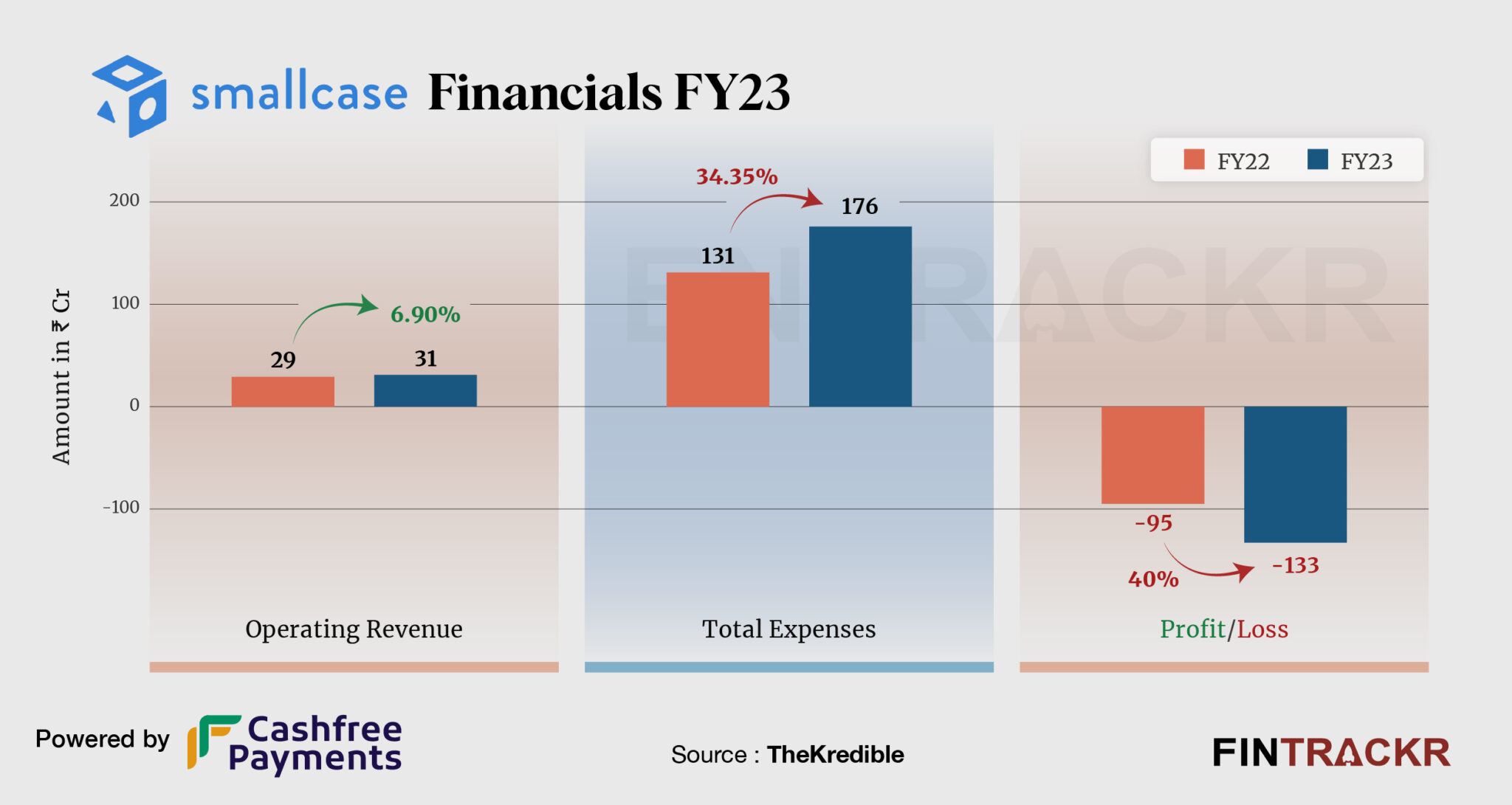

Amazon-backed wealth management startup Smallcase has posted a flat growth in the fiscal year ending March 2023. However, its losses spiked 40% and stood at Rs 133 crore as its employee cost soared 70% in FY23.

Smallcase’s revenue from operations saw a modest increase of 6.9% to Rs 31 crore in FY23 from Rs 29 crore in FY22, its consolidated financial statements filed with the Registrar of Companies (RoC) show.

Platform fees charged by the company from the users formed 39% of the overall revenue which increased 50% to Rs 12 crore in FY23. The rest of the revenue came from subscriptions (Tickertape Screener), transactions, and other ancillary services.

Revenue Breakdown

https://thekredible.com/company/smallcase/financials

View Full Data

Check TheKredible for the detailed revenue breakup.

On the cost side, employee benefits were the largest cost center as it accounted for 47% of the overall cost. This cost surged by 69.4% to Rs 83 crore in FY23 from Rs 49 crore in FY22. Its advertisement cost remained flat at Rs 66 crore during the previous fiscal year (FY23).

Expenses Breakdown

https://thekredible.com/company/smallcase/financials

View Full Data

https://thekredible.com/company/smallcase/financials

View Full Data

- Employee benefit

- Advertising promotional

- Technology cost

- Legal professional charges

- Others

Cost of technology along with legal-professional and other overheads catalyzed Smnallcase’s overall expenditure by 34.35% to Rs 176 crore in FY23 from Rs 131 crore in FY22. Head to TheKredible for the detailed expense breakup.

Caveat: We have excluded the expense of net loss on fair value changes of shares subject to buyback from both years (FY23 and FY22).

The flat revenue and increased cost led its losses to grow by 40% to Rs 133 crore in FY23 from Rs 95 crore in FY22. Its ROCE and EBITDA margin stood at -76% and -300% respectively. On a unit level, it spent Rs 5.69 to earn a rupee in FY23.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | -242% | -300% |

| Expense/₹ of Op Revenue | ₹4.52 | ₹5.68 |

| ROCE | -32% | -76% |

So far, the company has scooped up $70 million across funding rounds, including a $40 million Series C raise in August 2021.

According to the startup data intelligence platform, TheKredible PeakXV is the largest external stakeholder in Smallcase with a 17.67% stake followed by Faering Capital and Blume Ventures. Its co-founders Vasanth Kamath, Anugrah Shrivastava, and Rohan Guta cumulatively command 19.5% of the company.