Quick commerce platform Zepto surprised skeptics yet again as it turned unicorn last month after raising $200 million in a Series E round led by venture capital firm StepStone. While the Mumbai-based company did not disclose more details of the round, Fintrackr has sifted through its regulatory filings to decode the round break-up, their captable, and exact valuation.

The board at Zepto passed a special resolution to allot 6,52,948 Series E preference shares at an issue price of $297.6 per share to raise $194.2 million, according to the regulatory filing source from its parent company Kiranakart Pte Ltd. in Singapore.

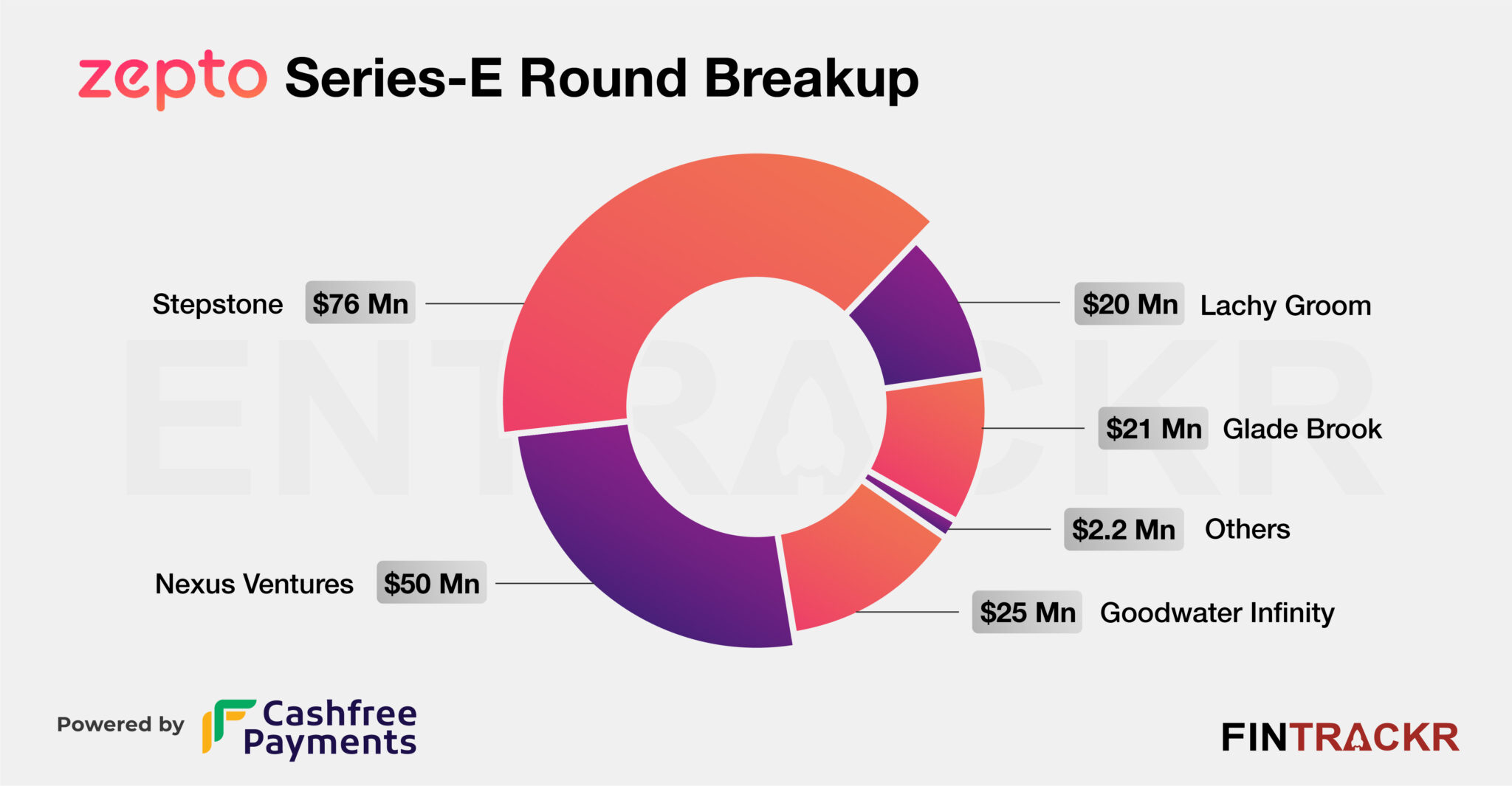

StepStone made the largest investment of $76 million, while Nexus Venture and Goodwater Infinity contributed $50 million and $25 million, respectively. Existing investors Glade Brook and Lachy Groom also joined in, adding $21 million and $20 million to the round.

As per Fintrackr’s estimates, the company has been valued at $1.32 billion (post-allotment). Zepto has raised over $560 million in funding to date. Check TheKredible for the timeline and details of the funding since its inception.

