The ongoing financial year has been tough for edtech companies and Unacademy is no exception. The SoftBank-backed company had shed employees, cut costs, moved away from the K-12 business, and marked its entry into offline learning in FY23. While the impact of these exercises and initiatives will be gauged when the current fiscal year ends, Unacademy has managed to cross the Rs 700 crore mark in FY22.

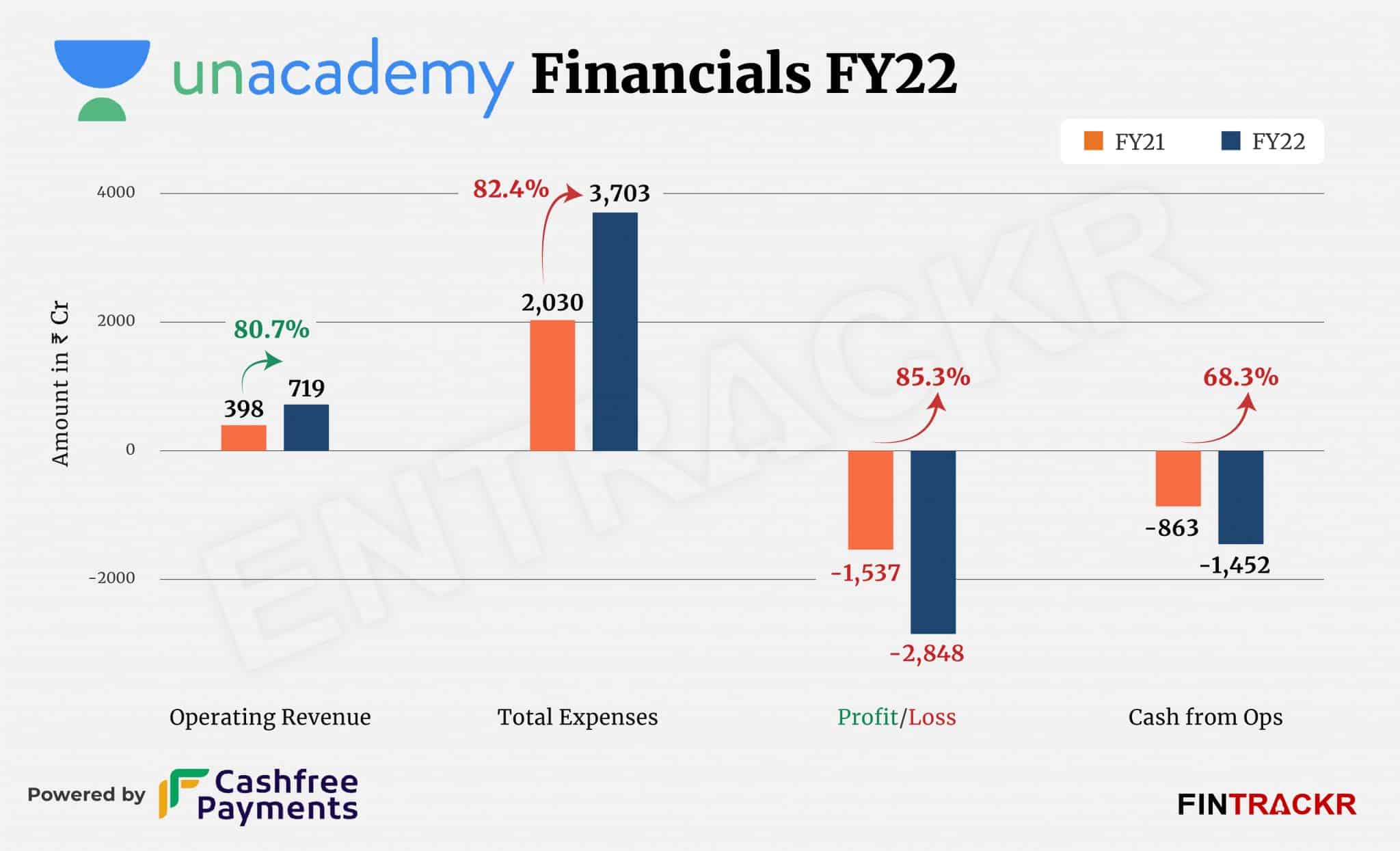

Unacademy’s operating revenue surged by 80.7% to Rs 719 crore during the financial year ending March 2022 from Rs 398 crore recorded in FY21, as per the company’s annual financial statements with the Registrar of Companies (RoC).

