The third quarter of 2023 was distinctive for Indian startups for multiple reasons. We saw the first unicorn of the year, July and August saw the lowest funding in the past three years, and layoffs and shutdowns broke all previous records.

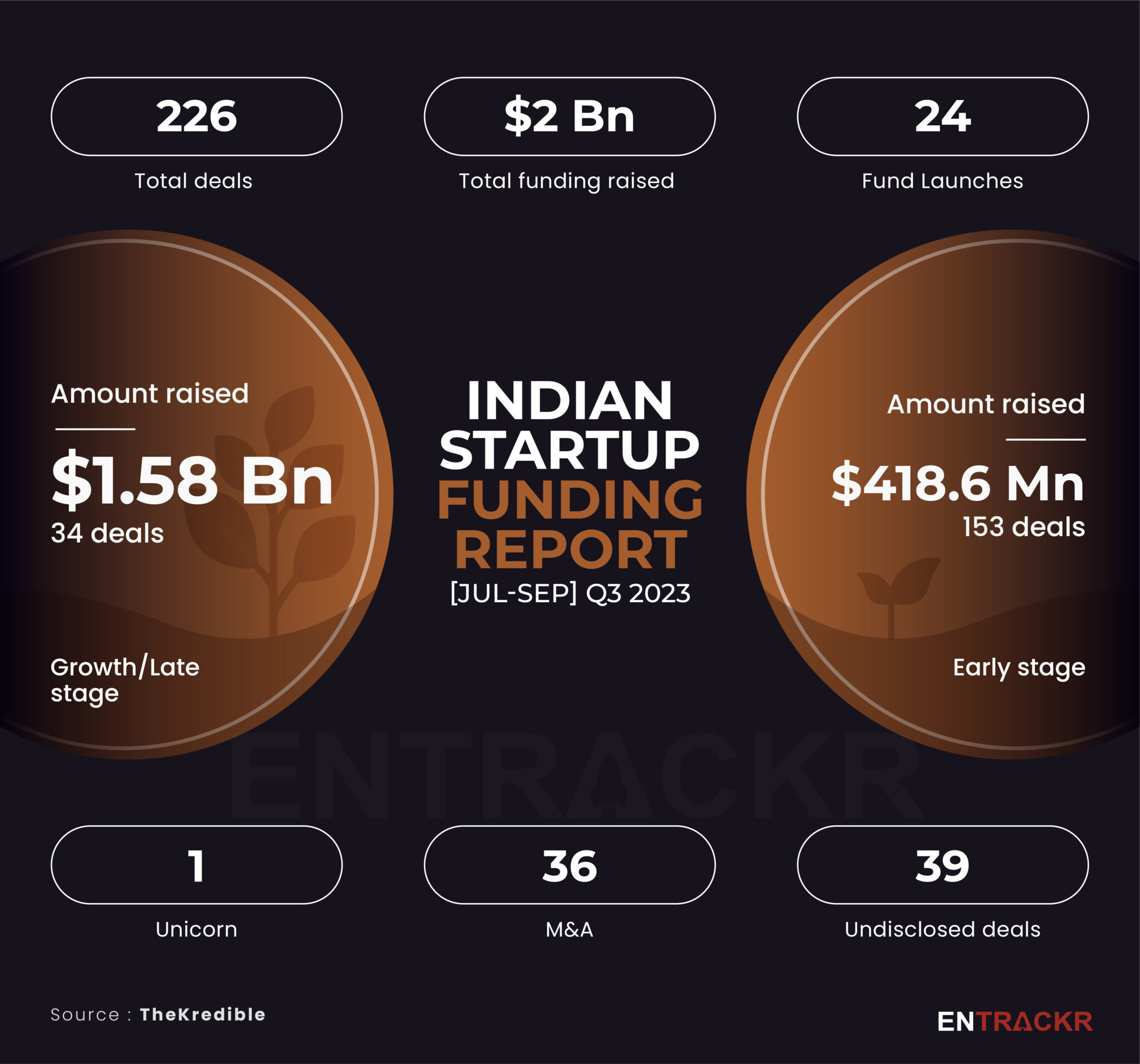

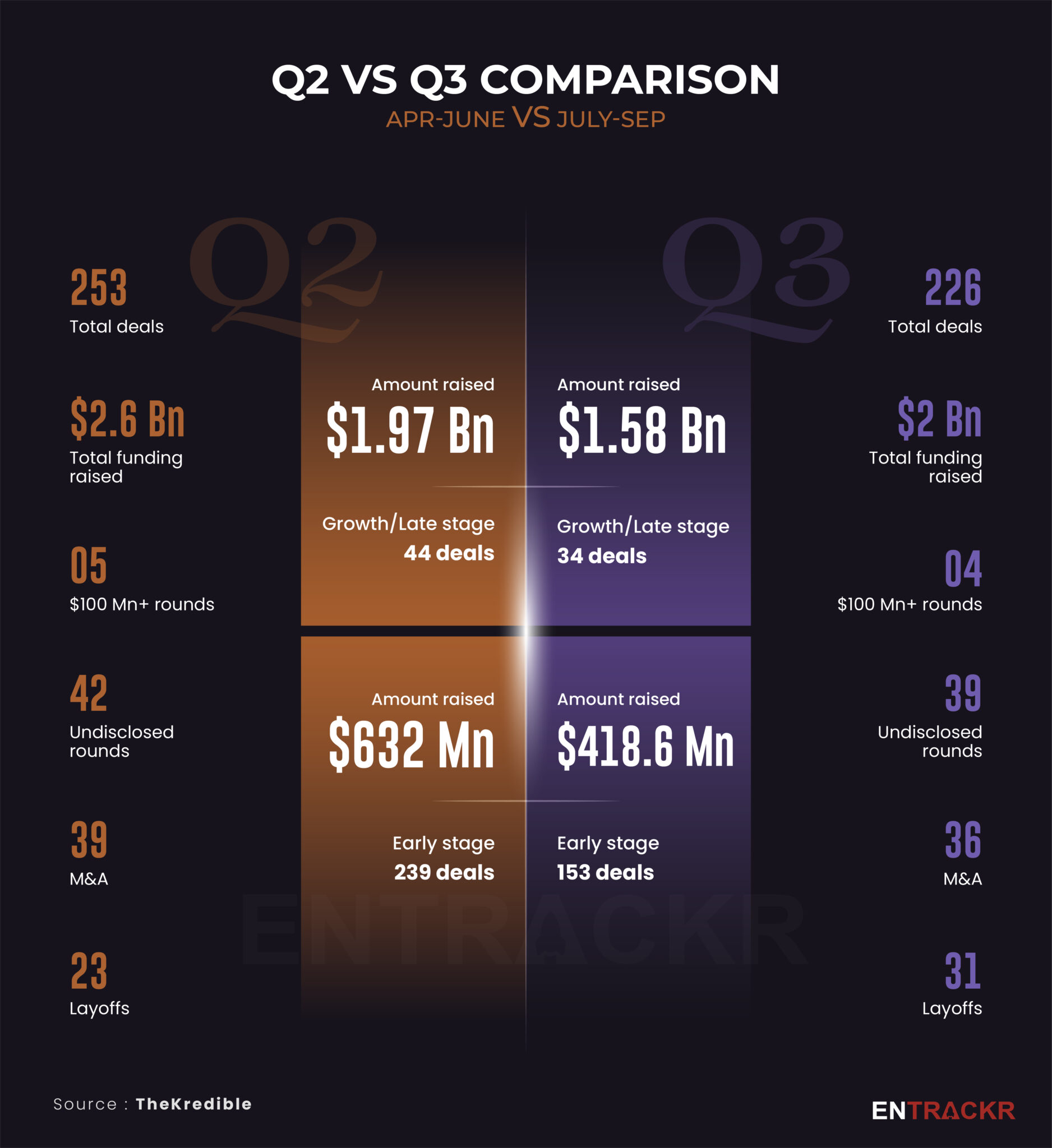

Let’s begin with the fundraising trend first. Data compiled by TheKredible shows that Indian startups raised $2 billion across 226 deals during Q3 2023 or the September quarter. This includes 34 growth stage deals worth $1.58 billion whereas the early stage saw 153 deals amounting to $418.6 million. There were 39 undisclosed deals with the majority of startups in the early stage.

