Lightspeed and Tiger Global-backed bookkeeping app OkCredit has been struggling to grow and even in its fifth year of operation, the company hasn’t been able to clock significant revenues. Even though OkCredit’s operating income grew almost 10X in the fiscal year ending March 2022, that didn’t result in a growth in absolute numbers with the company not even crossing the Rs 50 lakh mark.

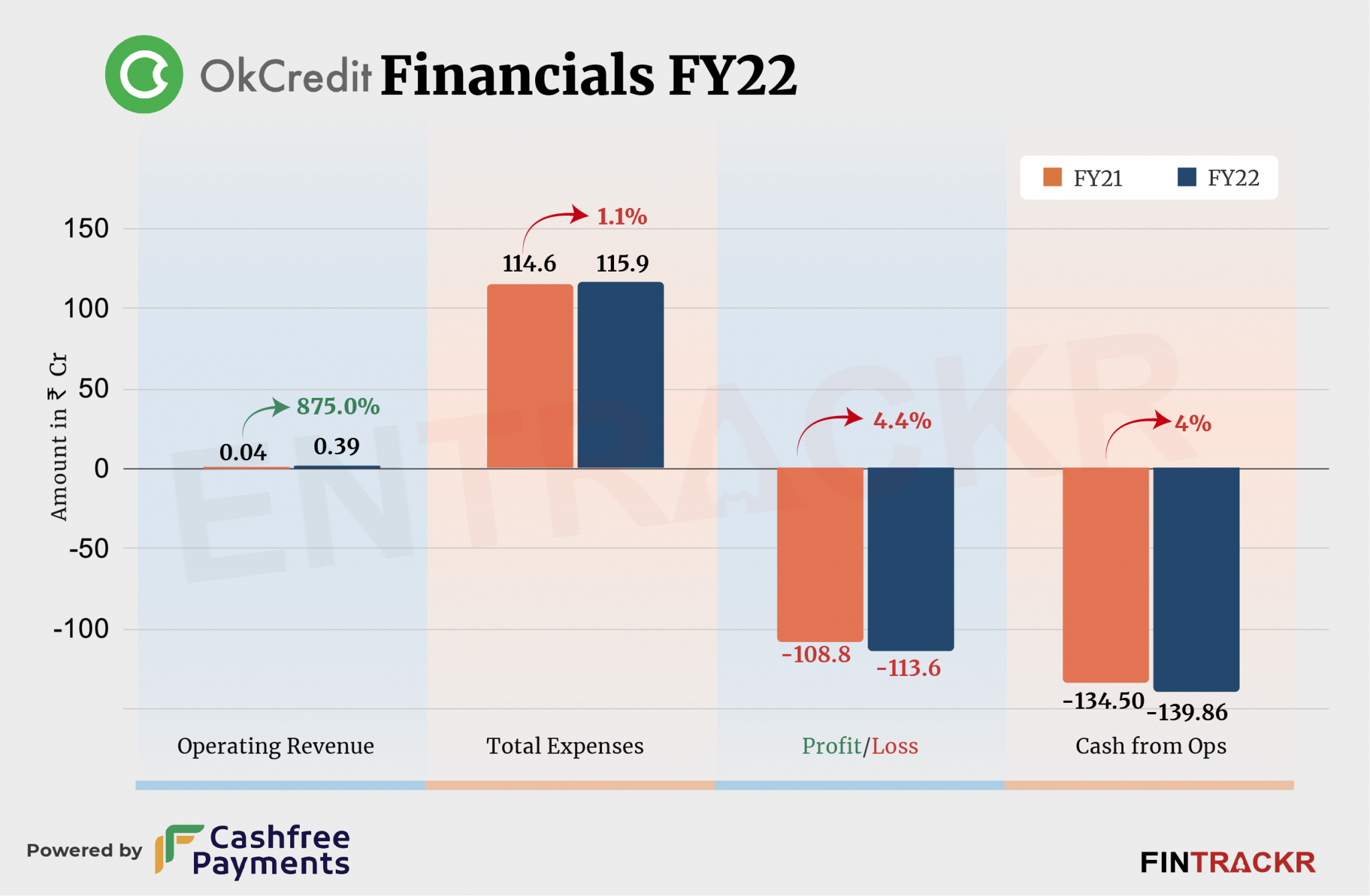

OkCredit’s revenue from operations grew to Rs 39 lakh during the last fiscal year from close to Rs 4 lakh in FY21, according to the company’s annual financial statements with the Registrar of Companies (RoC).

