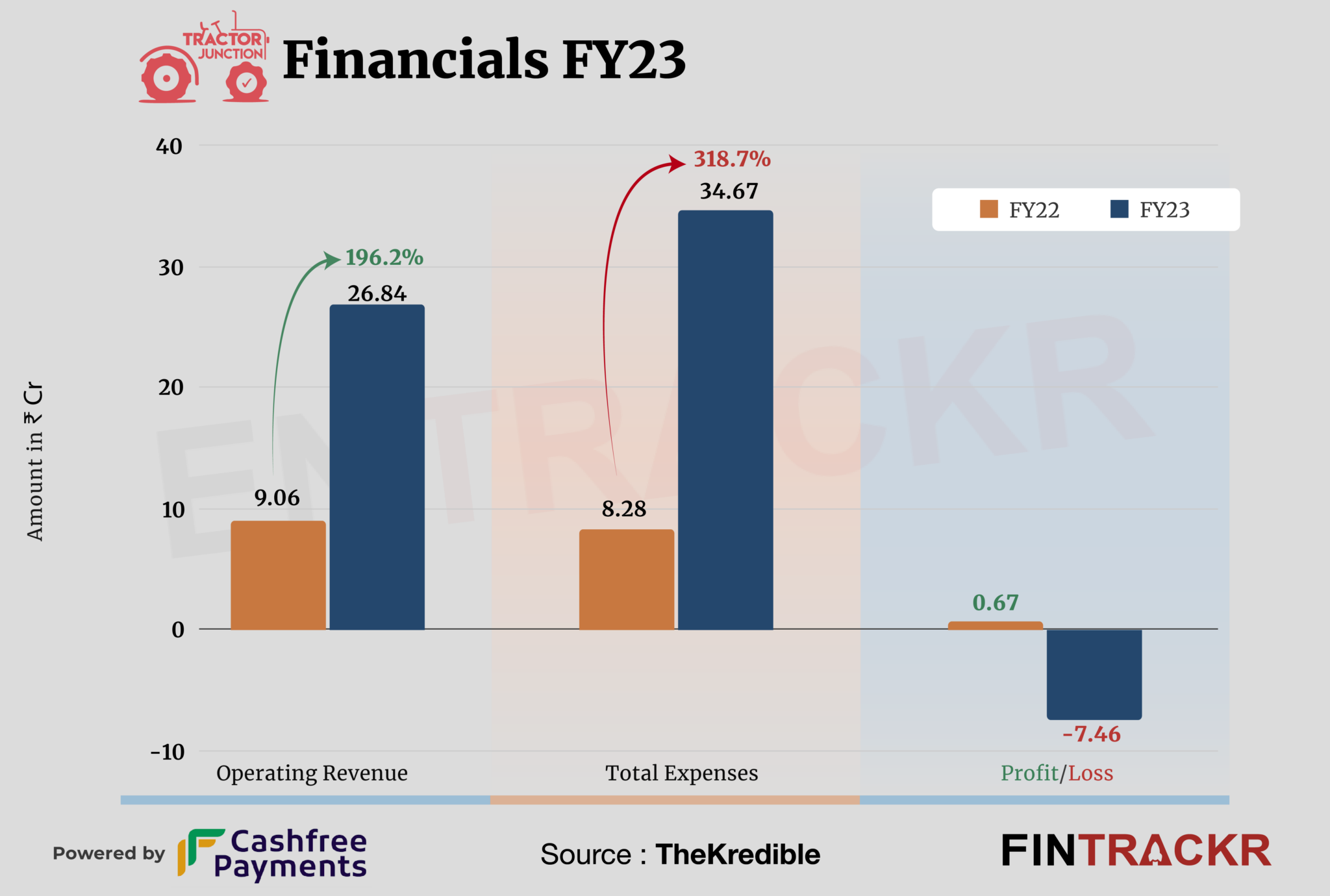

Rural vehicle marketplace Tractor Junction has managed to grow its scale by nearly three-fold during the last fiscal year (FY23). The byproduct of the fast-paced growth, however, is the five-year-old company slipping into red during the said period.

Tractor Junction’s revenue from operations grew 196.2% to Rs 26.84 crore during the fiscal year ending March 2023 as compared to Rs 9.06 crore in FY22, as per the company’s consolidated annual financial statement with the Registrar of Companies.

Launched by Shivani Gupta and Rajat Kumar, Tractor Junction is a rural vehicle marketplace that helps buy, sell, finance, and insure new and used tractors, farm equipment, and rural commercial vehicles. It also provides necessary information and vetted reviews on farm machinery, enabling users to compare shortlisted options, and bringing transparency in pricing.

The company made 55% of its revenue from sale of tractors while the remaining came from the sale of services.

The sales of services segment mainly deals in the business of providing advertising services to Original Equipment Manufacturers (OEMs) through generation of leads from their website and selling those leads to OEM’s.

Revenue Breakdown

https://thekredible.com/company/tractor-junction/financials

View Full Data

Tractor Junction also cornered Rs 1.75 crore via interest and gains on financial assets (non-operating revenue). Including this, the company’s total income stood at Rs 28.6 crore in FY23.

Further, the Alwar-based company spent most on the cost of materials accounting for 42% of the total expenditure. This cost shot up over 20X to Rs 14.54 crore in FY23 from Rs 71 lakh in FY22. Employee benefit cost for the company jumped over 2X to Rs 9.35 crore during the last fiscal year. Moreover, advertising & publicity expenses also increased 56.1% to Rs 3.81 crore during FY23 from Rs 2.44 crore in FY22.

Overall, the company’s total expenditure ballooned more than four-fold to Rs 34.67 crore in FY23 from Rs 8.28 crore in FY22.

Head to startup intelligence platform TheKredible for complete expense breakdown and year-on-year financial performance of the company.

Expense Breakdown

https://thekredible.com/company/tractor-junction/financials

View Full Data

https://thekredible.com/company/tractor-junction/financials

View Full Data

- Cost of materials

- Employee benefits

- Advertisment & publicity

- Rates and taxes

- Legal & professional

- Others

On the back of rising expenses, the company slipped into red. Tractor Junction recorded Rs 7.46 crore losses in FY23 against Rs 67 lakh profit in FY22.

The impact of cash burn can also be seen in operating cash outflows which climbed to around Rs 17 crore during the last fiscal year.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | 11.15% | -19.41% |

| Expense/Rupee of ops revenue | ₹1.29 | ₹0.91 |

| ROCE | 33.95% | -15.36% |

The EBITDA margin and ROCE of the firm stood at -19.41% and -15.36%, respectively in FY23. On a unit level, Tractor Junction spent Rs 1.29 to earn a rupee of operating revenue during the fiscal year.

As per TheKredible, Tractor Junction has raised nearly $6 million to date from investors including Info Edge, Omnivore, Rockstart and Indigram Labs et al.