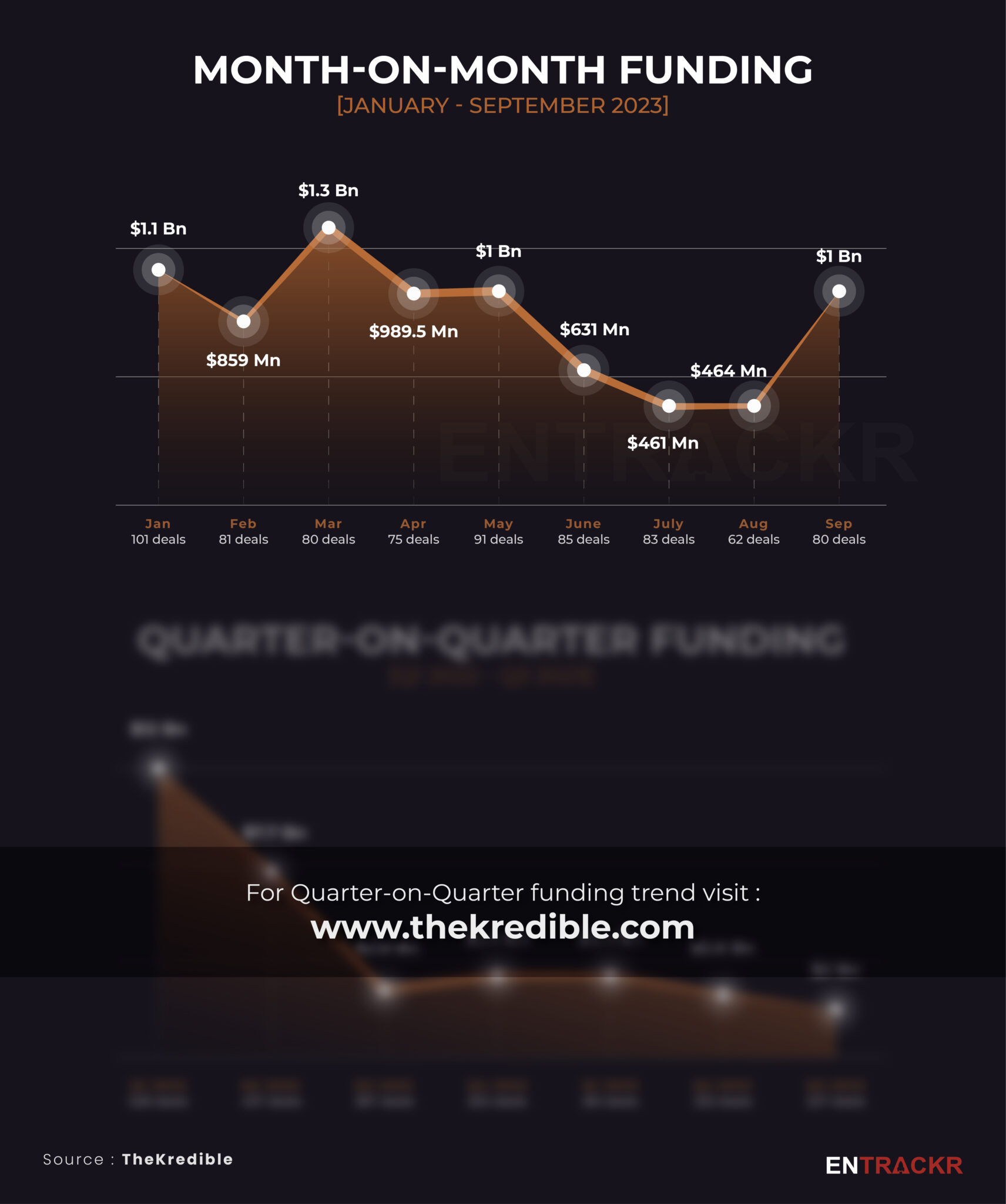

[Month-on-month and quarter-on-quarter trend]

July began on a low note as total fund inflows to Indian startups slipped below the $500 million mark for the first time in the past three years. August also saw less than $500 million funding despite producing the first unicorn of this year (Zepto) that raked in $200 million alone. However, there was a sign of revival in September when the total infusion for the quarter crossed the $1 billion milestone after a gap of three months.

