Grofers is the second-largest online grocery delivery service in India, trailing behind BigBasket and fighting off competition from other localised delivery providers such as Dunzo, Swiggy’s Instamart and Amazon Fresh.

Things have changed significantly for the e-grocery sector since last year as India’s two largest business groups – Reliance with JioMart and Tatas via BigBasket – entered the fray.

While it will be interesting to see how Grofers would evolve new strategies to counter them in the ongoing fiscal FY22, the company recently filed its annual financial report for FY20 in Singapore and that gave us an opportunity to crunch some numbers to understand their current state.

Fintrackr is reviewing the numbers for its consolidated business during the fiscal ended March 2020. Grofers operates with separate retail delivery and wholesale procurement channels controlled by its Singapore based parent.

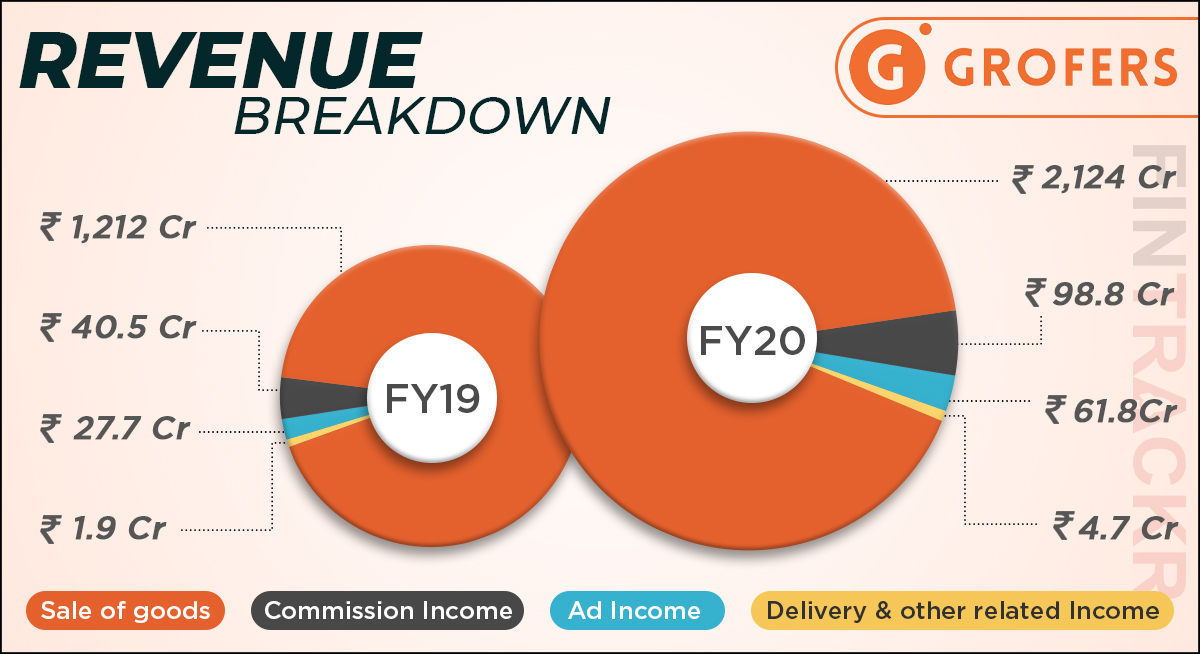

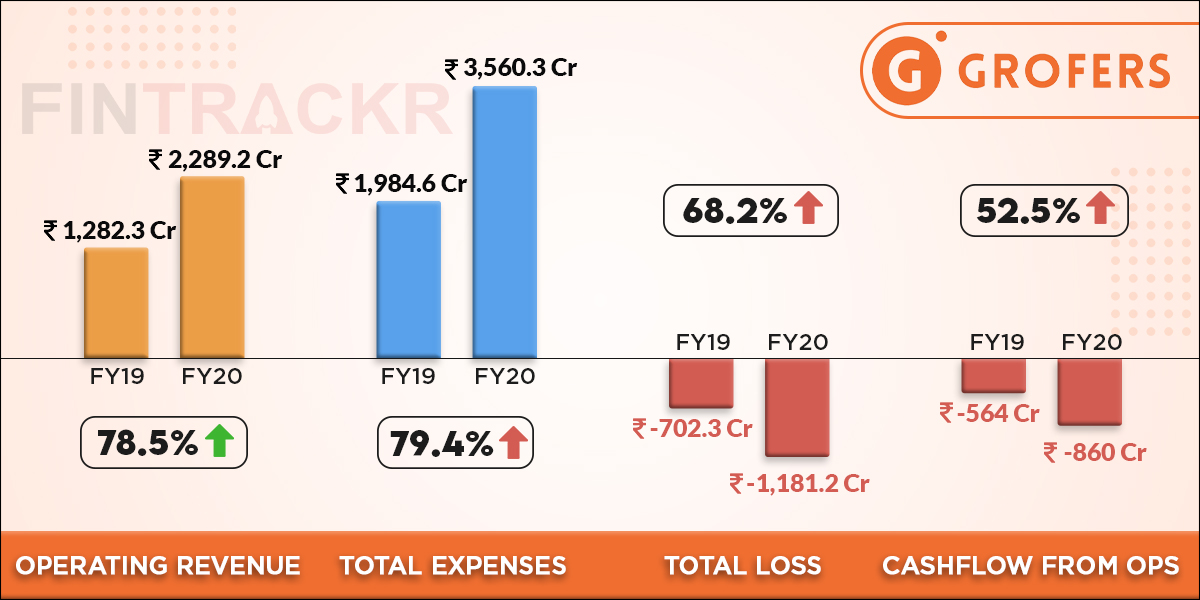

The company managed to grow its revenue from operations by a healthy 78.52% from Rs 1,282.3 crore in FY19 to Rs 2,289.2 crore in FY20. Around 92.8% of the revenue came from the sale of groceries which amounted to Rs 2,124 crore while commission income and advertising revenue stood at Rs 98.8 crore and 61.8 crore respectively.

Delivery and other related services generated another Rs 4.7 crore for Grofers during FY20.

The procurement of grocery goods traded on its platform is the largest cost centre for the company, accounting for 59.2% of the annual costs. Purchase of Goods grew by 75.1% from Rs 1,203.8 crore in FY19 to Rs 2,108.2 crore in FY20.

