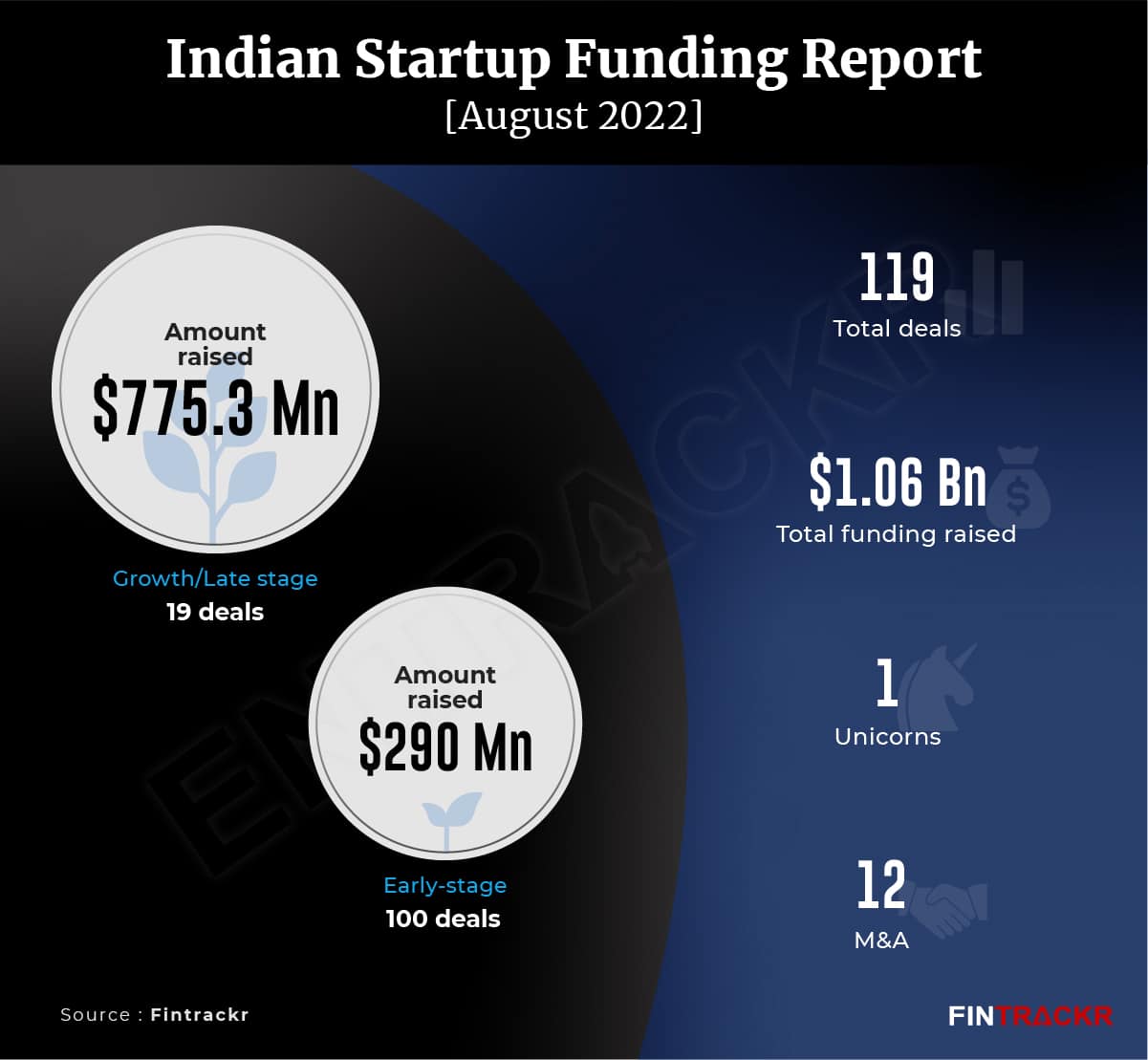

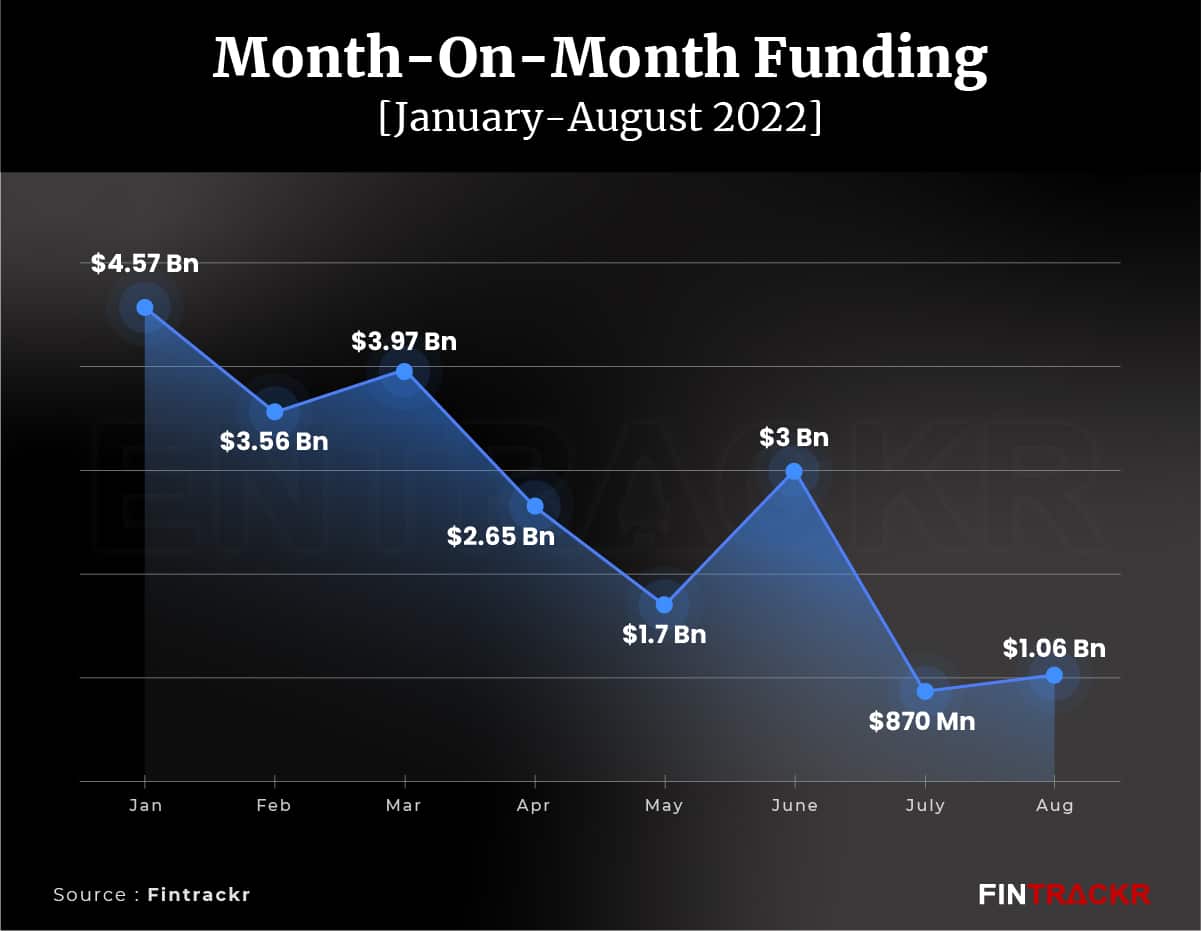

Fund inflow for Indian startups remained slow in August when compared to the beginning of this year, but slightly more than the month prior. Thanks to a clutch of startups that managed to raise big rounds, the total funding for the month of August rose to a little over $1 billion from $870 million in July.

Around 119 Indian startups announced their fundraise worth $1.06 billion in August which include 19 growth stage, 80 early stage and 20 undisclosed deals, as per data tracking platform Fintrackr.

The full database can be seen here.

