Business accounting software aka digital ledger or bookkeeping space witnessed heightened interest from venture capital firms in 2019. As a result, the segment’s posterboys: OkCredit and Khatabook collectively raked in close to $175 million from investors such as Lightspeed, Sequoia, B Capital and Tencent among others.

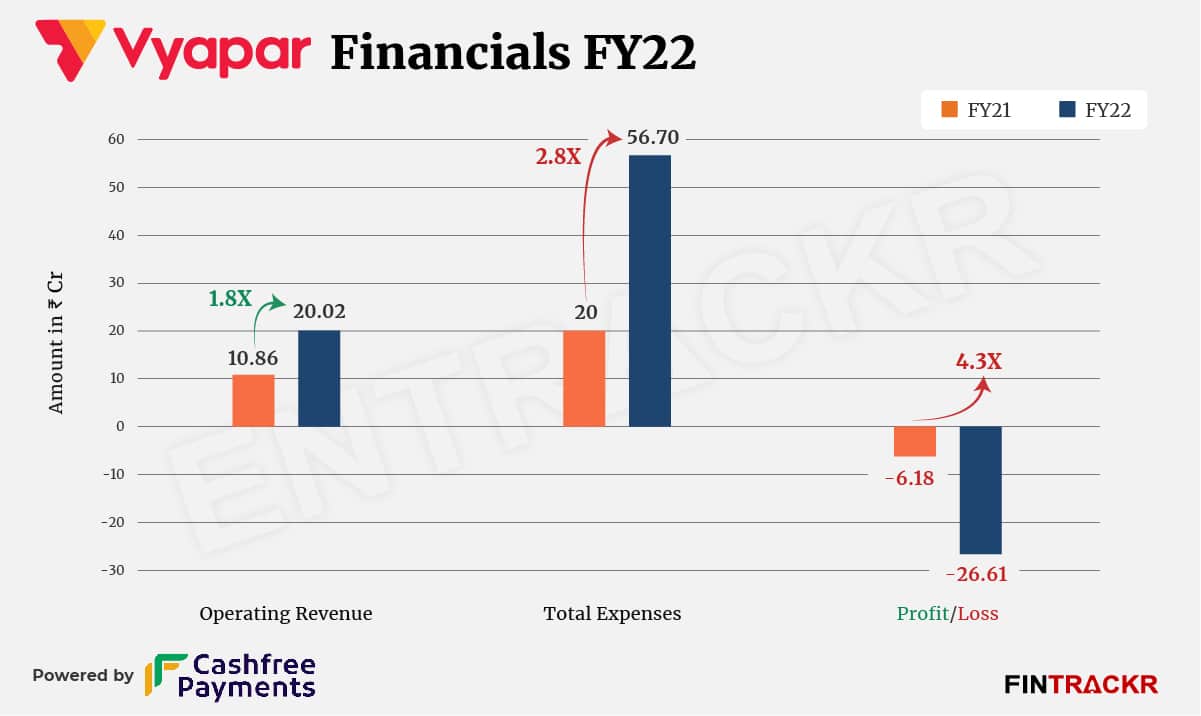

While OKCredit and Khatabook were chasing growth until FY21 and continued to bleed during the last fiscal year, Indiamart-backed Vyapar has been growing steadily with better unit economics for the last two fiscal years. The Bengaluru-based company registered an 84.3% growth in its operating revenue to Rs 20 crore from Rs 10.86 crore in FY21, as per its annual financial statements filed with the Registrar of Company (RoC).

Vyapar also booked an income of Rs 88 lakh from interest income during FY22.

Founded by Sumit Agarwal and Shubham Agarwal in 2016, Vyapar helps SMEs keep track of their receivables and payables, inventory management, send customized invoices, payment reminders and transaction messages in multiple languages. The platform claims to have more than 10 million customers.

