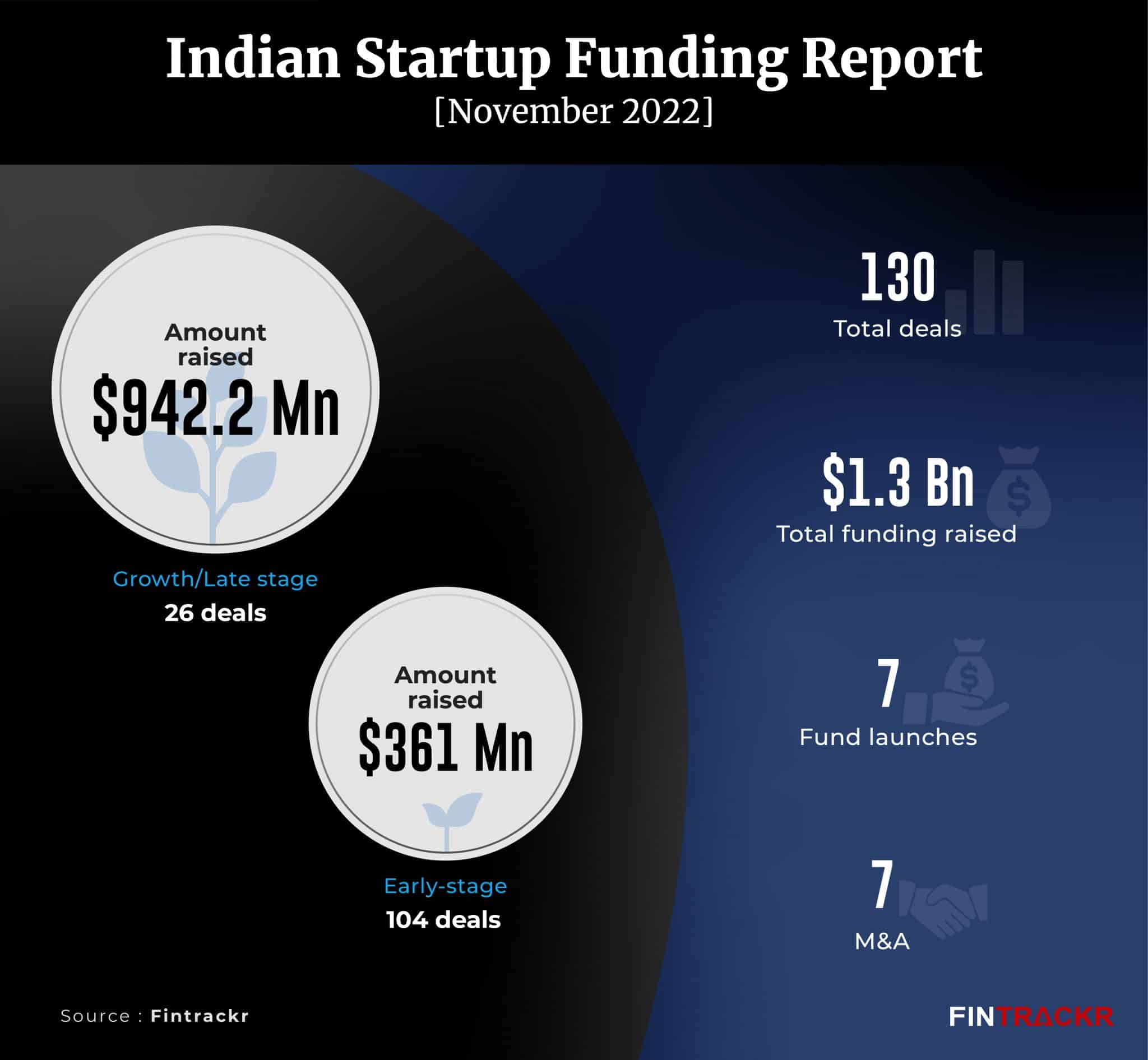

The fund inflow in Indian startups remained flat in November as compared to the previous month. Startups in the country managed to grab $1.3 billion across 130 deals comprising 26 growth stages and 104 early stage startups, according to data compiled by Fintrackr. This also included 23 undisclosed deals.

This is in line with the amount raised in October which was $1.26 billion across 94 deals.

So far, Indian startups have raised $25 billion in the past 11 months. If the trend continues, this year may end up with startups raising around $26 billion in total funding, significantly lower than the $38 billion raised in 2021.