While 2022 started on a good note with homegrown startups mopping up $4.57 billion in January and the same momentum continued through the following month until it saw a steep fall in April and May. June witnessed $3 billion in funding which further fell below $1 billion in July and now seems to have recovered a bit in August, which is still one of the lowest funding months since January 2021.

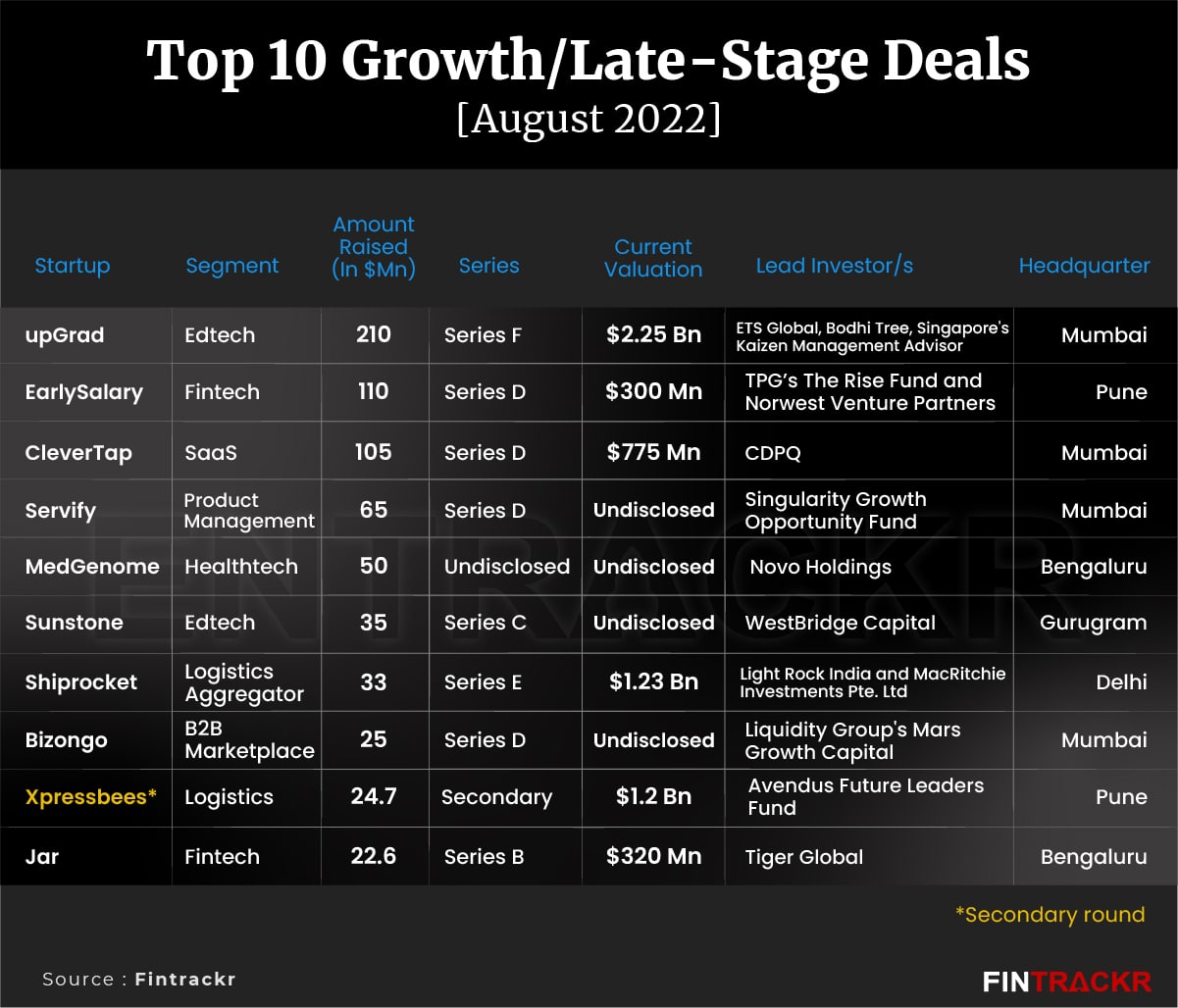

TOP 10 growth stage deals

Edtech startup upGrad was the top fundraiser among the growth and late stage startups in the last month with a $210 million round at a valuation of $2.25 billion. Digital lending platform EarlySalary and customer retention platform CleverTap raised $110 million and $105 million, respectively.

