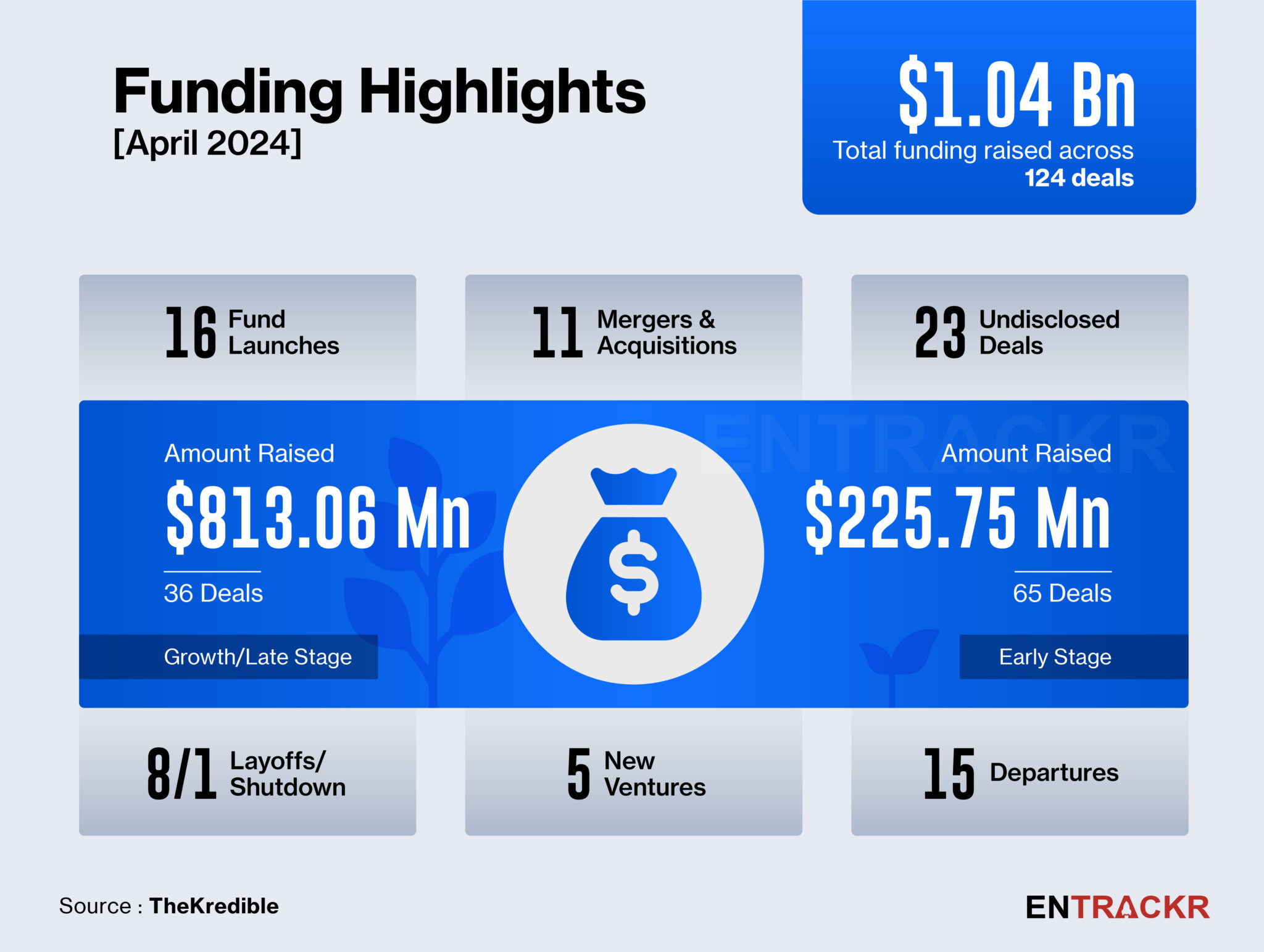

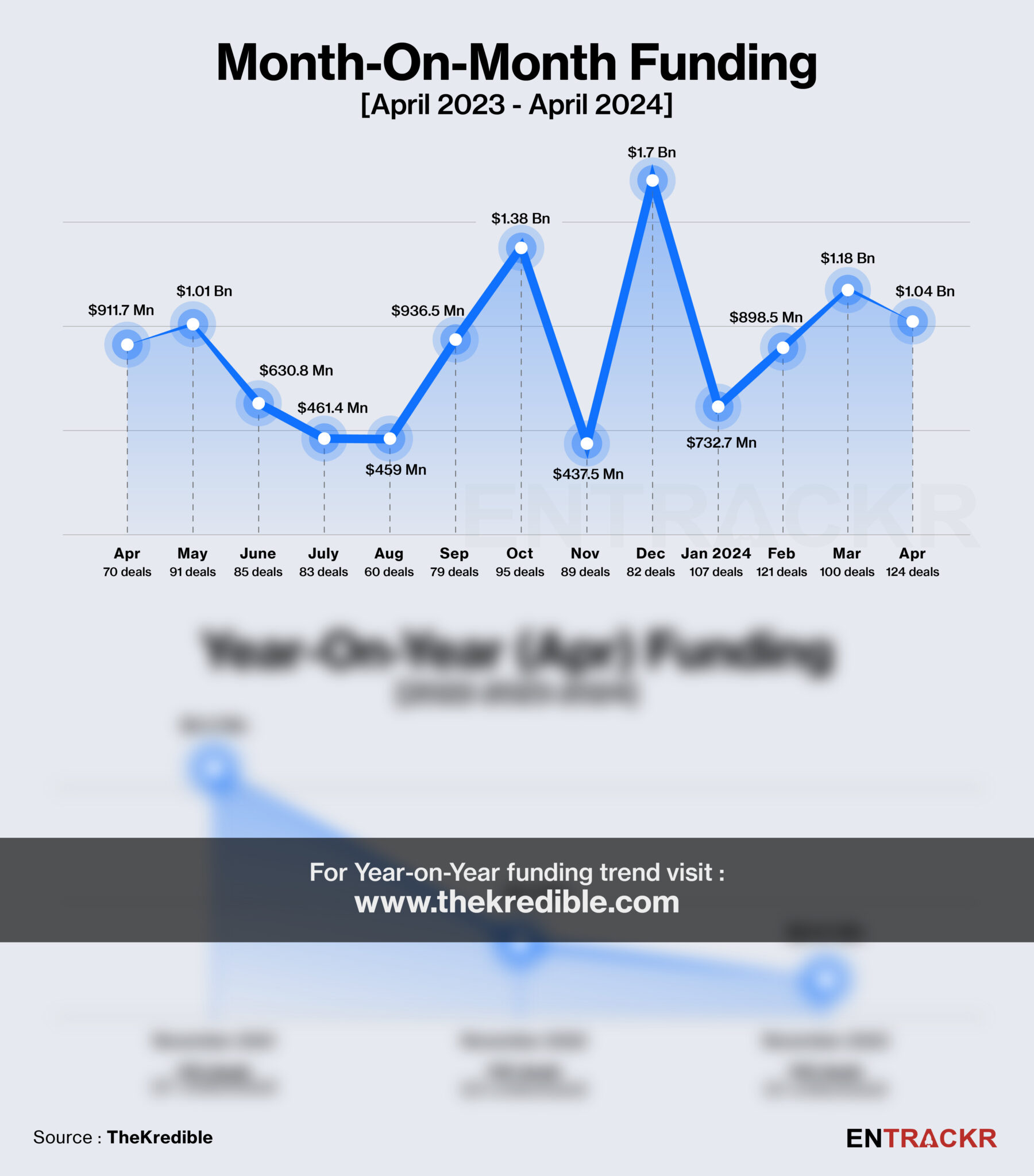

The year 2024 started on a good note for Indian startups: an average of $1 billion in monthly funding, which is a significant growth when compared to the previous year during which monthly funding went below $500 million three times. In April 2024, however, startups crossed the $1 billion threshold on the back of a couple of pre-IPO funding, a few late-stage rounds, and debt deals.

Indian startups raked in more than $1 billion across 124 deals in April, according to data compiled by startup data intelligence platform TheKredible. This included 36 growth-stage deals worth $813 million and 65 early-stage deals amounting to $225.75 million. Moreover, there were 23 undisclosed rounds, primarily early-stage deals.

During the recent Startup Mahakumbh festival, Peak XV Partners’ managing director Rajan Anandan said that Indian startups are expected to raise $8 billion to $12 billion this year. He also added that around $20 billion of private capital is lying uninvested and is committed to investment in private firms and startups in India. This estimate appears close considering the current rate of monthly funding.

