The Indian startup ecosystem is going through a downturn after a blockbuster fundraising year in 2021. While the total investment in home grown startups until the first half of 2022 is at par with the previous year, growth and late stage companies are now finding it difficult to raise capital and are bound to see further correction in valuations.

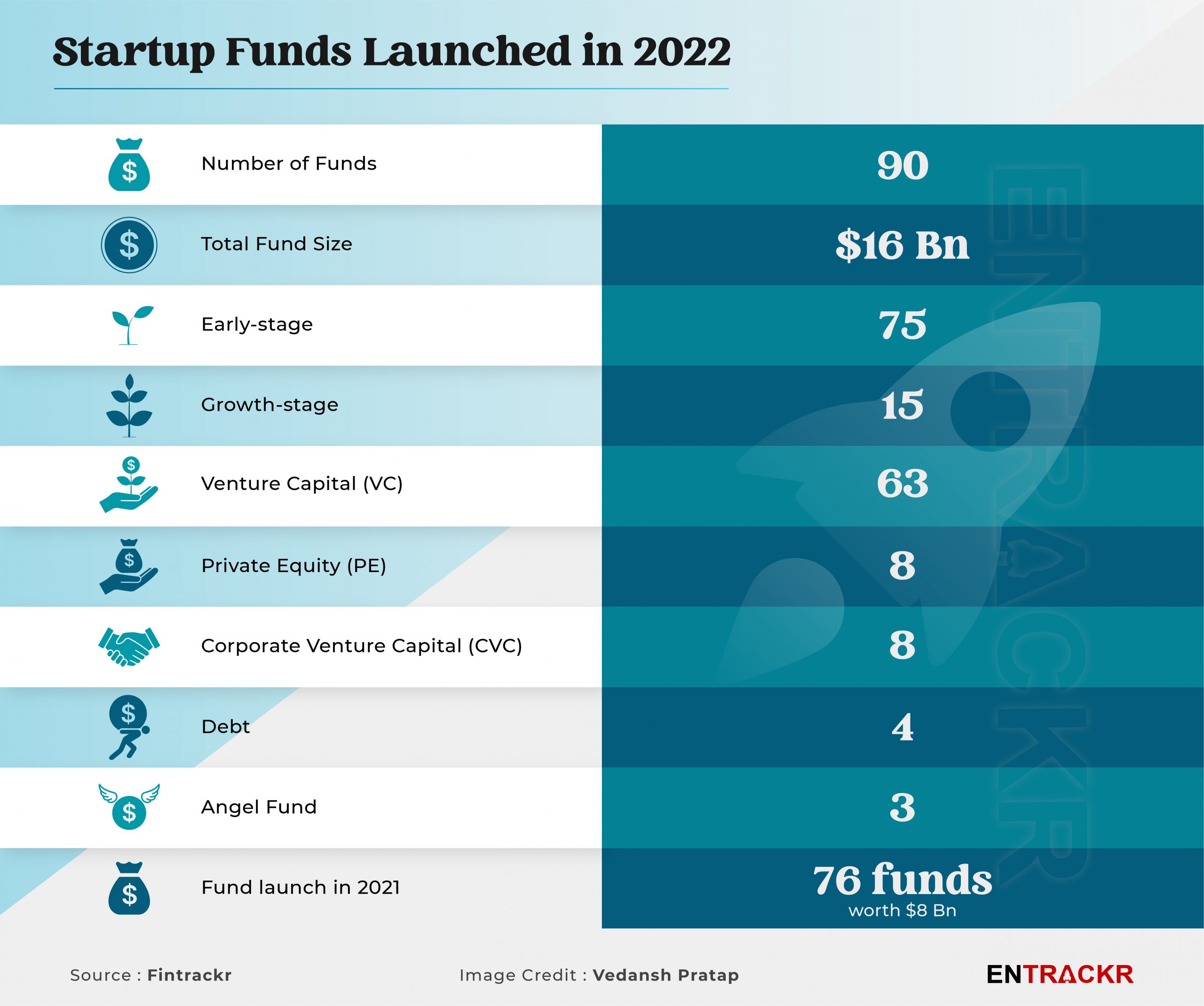

But despite challenges and the cooling, around 90 startup investment firms, including venture capital (VC), private equity (PE), micro venture capital, angel investment firms and debt firms, have launched or are in the final leg to announce their new fund as of July 25, 2022, according to data compiled by Fintrackr. This includes 63 VC firms, eight PE firms, and four debt firms.

