E-commerce giant Amazon has been strengthening its grip on the grocery, food and FMCG verticals through a combination of Amazon Pantry, Amazon Fresh and Amazon Retail in India. While Pantry and Fresh are consumer-facing verticals featured on its Indian marketplace, Amazon Retail fulfils demands generated by the two.

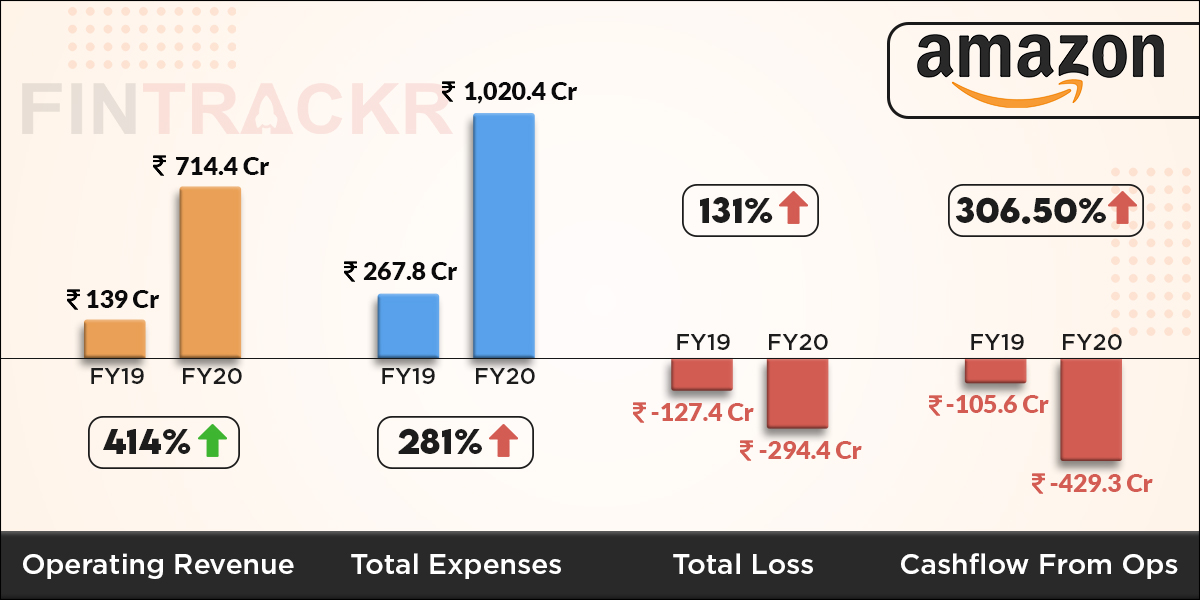

Amazon Retail, which had started operations in FY19 with a food and beverage licence from DIPP, has scaled at a quick pace in FY20. The company’s annual financial statements sourced from the MCA shows that its revenue from operations climbed 414% to Rs 714.4 crore in FY20 from Rs 139 crore in FY19.

Amazon Retail procures traded goods from wholesale channels and manufacturers which are then sold on its marketplace. It spent Rs 636.3 crore on procurement of grocery goods, accounting for 62.4% of its annual expenses. The expenses grew by 275.2% from Rs 169.6 crore spent on these purchases in FY19.

With the increase in order volumes, the company spent more on delivery expenses which went up by 338.2% from Rs 22 crore in FY19 to Rs 96.4 crore in FY20. The company also spent money to increase its employee strength to manage the rising scale and saw its employee benefit expenses surge by 57% from Rs 11.1 crore in FY19 to Rs 17.4 crore in FY20.

Notably, Amazon’s India F&B business unit spent 20.4% of its annual expenditure on legal & professional costs which were paid to its parent Amazon.com Inc during the last fiscal. These costs shot up by 227.6% from Rs 63.5 crore in FY19 to Rs 208 crore in FY20.

The company also paid another Rs 56.1 crore as platform selling fees, which went up by 157.3% from Rs 21.87 crore in FY20.

Another Rs 6.8 crore were spent on rent and related expenses which pushed the total expenses to Rs 1,020.4 crore in FY20 and which went up by 281% from Rs 267.8 crore in FY19.

