Looks like gaming companies have cracked the code on scale and profitability, and their formula seems straightforward: charge exorbitant commission and platform fees. This trend has become evident from the financial statements of Dream11, Gameberry and now Gameskraft.

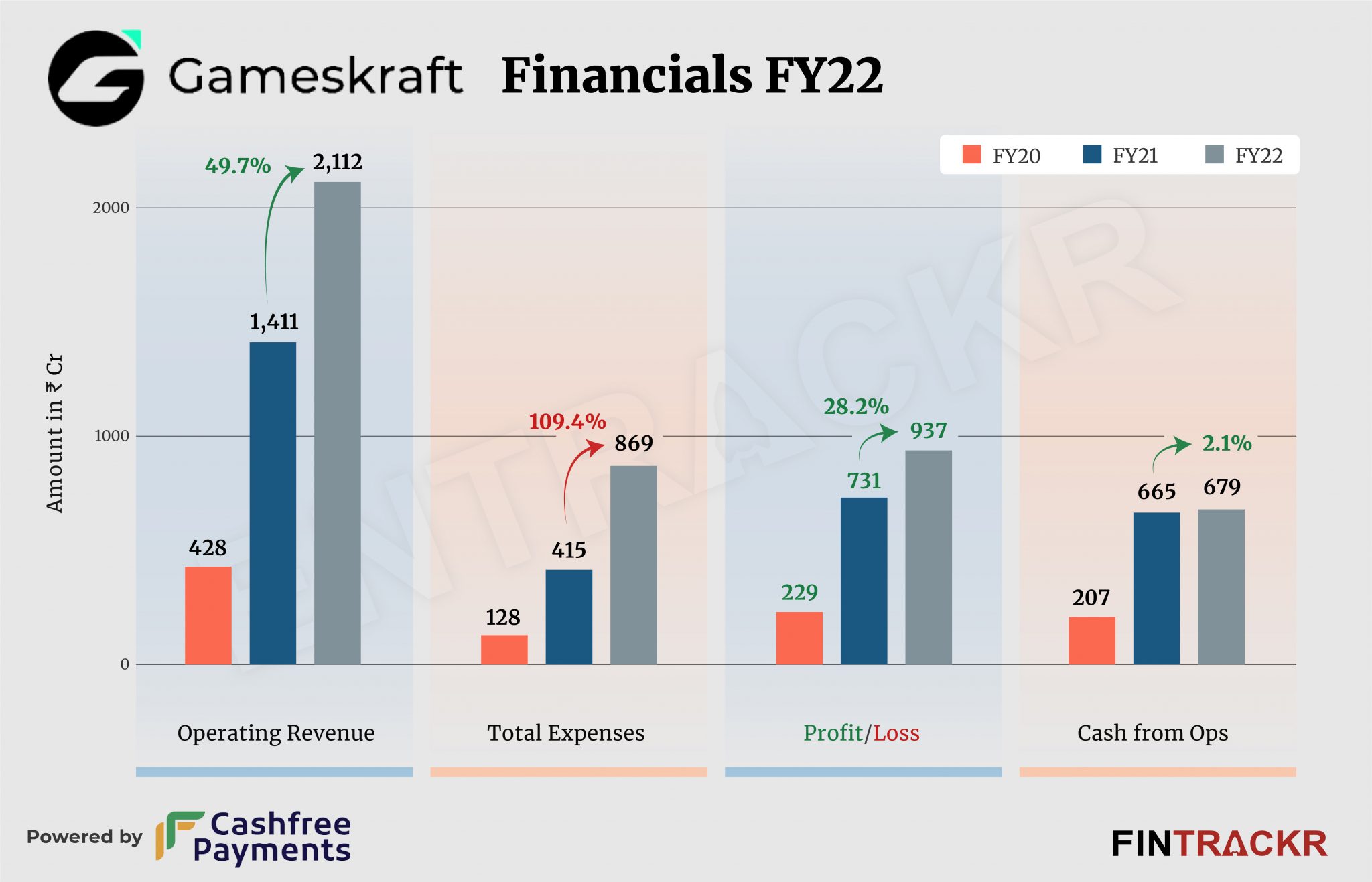

Five-year-old Gameskraft—which operates Rummy Culture, Gamezy, Rummy Time, among others—touched Rs 2,112 crore in revenue during FY22, according to Fintrackr’s analysis based on its financial statements filed with the Registrar of Companies.