The top 10 list also includes product management Servify, genetic diagnostics company MedGenome, edtech company Sunstone and logistics aggregator Shiprocket. Zomato-backed Shiprocket also achieved a unicorn status and was the only startup to do so in the last month.

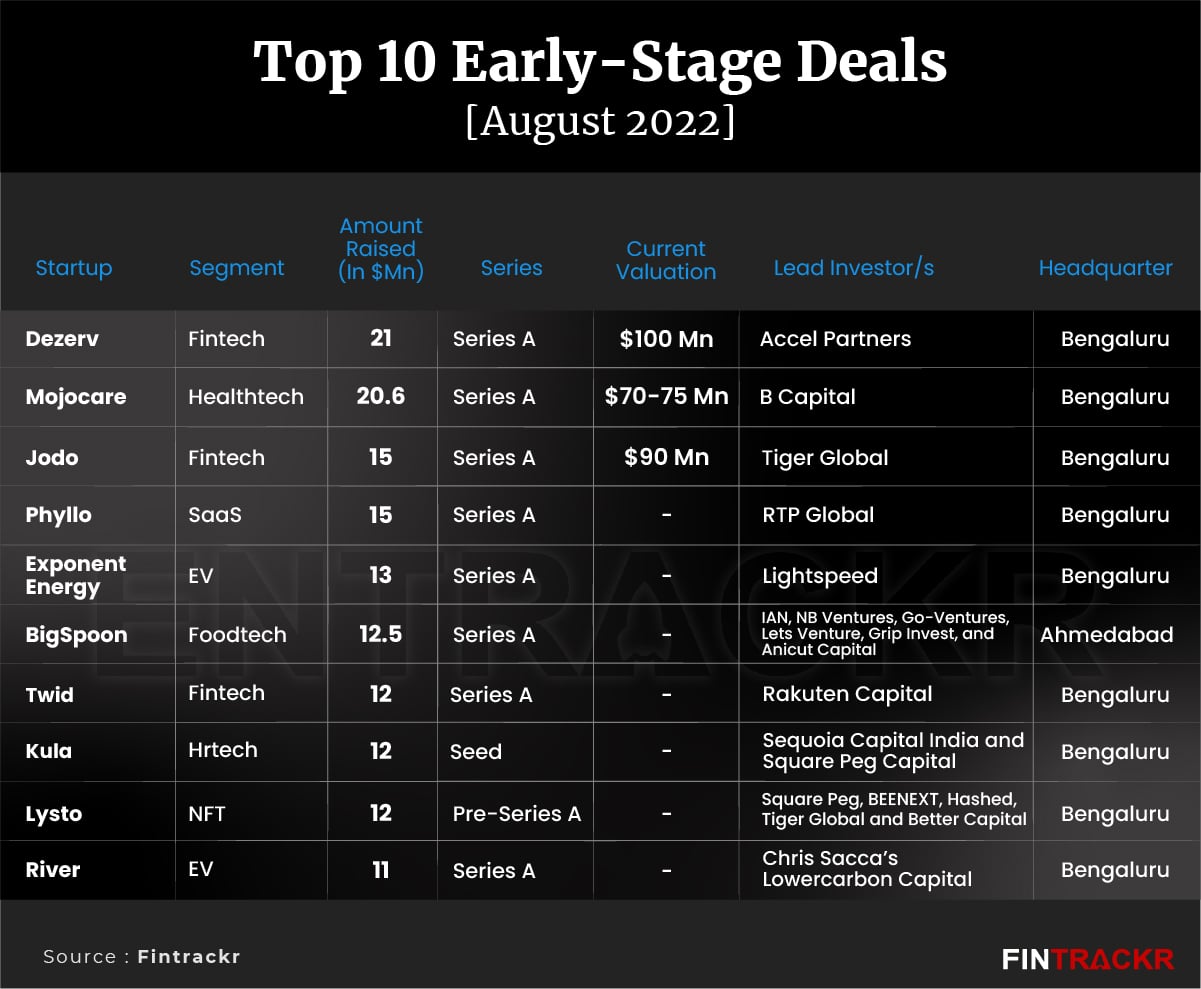

Top 10 early stage deals

Tech driven portfolio management platform Dezerv picked up $21 million in its Series A round whereas Mojocare, a wellness products and services platform, scooped up $20.6 million in Series A led by B Capital.

Fintech startup Jodo and SaaS platform Phyllo, EV startup exponent energy, cloud kitchen platform BigSpoon were next on the list. The month also saw 20 undisclosed deals which are mainly in the early stage.