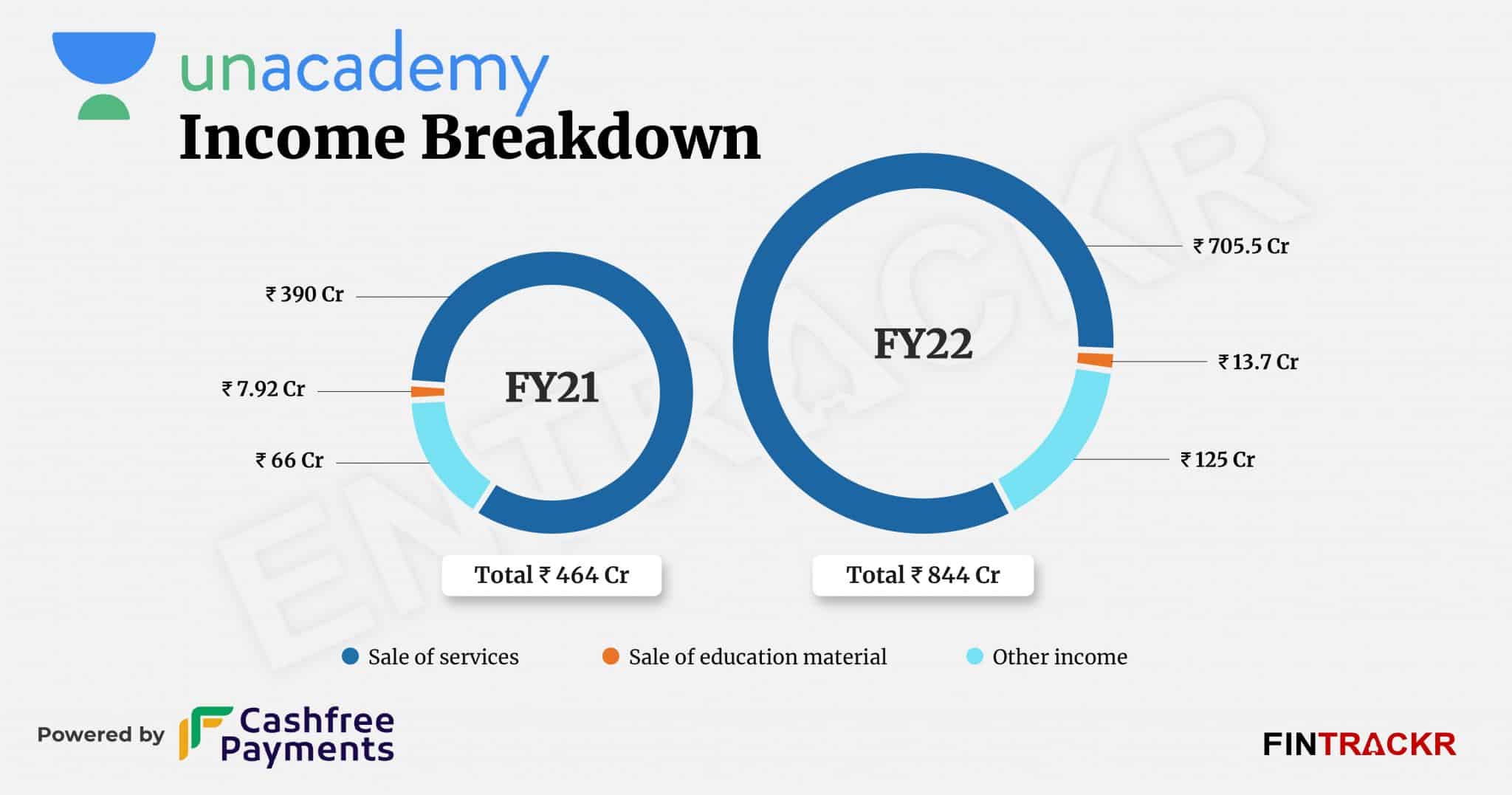

The Bengaluru-based company mainly generates revenue from course subscription fees it collects from students. Collection from this vertical grew 81% to Rs 705.5 crore in FY22 from Rs 390 crore in the previous fiscal year. It made another Rs 13.7 crore from the sale of educational materials during FY22.

Unacademy generated total revenue of Rs 844 crore during FY22 including a non-operating income of Rs 125 crore mainly from interest on fixed deposits, gain on mutual funds, and other financial investments.

For the uninitiated, Unacademy offers courses for competitive exams including NEET UG, IIT JEE, GATE, and UPSC CSE, claiming to have over 1,000 educators on its digital learning platform. Previously, the platform also ran online classes for K-12 but it reportedly shut down the vertical in March this year to focus on test preparation.

