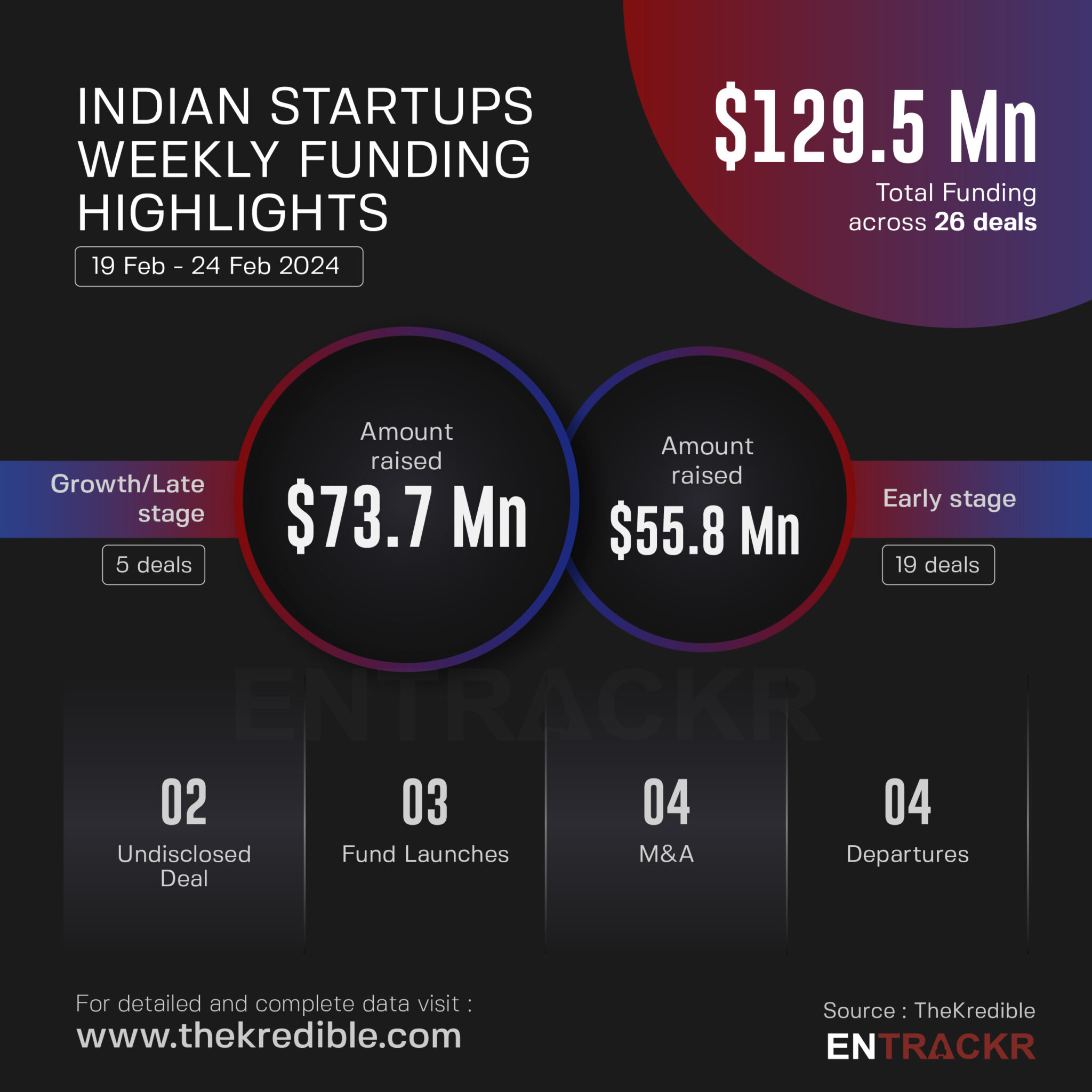

This week as many as 26 Indian startups raised funding amounting to nearly $129.5 million. These deals count five growth-stage deals and 19 early-stage deals. The early-stage deals also include two startups that kept their transaction details undisclosed.

Last week, 27 early and growth-stage startups collectively raised around $162 million, including four undisclosed deals.

[Growth-stage deals]

Among the growth stage deals, five startups raised $73.7 million in funding this week. Furniture rental brand Rentomojo topped the list with its $25 million fundraise. This was followed by D2C ice cream brand NIC and electric two-wheeler startup Yulu which raised $20 million and $19.25 million, respectively.

Further, education-focused NBFC Auxilo and train ticketing platform RailYatri also secured funding this week.