In fact, the company earned more from interest and gain on current investments and other non-operating revenue with Rs 1.93 crore (though this amount declined 66.6% when compared to FY21).

OkCredit is a digital ledger app for small and medium-sized businesses which facilitates the recording of credit/payment transactions digitally. As per its website, the app is available in more than 10 local languages and has over 10 million downloads. Founded in 2017, it has raised $90 million to date including a $67 million worth Series B round in Sep 2019.

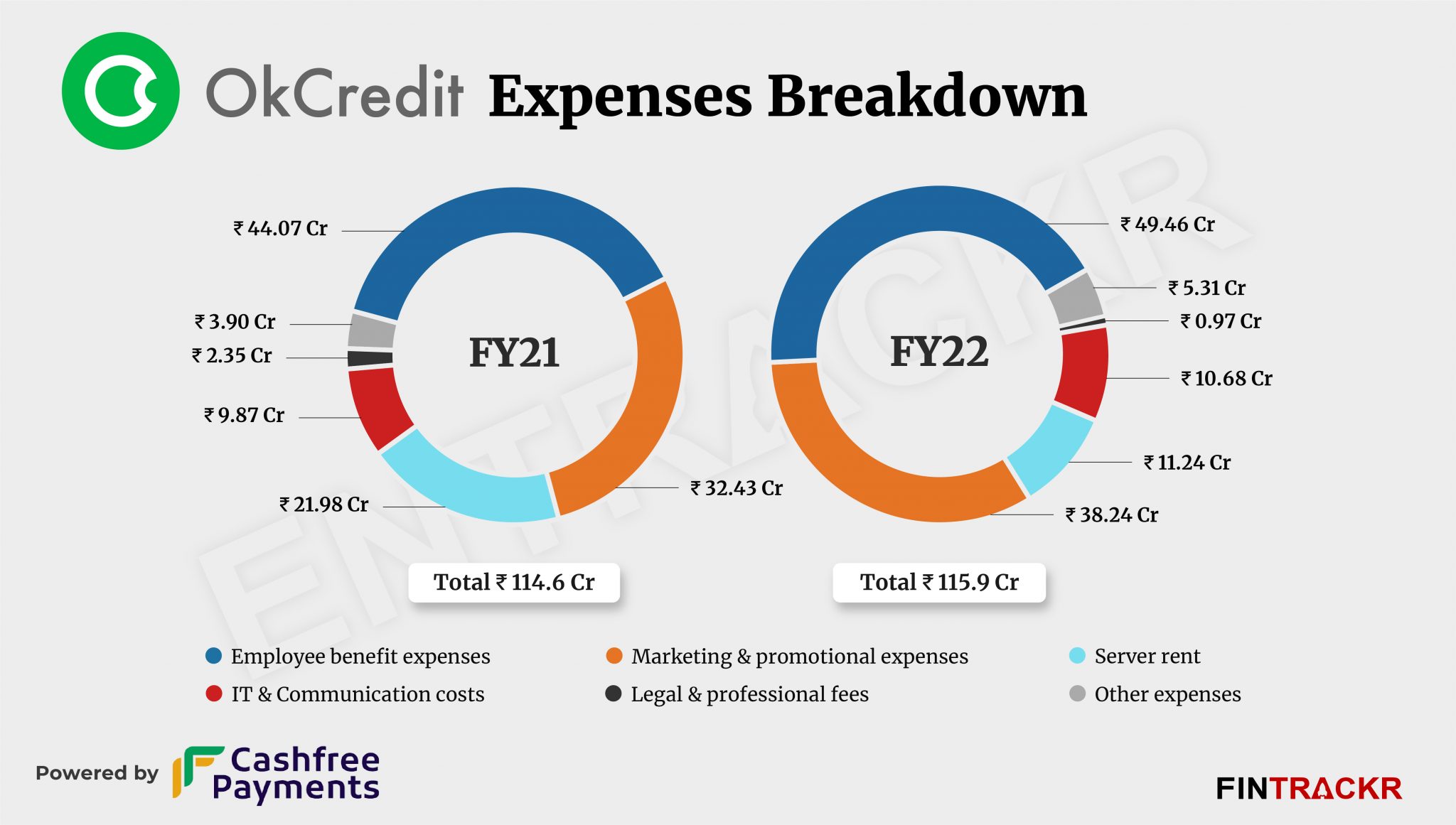

On the cost side, employee benefit expenses emerged as the largest cost center forming 42.7% of the total expenses. This amount surged 12.2% to Rs 49.46 crore in FY22 from Rs 44.07 crore in FY21. Importantly, this cost also includes Rs 9.13 crore as employee stock option compensation.

