The pandemic had given wings to the gaming ecosystem and almost every company in the space registered multi-fold scale during FY22. One such firm was gaming publisher Gameberry which registered 4.4X growth in its scale in FY21 but its mojo faded in FY22 as the world came back to normal. Its scale and profit saw negative growth in FY22.

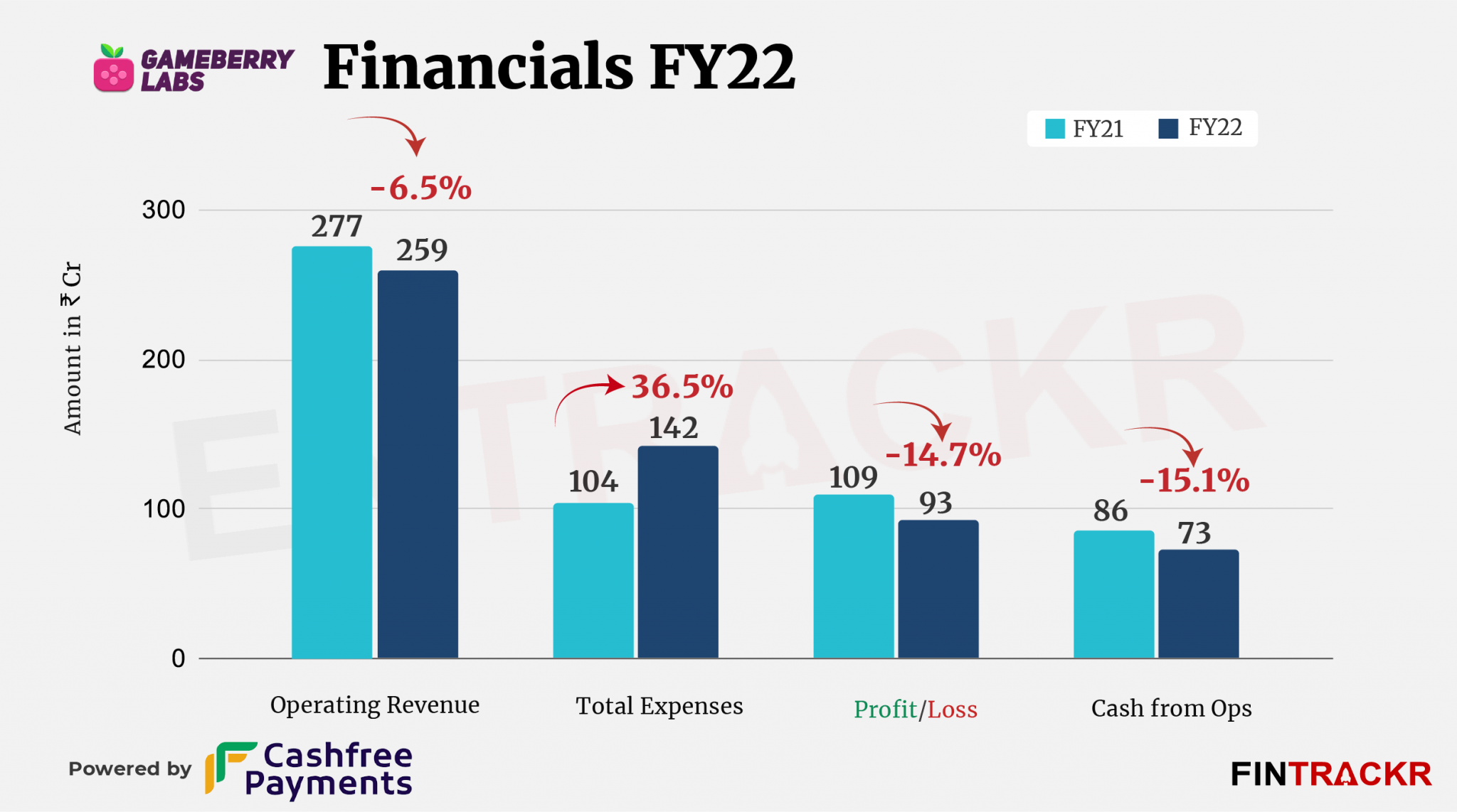

Gameberry’s revenue from operations shrank 6.5% to Rs 259 crore in FY22 from Rs 277 in the previous fiscal year (FY21), according to its annual financial statement with the Registrar of Companies (RoC).