On a quarterly basis, Q3 saw lowest funding in 2023, 2022 and 2021. Visit TheKredible to check quarterly funding breakup.

[Top 15 growth stage deals in Q3 2023]

In the growth stage, SaaS-based B2B fintech firm Perfios scooped up the largest funding of the September quarter with its $229 million round. This was followed by quick commerce platform Zepto’s $200 million funding. The growth stage also saw two more $100 million plus deals as electric vehicle startups and arch rivals Ola Electric and Ather Energy raised $140 million and $108 million respectively.

Other notable deals in the growth stage includes martech firm Pixis, agritech company Leads Connect, fintech startup Bright Money, furniture tech company Furlenco and coffee chain Third Wave Coffee.

[Top 15 early stage deals in Q3 2023]

Telecom startup WIOM topped the early stage chart with $17 million funding followed by decentralised exchange BrineFi’s $16.5 million. AI startup DynamoFL and spacetech startup SatSure raised $15.1 million and $15 million respectively.

Online visa application platform Atlys, HRtech company Atomicwork, EV startup Ati Motors, IoT startup Cavli Wireless, NBFC Dvara KGFS and smartphone retail chain SmartDukaan raised more than $10 million each.

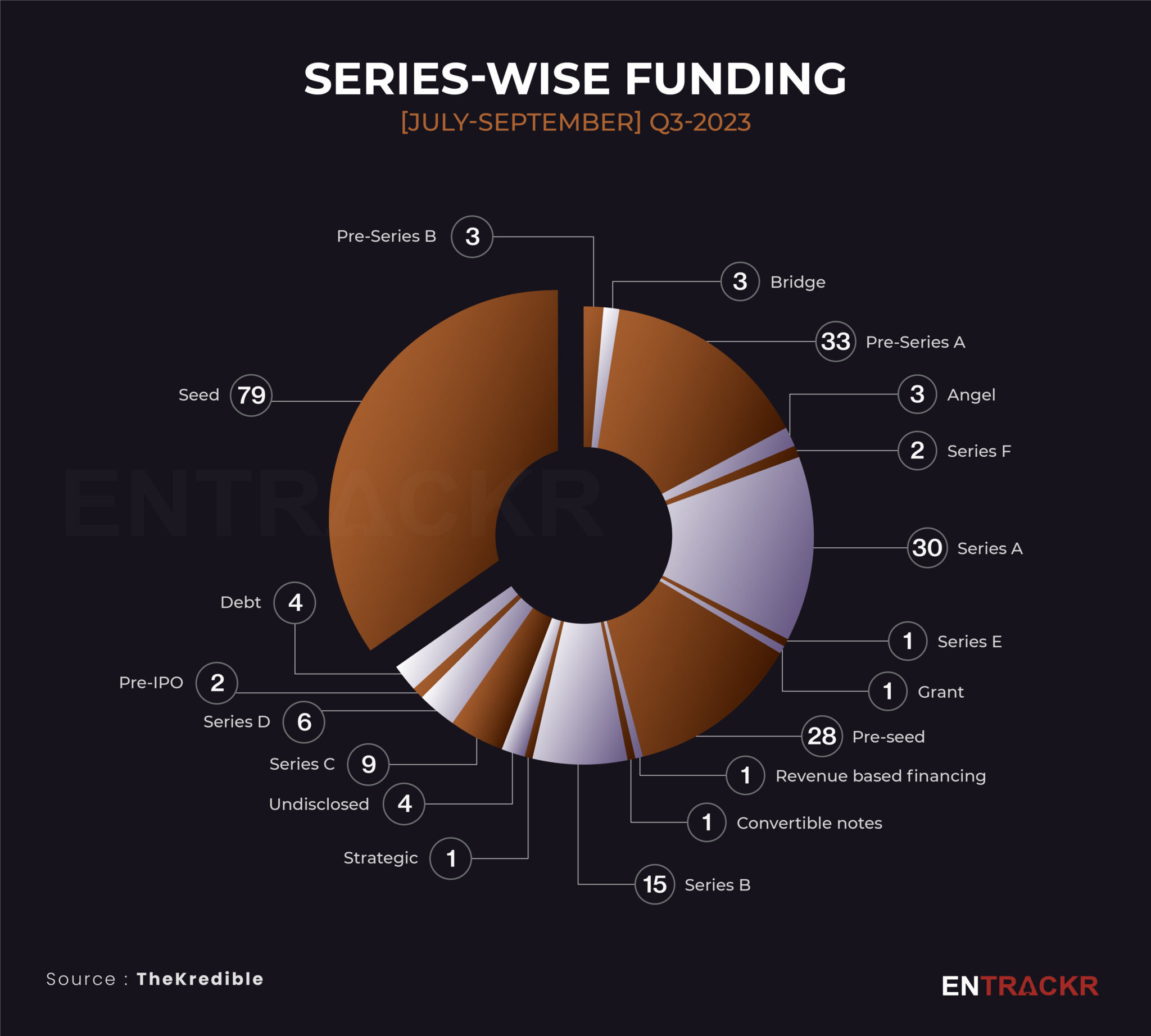

[Stage wise deals]

In Q3, seed and pre-seed stage startups once again dominated the chart with 79 and 28 deals respectively. This was followed by 33 pre-Series A and 30 Series A deals. In the growth stage, Series B, Series C and Series D saw 15,9 and 6 deals respectively. In late stage deals, Series F and Series E saw 2 and 1 deals respectively.

The complete breakdown can be seen in the chart below:

A couple of companies raised their pre-IPO round. The amount wise breakdown of stages can be found at TheKredible.

[Mergers and acquisitions]

The third quarter saw three dozen mergers and acquisitions. It started with Reliance Brands acquiring Alia Bhatt’s kidswear brand Ed-a-Mamma at a valuation of around Rs 300-350 crore. Swiggy also announced the acquisition of retail distribution company LYNK Logistics.

The notable M&A deals in Q3 includes the acquisition of OLX India’s auto and classifieds business by CarTrade, Sachin Bansal-led Navi Group’s subsidiary Chaitanya India Fin Credit by Svatantra Microfin Private Limited and most recently the acquisition of digital entertainment platform Pocket Aces by music label Saregama. Visit TheKredible for all 36 deals of M&A.

