Sustainable footwear startup Neeman’s has been growing gradually as its scale jumped nearly 50% in FY23. At the same time, the company’s losses went out of control past Rs 100 crore.

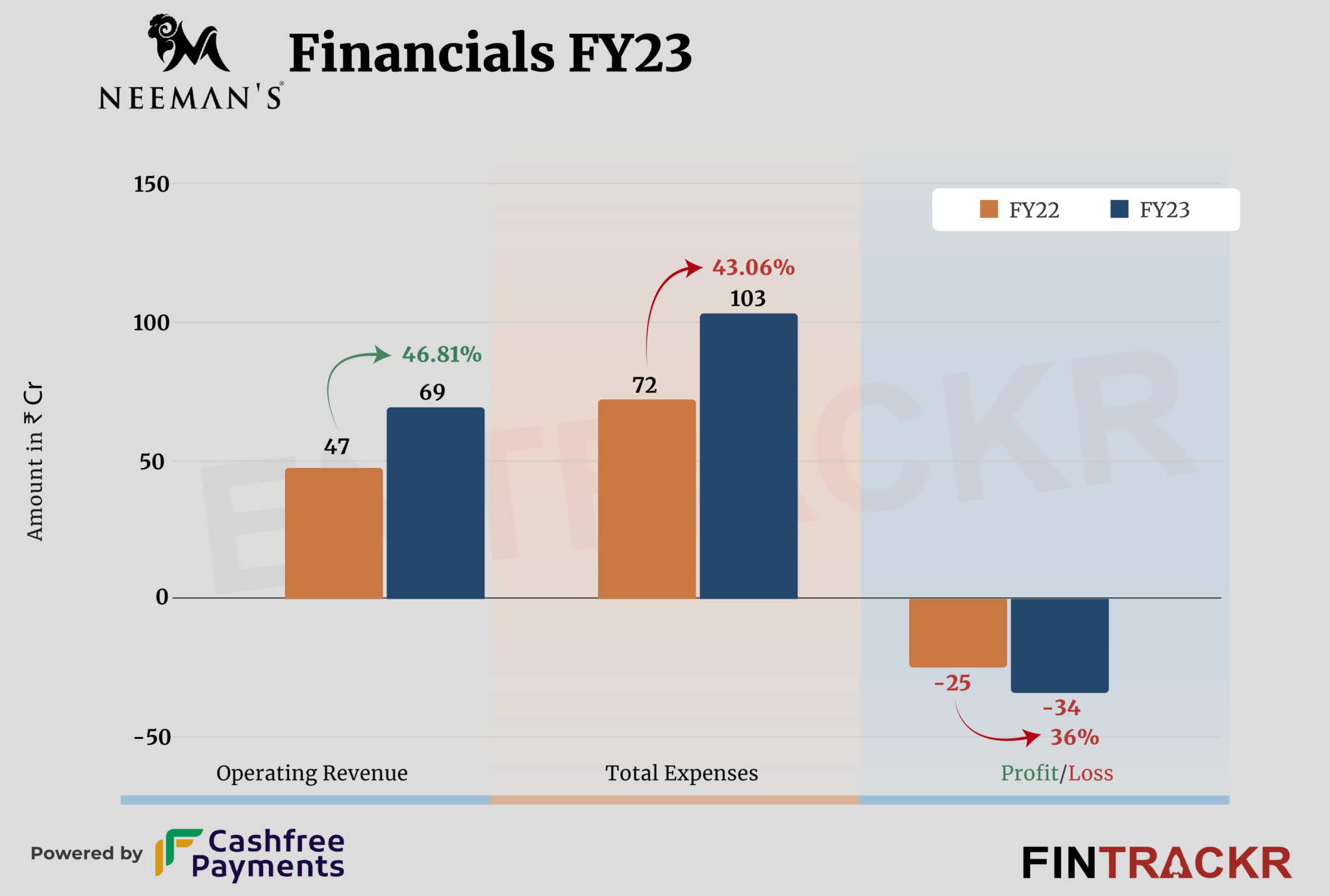

Neeman’s revenue from operations increased 48.81% to Rs 69 crore in FY23 from Rs 47 crore in FY22, its annual financial statements filed with the Registrar of Companies show.

The five-year-old company makes footwear from merino wool, organic cotton, recycled PET bottles, and recycled tires. The company sells its products from its website and e-commerce platforms and the sale of footwear is the only source of income for Neeman’s.

In August last year, Neeman’s claimed that the brand has recycled more than one million plastic bottles to date and is selling roughly 80,000 pairs of shoes monthly. It recently opened a brand outlet in Hyderabad to add to its brick-and-mortar presence in the city.

For the shoe-maker brand, the cost of procurement of raw materials accounted for 39% of the total burn. This cost increased 42.9% to Rs 40 crore in FY23 from Rs 28 crore in FY22. Its employee benefits also saw a surge of 2.25X during FY23.

Neeman’s advertising and business promotion, freight, commissions, information technology, legal and other overheads took the total expenditure up by 43.06% to Rs 103 crore in FY23 from Rs 72 crore in FY22. The advertising cost is likely to go up in the ongoing fiscal year as it roped in Indian cricketer Jasprit Bumrah for campaigns in October 2023.

Check TheKredible for more details.

Expense Breakdown

https://thekredible.com/company/neeman-s/financials

View Full Data

https://thekredible.com/company/neeman-s/financials

View Full Data

- Cost of materials consumed

- Employee benefit

- Advertising

- Freight

- Commission and discount

- Others

As the total cost crossed over 100 crore in FY23, the losses witnessed a 36% surge to Rs 34 crore in FY23 as compared to Rs 25 crore in FY22. Its ROCE and EBITDA margin stood at -114% and -46.5% respectively.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | -51% | -46.5% |

| Expense/Rupee of ops revenue | ₹1.53 | ₹1.49 |

| ROCE | -923% | -114% |

On a unit level, it spent Rs 1.49 to earn a rupee in FY23.

Neeman’s has raised Rs 94 crore to date. According to startup data intelligence platform TheKredible, Sixth Sense Ventures is the largest external stakeholder with a massive 42.94% followed by Anicut Capital. Its co-founders Taranjeet Singh Chhabra and Amar Preet Singh cumulatively command 29.68% of the company.

With sustainability in manufacturing no longer a rare sight with better recycling technologies, Neeman’s needs to look beyond the hook to attract profitable buyers. It has had to bend to market practices when it comes to discounting for instance, underlining the limitations of a plant-friendly pitch for buyers. Be it distinct designs, or influencers who can move the needle, the firm still seems some distance away from establishing a firm foothold for itself. Competition in the sustainable space will only intensify further, making the case for the firm to move more urgently on multiple fronts.