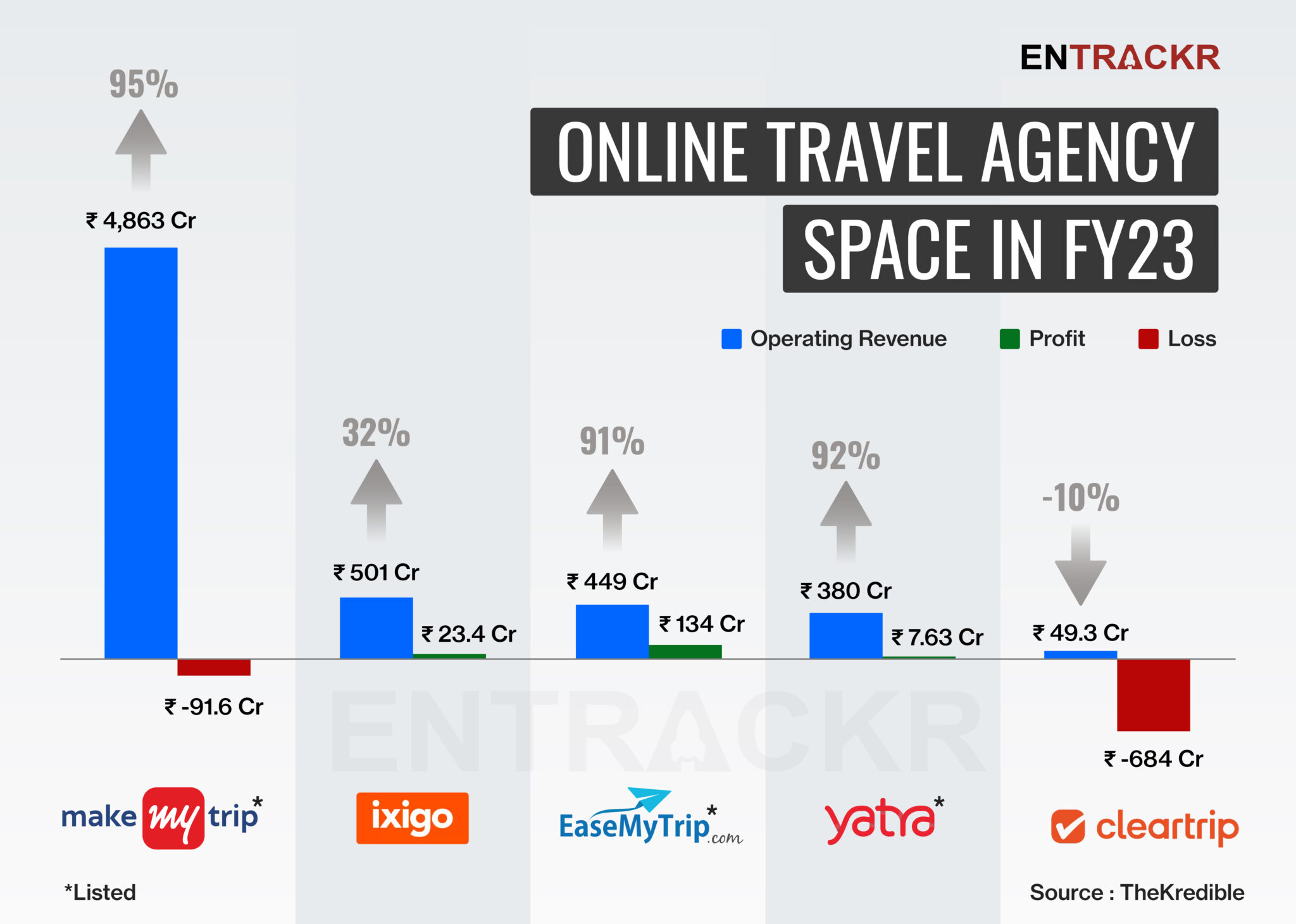

India’s online travel agency (OTA) sector is on the rise. Some of the leading players in the space, such as MakeMyTrip, Ixigo, EaseMyTrip, and Yatra Online, have all demonstrated rapid growth in the last financial year.

Startup data intelligence platform TheKredible has sifted through the filings of these companies to bring to the fore their financial performance. While some witnessed notable growth during the fiscal year ending March 2023, some turned profitable during the period.

[MakeMyTrip]

Among the top five OTAs, MakeMyTrip is leading the chart in terms of operating revenue, witnessing a 95% surge to Rs 4,863 crore in FY23 from Rs 2,492 crore in FY22.

