After maintaining its leadership position in the online grocery space for years, BigBasket slipped to the second position, months after the launch of JioMart during the second half of 2020. Considering the deep financial muscle of Reliance, pundits started speculating doom and gloom for the decade-old firm.

Amidst such speculations, the company got an unexpected buyer: Tata Group.

Tata Group is reportedly in the last leg to acquire a 68% stake in the Bengaluru-based firm in a deal worth $1.2 billion. While the logic behind the acquisition could be many, BigBakset’s financial performance in FY20 set a precursor for the deal.

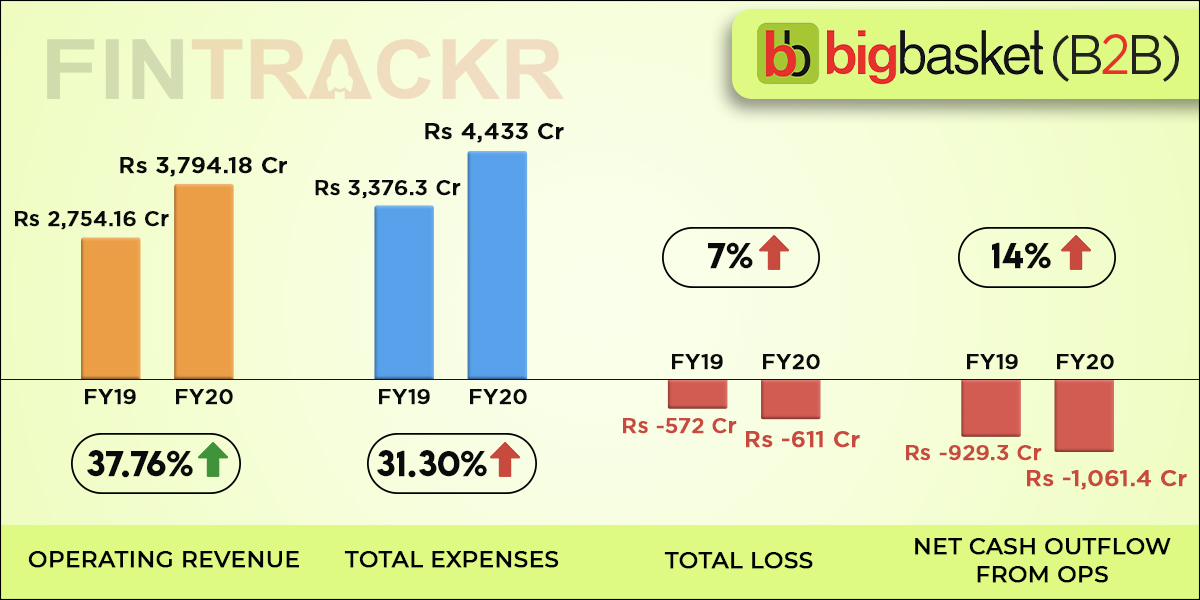

BigBasket has stood out as the largest online grocery delivery platform in FY20. Supermarket Grocery Supplies Pvt that handles the B2B side of the business saw its earnings growth by 36.3% to Rs 3,822 crore during the fiscal ended in March 2020, regulatory filings show.