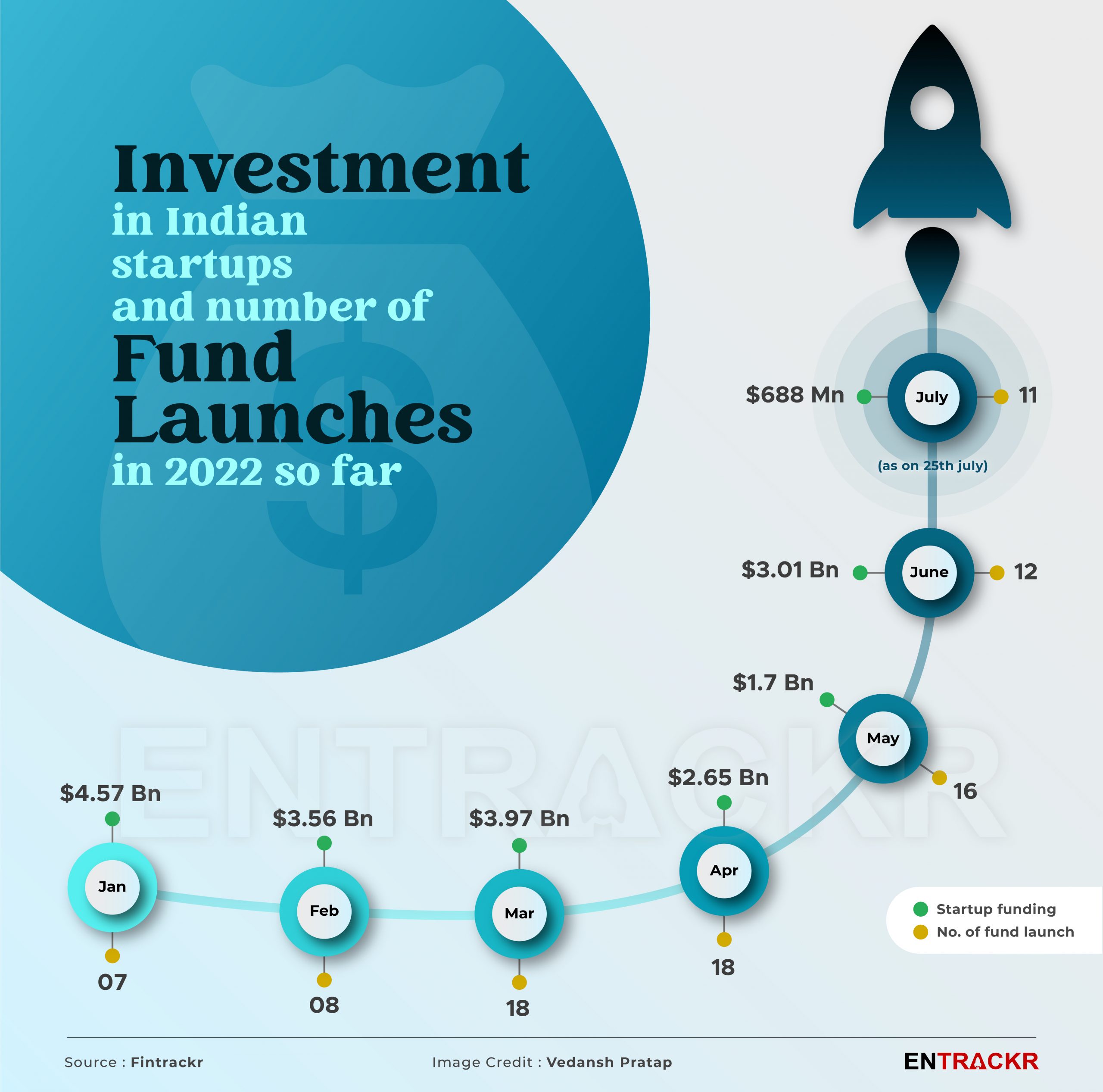

In comparison, there were nearly 76 India-focused funds announcements in 2021. The size of funds is also up, from $8 billion in 2021 (excluding global funds of Accel and Tiger Global) to $16 billion in 2022 to date. To recall, the total investment inflow in Indian startups stood at $38 billion in 2021 and it was close to $20 billion in the first half of 2022.

The full database can be seen here.

