Bharat-focused franchise-led grocery chain Apna Mart managed to grow its topline by over eight-fold during the fiscal year ending March 2023. But this growth was fueled by aggressive spending on promotions, manpower, and employee benefits.

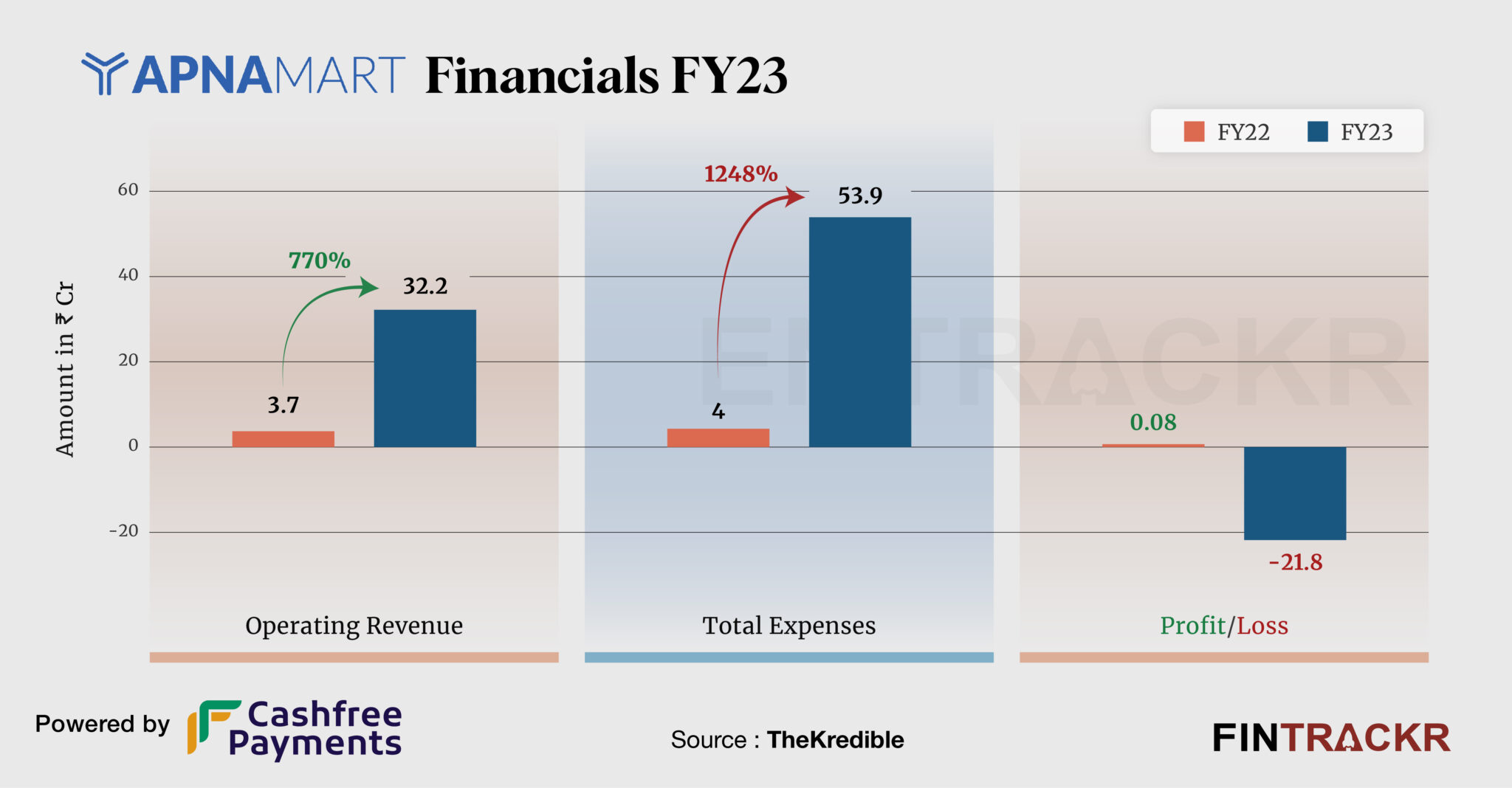

Apna Mart’s revenue from operations surged 770% to Rs 32.2 crore during FY23 in comparison to Rs 3.7 crore in FY22, the company’s financial statement with the Registrar of Companies shows.

