Ninjacart has turned out to be a posterboy of the Indian agritech space with every likelihood of becoming the first unicorn from the agritech space. In December 2021, the company had cornered the largest funding round in the space with its valuation touching $815 million.

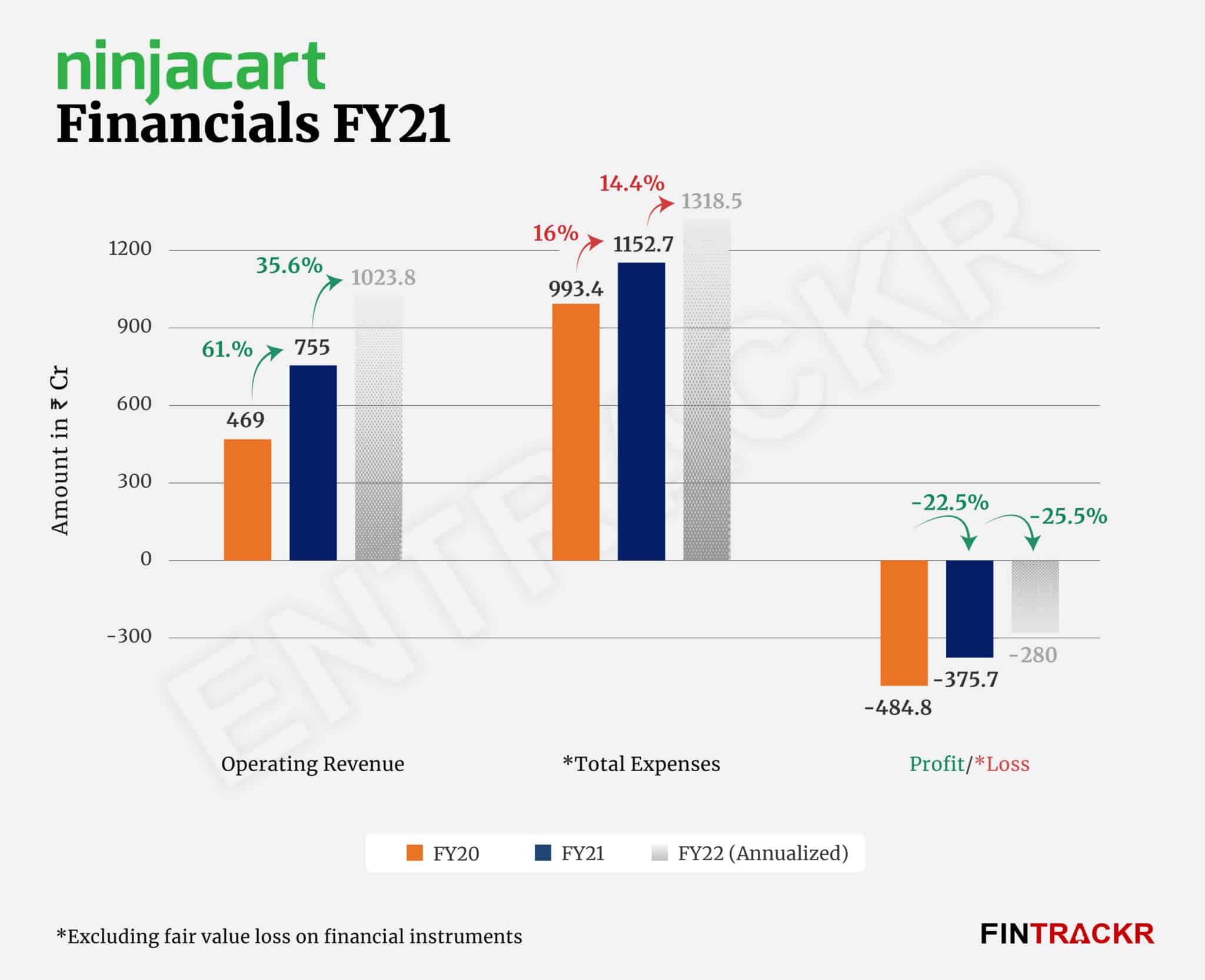

In terms of scale, it’s probably the biggest company with its operating revenue slated to cross Rs 1,000 crore in the fiscal year ending March 2022. As per documents filed with the Registrar of Companies (RoC), Ninjacart’s revenue from operations is projected to be around Rs 1,023.8 crore (on the basis of nine month annualised revenue run rate: Apr-Dec 2021).

While the company hasn’t given any other financial revenue except projected revenue for FY22, it has filed its annual financial statement for the fiscal year ending March 2021 with the regulator.

The Bengaluru-based startup had managed to grow its revenue from operations by 61% to Rs 755 crore in FY21 from Rs 469 crore earned in FY20. The seven-year-old company provides agricultural supply chain solutions, connecting farmers to restaurants, hotels and retailers across seven cities. It claims to move over 1,400 tons of fresh produce every day within its network of over 200 collection centres and 1,200 warehouses in India.