The recent data also indicates that Indian startups saw a steep fall in funding in the second quarter of 2022: $12 billion in Q1 to $7.56 billion in Q2. Moreover, in the first three weeks of July, local startups raised less than $700 million including one of the lowest funding of $90 million during a week.

However, the surge in the number of startup focused funds, especially in the second quarter of 2022, seems to indicate a bottoming out as far as the slowdown goes, and a positive sign of revival. In this edition of startup focused funds, Entrackr has prepared a list of top 10 investment firms (VC and PE) for growth as well as early stage startups.

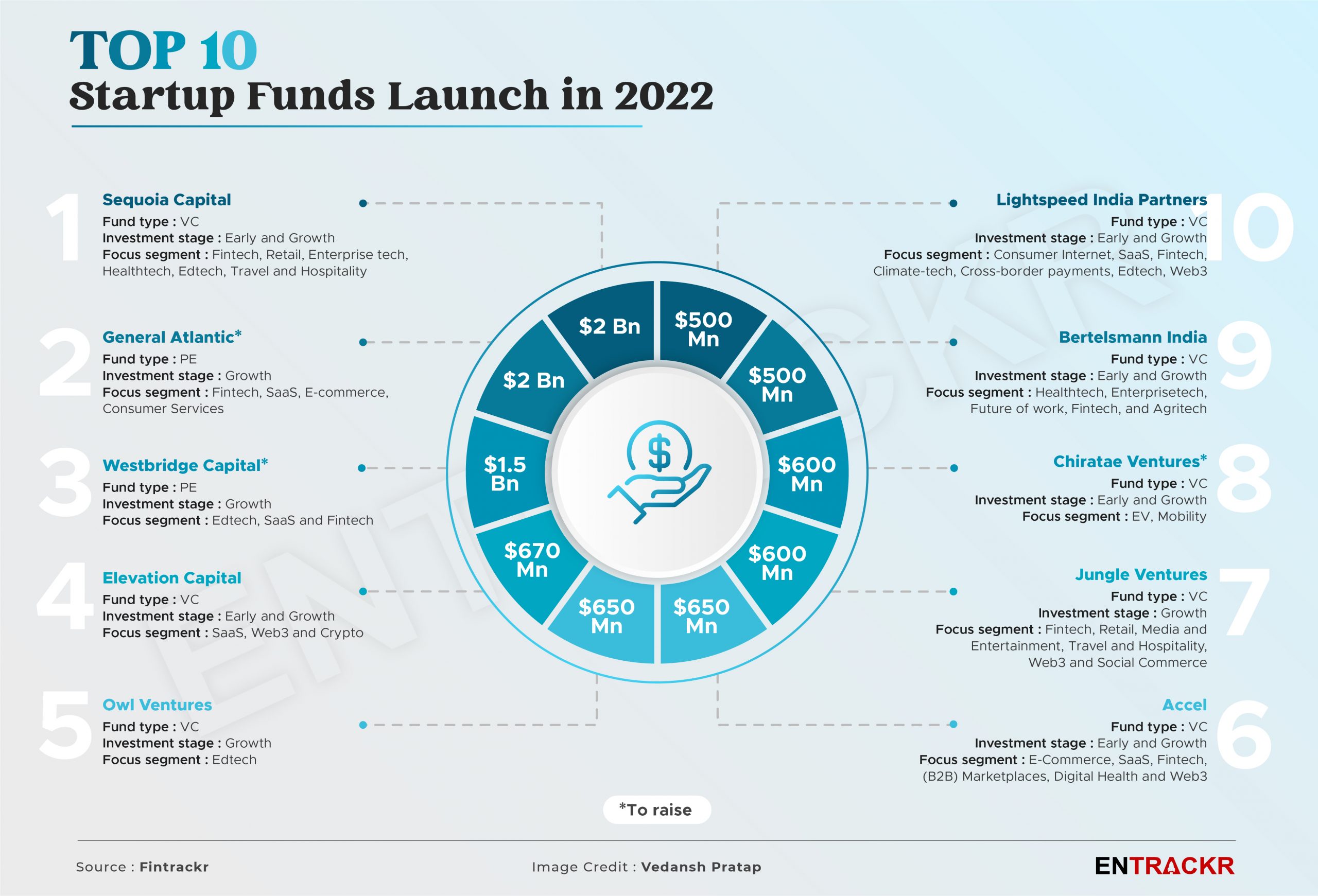

TOP 10 startup funds announced in 2022

In June, Silicon Valley-based venture capital firm Sequoia Capital launched a $2 billion worth fund for investments in Indian startups. The firm said that it will back startups from seed to IPO stage. Private equity firm General Atlantic is also launching a $2 billion worth fund for backing growth stage startups in the country.