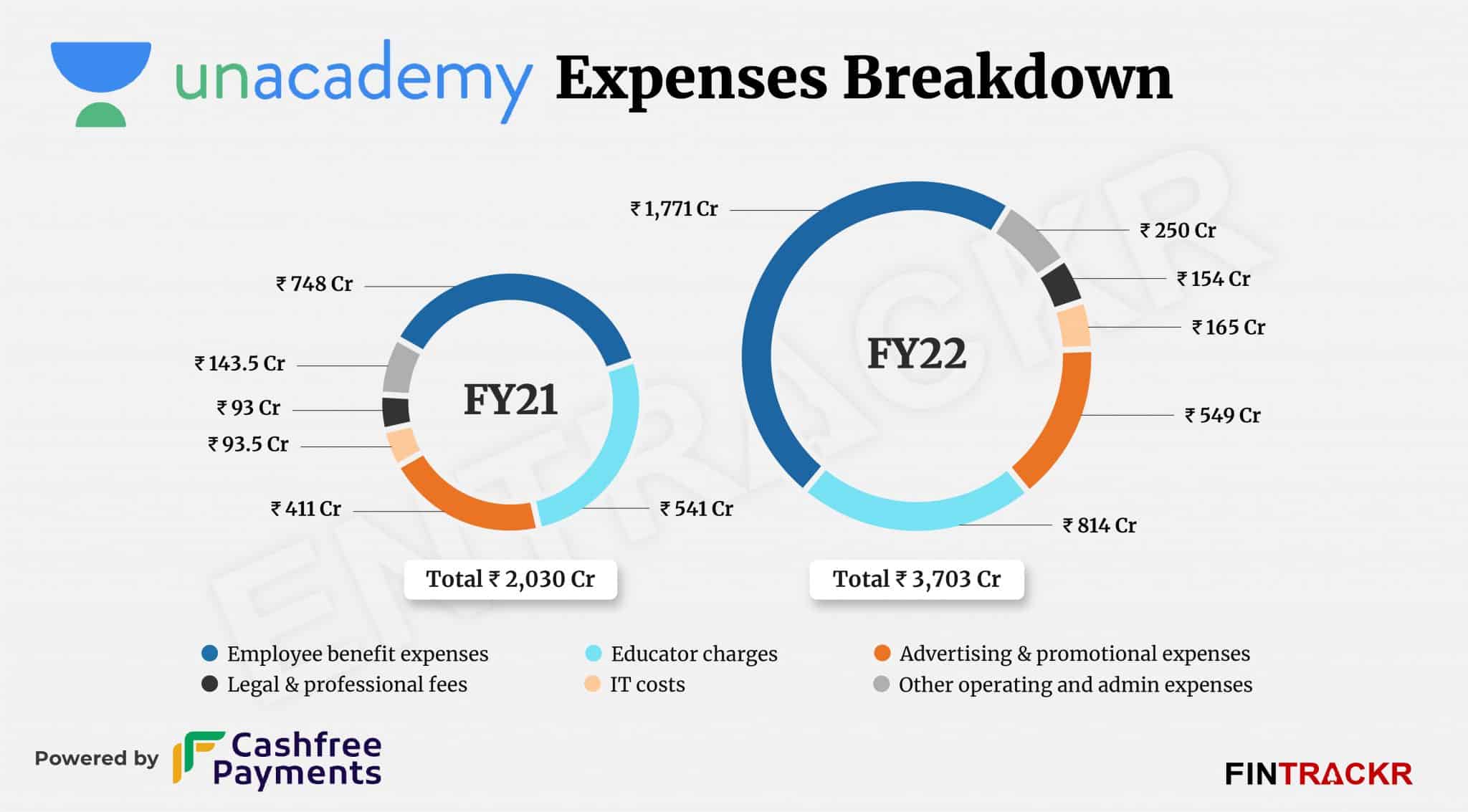

When it comes to expenses, employee benefit expenses emerged as the largest cost center contributing nearly 48% of the total expenditure. This cost surged 136.8% to Rs 1,771 crore in FY22 including Rs 1,140 crore of ESOP expenses which were settled in cash and equity. ESOPs expenses formed around 31% of its total expenses.

In September last year, Unacademy announced an ESOP buyback worth $10.5 million, and its ESOP pool is currently valued at around $400 million.

Payments to educators turned out to be the second largest cost center and accounted for 22% of the total expenses in FY22. This cost increased 50.5% to Rs 814 crore in FY22 while advertising and promotional expenses went up 33.6% to Rs 549 crore during the same period. For context, the company claims to have a lifetime educator base of 91,000.