The company made 57% of its operating revenue from hotels and packages vertical amounting to Rs 2,769 crore in FY23 while air ticketing and bus ticketing contributed around 25% (Rs 1,212 crore) and 12.6% (Rs 614 crore), respectively. The remaining sum of Rs 268 crore was generated through other operating activities during the fiscal year.

MakeMyTrip spent Rs 1,082 crore on employee benefits and Rs 833 crore on marketing & promotional expenses which contributed 21.7% and 16.7%, respectively, to the total expenses (Rs 4,986 crore) incurred by the company in FY23.

On the lines of rising scale, the company managed to control its losses with a significant margin to Rs 91.6 crore in FY23 against Rs 373.6 crore in FY22.

[Ixigo]

Ixigo grabbed the second spot with 32% growth in scale to Rs 501 crore during FY23 from Rs 379.6 crore in FY22. Along with the topline growth, it also turned profitable during the fiscal with Rs 23.4 crore profits in FY23 against Rs 21 crore loss in FY22.

The company generated 56.7% (Rs 284 crore) of its revenue from train ticketing while the air and bus ticketing amounted to Rs 97.12 crore and Rs 86 crore, respectively.

On the cost side, Ixigo’s spending on employee benefits and marketing & promotions stood at Rs 126 crore and Rs 93 crore, respectively, which collectively contributed 45% to the overall expenditure (Rs 484 crore) of the company in FY23.

In August 2021, Ixigo filed its draft red herring prospectus (DRHP) with the regulator SEBI to raise Rs 1,600 crore through an initial public offering (IPO). However, the firm has put its IPO plans on hold citing the macroeconomic environment.

[EaseMyTrip]

EaseMyTrip also achieved an impressive growth in scale during the fiscal year with rising profits. Its operating revenue grew 91% to Rs 449 crore in FY23 meanwhile profits also increased to Rs 134 crore.

Unlike other players, EaseMyTrip collected over 90% of its revenue from air ticketing amounting to Rs 408 crore. Collections from hotels and packages stood at Rs 37.87 crore during the year.

Employee benefits formed around 19% of the total expenses with Rs 52.4 crore in FY23 while marketing & promotional expenses at Rs 83 crore constituted 29.7% of the total expenses (Rs 279 crore).

[Yatra Online]

Yatra Online, which recently launched an IPO, also managed to grow its operating scale by 92% to Rs 380 crore in FY23 from Rs 198 crore in FY22. The company also turned profitable during the fiscal with Rs 7.63 crore profits against Rs 30.8 crore loss in FY22.

The company generated 47.8% (Rs 178 crore) revenue from air ticketing, 38% (Rs 144.5 crore) via hotels and packages, 11.1% (Rs 42.1 crore) from advertising and the remaining Rs 15.4 crore through other operating activities during FY23.

On the cost front, employee benefits expenses registered at Rs 109 crore while marketing & promotional cost stood at Rs 33.6 crore during FY23. These two costs collectively contributed to 37% of the total expenditure (Rs 385 crore).

[Cleartrip]

Flipkart-owned Cleartrip has been an exception to its peers, as its scale shrank 10% to Rs 49.3 crore during the last fiscal year (FY23) when compared to Rs 54.7 crore in FY22. The company had not disclosed the bifurcation of revenue. It makes the majority of its revenue via air ticketing and hotel bookings.

The company spent over 55% of its total expenditure on employee benefits (Rs 247 crore) and marketing & promotions (Rs 183.7 crore) during FY23. This collectively amounts to more than the operating revenue generated by the company during the year.

Followed by aggressive spending, losses of the company nearly doubled to Rs 684 crore in FY23 from Rs 358.6 crore in FY22.