[Early-stage deals]

Equivalent to 19 early-stage startups raked in funding worth $55.77 million during the week. EV financing and vehicle lifecycle management platform Vidyut scooped $10 million in funding while agriculture financing startup Samunnati, climate-tech firm Varaha, EV company Pure EV, and digital-first retailer Pratech Brands also raised a significant amount to make it to the top five early-stage startups.

The list further includes foodtech platform Ghost Kitchens India, augmented reality startup AutoVRse, healthcare edtech startup Virohan, elder care company Samarth Life, and B2B fintech supply chain startup QuiD among others. For more information, visit TheKredible.

[City and segment-wise deals]

In terms of the city-wise number of funding deals, Bengaluru-based startups are on the top of the list with nine deals. This was followed by Delhi-NCR, Mumbai, Hyderabad, Pune, Chennai, and Udaipur.

The complete breakdown of the city and segment can be found at TheKredible.

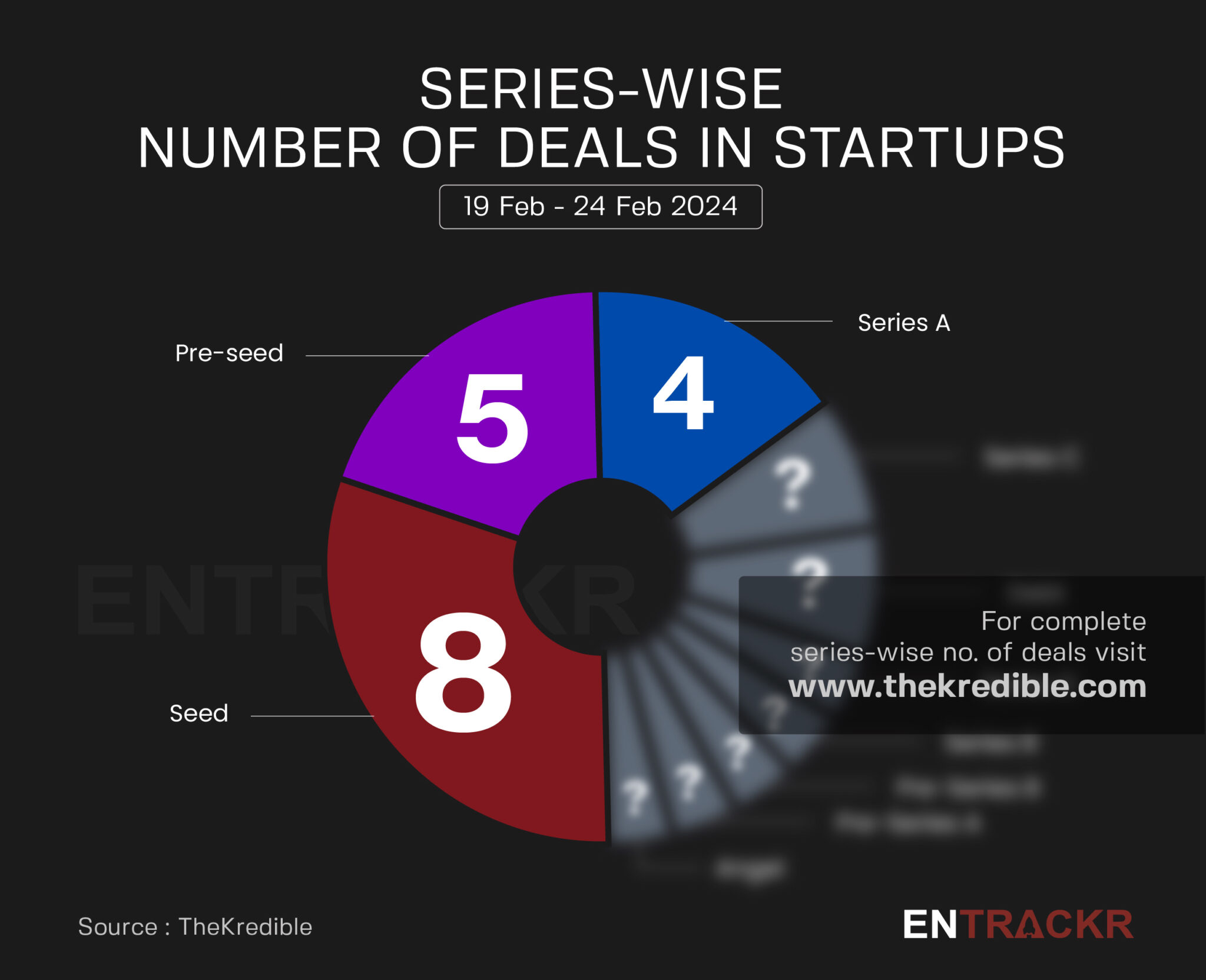

[Series wise deals]

This week, eight startups raised funding in their seed round followed by five pre-seed, four Series A, and two Series C deals. The list further includes debt, Series D, Series B, and other funding deals.

