Fundraise for Indian startups remained a challenge during the first half of 2023. This can be attributed to tough market conditions, lack of larger rounds amid absence of top investors like Tiger Global and Softbank, and mass layoffs across the ecosystem.

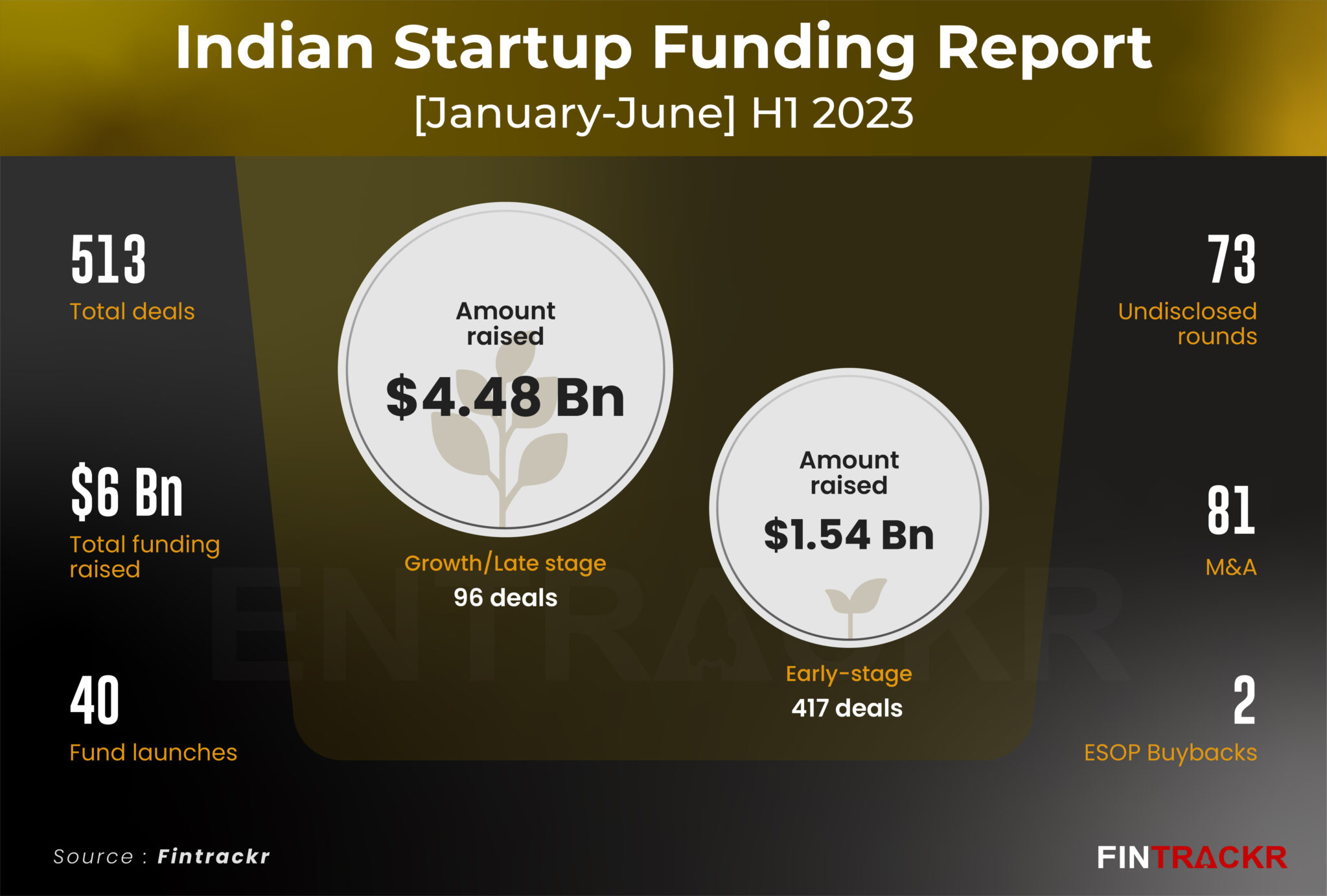

As per data compiled by Entrackr analytics platform Fintrackr, the Indian startups managed to raise $6 billion in funding during H1 when compared to $20 billion in H1 2022.