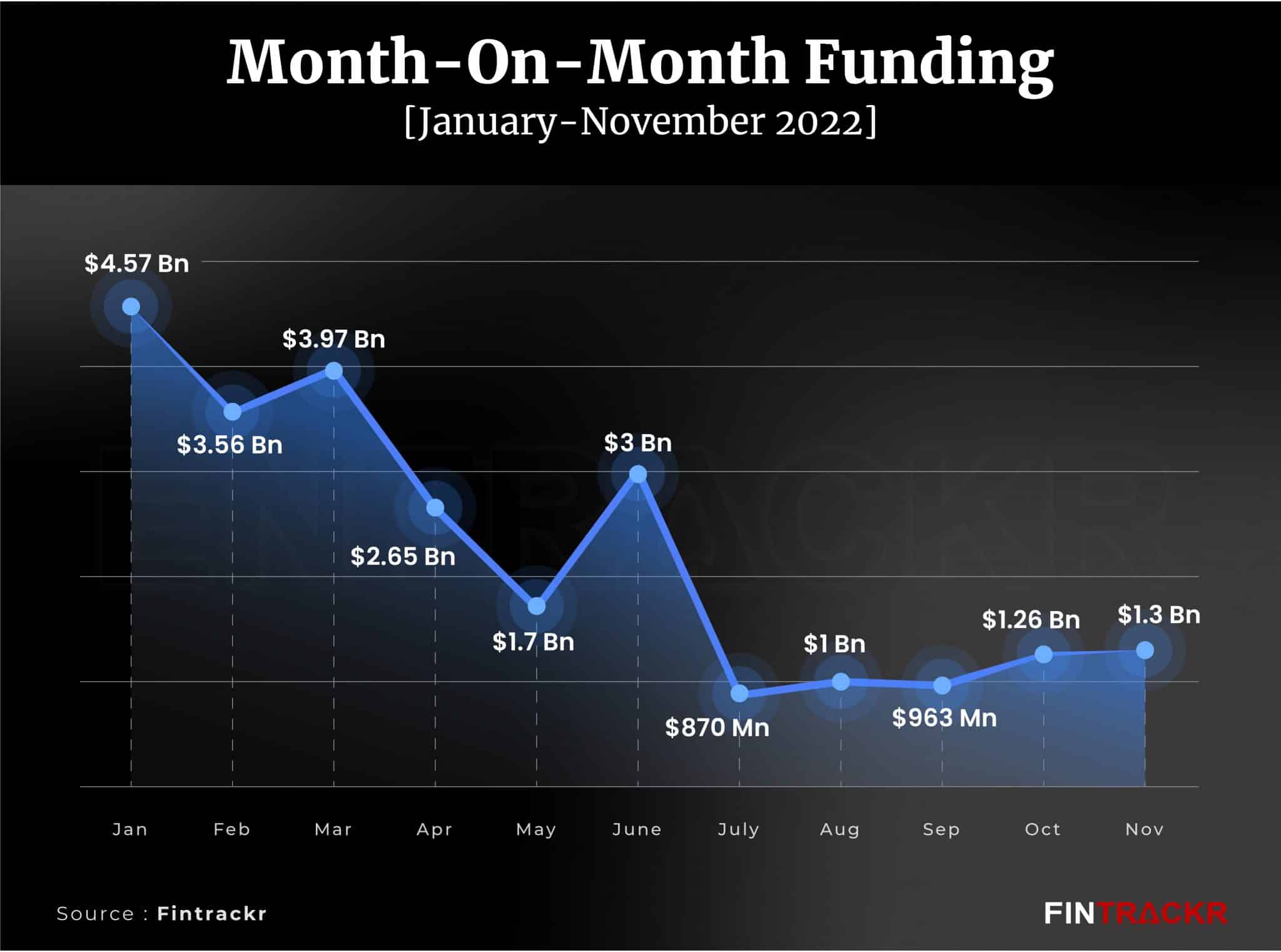

Unlike the first half of 2022 when startups mopped up nearly $20 billion, the latter half saw a steep fall with a global market slowdown.

The funding decline can be seen in the month-on-month trend below:

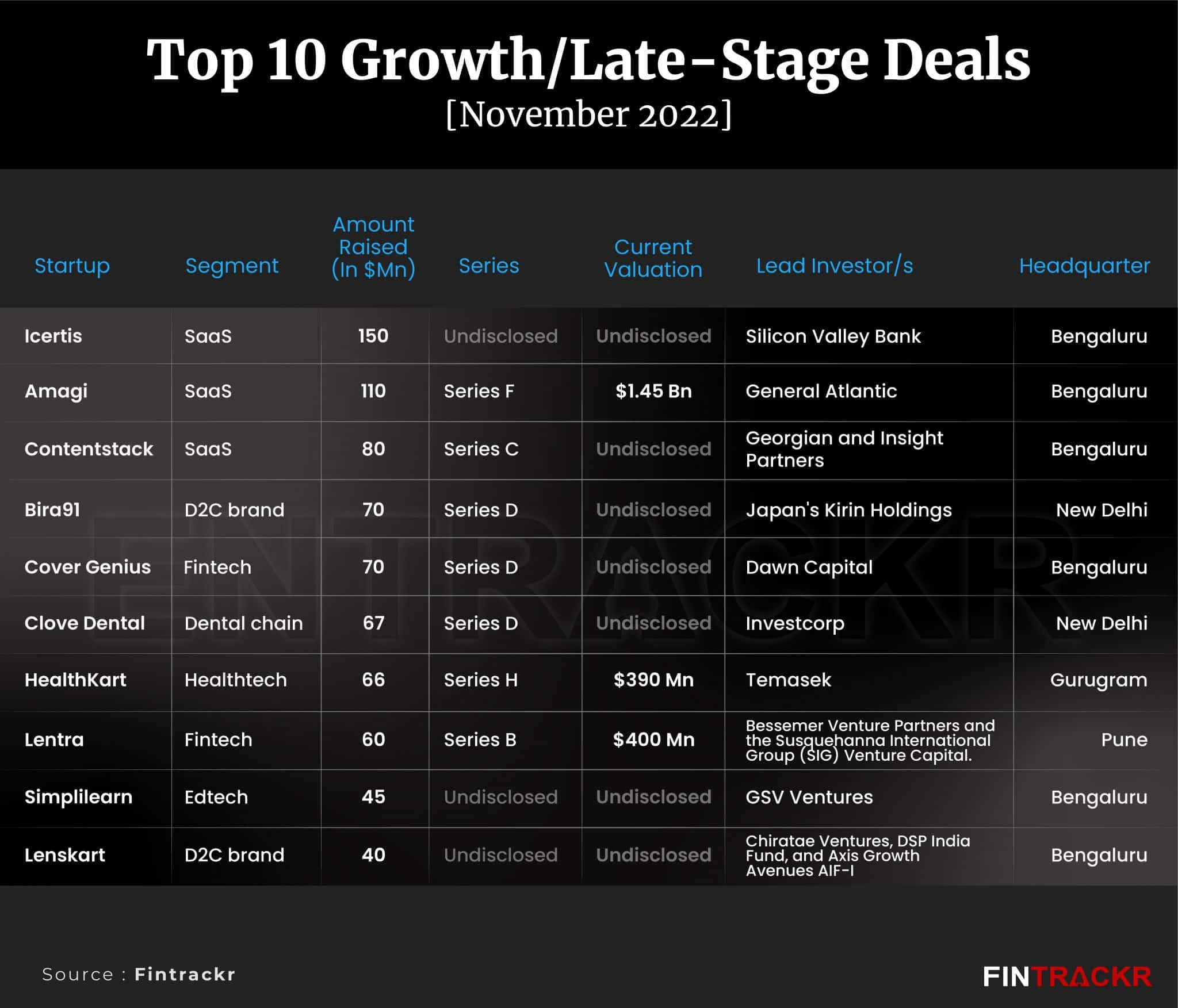

Top 10 growth-stage deals

Funding in November would have been much lower had it not been for three SaaS startups such as Icertis, Amagi, and Content Stack (with major operations outside India) who collectively raised $340 million to nudge the overall numbers to over $1 billion mark.

The full database can be seen here.

Among growth-stage startups, Bira91, Cover Genius, Clove Dental, Healthkart, and Lentra raised over $50 million each. In total, growth-stage startups raised $942 million of the $1.3 billion in November.

