HR-tech startup BetterPlace has demonstrated outstanding financial performance during the last two fiscal years: tenfold growth from Rs 51 crore in FY21 to Rs 523 crore in FY23.

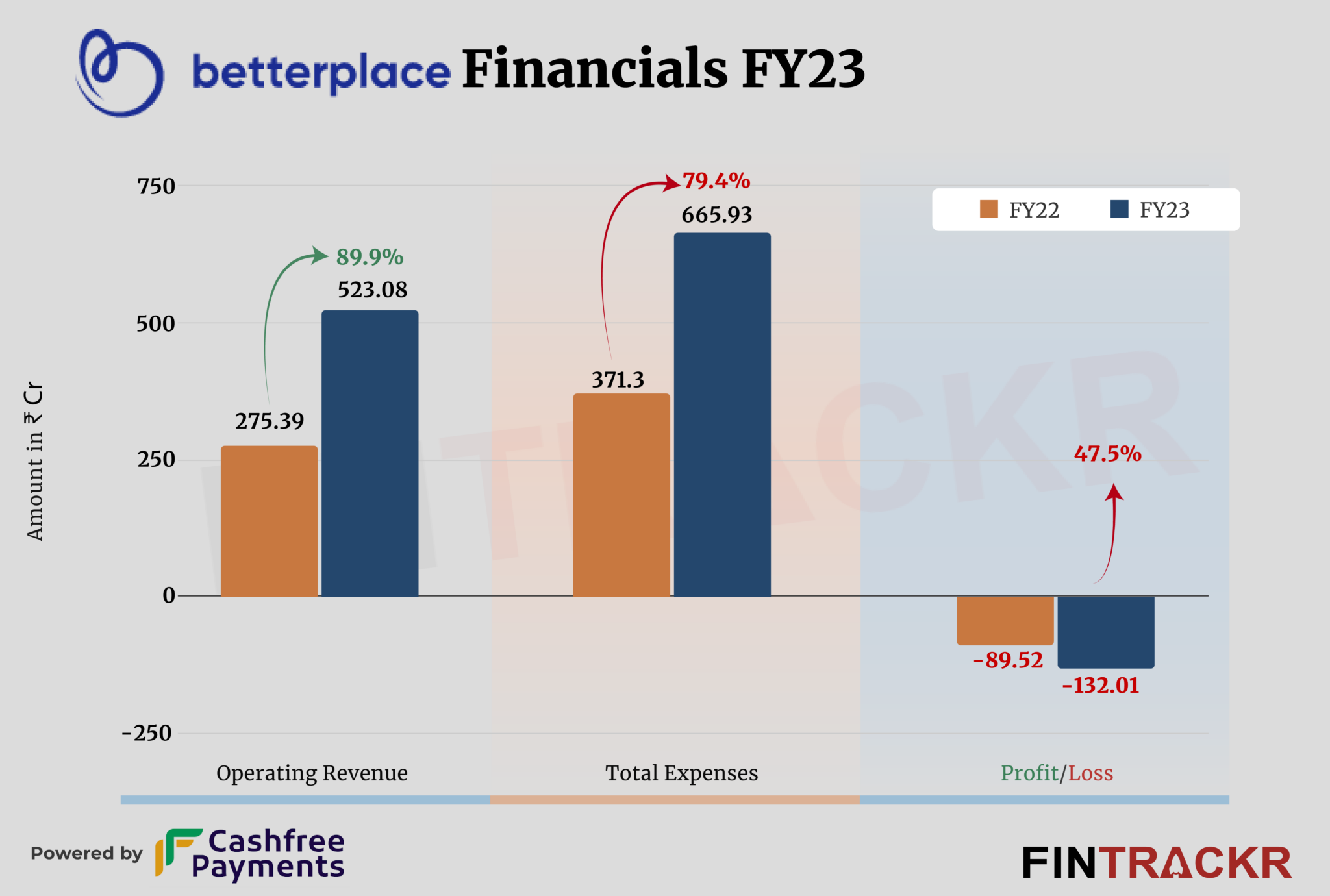

BetterPlace’s revenue from operations grew 90% to Rs 523 crore in FY23 from Rs 275 crore in FY22, its consolidated financial statements filed with the Registrar of Companies show.

Founded in 2015, BetterPlace caters to the entire value chain of frontline workforce management encompassing discovery, hiring, onboarding, background verification, and payroll to upskilling, and services such as vendor management, workforce fulfillment, insurance, and credit.

The income from workforce fulfillment services accounted for 91.2% of the total operating revenue which surged 2.3X to Rs 477.3 crore in FY23 from Rs 202.29 crore in FY22.

Onboarding, software licensing, sale of products, and interest income (non-operating) are some other revenue drivers that tallied its total income to Rs 534 crore during the preceding fiscal year (FY23).

Check TheKredible for the detailed revenue breakup.

Revenue Breakdown

https://thekredible.com/company/betterplace/financials

View Full Data

Employee benefits emerged as the largest cost center for BetterPlace, forming 82.73% of the overall expenditure. This cost grew two-fold to Rs 551 crore in FY23. It includes Rs 8.78 crore as ESOPs cost.

Other overheads such as procurement, legal, KYC authentication, software, and technology took the overall expenditure to Rs 666 crore in FY23 from Rs 371 crore in FY22. Head to TheKredible for the complete expense breakdown.

Expense Breakdown

https://thekredible.com/company/betterplace/financials

View Full Data

https://thekredible.com/company/betterplace/financials

View Full Data

- Cost of procurement

- Employee benefit

- Depreciation and amortization

- Legal and professional charges

- Sub-Contracting Expenses

- KYC authentication charges

- Software expense

- Other

The 90% growth in scale and controlled cost helped BetterPlace restrict its losses to Rs 132 crore in FY23 which stood at Rs 89 crore in FY22. Its ROCE and EBITDA margin stood at -182% and -24% respectively. On a unit level, it spent Rs 1.27 to earn a rupee in FY23.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | -27% | -24.0% |

| Expense/₹ of Op Revenue | ₹1.35 | ₹1.27 |

| ROCE | -46% | -182% |

BetterPlace has raised over $90 million across rounds. According to the startup data intelligence platform TheKredible, Jungle Ventures is the largest stakeholder with 17.99% shares followed by Unitus Ventures and 3one4 Capital.

Visit TheKredible for the full shareholding pattern.

Betterplace certainly seems to be well placed to grow, having finally cracked the growth code after years of trials and learning, one assumes. Typically, when a firm this old grows this fast, it can mean some strong years of growth ahead. Starting from just verification services, the firm has quietly integrated all subsequent services like onboarding, upskilling etc into a single platform, making it a true HR SaaS firm. Going ahead, it will probably be the quality of the top tier team, rather than just the founders who decide how far this firm goes.