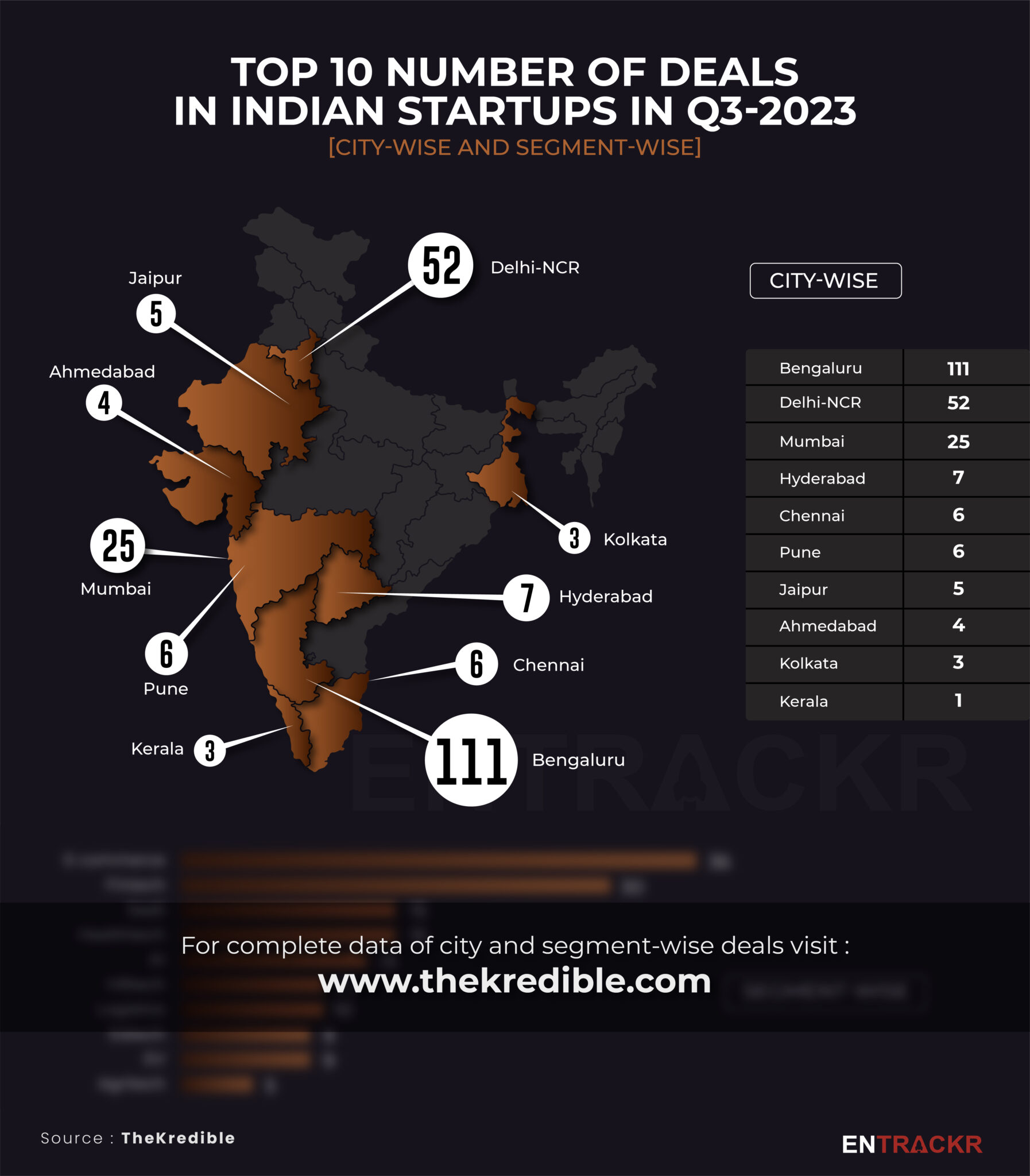

[City and segment]

City wise, Bengaluru saw 111 deals amounting to $1.26 billion or 63% of the total fundraise in the last quarter. Delhi-NCR-based startups were the next with 52 deals worth $338 million. Mumbai, Hyderabad and Chennai were next on the list. Interestingly, Gwalior, Surat and Seoni Malwa also saw one deal each.

E-commerce startups dominated in terms of segment wise deals followed by fintech, SaaS, healthtech and AI. Interestingly, edtech, EV and agritech manage to get in the top 10 list. Deals in agritech, gaming, and dronetech saw a decline.