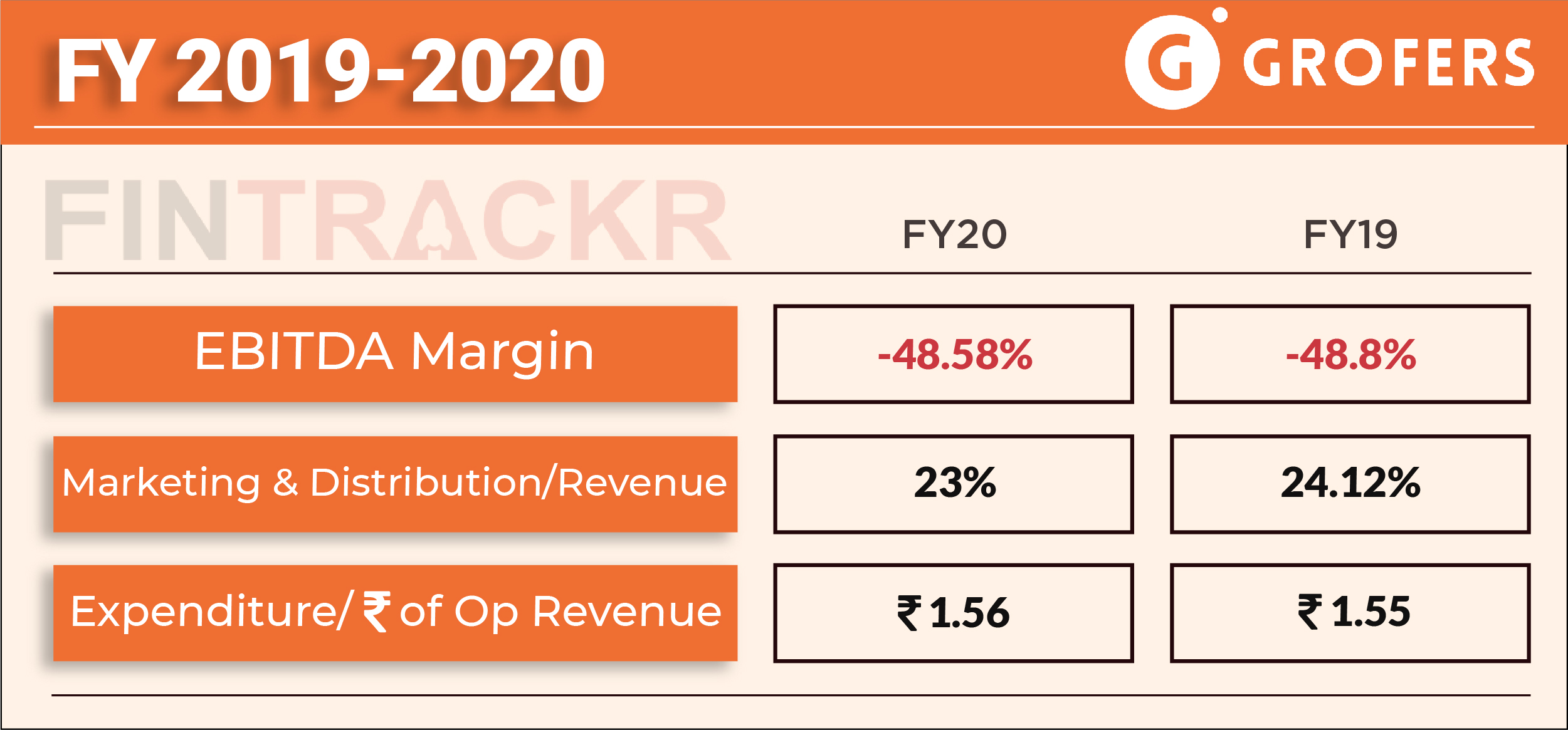

Marketing and distribution was the second biggest expenditure for the company, growing by 69.7% from Rs 309.4 crore in FY19 to Rs 525.1 crore in FY20. Importantly, these costs include rebates and discounts offered by Grofers to its customers which grew by 23.6% from Rs 128.3 crore in FY19 to Rs 158.6 crore in FY20.

Employee benefit expenses also grew significantly during the previous fiscal, jumping 70.2% from Rs 125 crore in FY19 to Rs 212.7 crore during FY20. These payments include share-based payment to employees amounting to Rs 30.4 crore. Apart from these costs, Grofers also incurred manpower expenses which grew by 32% to Rs 163.7 crore in FY20.

The company also increased its expenditure on technology by 226.7% from only Rs 14.6 crore in FY19 to Rs 47.7 crore in FY20. Legal and professional expenses also jumped by 195.6% to Rs 33.4 crore while rental and power costs grew by 175.3% to Rs 45.7 crore in FY20.

One peculiar cost that stood out was forex losses incurred in the previous fiscal which jumped by 260.4% from Rs 76.8 crore in FY19 to Rs 276.8 crore in FY20.

Overall, total expenses incurred by Grofers surged by 79.4% to Rs 3,560.3 crore in FY20 from Rs 1,984.6 crore in FY19. Grofers spent Rs 1.55 to earn a single rupee of revenue during FY20.

The Albinder Dhindsa-led firm has lost Rs 1,181.2 crore in FY20, up 68.2% from FY19’s losses of Rs 702.3 crore but the EBITDA margin remained somewhat stable at -48.6%.

Importantly, these losses don’t include the loss on the valuation of outstanding preferential shares, which is a notional loss recorded as per Singapore’s laws.

The company had accumulated losses north of Rs 3,284 crore as of March 2020 and would need a significant infusion of capital or a possible take over to scale further in India and hold on to its market share.

While the company has seen a resurgence in order quantities amidst the second wave of COVID-19 in India, it now has two deep-pocketed Indian giants – Tata and Reliance – to fight for market share besides the several localised delivery services like Dunzo.

Unlike its competition, Grofers has been completely relying on a monthly stock-up model and private labels across categories including staples and FMCG.

Since last year, it has also forayed into essential electronics and fashion. However, the fashion segment seems to have not worked out as no products are listed on its mobile and web apps. It also recently re-entered the vegetables and food category after withdrawing multiple times.