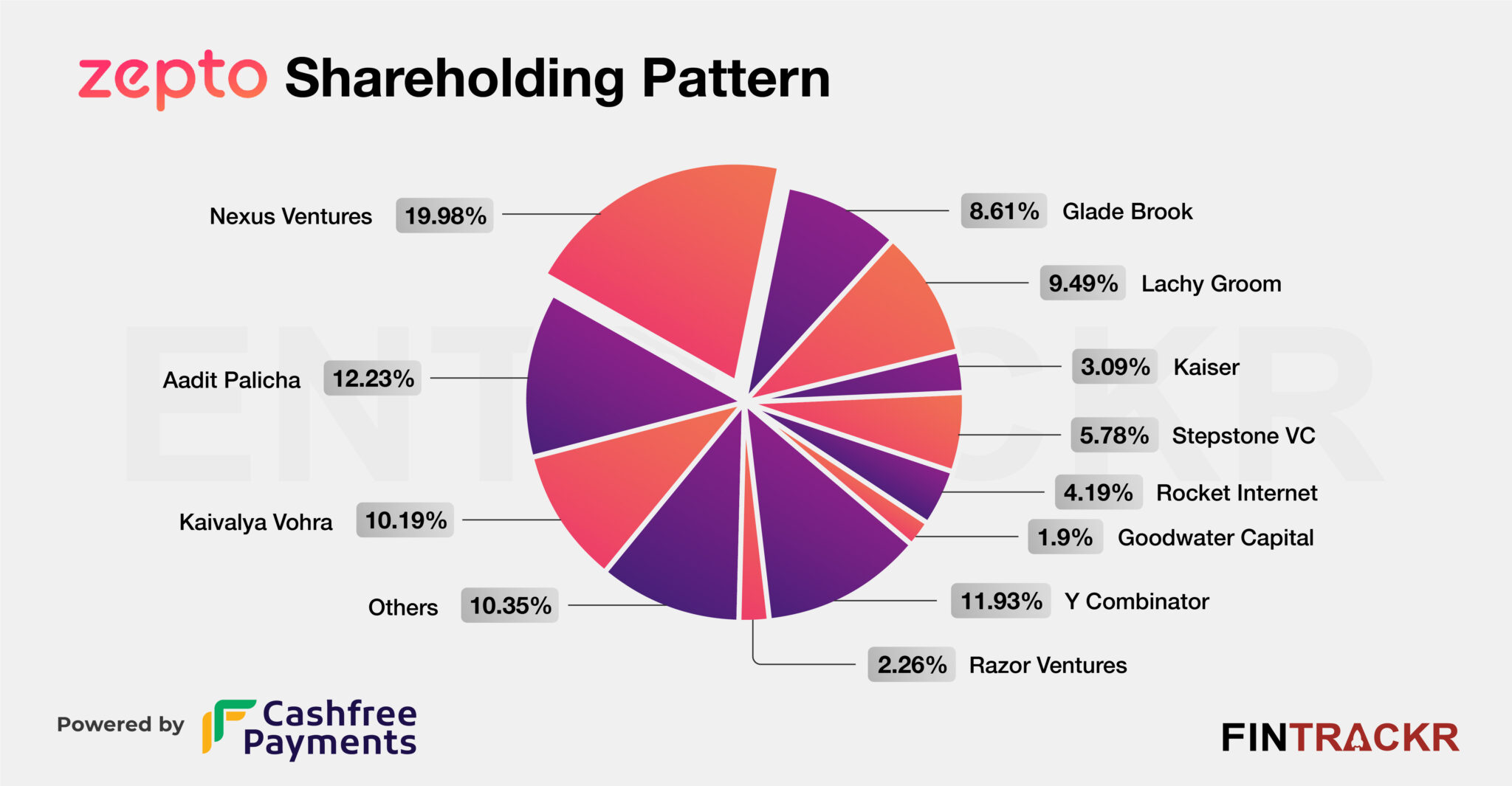

Following the allotment of the Series E round, Nexus Venture remains the largest external stakeholder in the firm with around 19.98% stake while YCC20 (Y Combinator) is the second largest external shareholder holding 11.93% in the company. Lachy Groom, Glade Brook, StepStone, and Rocket Internet command 9.49%, 8.61%, 5.78% and 4.19% in Zepto. The company’s co-founder and CEO Aadit Palicha and the other co-founder Kaivalya Vohra along with their family collectively hold over 22.4% of the company.

Zepto is one of the few Indian startups where the founding team controls more than 20% stake even after the Series E stage. Other such companies are Byju’s and Oyo where its founders hold more than 30% stake in their company after the Series F stage.

Zepto claims to provide quick delivery of 6,000 products across groceries and produce in seven cities including Delhi NCR, Mumbai, Bengaluru, Kolkata, Hyderabad, Pune and Chennai. As per Palicha, Mumbai, Bengaluru and NCR are its top three markets in terms of sales.

While the company is yet to report its FY23 financial numbers, Zepto posted Rs 142.36 crore revenue in FY22 with losses of Rs 390 crore. According to Palicha, the firm closed FY23 with a 10-fold jump in revenue in the last fiscal (FY23) with an improvement in EBITDA.

After their Series E fundraise, Palicha had said, “Our current monthly average revenue run rate is around Rs 400 crore and our growth numbers will see a similar curve in FY24.”

Even as Zepto has surprised with its resilience in a tough grocery market, the current bleed rate will ensure it needs at least one more funding round by 2025, if not earlier. That makes a case for the firm that pioneered quick delivery in many ways in India to relook the model where it can to squeeze out more efficiencies and a more viable model going ahead. Already, the model has evolved, to a more carefully curated selection of products, with the firm barely competitive on price at least. Thus, with its value proposition weakening, it is down to the convenience factor where the firm is seeking to double up possibly. The problem there, as Dunzo has discovered, is that higher convenience comes at an even higher cost, with very uncertain rewards.

Much like its delivery time, the sooner it gets there the better it will be for all stakeholders.