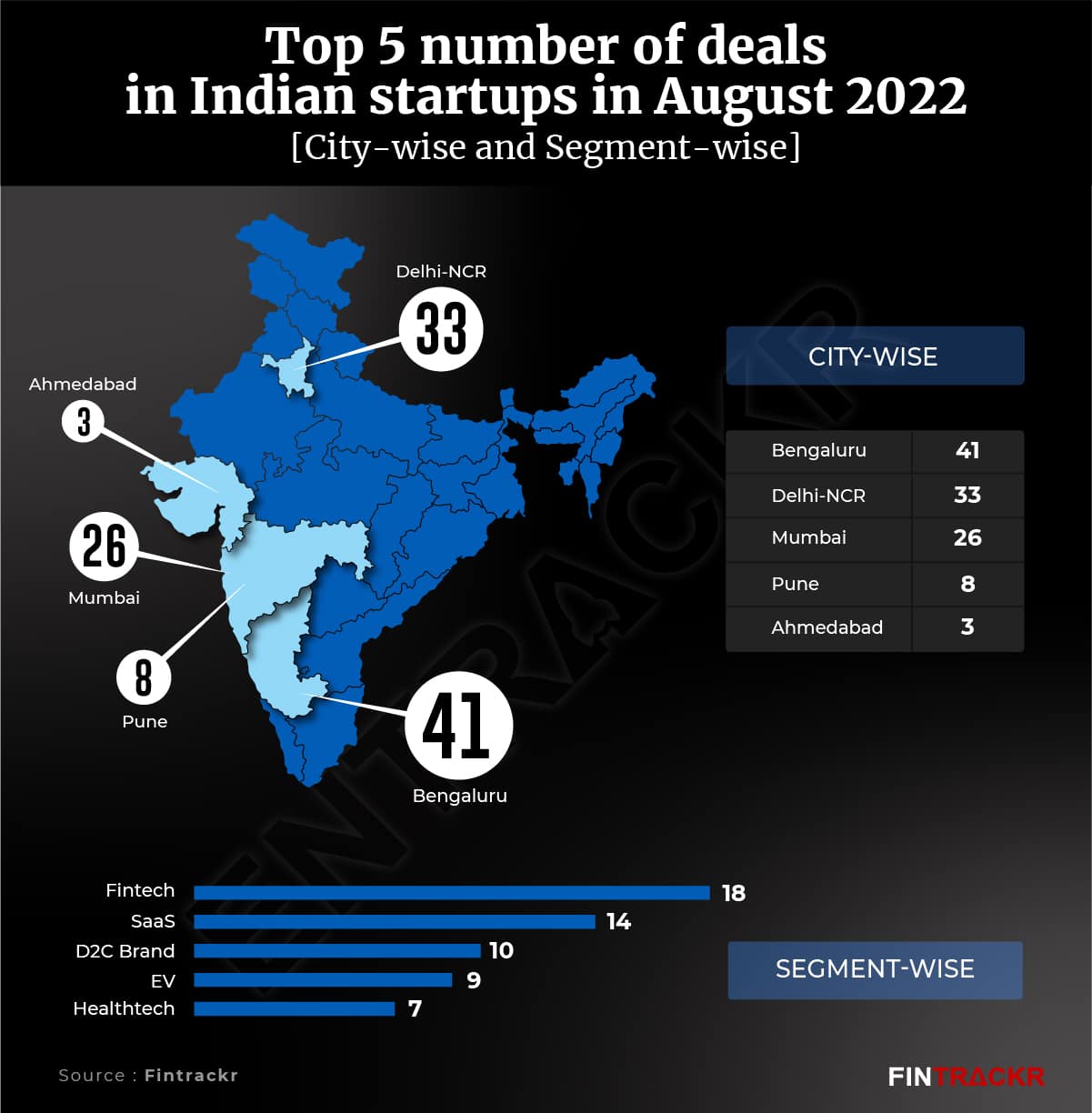

Segment and city wise deals

Data compiled by Fintrackr shows that Bengaluru startups raised $275 million across 41 deals making it the top city in terms of the number of deals. But Mumbai was top in terms of value as its startups scooped up $473 million across 26 deals. Delhi NCR-based startups raised $136 million across 33 deals and Pune-based startups managed to receive $148 million across 8 deals.

Segment wise, fintech startups raised $231 million across 18 deals while 14 SaaS-based startups scooped up $171 million. D2C brands, EVs and Healthtech were next on the list in terms of the number of deals.

The edtech segment gained some boost as upGrad alone raised $210 million. In terms of the number of deals, edtech startups were in the sixth position in the top 10 list.

The full report can be downloaded here.

Acquisitions

Apart from 115 funding deals, the Indian startup ecosystem also saw a dozen acquisitions in August. The acquisition of PoS solutions provider Ezetap by fintech giant Razorpay in a $200 million deal stood as the largest acquisition for the month.

Edtech company Brightchamps acquired Singapore-based Schola for $15 million. The rest of the acquisitions such as Exampur by upGrad and FreeCo by PhysicsWallah remained undisclosed.

Startups-focused funds in August

Fundamentum, a venture capital led by Infosys’ co-founder Nandan Nilekani, and Helion Venture Partners’ co-founder Sanjeev Aggarwal, launched a $227 million worth new fund to invest in growth stage Indian startups. Venture debt firm Stride Ventures also launched its new fund worth $200 million worth India-focused fund. The fund will focus on fintech, agritech, B2B commerce, healthtech, B2B SaaS, mobility and energy solutions (EV) startups.