The $6 billion funding consisted of 96 growth/late stage deals worth $4.48 billion and 417 early-stage deals worth $1.54 billion. Meanwhile, 73 startups did not disclose their transaction details. While startups chased mind boggling valuation in the past couple of years, they have been keeping profitability on top priority this year. As a result, there were no unicorns in the first six months of 2023. In fact, India saw its last unicorn in September 2022 when healthcare diagnostic firm Molbio announced its fundraise over $1 billion valuation.

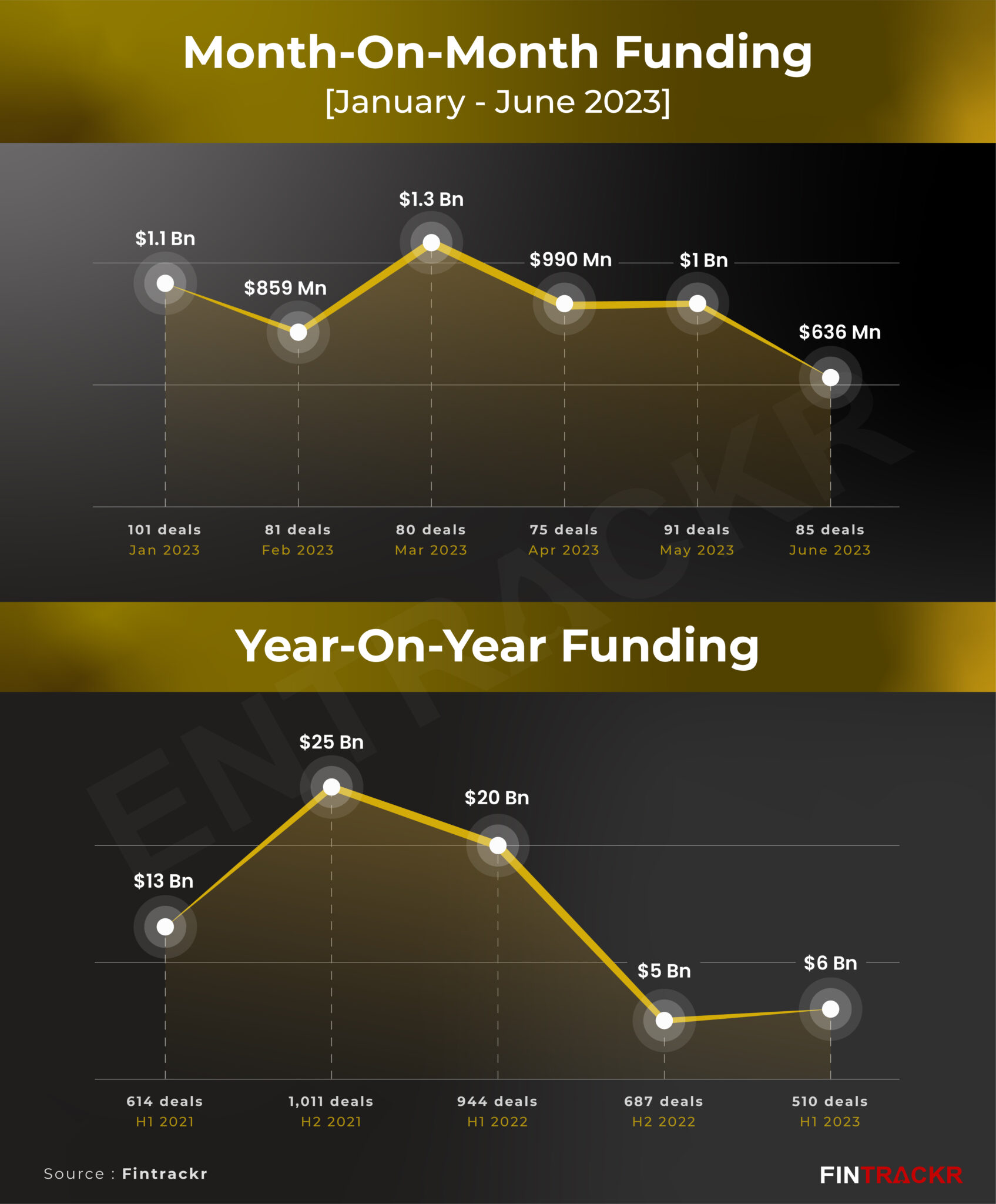

[Month-on-month and year-on-year trend]

While this is a sharp fall from $20 billion in H1 2022, the homegrown companies managed to go past the H2 2022 mark when the fund inflow stood at $5 billion. On a monthly basis, June saw the lowest funding with $636 million despite being the third highest in terms of number of deals. This is also the lowest funding month in the past two and half years (since January 2021). Overall, the average monthly funding stood at $1 billion which has become a new benchmark for the past 12 months.