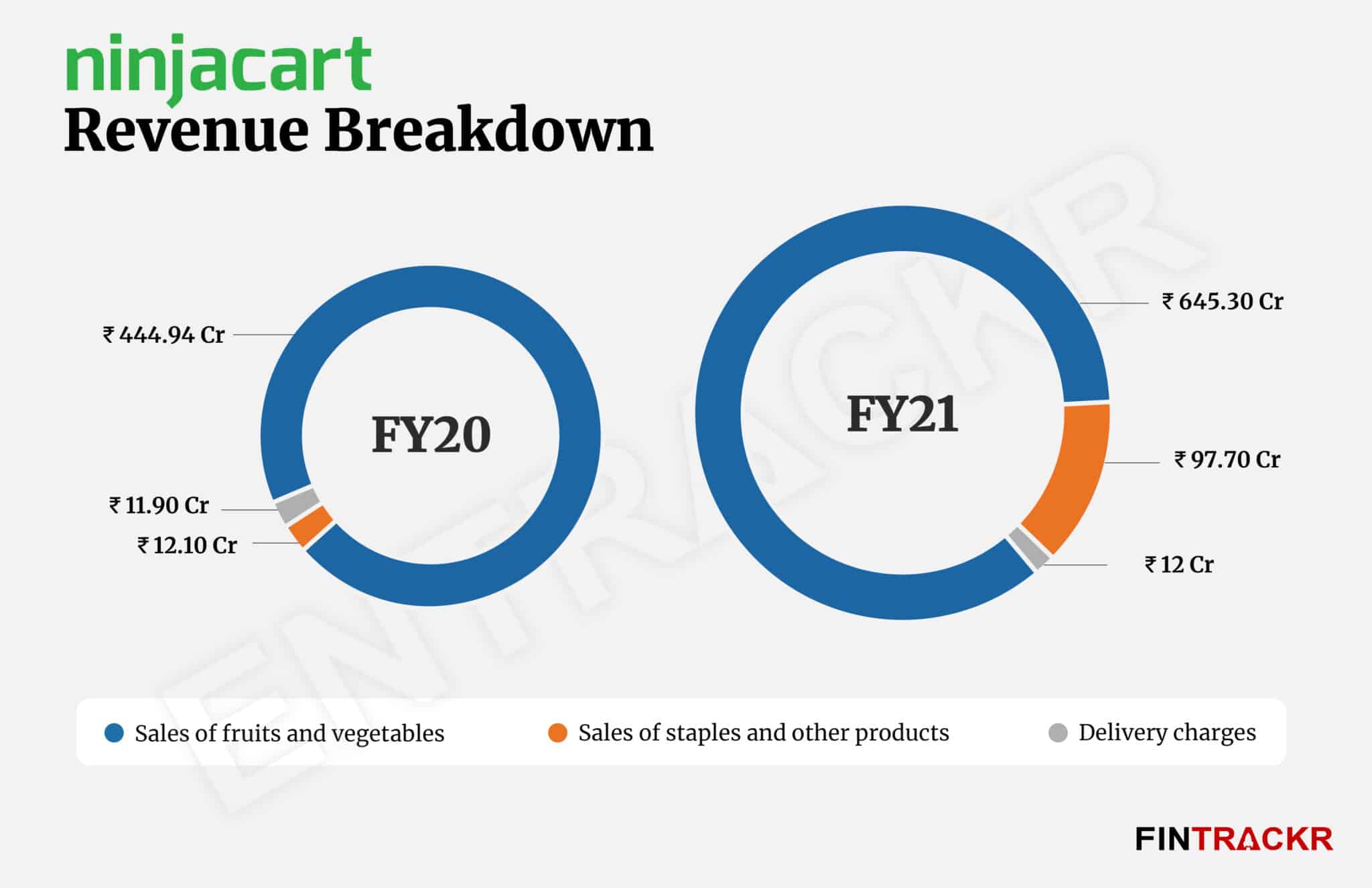

Ninjacart has generated 85.5% of its revenue from the sale of fruits & vegetables to retailers, and restaurant operators and the supply of grains and other food staples accounted for around 13%. Collections from the sale of fruits and veggies grew by 45% YoY to Rs 645.3 crore while sale of staples shot up 707.4% YoY to Rs 97.7 crore during FY21.