Merak Ventures and Cactus Ventures announced their new fund worth $100 million and $43.7 million respectively. They will join the likes of 90 startup focused funds such as Sequoia, Accel, B Capital, Elevation Capital, Lightspeed, and Matrix among others which also launched their new fund for India in 2022. Check the report published by Entrackr in July.

Layoffs, shutdowns and raids continue to haunt Indian startups

While Indian startups try to face the funding winter, a series of layoffs, shutdowns and multiple raids by the government on crypto startups became the headlines in August, too. Edtech startup Vedantu reportedly fired 100 employees for the third time in 2022. According to a report by Inc42, nearly 300 Meesho employees have been fired after the shuttering of the company’s grocery vertical Superstore. Agritech startup DeHaat is said to have fired a significant number of employees recently. Edtech company LEAD and social media platform Koo also joined the list.

Besides layoffs, a couple of companies also shut or are on the verge of shutting down their operations. Nandan Nilekani-backed e-commerce enabler ShopX shut down its operations. Quick commerce startup Fraazo is potentially staring at a complete shutdown as the company is only left with a few months of runway. Entrackr exclusively reported the developments.

Meanwhile, the Indian government is taking a hard stand on cryptocurrency startups. On August 25, the Enforcement Directorate raided the offices of cryptocurrency exchange CoinSwitch Kuber for alleged violations of the Foreign Exchange Management Act. Similar raids were done on two more crypto startups Vauld and WazirX where the agency froze accounts held by these exchanges. An ET report highlighted that ED is probing at least 10 cryptocurrency exchanges for allegedly laundering more than Rs 1,000 crore.