For context, OkCredit laid off around 35% of its workforce in February this year. Entrackr had exclusively reported this.

Further, marketing and promotional expenses spiked around 18% and stood at Rs 38.24 crore. OKCredit’s stagnant scale was also evident from its spending on the server and legal cum professional fees which shrank 48.9% and 58.7% respectively to Rs 11.24 crore and Rs 97 lakh.

OkCredit also incurred Rs 10.68 crore on information technology (IT) & communication costs including software, payment gateway, and other related costs. In total, its annual expenditure remained stable at Rs 115.9 crore in FY22 as compared to Rs 114.6 crore in FY21.

With controlled expenses, the firm’s losses surged only 4.4% to Rs 113.6 crore in FY22 against Rs 108.8 crore in FY21. Its cash outflows from operations stood at Rs 139.86 crore during the last fiscal year.

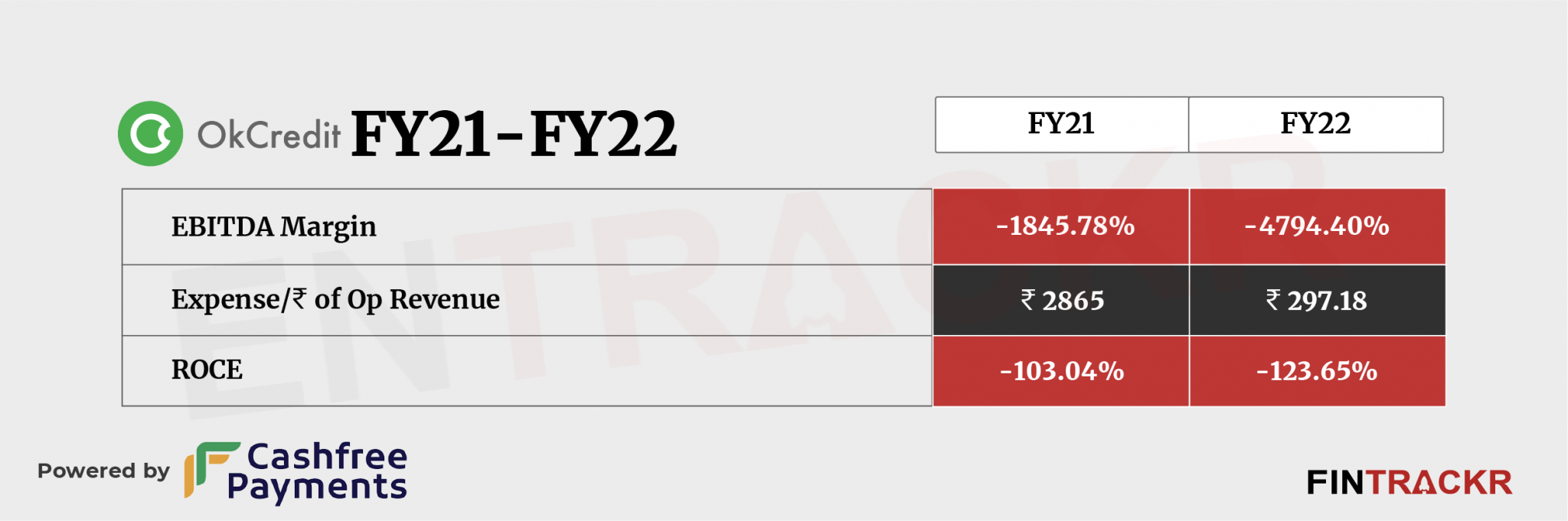

When it comes to ratios, EBITDA margin and ROCE stood at -4,794.40% and -123.65% respectively in FY22. On a unit level, OkCredit spent Rs 297.18 to earn a rupee of operating revenue during the same period.

OkCredit’s financial performance has been tepid in FY22 and even an eternal optimist won’t see a silver lining in these numbers. The company is left far behind in its core space in which its arch-nemesis Khatabook’s scale flew 4X and crossed the Rs 70 crore mark while IndiaMart-backed Vyapar touched Rs 20 crore in revenue in the last fiscal. OkCredit also entered the e-commerce enablement space with OKShop in 2020 but it pulled the plug from it in April this year.