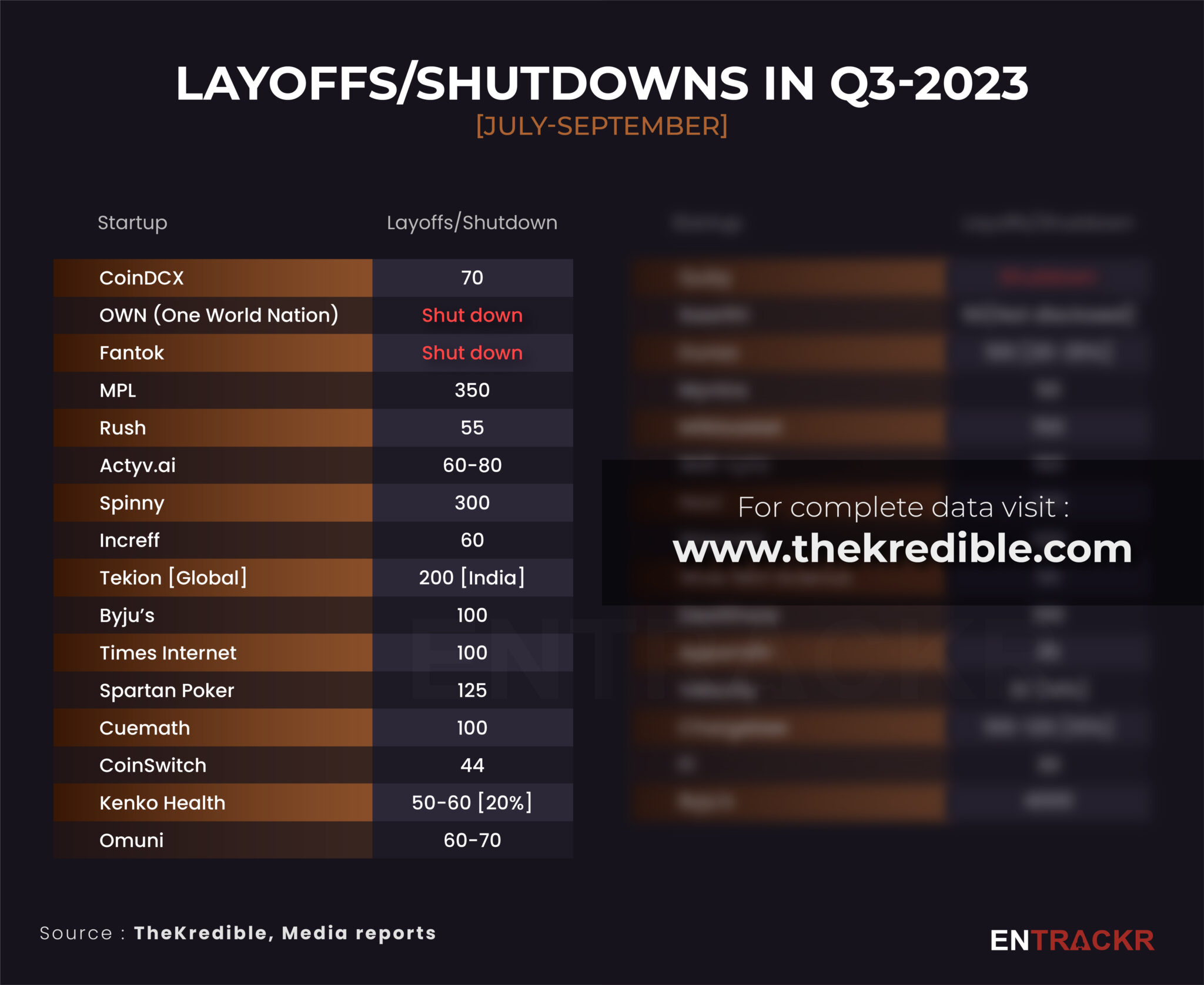

[Layoffs]

The number of layoffs has continued to cause havoc for startup employees as more than 30 startups fired 7,000-8,000 employees in the third quarter of 2023. Moreover, three gaming-focused startups have announced shutting down of operations. The number of layoffs and shutdowns is probably higher as many have not made it to media coverage.

During the first six months of 2023, 15,000 employees were given pink slips across 60 startups. Overall, 2023 has already surpassed 2022 data when the startup ecosystem saw layoffs of 20,000 employees.

[Most active investors]

Early stage investor Inflection Point Ventures emerged as the top investor in Q3 with 13 deals. This was followed by WeFounderCircle which also invested through its accelerator program EvolveX. Blume Ventures, Peak XV Partners and 100X.VC were next on the list with 10,9 and 7 deals respectively. CRED founder Kunal Shah was on top among angel investors.