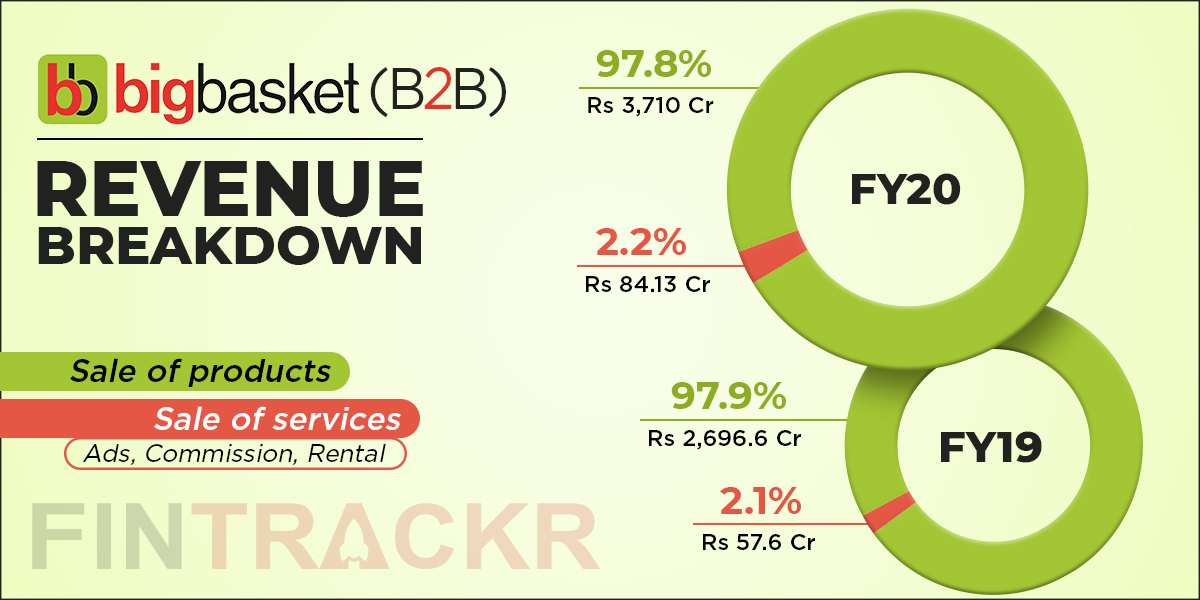

Its revenue from operations surged by 37.6% to Rs 3,794.2 crore in FY20 from Rs 2,757.2 crore in FY19. The sale of grocery and household goods of Rs 3,710 crore made the biggest chunk of the revenues, accounting for 97.8% of the total income. The rest 2.2% were collected through the provision of other ancillary services such as advertising and promotion on its platform, delivery and rentals etc. which amounted to Rs 84.13 in FY20.

BigBasket’s total expenses grew by 31.3% to Rs 4,433 crore in FY20 from the expenditure of Rs 3,376.3 crore in FY19. It spent Rs 1.17 to earn a single rupee in FY20 as compared to Rs 1.23 spent during FY19. The company is inching closer to break even with improved margins along with growth in scale every year.

During the fiscal ended in March 2020, the company raised a debt of Rs 100 crore for working capital needs and as a result, its finance costs shot up from only Rs 10 lakh FY19 to more than Rs 29.2 crore in FY20.

BigBasket purchased goods worth Rs 3,545.7 crore from its supplier during FY20, accounting for 80% of the total expenses. These purchases grew by 34.2% as compared to purchases of Rs 2,640.4 crore to keep up with the increased demand.

With an inventory turnover ratio of 16.13X, the company replaced its stock in around 23 days on an average during last year. BigBasket also incurred secondary packing costs of Rs 40.7 crore which increased by only 5% in FY20.

To promote sales on its online grocery platform, the company gave out discounts worth Rs 178.5 crore during FY20, which surged by 23.1% from the discounts of Rs 145 crore handed out in FY19.

BigBasket incurred advertising and promotion costs of Rs 148 crore in FY20, which came down 21.7% as compared to Rs 189 crore paid out for the same during FY19.

With an increased scale of operations, the company increased its employee base and its costs related to salary benefits grew by 27.08% to Rs 352.8 crore in FY20 from Rs 277.6 crore paid out in FY19. BigBasket also employs external subcontractors and their payments grew by 15.5% to Rs 59.6 crore in FY20.

Transportation and supply related costs grew by 37.8% to Rs 82.4 crore in FY20 from Rs 59.8 crore paid out in FY19. IT and payment gateway expenses have grown by 35% to Rs 62 crore in FY20 from Rs 45.9 crore booked in FY19.

Further, the company has managed to dial back other administrative and operative costs such as rent and security which were reduced by 39.3% to Rs 38.8 crore while office-related costs dropped by 42.2% Rs 4.8 crore in FY20.

Another Rs 3.7 crore was booked as miscellaneous expenses, pushing the net cash flow from operations to Rs 1,061.4 crore, a 14% up compared to outflows of Rs 929.3 crore in FY19.

BigBasket’s annual losses have registered an uptick of 7% growing from Rs 572 crore in FY19 to Rs 611 crore in FY20 while EBITA margins have improved by 548 BPS to -12.87% in FY20.

BigBasket retail arm: Innovative Retail Concepts in FY20

BigBasket has diversified its B2B and B2C operations between two companies. The aforementioned Supermarket Grocery Supplies Pvt Ltd works for the procurement of traded goods from FMCG companies while Innovative Retail Concepts handles the sales and home delivery of groceries.

