Slow but steady, the flow of funding continued to rise. This week as many as 21 Indian startups raised $248.94 million cumulatively. These transactions include five growth-stage and 10 early-stage deals. The amount raised by five early-stage startups was undisclosed.

Last week, around 28 growth and early stage startups collectively raised $178 million, including three undisclosed deals.

[Growth-stage deals]

Vivifi, the Hyderabad-based NBFC led the pack with $75 million fundraise followed by enterprise SaaS solution provider AiDash and Namdev Finvest which raised $50 million and $15 million, respectively.

Construction solutions firm Infra.Market and engineering, procurement, and construction company VIKRAN Engineering secured $12 million and $10 million, respectively.

[Early-stage deals]

Among the early-stage startups, 10 startups secured $86.94 million capital. Bhavish Aggarwal’s AI startup Krutrim topped with a $50 million fundraise in its unicorn round. NBFC Ecofy, networking platform to connect startups, investors, and industry experts, SCOPE and gen-z focused fast fashion D2C brand Newme followed the list.

Further, the list includes AI startup RagaAI, Karthik Gurumurthy’s new venture Convenio and gaming firm STAN among others.

During the week, Bookingjini, DocOsage, Studiovity, The Kenko Life, Kofluence and Analytics Jobs also raised capital but did not disclose the funding amount. For more information, visit TheKredible.

[City and segment-wise deals]

In terms of city-wise number of funding deals, Bengaluru-based startups topped the list with eight deals. This was followed by Mumbai, Hyderabad and Delhi-NCR-based startups with 4, 3 and 3 deals, respectively.

Moreover, Thane and Jaipur-based startups were next on the list.

The complete breakdown of the city and segment can be found at TheKredible.

