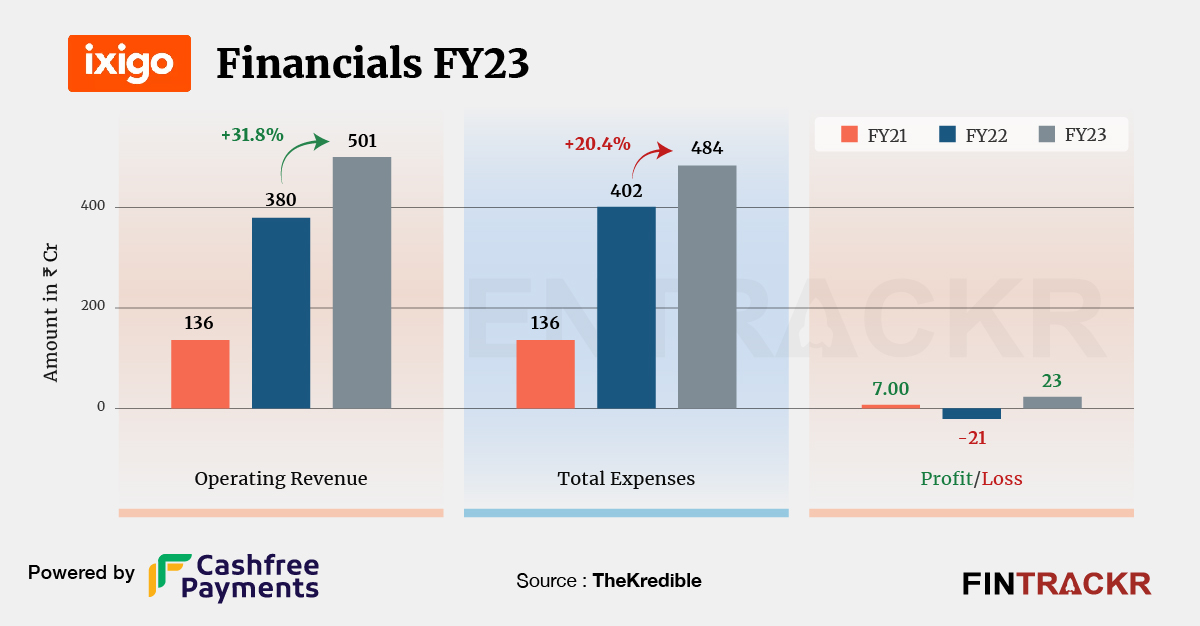

Full-fledged online travel agent (OTA) and largest third-party train travel booking platform Ixigo has truly put the pedal to the metal in FY23. It registered around 32% growth in the fiscal year ending March 2023 even as the company returned to profitability after posting losses in FY22.

Ixigo’s revenue from operations grew to Rs 501 crore in FY23 from Rs 380 crore in FY22, according to its consolidated financial statements sourced from RoC.