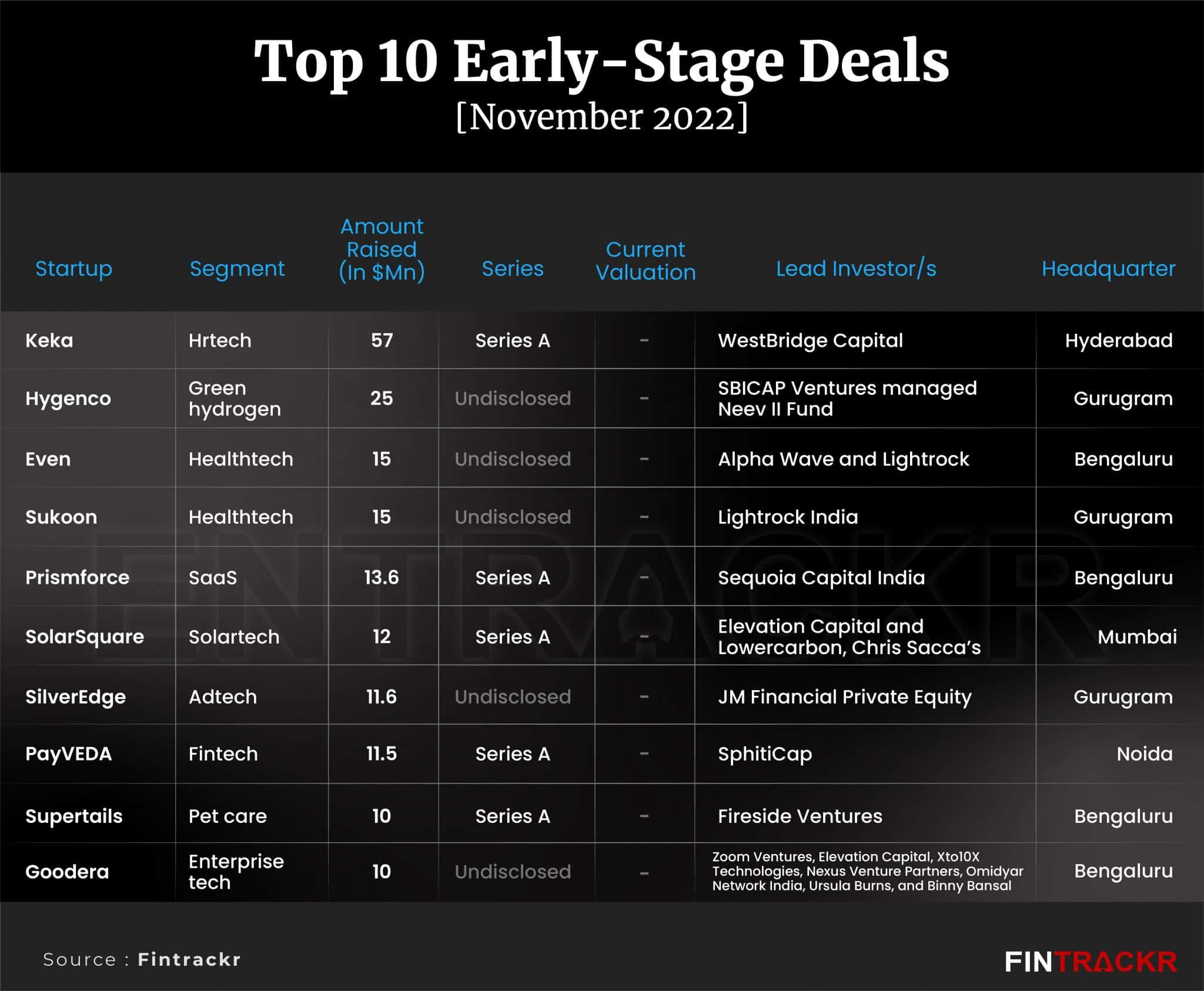

Top 10 early stage deals

Early stage startups scooped up $361 million in November. HRtech startup Keka raised the highest among them with $57 million followed by green hydrogen startup Hygenco. Rest, including Even, Sukoon, Prismforce, SolarSquare, and Silver Edge among others raised less than $20 million each.

Nearly two dozen startups also announced their funding round without disclosing transaction details. While most of them are in the early stage, B2B e-commerce platform Udaan and EV startup Ultraviolette were among the growth stage companies.