Another PE firm WestBridge Capital has reportedly raked in $1.5 billion for its new fund. The fund typically invests $25 million to $200 million in startups which have a significant presence in India or South Asia, or led by Indian entrepreneurs. Rest of the funds in the top 10 list raised less than $1 billion which include Elevation Capital, Accel, Owl Ventures, Jungle Ventures, Chiratae, Bertelsmann and Lightspeed.

Among them, Accel also announced a $4 billion worth late-stage fund to provide expansion capital to promising companies within its own portfolio globally. The list of global funds includes Bain Capital’s $560 million fund for crypto startups.

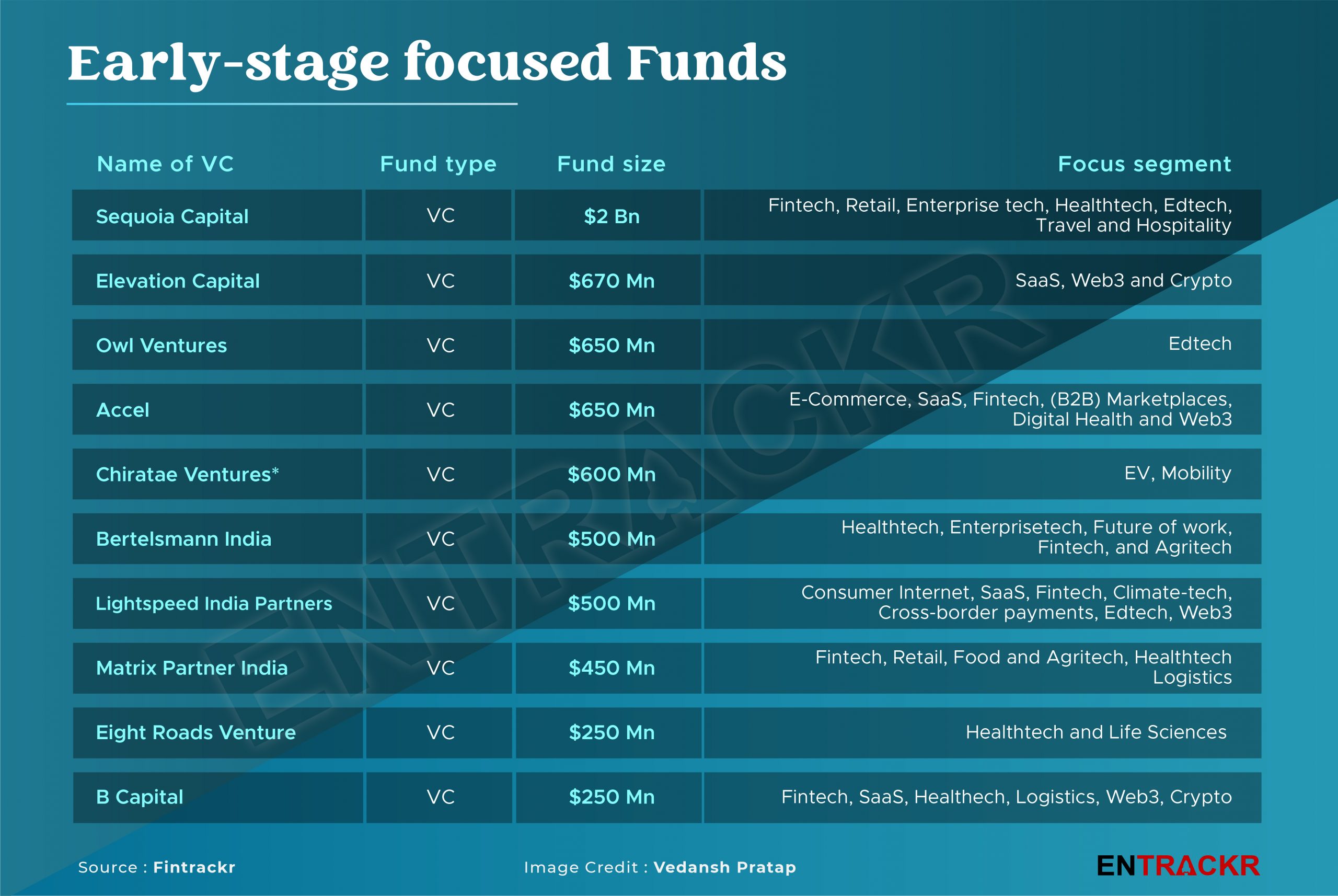

TOP 10 early stage funds

Like Sequoia, several funds such as Accel, Elevation Capital, Chiratae Ventures, Lightspeed, Matrix Partners India, Arkam Ventures, Rocketship.vc, 9Unicorns, Bertelsmann and Auxano Capital are going to back startups irrespective of stages from their new or upcoming funds.