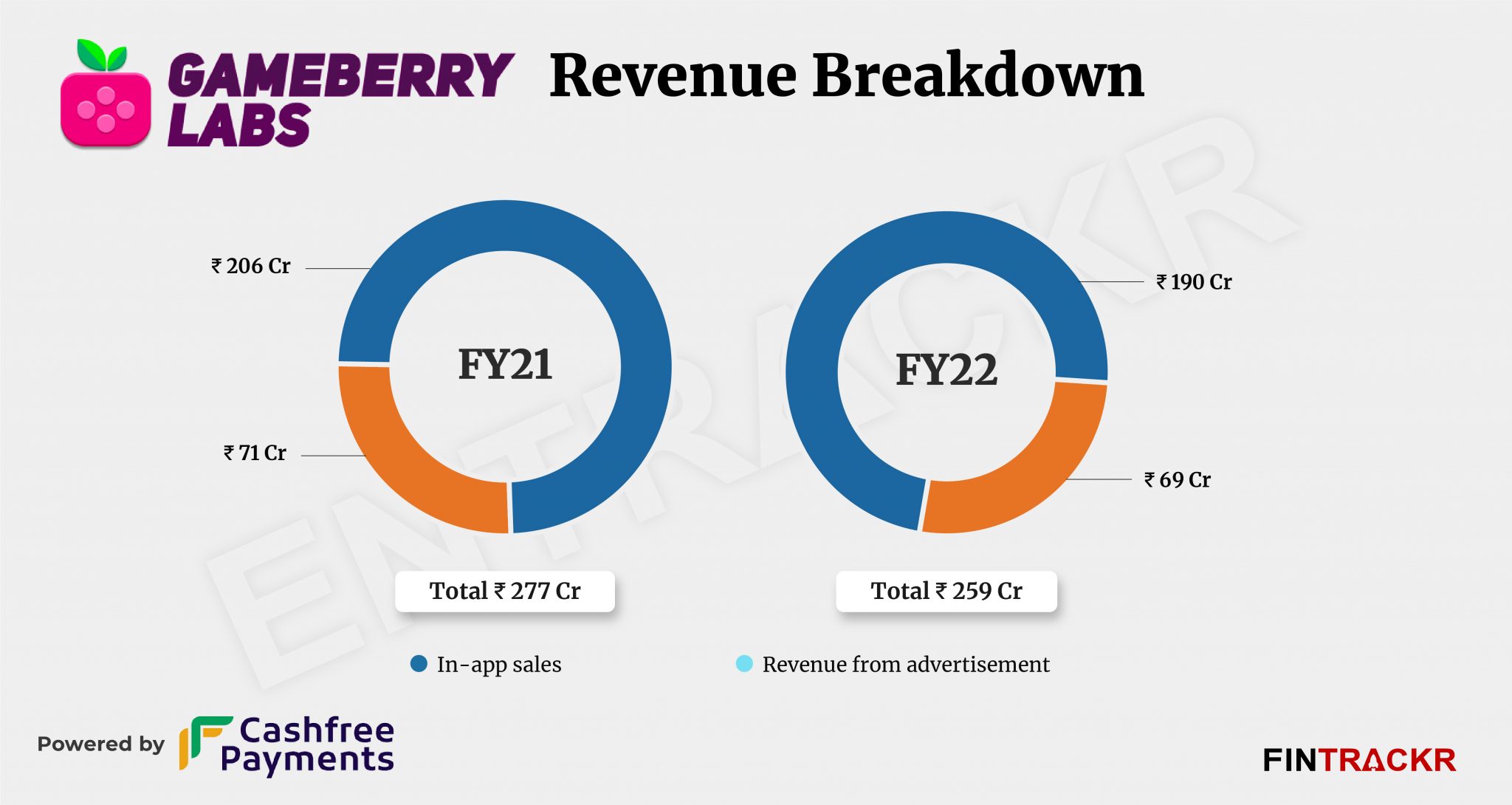

Gameberry hosts three games: Ludo Star, Ludo Titan, and Parchisi Star. Like most mobile game publishers, Gameberry’s earnings constitute a mix of users’ in-app purchases and advertising. In-app sales accounted for 73% of the total operating revenue which decreased 7.8% to Rs 190 crore in FY22 from Rs 206 crore in FY21.