This income of Rs 2,112 from subscription, platform or commission fees from the user for entering the contest grew 49.7% when compared to Rs 1,411 crore during FY21.

The company also has other financial income of Rs 20 crore mainly from interest on fixed deposits during the last fiscal year.

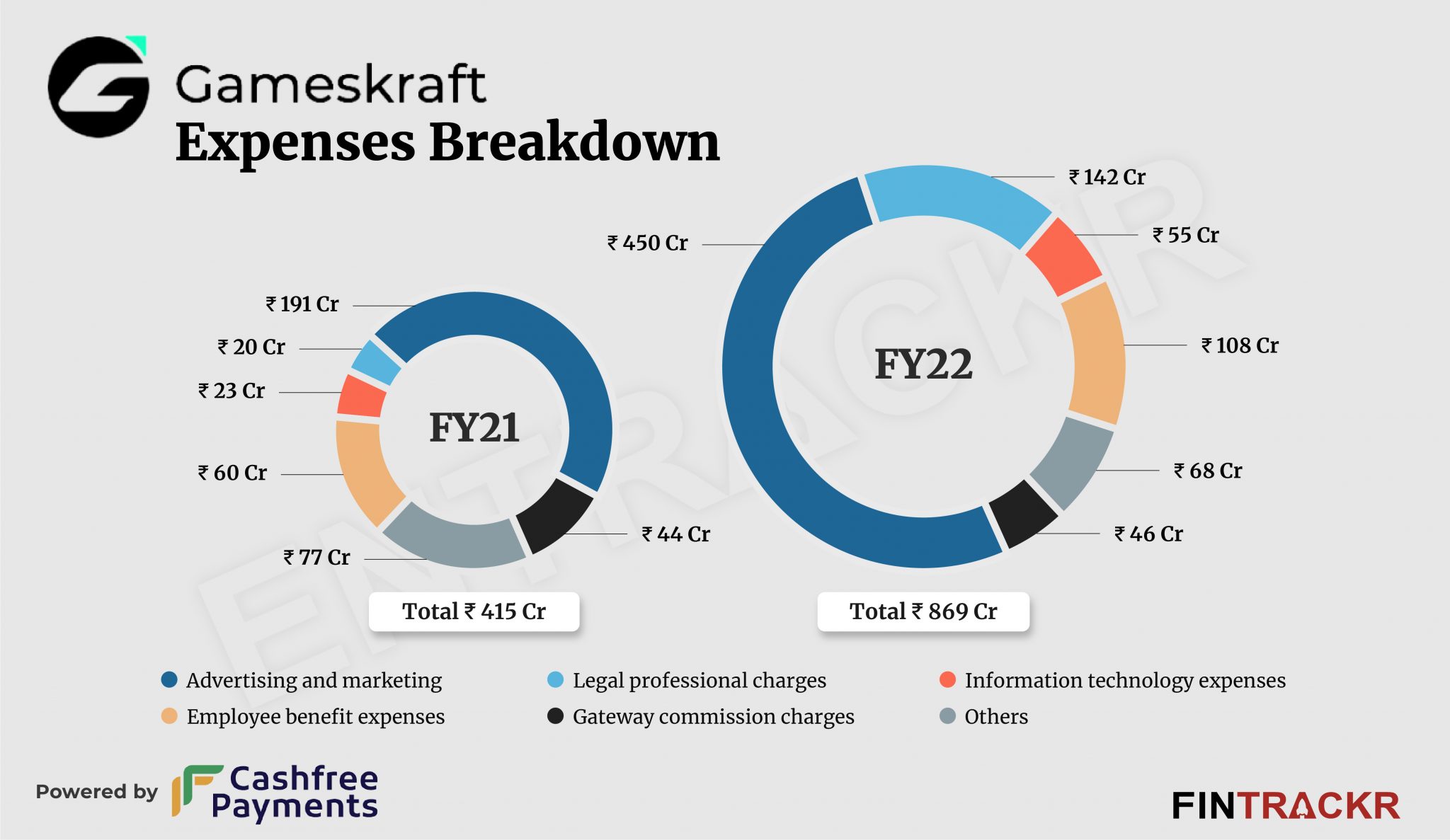

On the cost side, advertising and marketing formed 52% of the overall expenditure. These costs shot up by 135.6% to Rs 450 crore in FY22 from Rs 191 crore in FY21.