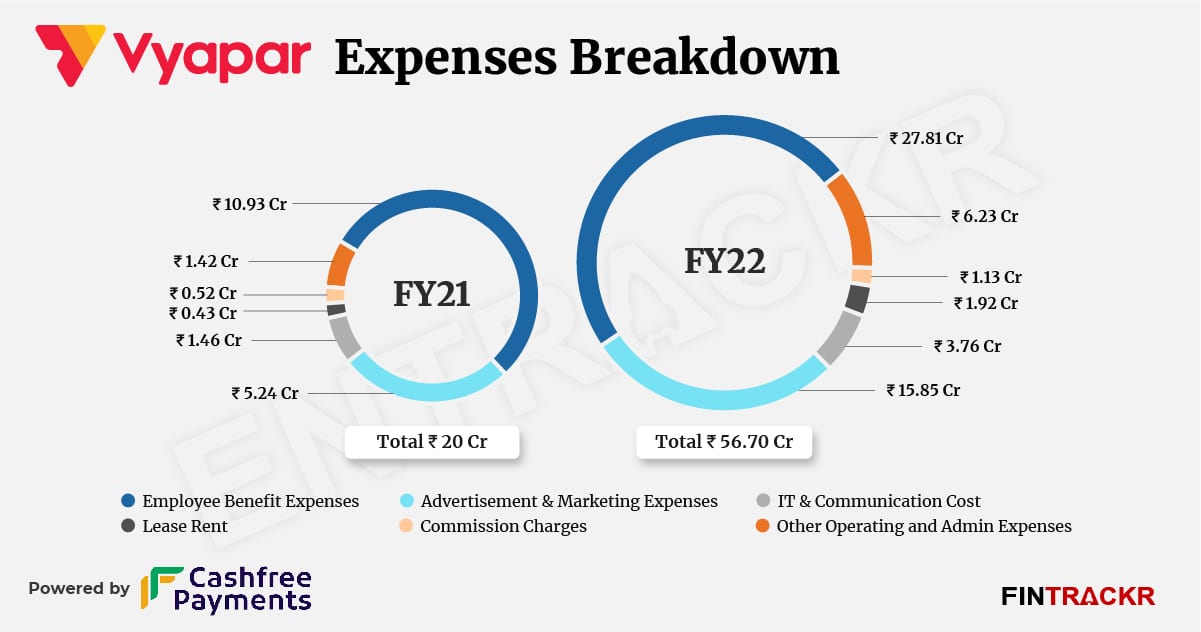

On the expense front, employee benefits expense emerged as the largest cost center for the company, contributing 49% to the total annual expenditure. This cost ballooned over 2.5X to Rs 27.81 crore in FY22 from Rs 10.93 crore during FY21.

As per Fintrackr’s analysis, advertising & marketing expenses contributed 28% of the total expenses. These costs shot up 3X to Rs 15.85 crore in FY22 from Rs 5.24 crore in the preceding fiscal year (FY21). Similarly, commission charges surged 2.2X to Rs 1.13 crore during the last fiscal year.

Vyapar also incurred IT & communication costs of Rs 3.76 crore in FY22 which include charges of API services, bulk SMS cost, payment gateway charges, et al. These cost elements surged nearly 2.6X from Rs 1.46 crore in FY21. In total, the annual expenses of the startup jumped 2.8X to Rs 56.7 crore in FY22 from Rs 20 crore during FY21.

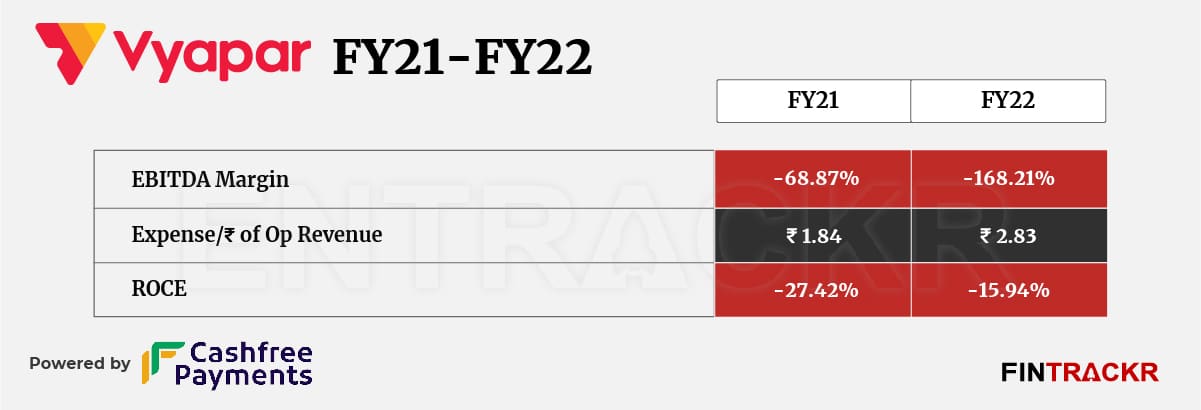

In line with annual expenses, losses of Vyapar also shot up 4.3X to Rs 26.61 crore in FY22 from Rs 6.18 crore during FY21. On a unit level, the company spent Rs 2.83 to earn a rupee of operating revenue during FY22.

The 2.8X jump in annual expenditure led to the company’s EBITDA margin worsening to -168.21% during FY22 from -68.87% in FY21.

In the last quarter of FY22, Vyapar had scooped $30 million in its Series B round led by WestBridge Capital. The proceeds will help Vyapar to ramp up its game against its major competitor Khatabook which raised $100 million in August last year. Significantly, OKCredit is no longer a significant player in the bookkeeping space and is currently looking for buyers with a steep discount in its valuation.

For Indiamart, which is an early investor from Vyapar’s Series A round in 2019, the returns, besides the valuation jump, are probably already coming in, assuming that Vyapar spends on the platform besides offering its services to Indiamart’s own user base of SMEs, easily the largest such platform in the country now.