Advertising revenue marginally decreased by 2.8% to Rs 69 crore while the company’s earnings from interest on fixed deposits (non-operating) spiked 51.8% to Rs 8.5 crore in FY22.

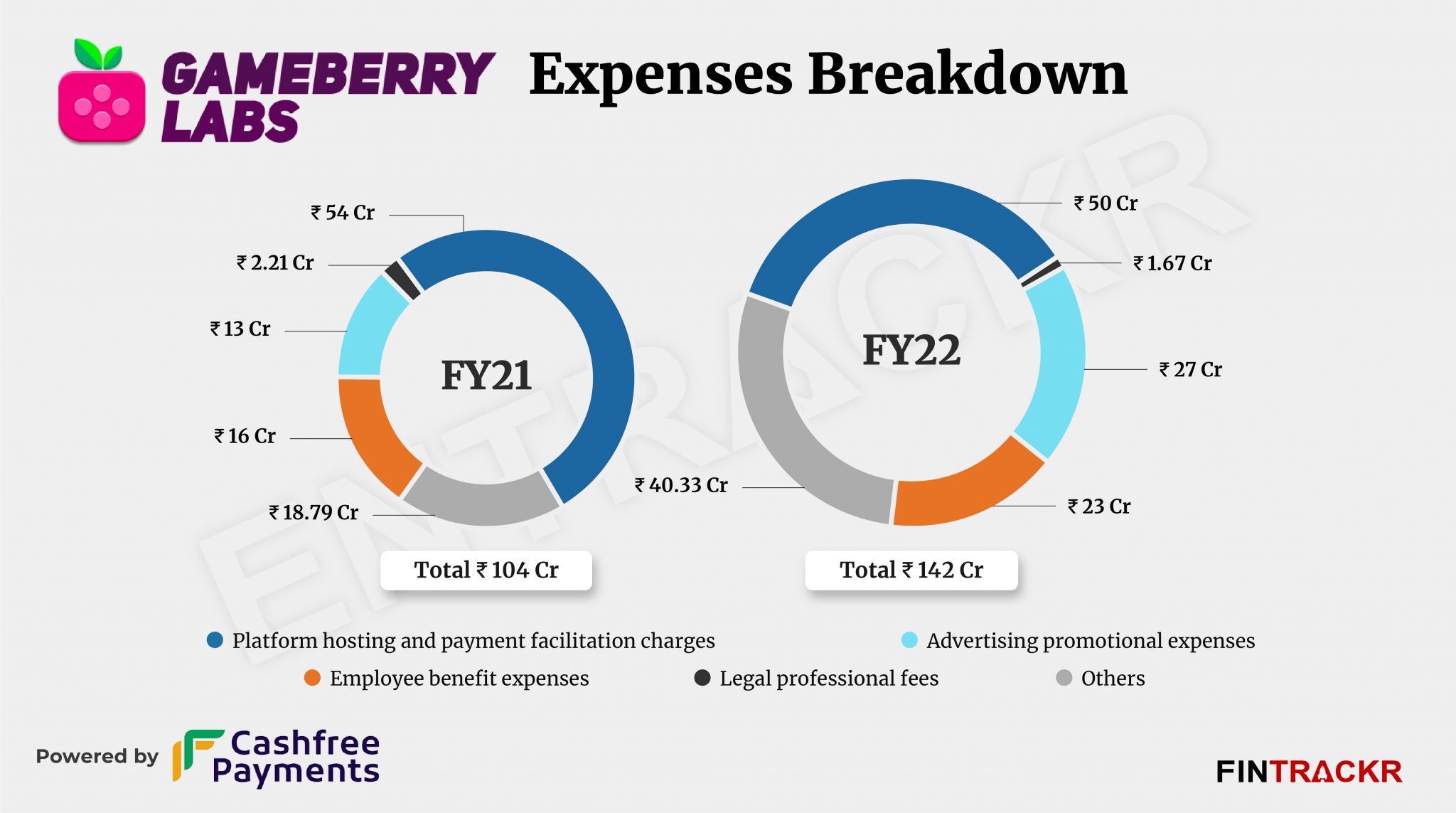

When it comes to expenditure, platform hosting and payment facilitation formed 35.2% of the overall cost which reduced by 7.4% to Rs 50 crore. Advertising and promotional expenses jumped around 2.1X to Rs 27 crore in FY22. Employee benefit expenses increased 43.8% to Rs 23 crore in FY22 while it incurred Rs 1.67 crore as legal and professional fees which pushed the total cost by 36.5% to Rs 142 crore in FY22.

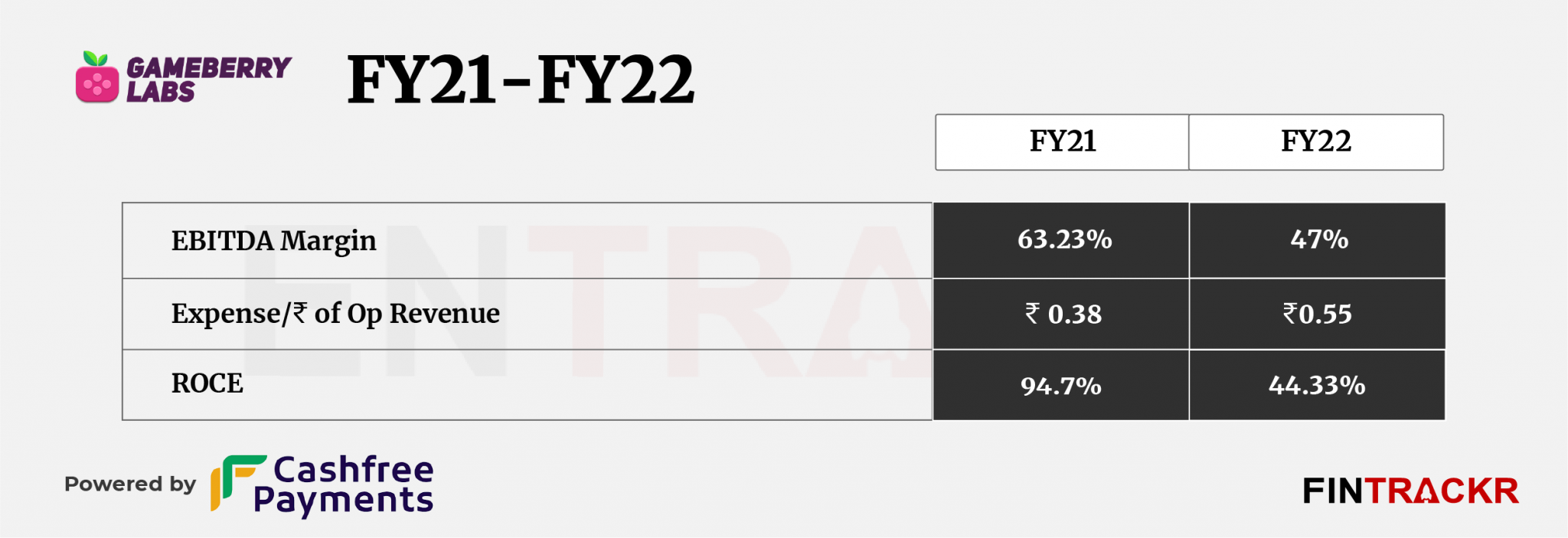

With a 36% surge in the overall cost, the firm’s profit reduced by 14.7% to Rs 93 crore in FY22 from Rs 109 crore in FY21. Its ROCE and EBITDA ratios stood at 44.33% and 47% respectively in FY22. On a unit level, Gameberry spent Rs 0.55 to earn a rupee of operating revenue.

Those margins remain healthy, but will continue to be under pressure with the onslaught of more competition in the market. The fact that a doubling of advertising could not shore up revenues in Fy22 simply points to the fact that the market is a lot more crowded, and time at hand much less for users, than it was during the pandemic. The only way out, launching new games that can both help retain and draw in new users remains an uphill task for most game developers in India.