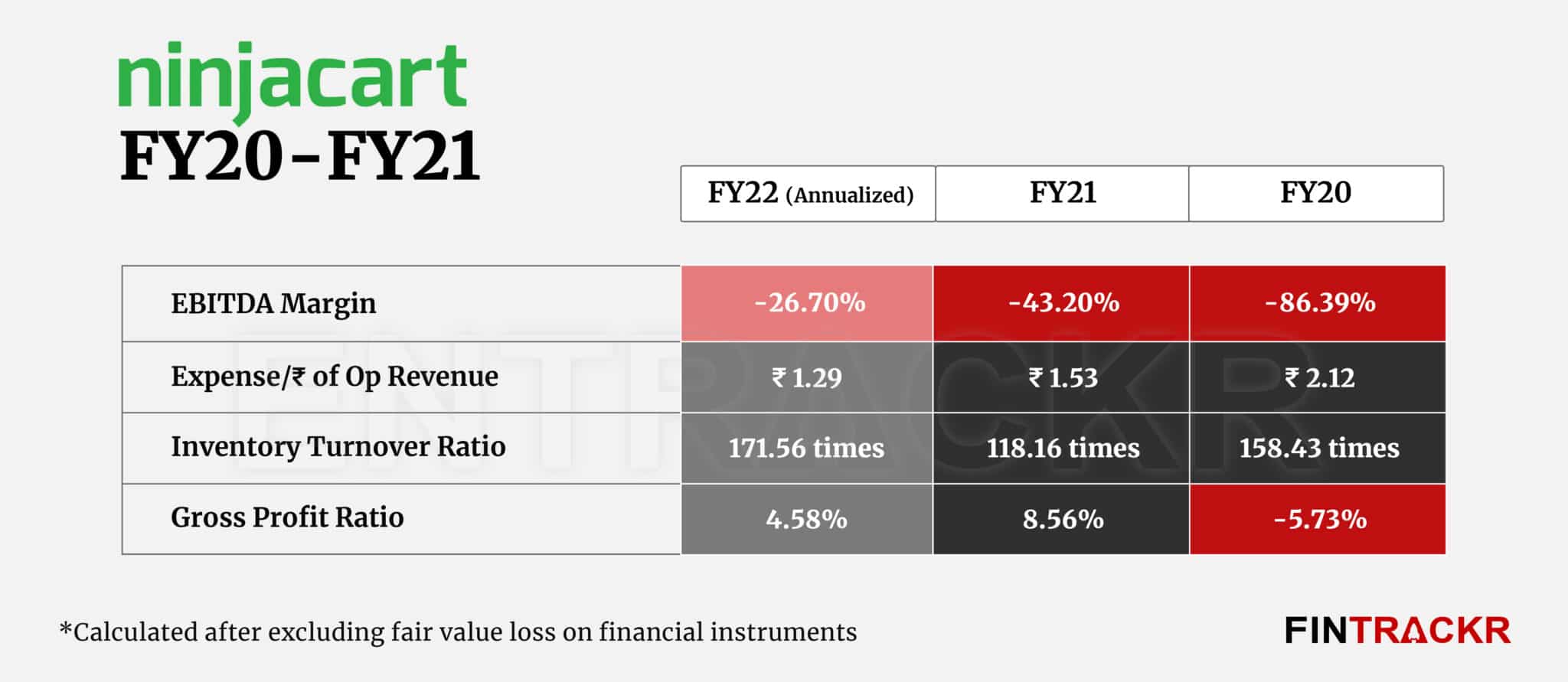

Importantly, the company has managed to turn around its gross profit ratio from a negative 5.73% in FY20 to 8.56% during FY21 along with growth in sales.

Earnings from delivery contribute only 1.6% to Ninjacart’s revenue and remained stable at around Rs 12 crore during the fiscal ended in March 2021. It also earned another Rs 21.8 crore from its financial assets during the same period.