There are more than 50 funds announced in 2022 that will focus on early stage investments. Recently, global tech-focused investment firm B Capital raised $250 million as part of its first dedicated early-stage vehicle Ascent Fund. In May, Eight Roads Venture, a global investment firm backed by Fidelity, launched its first dedicated India healthcare & life sciences fund worth $250 million.

Venture Capital firm Quona Capital is also in the process of closing its third fund at $325-350 million. Stride Ventures, Aavishkaar Capital, Prime Venture Partners, Tenacity Ventures, KuCoin Ventures, and Roots Ventures raised $100 million or more in their new fund in 2022 for early stage investments.

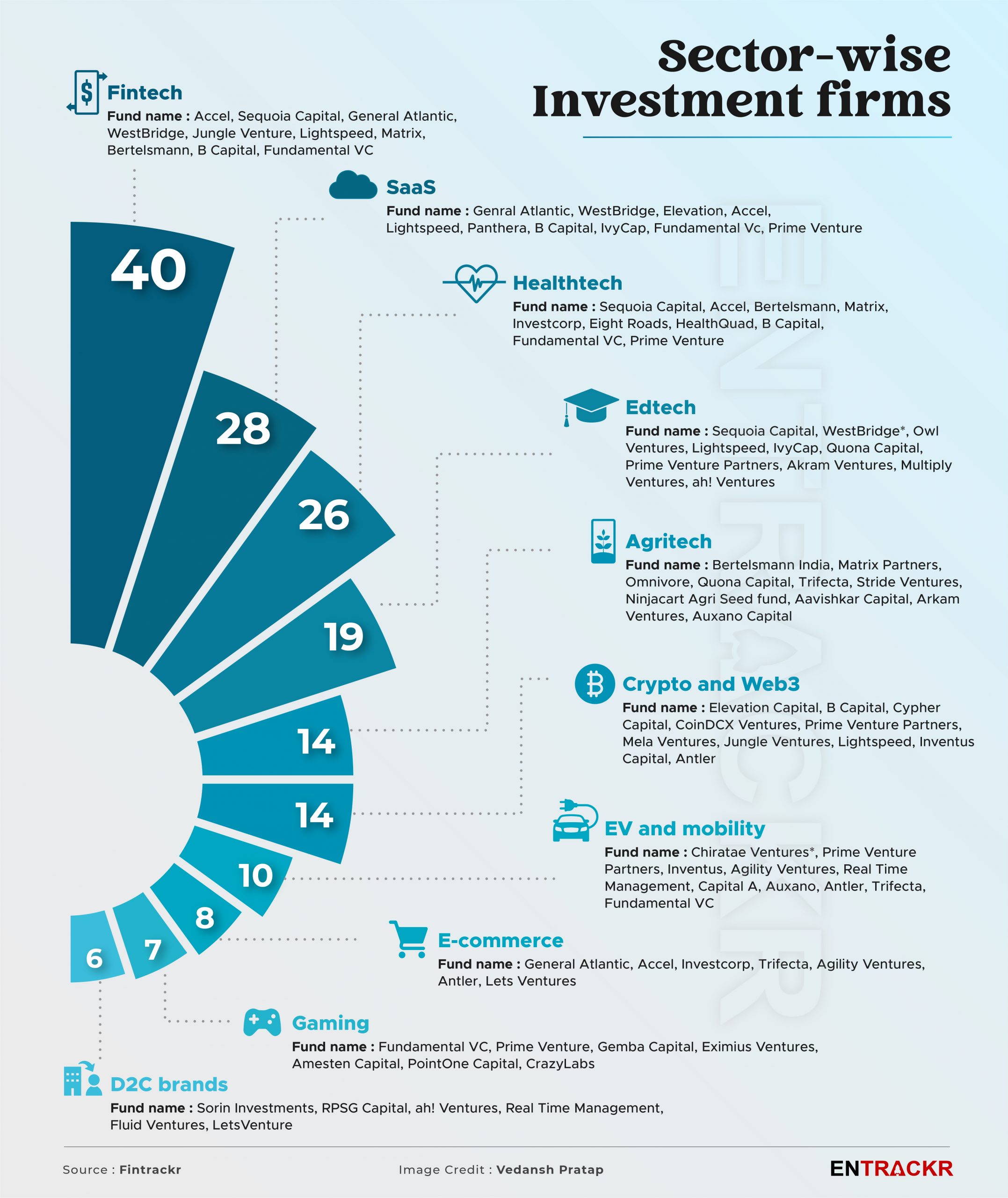

Sector-wise funds: Fintech, SaaS, healthcare, agritech on the rise

In 2021, startups in the fintech and edtech space were the top fundraisers, as per Fintrackr’s data. But that is set to change this year as a tightening of rules by RBI for fintech startups has changed the environment. Meanwhile, the reopening of schools, colleges and offline coaching centers has expectedly impacted edtech startups, when they were not yet close to breakeven. Expectedly, this led to several layoffs and shutdowns in this segment.

While fintech startups maintained their top position in terms of the number of deals during the first half of 2022, edtech slipped to fifth position. Moreover, crypto startups have been facing strong negative signals from the Indian government and RBI while agritech startups saw a rise in funding.

Data compiled by Fintrackr suggests that nearly 40 investment firms (including VC, PE and debt) have announced that they will focus on fintech startups from their new fund. SaaS, healthcare, edtech and agritech startups focused funds were next on the list. The ongoing pandemic appears to be the reason behind the rise in the number of investment firms focusing on healthcare.

Entrackr also published a report on the rise of agritech startups in India since 2020. The investments in agritech is likely to go up in the coming years but the space needs more funds such as Omnivore Capital and Ninjacart’s Agri Seed Funds that extensively focus on agriculture-based startups.

Like Ninjacart, a clutch of startups have launched corporate venture capital or CVC to back startups in particular segments. The list includes CoinDCX Ventures and Tegro, a fund launched by WazirX co-founder Siddharth Menon and Indian game developer SuperGaming.