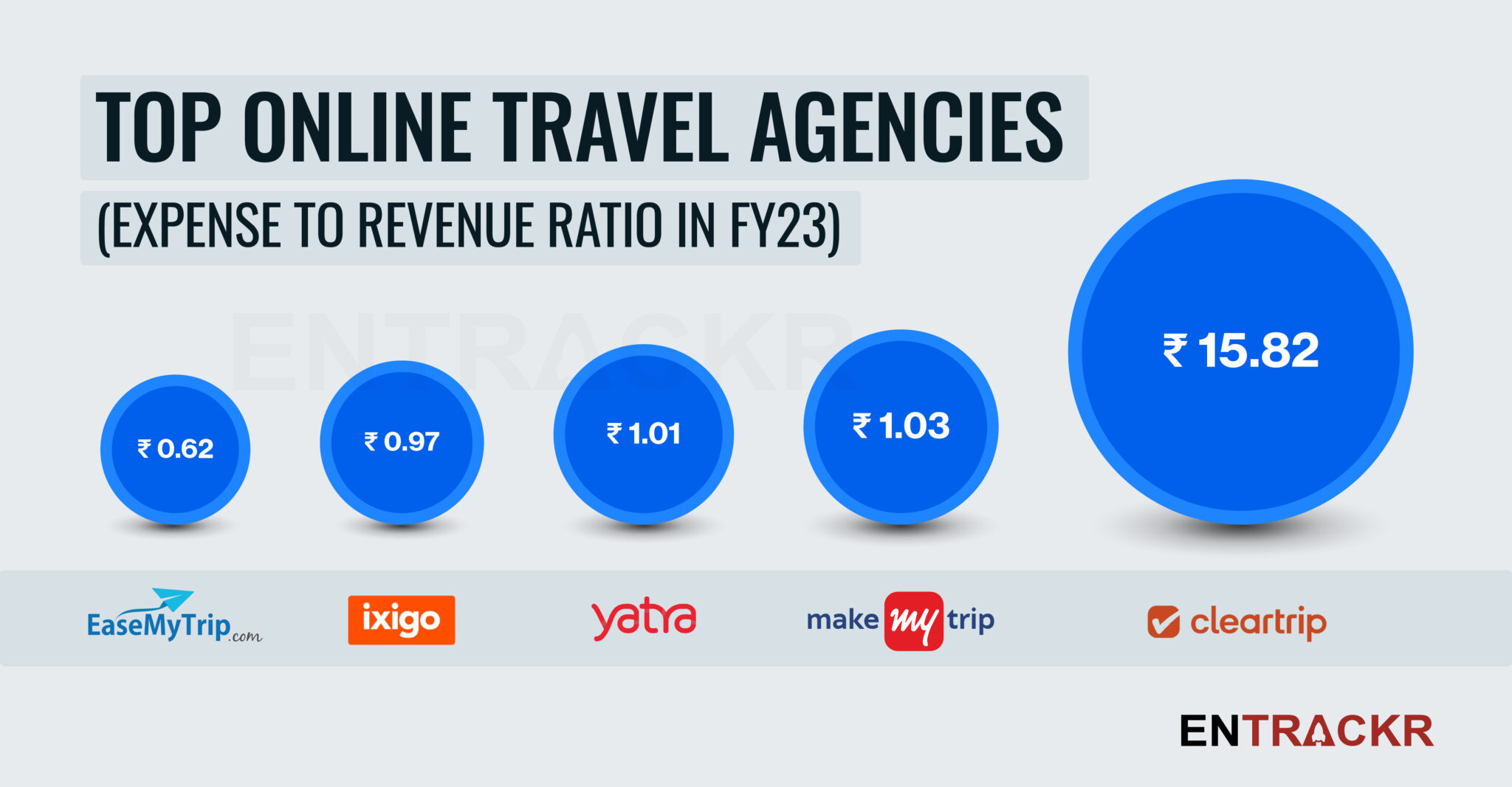

In terms of loss- making companies, Cleartrip stands on top among the five. When comparing expense to revenue ratio, EaseMyTrip stood at top followed by Ixigo and Yatra. However, Ixigo was on top in terms of revenue among profit generating and non listed OTAs.

[Listed companies and their quarterly performance]

Among the above five OTA players, three (MakeMyTrip, EaseMyTrip, and Yatra Online) are listed or public companies.

MakeMyTrip is the oldest publicly listed company and made its entry on NASDAQ in Aug 2010 while EaseMyTrip was listed in India in March 2021. Yatra Online is the newest publicly listed OTA company and made its entry into the public market in September 2023.

[Conclusion]

The travel segment will continue to remain an attractive opportunity, thanks to India’s expanding middle classes as well as the significant growth in overseas traveling especially. Truly powerful travel brands that will have the trust and business of customers are still work in progress, as value buys remain the norm still. To that extent, for the larger players, the market will continue to demand more investments, making a significant margin expansion challenging. It will take a significant amount of technology and on ground investments to wring out efficiencies from the market today. The best margins remain in holiday packages, as seen by the rush to enter the segment by every player as soon as they have used ticketing to establish a foothold. Industry feedback indicates domestic packages do not quite offer the same margins yet thanks to competition from smaller players, but the prospects remain good. The good news is, the international segment is going through a long term expansion, creating many opportunities to segment and find winning offers for the players.