Unacademy also spent Rs 319 crore collectively on IT (including payment gateway charges) and legal as well as professional fees.

With a surge in employee benefits and marketing expenses, Unacademy’s total costs went up by 82.4% to Rs 3,703 crore in FY22 from Rs 2,030 crore in FY21. Its operating cash outflows also jumped 68.3% to Rs 1,452 crore during the year. On the lines of the company’s revenue, Unacademy’s losses spiked over 85% to Rs 2,848 crore in FY22 as compared to Rs 1,537 crore in FY21.

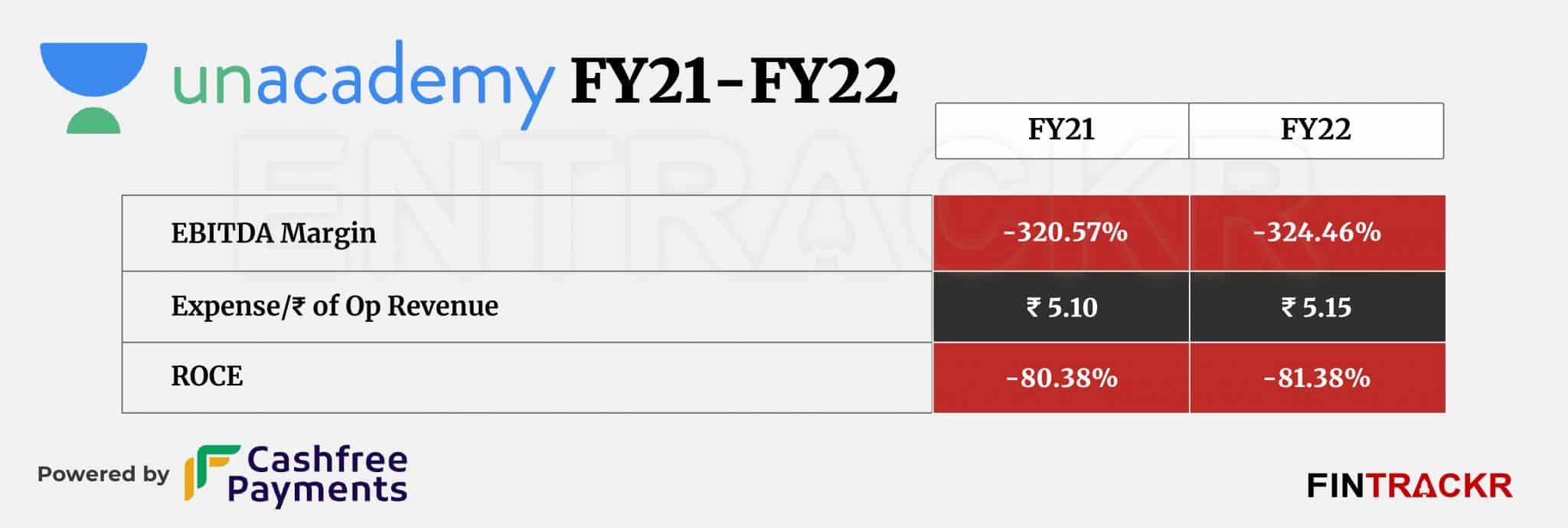

Coming to ratios, Unacademy’s EBITDA margin and ROCE worsened by 389 and 100 BPS to -324.46% and -81.38% respectively in the fiscal ending March 2022. On a unit level, the edtech unicorn spent Rs 5.15 to earn a rupee of operating revenue.

In the ongoing fiscal year (FY23), the company has put in several cost cutting measures including the discontinuation of its IPL sponsorship from next year. Unacademy’s chief executive Gaurav Munjal had said that the company has Rs 2,800 crore in the bank account and is on track to go for its IPO by 2024.

Unacademy, unlike a few of the other edtech players, seems to have decided on and focused hard on the test prep market. With time, as it continues to build a track record of success stories and ‘testimonials’, it clearly has enough of a runway to seek growth for a long time to come. With a massive push across India to fill up job vacancies in the government sector, millions of aspirants will be willing to invest time and money to improve their odds of selection. It remains to be seen how the company evaluates these opportunities, as that might prove to be a decisive edge for it.

Unacademy’s rival Byju’s recently filed its FY21 results in which it registered Rs 2,280 crore in operating revenue and incurred a loss of Rs 4,564 crore. Its FY22 numbers are yet to be filed but the company had anticipated to touch the Rs 10,000 crore income mark in the last fiscal year.