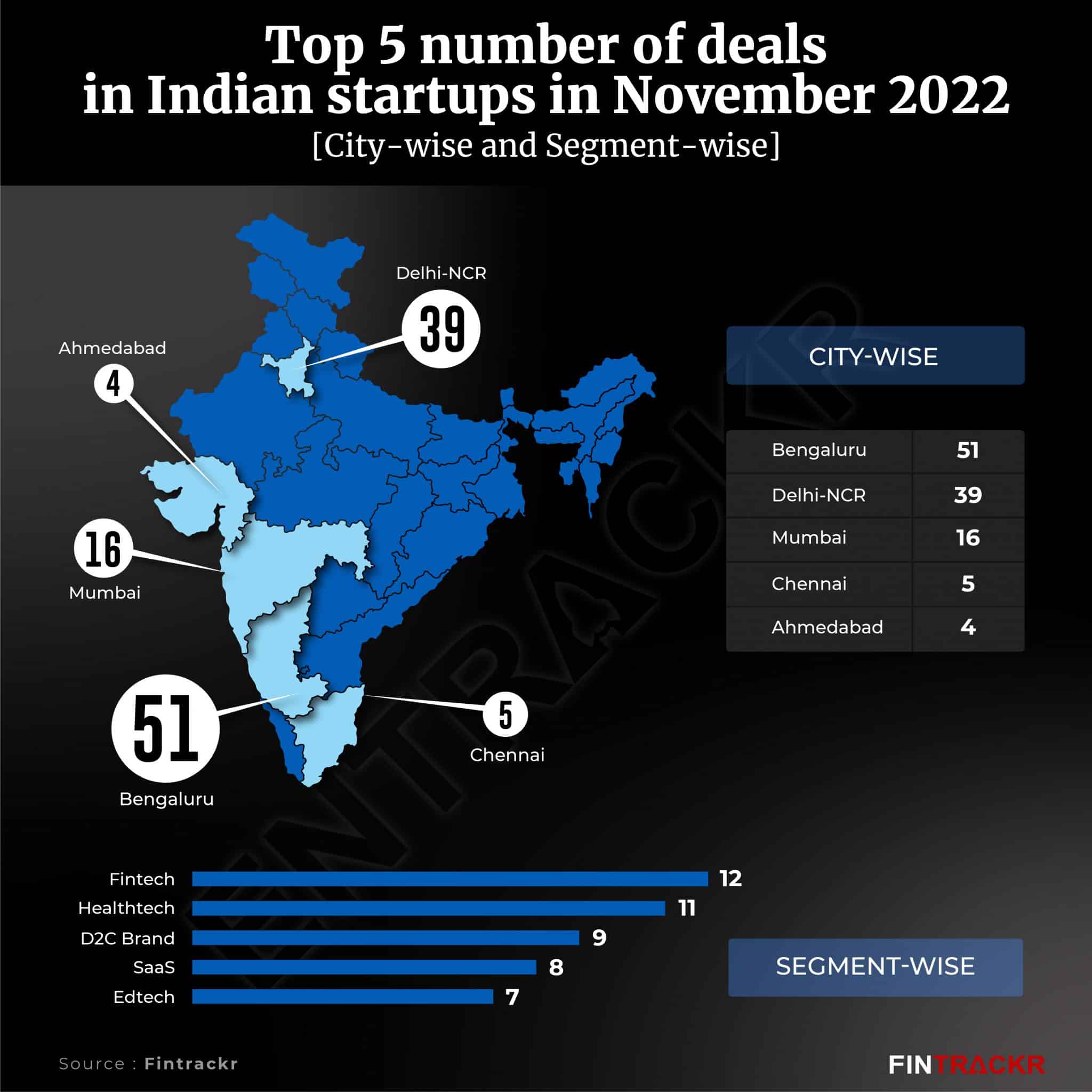

Segment and city-wise deals

Data compiled by Fintrackr shows that startup capital Bengaluru once again remained at the top spot with $636 million across 51 deals. Delhi NCR-based startups raised around $423 million across 39 deals and Mumbai, Chennai and Ahmedabad were next on the list.

Segment-wise, fintech was on top in terms of number of deals. However, SaaS startups raised more money. Healthtech, D2C brands, and Edtech were in the top 5 list.

Startup-focused funds

Over 90 VCs, PE, and debt funds announced their new fund launch as of July this year, according to a report by Entrackr. Since then, around two dozen more venture capital and debt firms have announced fund launches. The list counts Fundamentum, Stride Ventures, Merak Ventures, Cactus Ventures, Elev8 Venture Partners, StartupXseed, Blacksoil, Kettleborough VC, Fireside, Avatar Ventures, Alteria Capital, and IAN.

In November, seven funds including Quona Capital, Kae Capital, Transition VC, Yatra Angel Network, and Pi Venture announced their launch.

Trends

Layoffs: Layoffs continued to haunt the Indian startup ecosystem in November. Around eight Indian startups fired more than 1,200 employees in the past month. While the majority of them saw layoffs for the first time, for Udaan and Unacademy this was their second round of layoffs this year.

Debt funding in growth-stage startups: Like October, debt funding in growth and late-stage startups continued in the last month too. Udaan and Rebel Foods raised back-to-back debt funds in the past few months. Dunzo and ReshaMandi also joined the list of growth-stage companies in debt funding.

Startup funds continue their new launch: Despite funding winter, venture and debt funds continued to announce their new launch. After a decline in August and September, October saw 11 fund announcements whereas seven funds were announced in November.

No unicorn in November: Indian startups failed to create a new unicorn in October as well as in November. Interestingly, agritech and EV did not see any unicorns despite being one of the top-funded segments in 2022. In September, healthtech startups Molbio and 1mg entered the club while Zomato-backed Shiprocket achieved the status in the previous month.