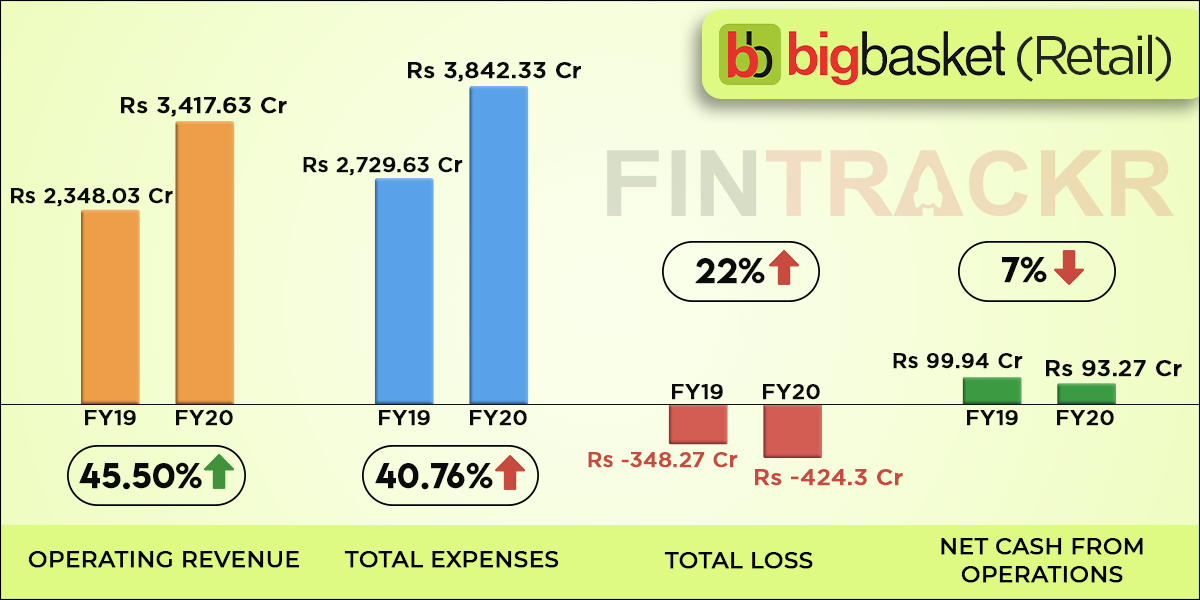

The consumer-facing entity achieved a 45.5% growth in its operating revenue which stood at Rs 3,417.63 in FY20. It sold goods worth Rs 3,350.85 crore in FY20, registering a 42.7% YoY growth. Its collection of delivery fees from end customers shot up by 97% to 66.84%.

Innovative Retail issued e-vouchers worth Rs 105.8 crore to customers during FY20 and these costs grew by 56% from Rs 68 crore booked in FY19. The company recorded transportation expenses of Rs 212.23 crore in FY20, growing from Rs 143 crore in FY19. These costs were incurred in the delivery of goods to the final customers.

Another Rs 8.12 crore were paid for the procurement of uniforms for works and delivery bags pushing the total expenditure to Rs 3,842.3 crore in FY20 which grew 40.8% YoY. The B2C entity’s losses grew by 22% to Rs 424.3 crore during FY20 at an EBITDA margin of -11.63%.

Significantly, the auditor has pointed out that while the company has registered significant growth in business over the years, it has also incurred significant losses to invest in growth. The Retail arm sports a negative shareholder fund of Rs 1,258.43 crore. Due to these accumulated losses, complete erosion of net worth and negative working capital position as of the balance sheet date, indicate that a material uncertainty exists that casts significant doubts on the company’s ability to continue as a going concern.

The financial performance of BigBasket has improved in FY20. However, it’s still not close to churning profits. According to experts, the company will take at least two-three years to become financially stable. “Profitability may not be on BigBasket’s card as it has been locked in an intense battle with JioMart. Since Tata is acquiring a major stake in the company, it will depend on the group’s call whether to acquire more market share or chase sound unit economics,” said Satish Meena, Forecast Analyst, Forrester India.

Innovative Retail was set up as a seller on the BigBasket platform but we can see it makes up for almost all of the sales by Supermarket Grocery Private Limited. It also receives a credit period of four months which is quite rare in the FMCG space and no disclosure was presented in the annual report as all the transactions between Innovative retail and Supermart Grocery were termed as on “arm length basis”.