The rise and fall in funding can be seen below:

[Top 25 growth stage deals in H1, 2023]

To analyze the trend of startup funding, Entrackr has prepared a list of top 25 funded startups in growth as well as in early stages. Fintech company PhonePe spearheaded the chart with $850 million in funding across 4 tranches. This was followed by eyewear brand Lenskart which mopped up $600 million across two deals. Importantly, these two were exceptions for raising more than one round of funding this year.

Fintech platform DMI Finance, edtech company Byju’s, fintech lending platform KreditBee, supply chain company Mintifi, e-commerce platform for meat FreshToHome and fintech company Stashfin managed to raise at least $100 million each. In the list, IoT company Atomberg and foodtech company Drools managed to raise more than $50 million.

The full report can be downloaded here.

[Top 25 early stage deals in H1, 2023]

While we generally see early stage deals of smaller cheque sizes, however, a bunch of deals surprised the ecosystem despite the so-called funding winter. Fintech insurance platform InsuranceDekho raked in $150 million in its maiden funding round. EV startup Charge+Zone and sportstech platform Agilitas Sports, launched by former executives of Puma India, raised $52 million in its first funding round.

Some notable deals in early stage include EV platform BluSmart, edtech startup NxtWave, AI startup SpotDraft, SaaS company Beconstac, drone company Garuda Aerospace and EV startup Magenta Mobility. It’s worth mentioning that all 25 deals in the early stage chart raised more than $10 million each.