[Month-on-Month and Year-on-Year trend]

In April 2024, there was a 14% year-on-year jump in funding from $912 million in the same month last year. Even on a monthly basis, April almost matched March’s $1.18 billion funding. Interestingly, only one startup i.e. PharmEasy managed to raise funding in three digits during the last month. Since January, homegrown startups have raised close to $4 billion, and at this rate, it may cross the $11 billion funding raised in 2023.

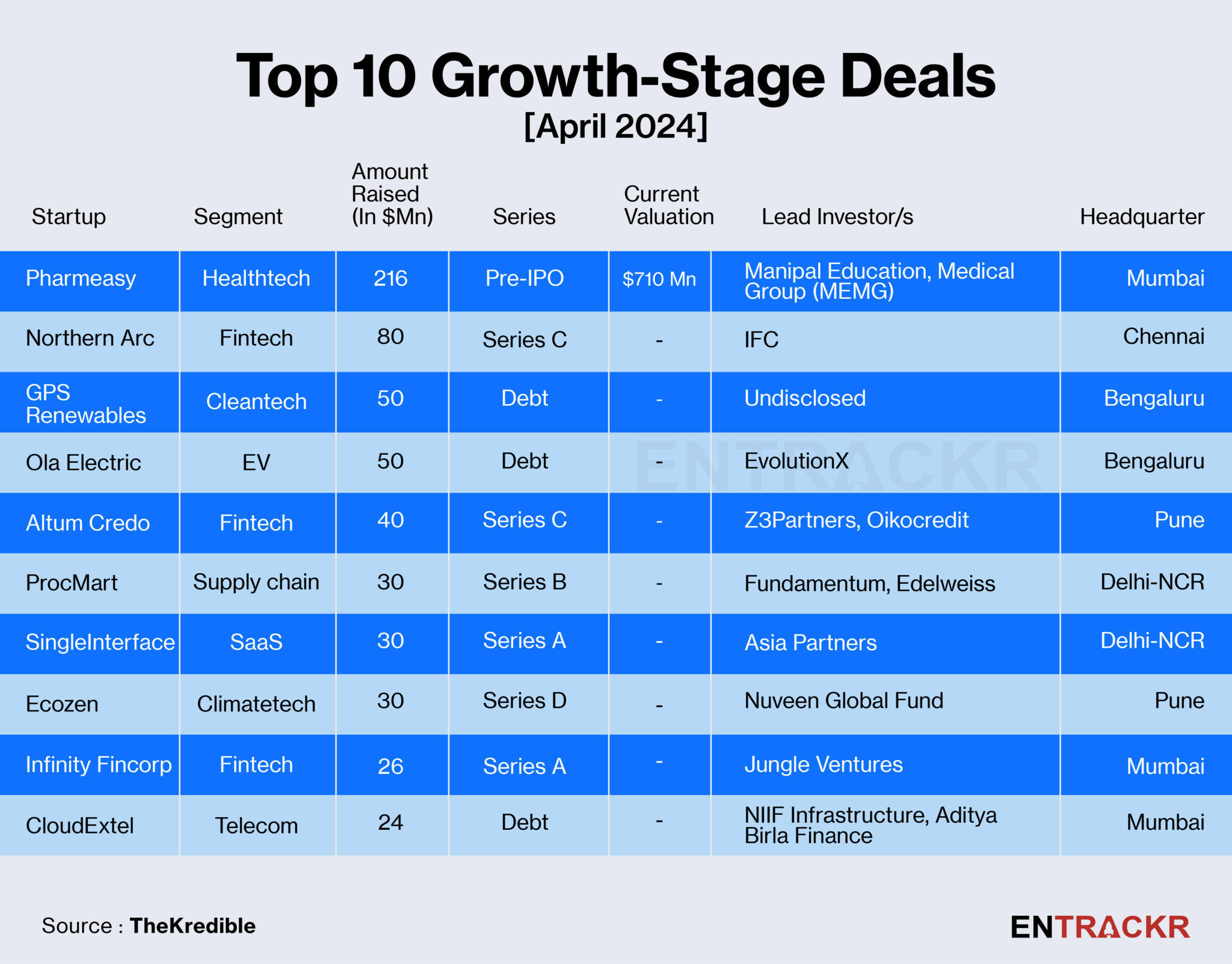

[Top growth stage deals]

Healthcare startup PharmEasy’s $216 million pre-IPO round stood at the top, though its valuation dropped nearly 90% from $5.6 billion to $710 million during the latest fundraise. Financial services firm Northern Arc also announced its $80 million Series C round while Ola Electric raised $50 million in debt even after filing draft IPO papers.