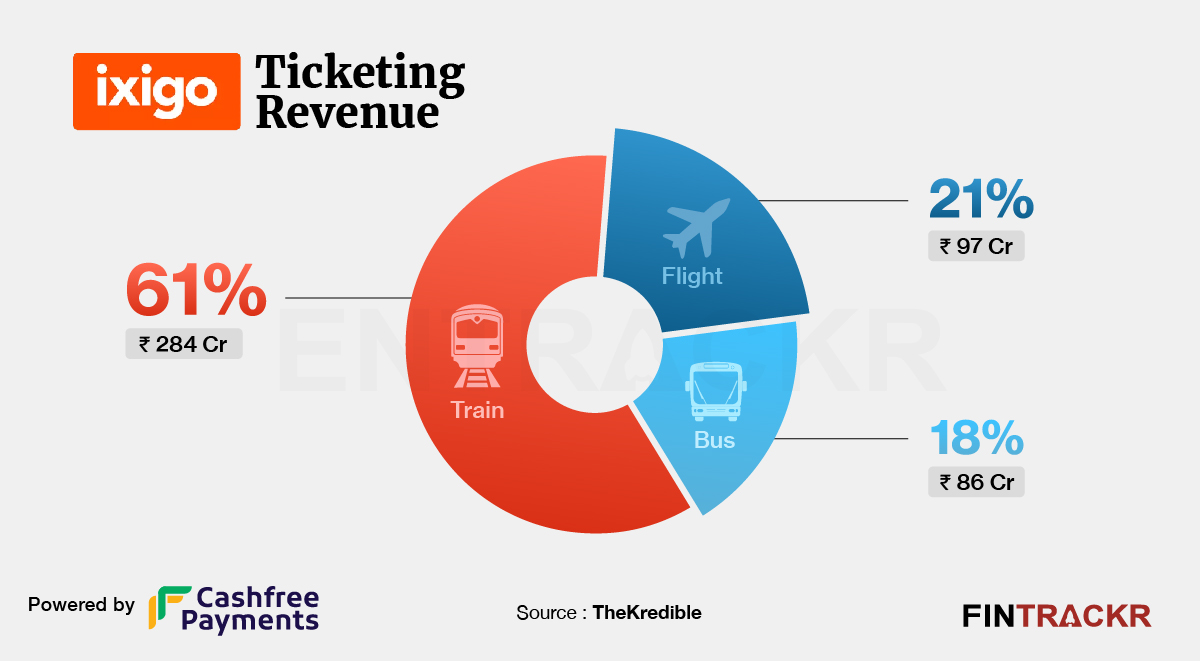

Convenience fees and commissions from the reservation of rail, airline, and formed 93% of the firm’s total operating revenue which increased by 29% to Rs 467 crore in FY23. The remaining income originated from advertising and technical support services. See TheKredible for a detailed revenue breakdown.

Revenue Breakdown

https://thekredible.com/company/ixigo/financials

View Full Data

Booking of train tickets was the highest revenue grosser with 61% followed by flight and bus which contributed 21% and 18% respectively to the scale in FY23. It’s worth noting that Ixigo acquired ConfirmTkt in February 2021 and the acquisition seems to have worked really well for the Gurugram-based company. After this deal, Ixigo emerged as the largest third-party train booking platform.

Akin to most late-stage tech companies, employee benefits were the largest cost center accounting for 26% of the total expenditure. This cost increased 32.6% to Rs 126 crore in FY23 from Rs 95 crore in FY22.

Its advertising-promotional, information technology, partner support, distribution, customer refund, and payment gateway charges were some other operating overheads that steered Ixigo’s total expenditure 20.4% to Rs 484 crore in FY23 from Rs 402 crore in FY22.

Expenses Breakdown

https://thekredible.com/company/ixigo/financials

View Full Data

https://thekredible.com/company/ixigo/financials

View Full Data

- Employee benefit expense

- Advertising promotional expenses

- Information technology expenses

- Others

Notable growth and controlled expenditure helped Ixigo move itself into black. The company’s Rs 23 crore profit in FY23 compares to a loss of Rs 21 crore in FY22. Its ROCE and EBITDA margins improved to 6% and 7% respectively in FY23. On a unit level, it spent Rs 0.97 to earn a rupee of operating revenue.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | -3% | 7% |

| Expense/₹ of Op Revenue | ₹1.06 | ₹0.97 |

| ROCE | -5% | 6% |

In August 2021, Ixigo filed its draft red herring prospectus (DRHP) with SEBI to raise Rs 1,600 crore through an initial public offering (IPO). However, the firm put its IPO plans on hold citing the macroeconomic environment. The firm recently said that it will launch its own independent hotel booking platform. Currently, it works with Booking.com for such transactions.

Over 15 years after its launch as a site promising to provide the best flight ticket options, Ixigo has come a long way, not only turning into a full stack travel site but doing it profitably too. Known for its quirky communications every now and then, its full stack model might be an obvious route to scale, but comes with a whole new set of challenges. While competition is a given, finding the next segment winner like train tickets will not be as easy. An IPO seeking three years revenue might seem like a sweet exit ticket out for some, and long term insurance for others, but the firm has shown it is not deterred by the odds against it.