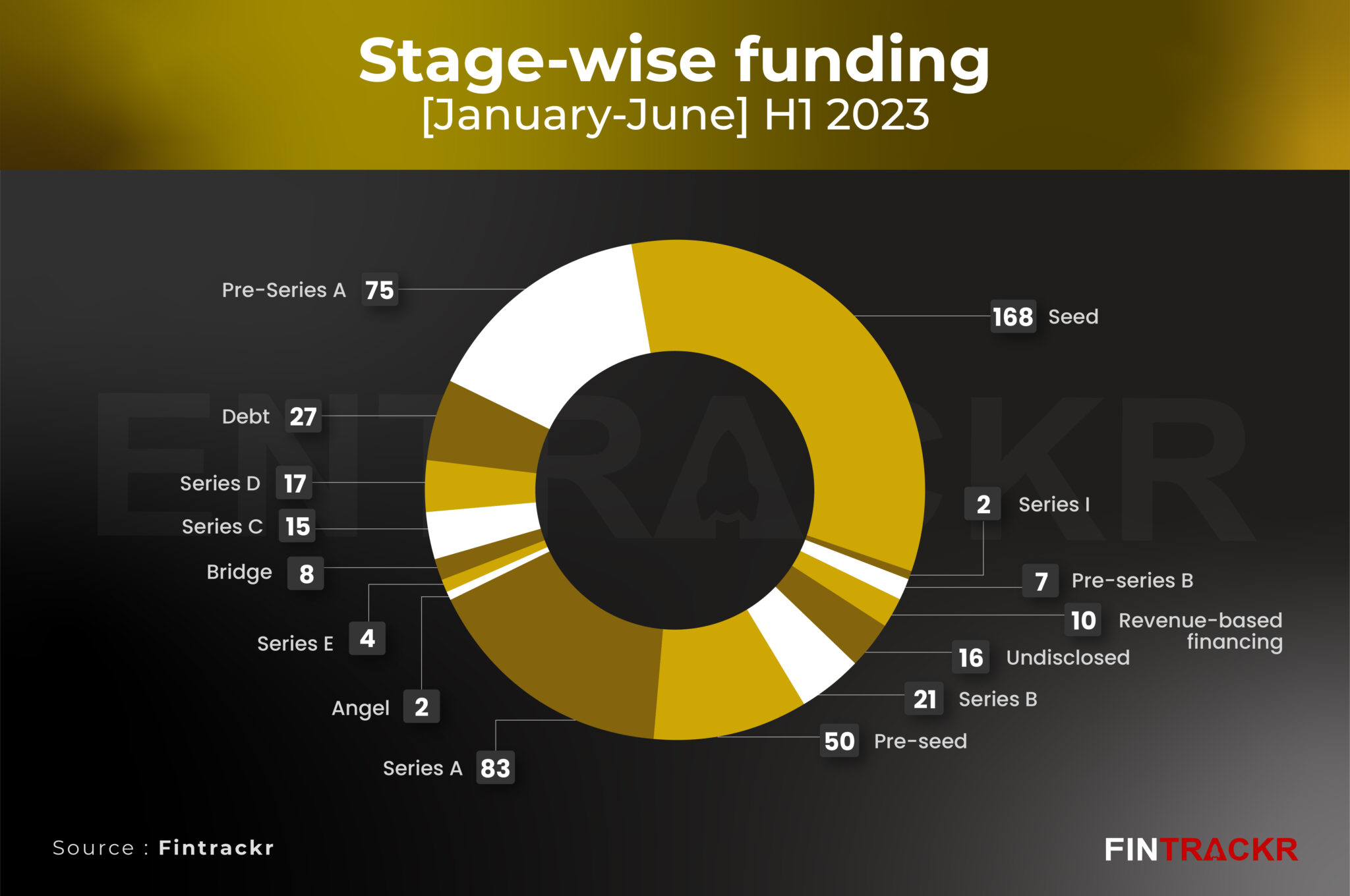

[Stage wise deals]

H1 saw 168 seed funding whereas 50 deals were in pre-seed stage. Notably, the seed and pre-seed contributed to more than 40% of the total deals during the period. This was followed by Series A, pre Series A where 83 and 75 startups get funded. In growth stage deals, Series B, Series C and Series D saw 21, 15 and 17 deals respectively. The chart also included 10 revenue based financing, 8 bridge rounds, a couple of Series I rounds and a pre IPO funding.

The full chart can be seen below:

[Mergers and acquisitions]

The ongoing calendar year has seen 81 merger and acquisition deals so far. If we see the past year’s trends, then it falls below more than 250 mergers and acquisitions in 2021 and 204 deals in the last year. While the first half did not see any blockbuster merger and acquisition deals, a clutch of transactions including the acquisition of Build On Scenes by Unacademy’s Graphy, Ustraa by VLCC, Trainman by Adani Digital, Chumbak by GOAT brand Labs, and Upwards by Lendingkart grabbed the headline. Most of the deals were undisclosed.