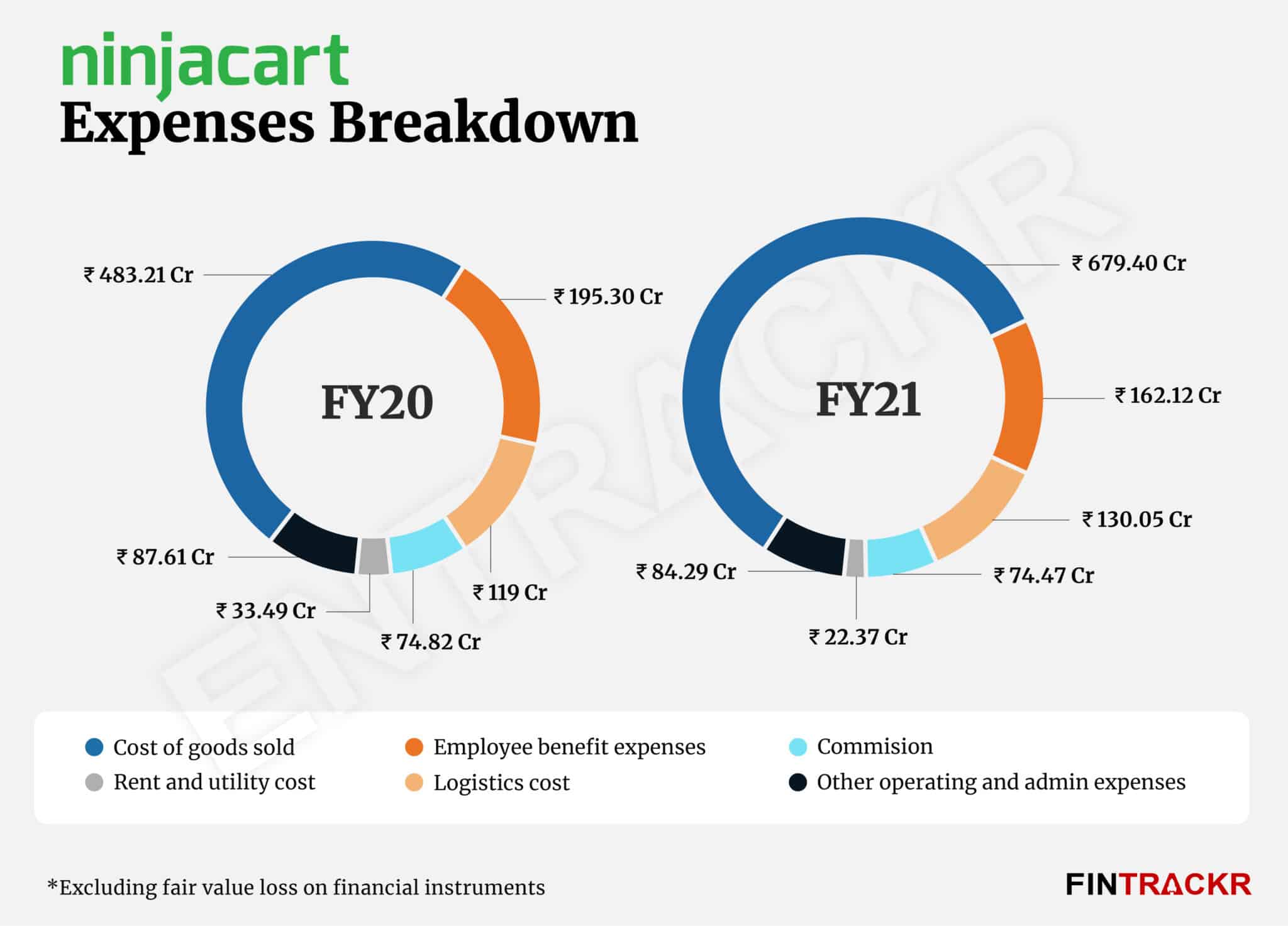

Moving over to the expense sheet, the cost of goods sold is Ninjacart’s single largest expenditure, accounting for 59% of its annual costs. This expense surged in line with demand, growing by 40.6% to Rs 679.4 crore in FY21 from Rs 483.2 crore in FY20.

Expenditure on logistics accounts for 11.3% of the annual costs and grew by 9.3% YoY to Rs 130.05 crore during FY21. Commission paid to procurement agents also remained stable at Rs 74.5 crore during the fiscal ended in March 2021.

During the fourth quarter of FY21, Ninjacrt had laid off around 200 people on account of performance issues and austerity measures. Due to this, the company managed to bring down its employee benefit cost down by 17% to Rs 162.1 crore in FY21 from Rs 195.3 crore in FY20.

Warehouse rent and related utility costs of Rs 22.4 crore pushed its annual expenditure to Rs 1,152.7 crore during FY21, 16% more as compared to Rs 993.4 crore spent in total during FY20.

On a unit level, Ninjacart spent RS 1.53 to earn a single rupee in FY21, a significant improvement from Rs 2.12 spent to earn the same during FY20.

Apart from the aforementioned boost in gross profit ratio, the company has managed to improve its EBITDA margin from -86.4% in FY20 to -43.2% during FY21. The improved margins along with growth in sales are visible in Ninjacart’s annual results as annual losses have shrunk by 22.5% to Rs 375.7 crore during FY21 from Rs 484.8 crore lost in FY20.

In the agritech space, Ninjacart has emerged as the leader in terms of revenue followed by Waycool and DeHaat. LightBox-backed Waycool posted Rs 382 crore revenue in FY21 whereas Temasek and Prosus-backed DeHaat registered Rs 358 crore in revenue in the fiscal year.

Rising food inflation offers the firm an easy bump up in topline this year. However, it will continue to have to eke out every percentage point improvement in margins, in the volatile and tough B2B food distribution business. While the scale of the opportunity has never been in doubt in India, multiple challenges that have deterred many in the past, be it cold chains, connectivity or even access to produce have all been improving consistently, the reason why its investors have such high hopes from Ninjacart.