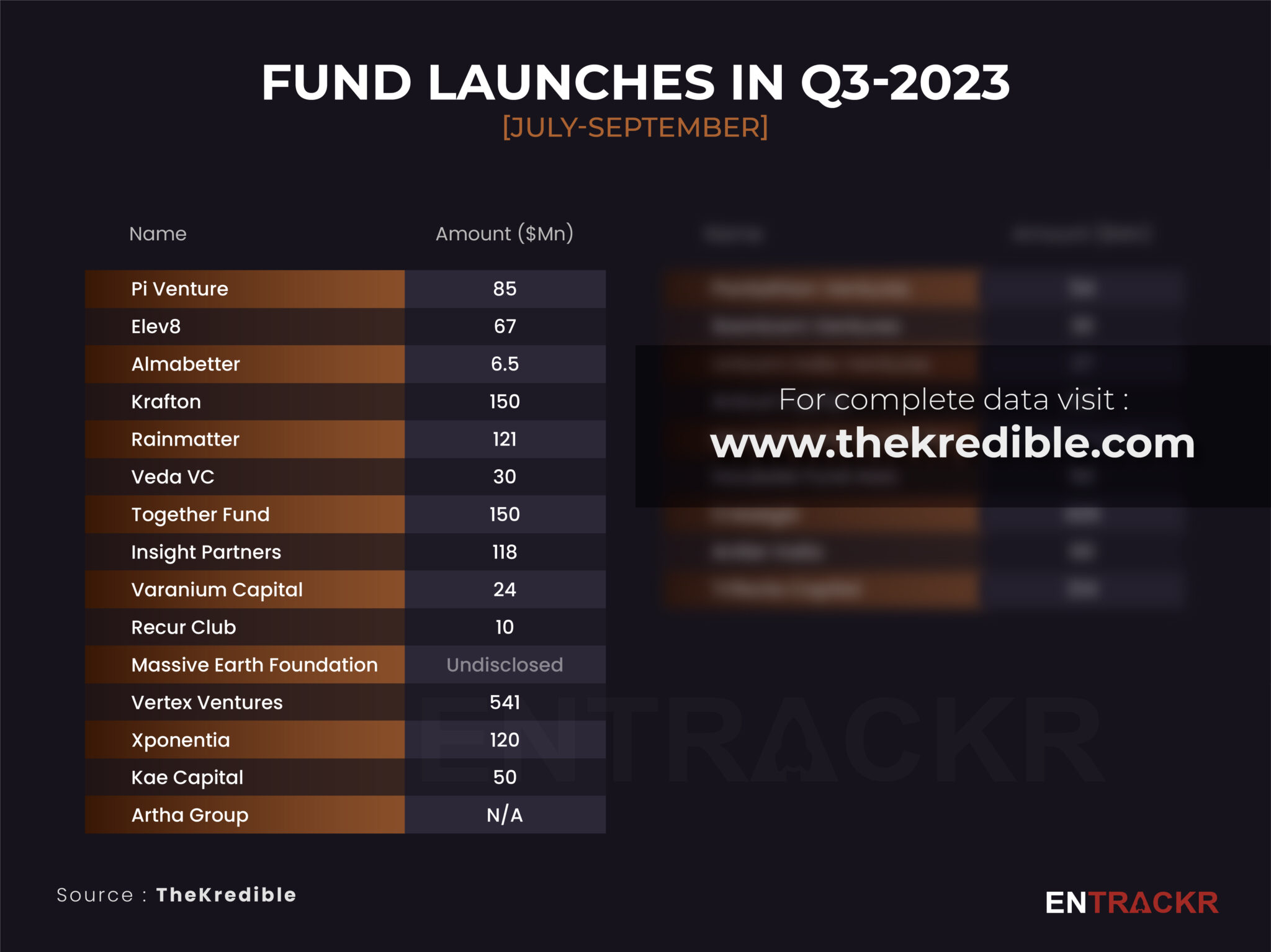

[Fund launches]

Unlike previous quarters, the last quarter saw no action from billion dollar Indian focused funds such as Tiger Global and B Capital. However, early and growth stage focused venture capitals and debt firms have continued to show their support during the funding slowdown. Starting with the largest fund, Vertex Ventures Southeast Asia and India has completed the fundraising for its fifth fund with commitments of $541 million.

This was followed by homegrown private equity firm Creaegis which closed a $426 million worth maiden fund. Krafton, Together Fund, Zerodha’s Rainmatter Capital, Insight Partners, among others also closed their new fund during Q3.

[Q2 Vs Q3]

TheKredible has prepared a comparison chart for a better understanding of the growth/decline in Q3 Vs Q2.

[Conclusion]

The underlying strength of the funding environment points to the maturity in the ecosystem today. Even as talk of a slowdown globally continues to rise, funds raised during 2021 to 2023 have clearly helped save the day for startups in India. Unicorns, or mostly missing unicorns might take attention, but the support for early stage startups indicates some resilience in the system now, whatever be the arguments around valuations. Thus, we believe the market continues to move in the right direction. The only big shift that remains is a wider spread of the startup ecosystem, rather than the concentration we see between Bengaluru, NCR, and the Mumbai-Hyderabad-Chennai grouping, in that order. Early shoots are visible in India’s so called tier 2 cities, driven by lower costs as well as an evolving infrastructure that works for Gen Z and millennials at least. (Read, less than ideal health infrastructure).