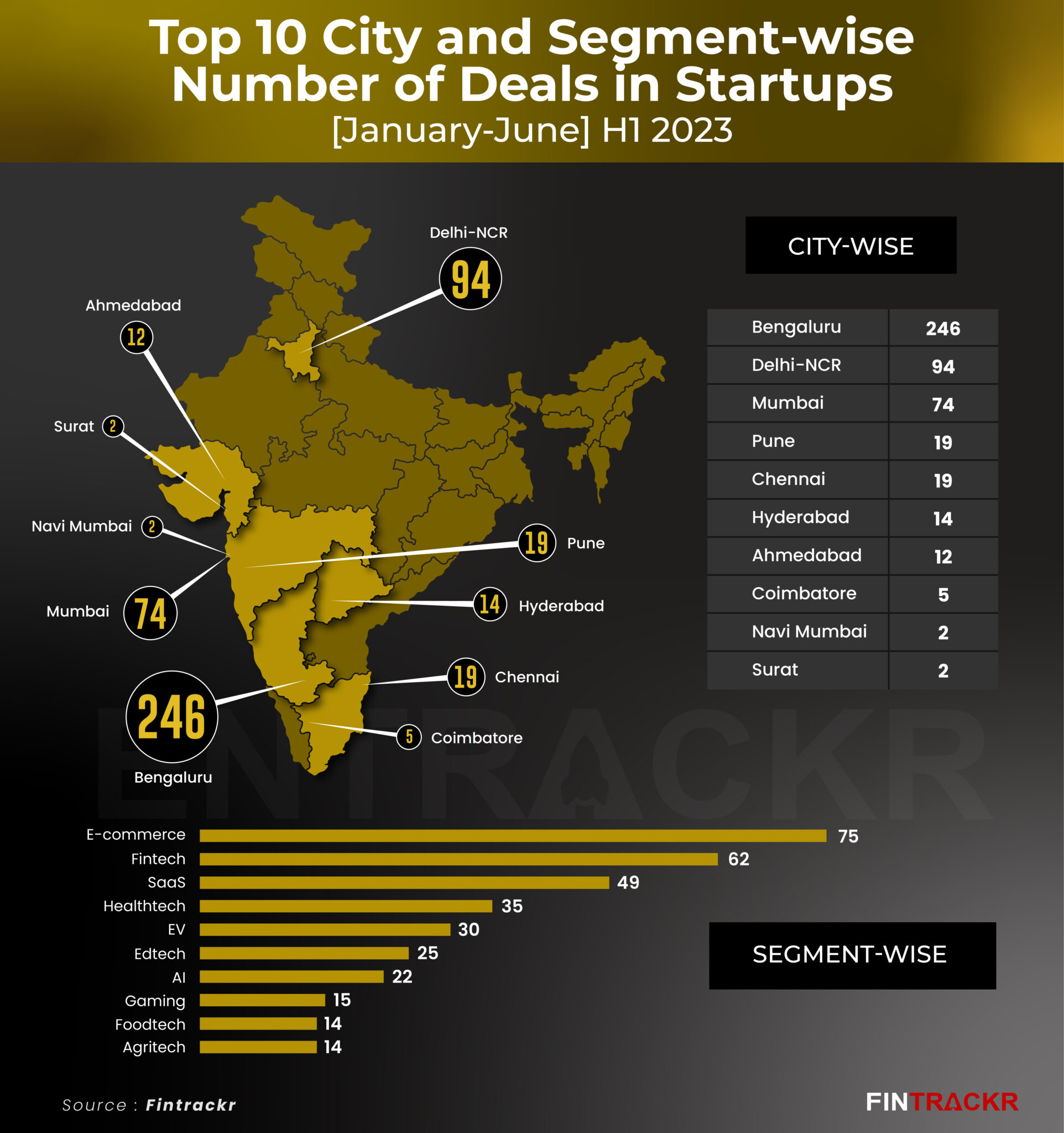

[City and segment]

Bengaluru, once again became hub of startups as 246 startups from the city raked in nearly $3 billion in funding during the first half of 2023. This is close to 50% of the total funding during the last year. Delhi-NCR-based startups were the next with 94 deals amounting to $1.24 billion. Mumbai, Pune, and Chennai made it to the top 5 list.

E-commerce dominated in terms of segment wise deals followed by fintech, SaaS, healthtech and EV. Edtech remained out of the top five list. Value wise, fintech startups scooped up more than $2 billion whereas e-commerce raised over $1 billion.

[Layoffs]

Layoffs continue to hinder the growth of Indian startups as more than 60 startups fired over 15,000 employees, according to data compiled by Fintrackr. The number of startups that resorted to layoffs is on par with the last year when more than 20,000 employees were given pink slips amid funding winter.