[Week-on-week funding trend]

On a weekly basis, startup funding declined by 20% to $129.5 million as compared to $162 million in the previous week.

The average funding in the last eight weeks stands at around $158 million with 25 deals per week.

[Mergers & Acquisitions]

The week also witnessed a few acquisition deals. DroneAcharya Aerial Innovations Ltd is acquiring a majority (76%) stake in Aerophile Academy Pvt Ltd, which provides drone pilot training. Signzy has acquired fraud risk management solutions provider Difenz for $5 million. Redcliffe Labs-owned Medicentre Sonography & Clinical Labs has acquired Prime Sonography & Diagnostic Centre and Xoriant, backed by ChrysCapital, has acquired technology-solutions provider MapleLabs Inc.

[Fund launches]

Aroa Venture Partners has launched a new fund targeting a corpus of Rs 400 crore. Spyre PropTech Venture Fund, supported by Venture Catalysts and Neovon, has initiated a Rs 400 crore fund to invest in over 30 Indian startups in the PropTech sector. Equirus Capital achieved the first close of its maiden venture capital fund shortly after receiving SEBI approval for a category-I alternative investment fund (AIF).

[Departures]

Amid efforts to improve profitability, Flipkart, led by Walmart, has seen the departure of four senior vice presidents. Cleartrip’s Ayyappan R, Flipkart’s Amitesh Jha, Dheeraj A, and Bharath Ram, who held key positions in various departments, have recently left the company.

Visit TheKredible to see series-wise deals and amount breakup, complete details of fund launches, and more insights.

[New launches]

▪️ Razorpay launches an AI chatbot, RAY

▪️ Pocket FM rolls out e-novel platform Pocket Novel

▪️ Google to roll out SoundPod to more merchants

[Financial results this week]

▪️ RailYatri posts Rs 274 Cr revenue in FY23; losses shrink 58%

▪️ Smallcase spends Rs 176 Cr to earn Rs 31 Cr in FY23

▪️ Baazi Games’ revenue crossed Rs 200 Cr in FY23; profit grew nearly 4X

▪️ EatClub posts Rs 315 Cr revenue and Rs 69 Cr loss in FY23

▪️ Fintech firm CASHe’s revenue crosses Rs 560 Cr in FY23; remains profitable

▪️ Quikr posts Rs 51 Cr revenue in FY23, losses shrink 62%

[News flash this week]

▪️ RBI’s additional steps aim to protect ‘@paytm’ users, merchants

▪️ AR-based toy maker PlayShifu in talks to raise $6 Mn

▪️ NIIF to acquire a majority stake in iBus

▪️ Flipkart in talks to acquire Dunzo

▪️ Construction firm Infra.Market to raise $60 Mn debt

▪️ RBI grants Payment Aggregator license to Mswipe Technologies

▪️ X to withhold certain accounts, posts in India following govt orders

[Entrackr’s analysis]

The weekly funding again shrank by a significant margin, however, the week did not witness any major layoffs or business shutdowns. Additionally, the week witnessed three startup-focused funds: Aroa Venture, Spyre PropTech, and Equirus Capital.

In another development, IRCTC partnered with Swiggy to deliver pre-ordered meals at four railway stations, following a similar move by Zomato four months ago. This reflects a growing trend of leveraging food delivery platforms for railway catering services.

Meanwhile, Flipkart is reportedly in talks to acquire Dunzo, a hyperlocal delivery startup facing financial challenges for nearly a year. However, complexities surrounding Dunzo’s ownership, particularly its association with Reliance, are complicating the potential deal.

Additionally, the RBI has moved to provide more safeguards to customers affected by its actions against Paytm Payments Bank. This includes migrating ‘@paytm’ handles to other banks and advising customers to make alternative arrangements before March 15, 2024.

Meanwhile, drama has continued to unfold at Byju’s for one reason or another. On Friday, select shareholders held an Extraordinary General Meeting (EGM) to vote for leadership change and board restructuring. Later, Byju’s said the outcome of the EGM was “invalid and ineffective.” It also highlighted the interim relief provided by the Karnataka HC, which stated that any decisions made during the meeting would not be given effect until the next hearing.