Crypto and web3 also saw interest from investors, however, union finance minister Nirmala Sitharaman recently said that the Reserve Bank of India (RBI) wants cryptocurrencies banned in India. While RBI has been advocating against cryptocurrency, this comment could further impact the investment plans in crypto-based startups which were making headlines for fundraising almost every day until the past few months.

Amid surge in fund launches, large fund go slow or shift focus

According to a Bain and Company report, startups in India are likely to witness a shift in the pace and quality of VC deals in 2022. This can be learned from the recent events where VCs like Sequoia and Y Combinator have asked startup founders to focus on profitability over growth. Meanwhile, New York-based Tiger Global is reportedly planning to slow its investment for the next two quarters.

In May, Entrackr had written about how Tiger Global is shifting its focus from growth and late stage to early stage investment. The fund reported a massive $17 billion loss during the January-April period. Like Tiger Global, Softbank was also behind the making of unicorns in 2021 and 2022, but the fund will stay away from major investments in India.

Singapore state-owned fund Temasek, which has backed ShareChat, Ola, Country Delight, Zomato, Open and Unacademy, has also hinted that it may go slow this year, according to an ET report. In April, Temasek committed an investment of $162.5 million across three funds of Info Edge Ventures, the investment arm of Info Edge.

The list may become longer as more investment firms such as Coatue Management, the backer of BharatPe, CRED, Swiggy, Vedantu, Postman and Rebel Foods, are likely to follow the footsteps of the investors mentioned above.

For Indian startups, what all this means is quite simply, a need to refine their models and plans to add a level of maturity, in terms of both scope and speed. For existing startups, profitability will obviously matter, while for early stage firms, it might mean a broader market definition that includes possibilities beyond India. VCs and other backers increasingly straddle multiple markets, and are quick to spot the potential in migration of strong ideas and models, as we have seen among the many successful startups of the past 3 years. With the amount of catching up to do in healthcare, for instance, opportunities will open up to scale up, even in areas like services for the government healthcare sector. Similarly, hitherto smaller plays like cleantech and sustainability offer opportunities, in terms of the basic requirements of a large domestic play and global opportunities. Expect a few funding surprises in this sector too.