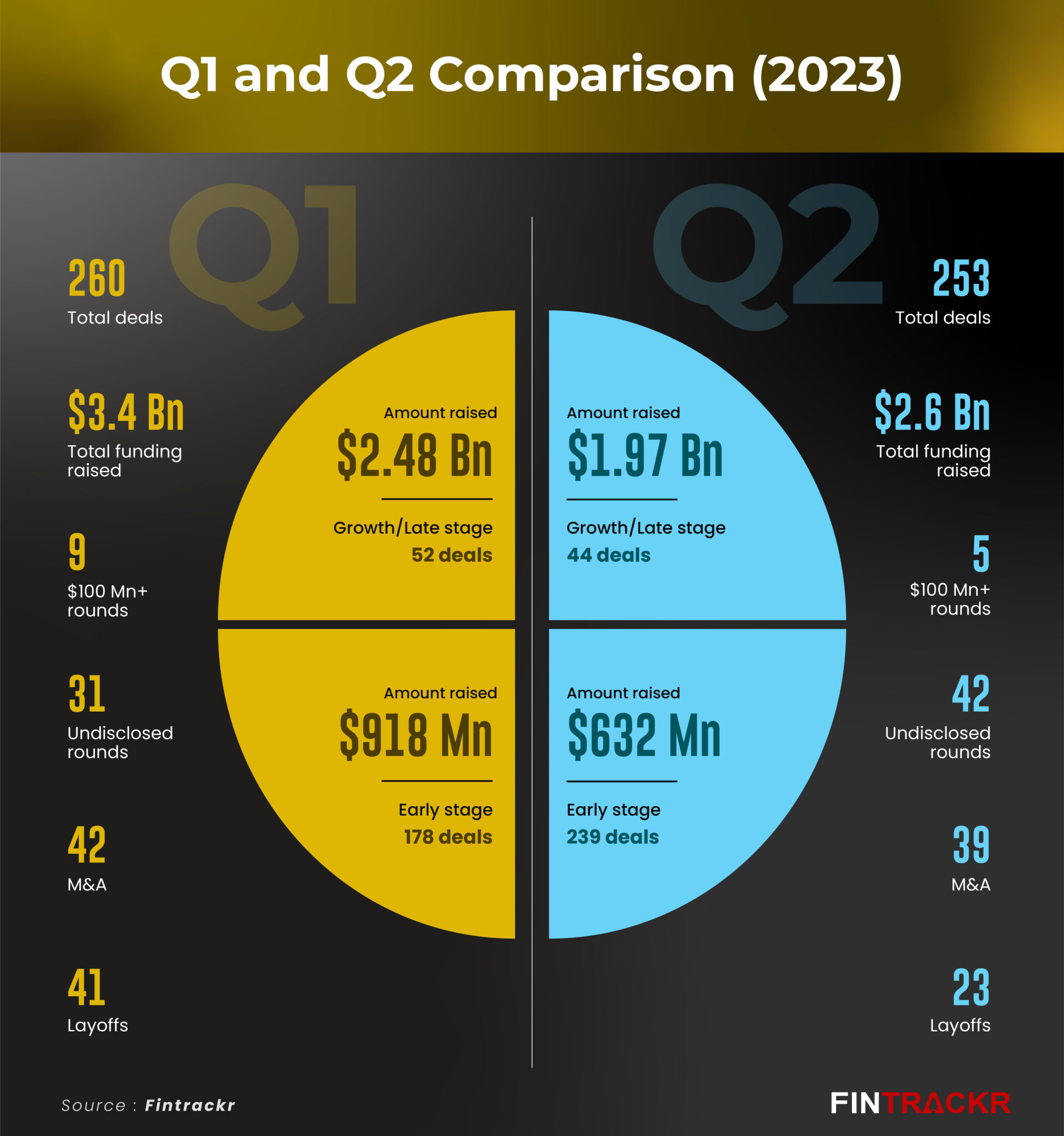

[Q1 Vs Q2]

If we compare the first two quarters of 2023, the number of deals declined by a small margin from 260 in Q1 to 253 in Q2. However, the deal size diminished by 30% from $3.4 billion in Q1 to $2.6 billion in Q2. Further, there were 9 $100 million plus rounds in the first quarter which fell to only 5 in the second. Entrackr has prepared a comparison chart for better understanding.

[Fund launches]

Despite the low funding environment, 40 startup funds announced their new fundraise till the first six months of 2023. Last year, around 100 such funds announced their new launch. New York-based Tiger Global Management, reportedly raised $2.7 billion for its new fund in June. The capital raised was 55% less than the target fund of $6 billion set by the investment firm. Unlike previous years, Tiger Global has almost stayed out of investments in Indian startups and backed only two companies: PhonePe and Infinite Uptime in the ongoing calendar year. Softbank, known as a unicorn maker along with Tiger Global, did not make any investment this year so far.

Silicon Valley-based venture capital firm Sequoia recently announced that it will split into three separate firms which will focus on its key markets – the US and Europe, China, and India and Southeast Asia. Following the move, Sequoia India and Southeast Asia has been rebranded as Peak XV Partners.

[Conclusion]

Even as funding is expected to have its cycles of ‘easy money’ and belt tightening, it is a little surprising that the ecosystem continues to make what many would consider obvious blunders. From outrageous valuations in the private market to the recent series of misdemeanors and outright frauds being seen, it is clear that VCs too need to introspect on their approach. Starting with the quality of due diligence they do on startups and founders. The saving grace has been the sheer number of deals done in the past few years, which makes these cases a tiny minority yet.

There is enough by way of real growth, real firms delivering value, and a pipeline of promising startups to indicate that the market will recover sooner than later. However, with recent VC fund raises becoming more conservative, the market will miss the kind of gunpowder and backing VC’s like Softbank could bring to back Indian founders with global ambitions. For it is becoming increasingly clear that targeting just the Indian market for most firms will not deliver the kind of growth or returns expectations a majority of VCs will have. Going global on the other hand does, but at a higher cost, especially in key sectors like manufacturing, which had been relatively ignored until now. That is one change we would love to see over the next few quarters and years, as much more depends on success in that area for India.