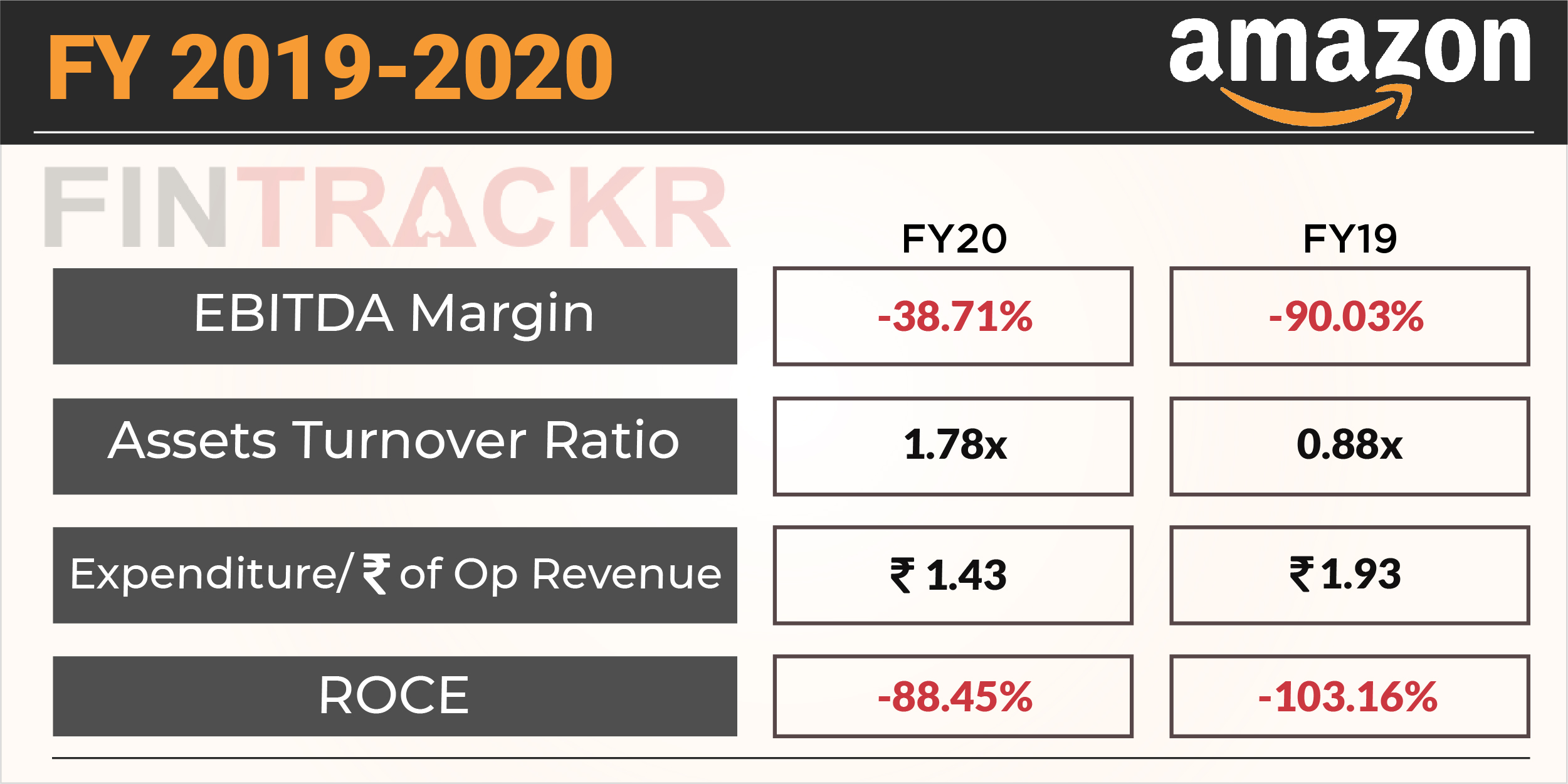

Amazon Retail spent Rs 1.43 to earn a single rupee of operating revenue in FY20 as compared to Rs 1.93 spent in FY19.

Cash outflows from operations have also surged by 306.5% from Rs 105.6 crore in FY19 to Rs 429.3 crore in FY20. The company has the benefit of being the subsidiary of the world’s largest online retailer, receiving robust financial backing from its parent entity.

Clearly, cash burn isn’t an issue and Amazon had pumped in Rs 456.5 crore in the F&B business during FY20 through allotment of shares.

While annual losses have surged by 131% from Rs 127.4 crore in FY19 to Rs 294.4 crore in FY20, the company has managed to improve its EBITDA margin from -90.03% in FY19 to -38.71% in FY20.

The five-fold increase in operating revenue of Amazon’s Food Retail unit in FY20 demonstrates the fact that its consumer-facing grocery business is likely to have grown at a similar pace.

While Amazon India doesn’t give separate break-ups for grocery sales at its marketplace, it’s unlikely to be anywhere close to the scale of BigBasket and Grofers – the two largest e-grocers in India during the last fiscal.

BigBasket had recorded Rs 3,800 crore in operating revenue during FY20 whereas Grofers’ revenue stood at Rs 2,289 crore in FY20.