Altum Credo, ProcMart, SingleInterface, Infinity Fincorp, CloudExtel, and LetsTransport also featured in the top 10 growth stage deals in April.

[Top early-stage deals]

Omnichannel fashion startup Lyskraft, founded by Zomato’s co-founder Mohit Gupta and Myntra and Cultfit’s co-founder Mukesh Bansal, scooped up $26 million in a seed funding round and was on the top of the list in early-stage deals in April. Gen AI startup Neysa bagged $20 million whereas spacetech company Dhruva Space and edtech firm Emversity (Beyond Odds) raised $15 million and $11 million, respectively.

The rest of the early-stage startups in the top 10 list raised less than $10 million each. The list includes Traya, LightFury Games, GTM Buddy, FincFriends, and Accacia.

[City and segment-wise deals]

City-wise, expectedly, Bengaluru-based startups are on top with 42 deals, contributing around 26% of the overall funding in April. Delhi-NCR and Mumbai followed with 30 and 26 deals, respectively. However, Mumbai-based startups topped the list in terms of the total amount raised. The list further counts Kolkata, Hyderabad, Pune, and Ahmedabad among others.

Segment-wise, e-commerce startups (including D2C brands) and fintech startups co-led the list with 19 deals each followed by healthtech (16), SaaS (15), EV (5), automotive tech (4), and foodtech (4) startups among others. Visit TheKredible for more details.

[Stage-wise deals]

Series-wise, 44 startups raised funding in the Seed round followed by 20 Series A deals, 13 Pre-Series A, 11 Series B deals, and 7 Pre-Seed deals. As many as 14 startups raised debt funding worth $199.2 million during the period.

[Mergers and acquisitions]

Indian startups saw nearly a dozen mergers and acquisitions in April of which most deals were undisclosed. Among the disclosed deals, National Investment and Infrastructure Fund (NIIF) acquired a majority stake in digital infrastructure solutions company iBUS for about $200 million. US-based Aurionpro Solutions also acquired Indian fintech company Arya.ai for $16.5 million.

The notable list of M&A also includes the acquisition of Shy Tiger brands by Ghost Kitchens India, Orbit by Postman, Awign by MyNavi, and Magzter by Dailyhunt’s parent company VerSe Innovations.

[Layoffs, top-level exits, and shutdown/s]

The mass firing in startups continued in April as they laid off nearly 1,500 employees during the month. April surpassed the cumulative layoffs of 1,100 employees during the first quarter of 2024. Troubled edtech company Byju’s remained on top with 500 layoffs, followed by The Good Glamm Group, Healthify, and Scaler with 150 layoffs each. Check the full list here.

April also saw high-profile exits from startups including five chief executives. Sujot Malhotra, CEO of Beardo, Surinder Chawla, CEO of Paytm Payments Bank, Arjun Mohan, CEO of Byju’s India, Sukhleen Aneja, CEO of The Good Glamm Group’s D2C Brands Division and Hemanth Bakshi, CEO of Ola Cabs, have quit this month.

Besides layoffs and departures, Nintee, a digital health startup launched by Wingify founder Paras Chopra, announced shutting down its operations after a year of launch. During the first three months of 2024, six startups announced their shutting down operations in India.

[ESOP buyback]

Employees’ stock buyback also continued in April as three growth-stage companies – Pocket FM, XYXX, and The Sleep Company – announced their ESOP buyback program last month. Pocket FM bought back $8.3 million worth of stocks from employees while the rest two did not disclose the transaction details. The March quarter saw four ESOP buybacks including MyGate, Meesho, Classplus, and Imagekit.

Visit TheKredible to see series-wise deals along with amount breakup, complete details of fund launches, and more insights.

[Conclusion]

While the trajectory of fund raising is positive, its quality might worry some, as it has gone to a firm that was clearly in distress and at a massive haircut (PharmEasy), besides the large, lumpy deal from NIIF. It might also be time to relook debt funding numbers as part of overall startup funding figures, as debt is usually taken by startups that are running operations sustainably from a financial perspective, or where founders do not want to dilute stakes any more. So it’s not quite the risk capital that equity funding is.

With a host of IPOs being lined up, we expect the growth trajectory to sustain as pleased investors return to find the next big opportunity.