With the regular interface of GST, income tax, and other regulatory departments during FY22, legal and professional fees turned out to be the second largest cost center. This cost ballooned 7X to Rs 142 crore in FY22.

Employee benefit expenditure spiked 80% to Rs 108 crore during FY22. Significantly, this also includes Rs 52 crore as ESOP expenses which were settled in equity (non-cash).

Gameskraft spent Rs 46 crore as payment gateway charges which steered its overall expenditure by 109.4% to Rs 869 crore in FY22.

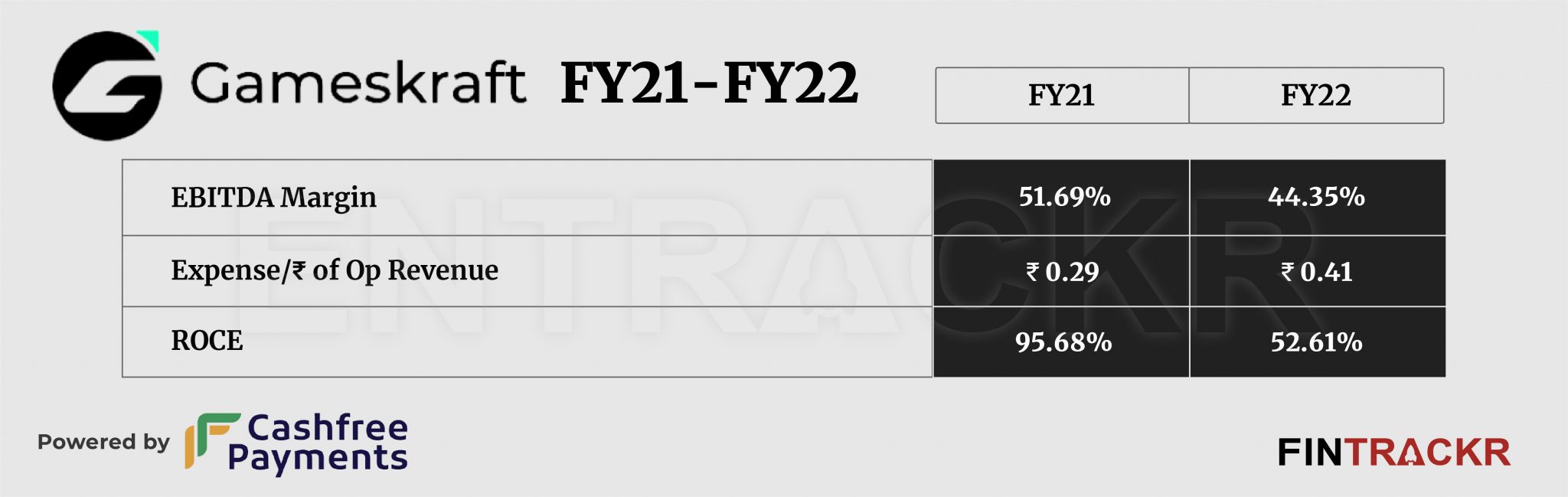

With a surge of around 50% Y-o-Y in scale, Gameskraft’s profit grew 28.2% to Rs 937 crore (after-tax) during the last fiscal. At the same time, the ROCE and EBITDA margin stood at 52.61% and 44.35%, respectively. On a unit level, the company spent Re 0.41 to earn a single unit of operating revenue in FY22.

In real money gaming and daily fantasy sports, only Gameskraft has managed to grow its profit in FY22. Data compiled by Fintrackr shows that Dream11, Gameberry and A23 saw decline in their profits while Games24X7 slipped into losses during the last fiscal. Mobile Premier League (MPL) registered 28.9% growth in its revenue to Rs 497 crore but its losses soared 202% to Rs 1,122 crore year-on-year.

GamesKraft has been brilliant at building out well known games with online versions that users clearly prefer over other options, be it Rummy or Poker. And then, they have the fantasy league offering cash prizes on prediction games. Thus, in a market as fickle as gaming, to deliver as they have year on year is indeed amazing, and the leadership team deserves credit for achieving this feat. Sustaining the tempo will remain the only challenge, and on a larger base, one would bet that they have the odds in their favour. The acceptance of the AVGC (Animation, Visual Effects, Gaming and Comics) sector in the 2022 budget strengthens their case for a strong run in a sector expected to quadruple to over $10 billion before 2030. Clearly, this is a company to watch if you want to check the pulse of the sector in India.