Founded in 2021 by Chetan Garg and Abhishek Singh, Apna Mart is a franchise-driven offline grocery and FMCG chain which also offers online ordering in Jamshedpur, Ranchi, Raipur, Dhanbad, Asansol, among others. The platform positions itself as DMart for smaller cities.

The cost of materials was found to be the largest cost component for the company forming 58.6% of the total expenses. This cost jumped 809.9% to Rs 31.6 crore in FY23 from Rs 3.47 crore in FY22. Employee benefit expenses also skyrocketed to Rs 9 crore during the year which also includes ESOP costs (non-cash in nature) worth Rs 1.89 crore.

Expenses Breakdown

https://thekredible.com/company/apna-mart/financials

View Full Data

https://thekredible.com/company/apna-mart/financials

View Full Data

- Cost of materials

- Employee benefits

- Manpower charges

- Advertisment & promotions

- Legal & professional

- Others

Further, expanding manpower charges, marketing costs, and legal expenses along with other operating costs took the firm’s total expenditure to Rs 53.9 crore in FY23.

The total cost was Rs 4 crore in the previous fiscal year (FY22).

In the end, Apna Mart’s bottom line suffered the impact of rising expenses and it posted a loss of Rs 21.8 crore in FY23 against Rs 8 lakh profit in FY22. For the complete expense breakdown and year-on-year financial performance of the company, head to TheKredible.

Followed by heavy cash burn, the operating cash outflows of the startup worsened to Rs 23.4 crore (negative) while the net cash flows stood at Rs 1.8 crore (positive).

The EBITDA margin and ROCE of the firm registered at -66.37% and -449.17%, respectively. On a unit level, Apna Mart spent Rs 1.67 to earn a rupee of operating revenue during FY23.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | 3.39% | -66.37% |

| Expense/₹ of Op Revenue | ₹1.08 | ₹1.67 |

| ROCE | 6.88% | -449.17% |

The company was in talks to raise about $15-20 million in funding from Accel and Sequoia (now Peak XV Partners). Entrackr had exclusively reported this development in April 2023.

As per TheKredible, Apna Mart has raised over $14 million to date from the likes of Accel Partners, Peak XV Partners, Titan Capital, Disruptors Capital, Sparrow Capital, and 2 am Ventures among others. The firm’s current valuation stands at Rs 397 crore or $48 million.

With Rs 397 crore valuation and Rs 32 crore revenue from operations, the company’s valuation-to-revenue ratio stands at 12.4 times.

Currently, the firm’s co-founders Abhishek Singh and Chetan Garg hold a 24.76% stake each, in the company. Accel Partners is the largest external stakeholder in ApnaMart followed by Peak XV Partners. For a complete shareholding pattern, visit TheKredible.

Apnamart, with its footprint mostly in the East and Central parts of India, has a tough path ahead, as scrutiny will be very high for any retail venture here. While having professional founders with solid credentials will help a lot, the founders will be aware that any misstep will be magnified, in regions where there has been a long history of ventures that flamed and died out after promising the moon in the retail category. ‘Scams’ like JVG, Bhadrika, etc are still fresh in the minds of many, and Apna Mart will do well to not seek a franchisee-funded model for now. The way ahead will remain tough on the margin front, which the firm will probably seek to overcome by going for local brands over national brands perhaps. How far that takes them is something many people will be watching for, as local brands have also come a long way in areas like packaging quality. Whether product quality stands the test of markets, remains to be seen.