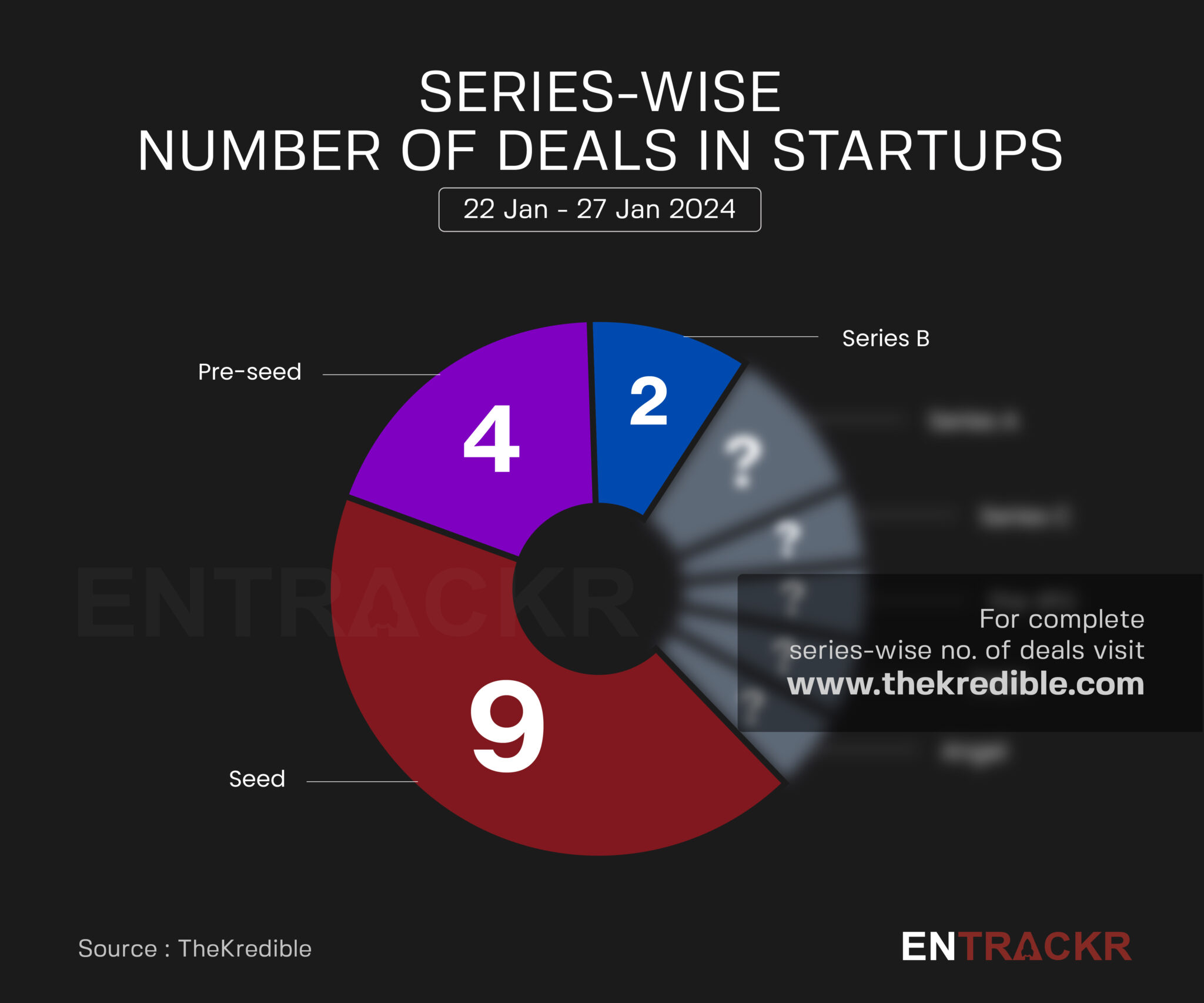

[Series wise deals]

This week, seed-stage deals grabbed the top spot with nine deals followed by pre-seed and pre-Series A stage startups with four and two deals, respectively.

[Week-on-week funding trend]

On a weekly basis, startup funding went up 39.9% this week to $248.94 million as compared to $178 million in the previous week.

The average funding in the last eight weeks stands around $299 million with 23 deals per week.

[M&A]

This week witnessed two acquisitions. Nazara-owned NODWIN Gaming acquired Comic Con India, which hosts multiple pop cultural festivals targeting youth in India. Traveltech firm MakeMyTrip acquired a majority stake in intercity cab service provider Savaari Car Rentals.

[Layoffs/Shutdown]

Health and wellness platform Cult.fit (formerly Cure.fit) has laid off around 150 employees this week while foodtech and quick commerce decacorn Swiggy is laying off 5-6% of its overall workforce as the company is looking to turn profitable by the second half of this year.

Moreover, cricket NFT platform Rario has announced to shut down its current product and will launch a new product by March. This comes months after both co-founders of the company quit along with mass exits of employees.

Visit TheKredible to see series wise deals and amount breakup, fund launches, departures and more insights.

[New launches]

▪️ Ex-CEO of Times Internet, Gautam Sinha floats an AI venture SimpleO.ai

[Financial results this week]

▪️ Chai Point crosses Rs 200 Cr revenue in FY23; losses slow

▪️ DealShare’s GMV remains flat in FY23 with Rs 1,043 Cr outstanding loss

▪️ Byju’s posts Rs 5,015 Cr revenue and Rs 8,245 Cr loss in FY22

▪️ Ferns N Petals posts Rs 607 Cr revenue in FY23; bleeds heavily

▪️ Eruditus’ revenue crosses Rs 3,300 Cr in FY23; losses dwindle 66%

▪️ Ratan-Tata backed CashKaro crosses Rs 250 Cr revenue in FY23

[News flash this week]

▪️ Zomato gets RBI nod for payment aggregator biz

▪️ Fidelity marks down valuation of Meesho and Pine Labs

▪️ SoftBank offloads Rs 3,800 Cr worth shares in Paytm in FY24

▪️ SaaS startup Perfios reportedly planning for public listing this year

▪️ Khazanah in talks to lead $400 Mn funding round in OYO

▪️ Healthcare firm Redcliffe and Qure.ai are in talks to raise fresh funds

[Entrackr’s analysis]

The ongoing surge in weekly funding remains a positive trend, with the latest week marking the emergence of the first unicorn of 2024. However, amid this positive momentum, the downside is apparent as companies like Swiggy and Cult.fit are reportedly undergoing significant layoffs, affecting hundreds of employees.

In a noteworthy development, Zomato has secured approval from the Reserve Bank of India to function as a payment aggregator and issuer of pre-paid payment instruments.

Moreover, Fidelity, a financial services firm, has marked down the valuations of e-commerce company Meesho and fintech unicorn Pine Labs. Notably, this valuation adjustment comes after Fidelity had previously marked up the valuations of both companies in July 2023, following a fair valuation reduction in April of the same year.

Looking ahead, SaaS firm Perfios is gearing up for public listing. While Oyo, Redcliffe, and Qure.ai are reportedly looking to raise new funding rounds.

Bhavish Aggarwal’s AI startup Krutrim becoming a unicorn in a relatively short span of time also suggests the possibilities of AI becoming the new favorites for investors.

A new season of Shark Tank India has started airing. We’re likely to see more new entrepreneurs from different parts of the country getting the limelight. Maybe some on-screen drama too.