Food supply chain platforms have been attracting large funding rounds at sizable valuations. Market leader Udaan raised new money at a $3 billion valuation whereas Ninjacart was valued at $850 million in its last round.

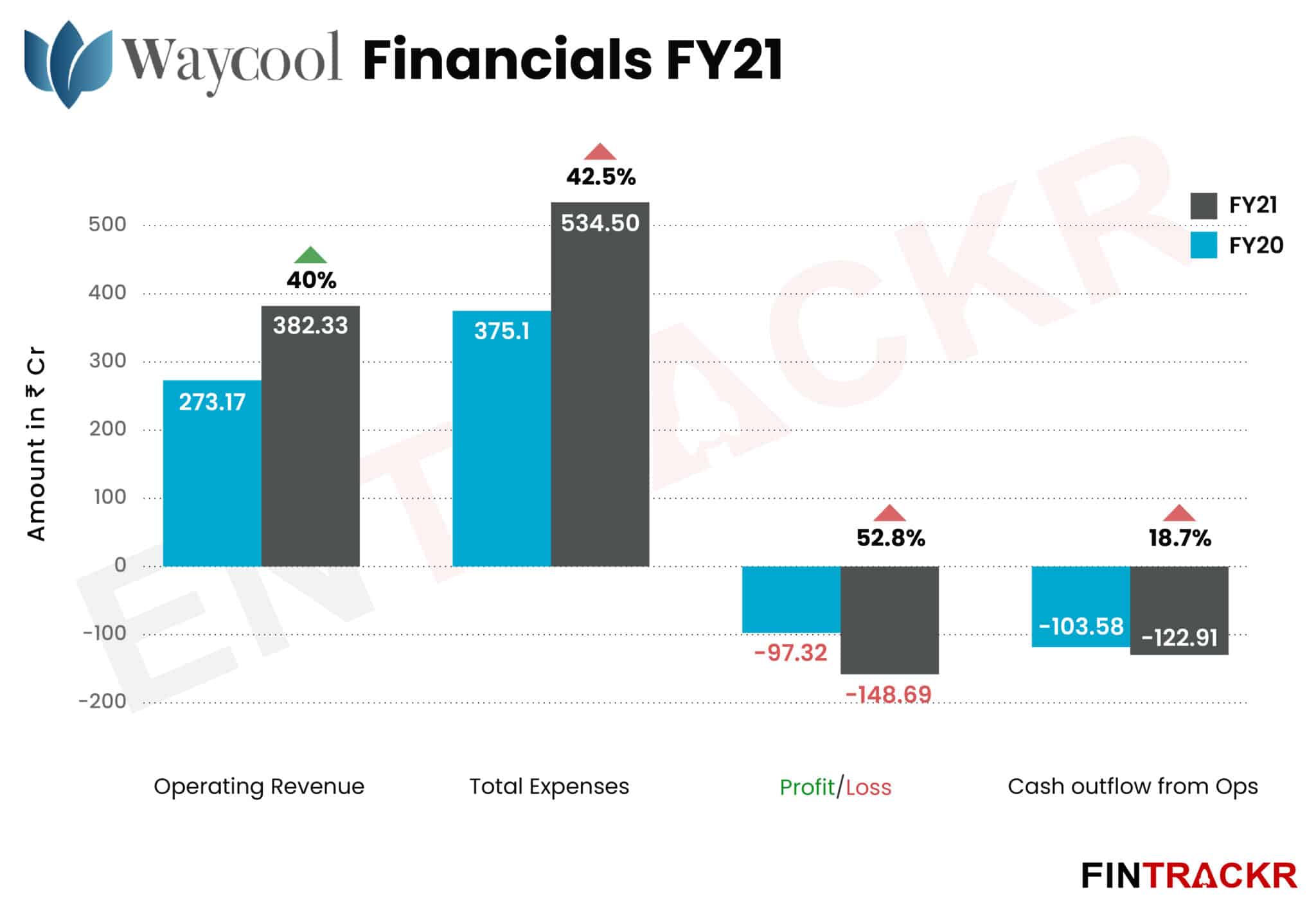

Chennai-based Waycool has also closed a $117 million debt and equity round with its valuation touching $460 million. While Udaan’s valuation had come on the back of its stupendous 6X jump in scale, Waycool’s operating revenue grew 40% in FY21 to Rs 382.33 crore from Rs 273 crore in FY20.

Walmart-backed Ninjacart operating revenue also increased by 61% during the fiscal year ending March 2021 to Rs 755.05 crore from Rs 469 crore in FY20.

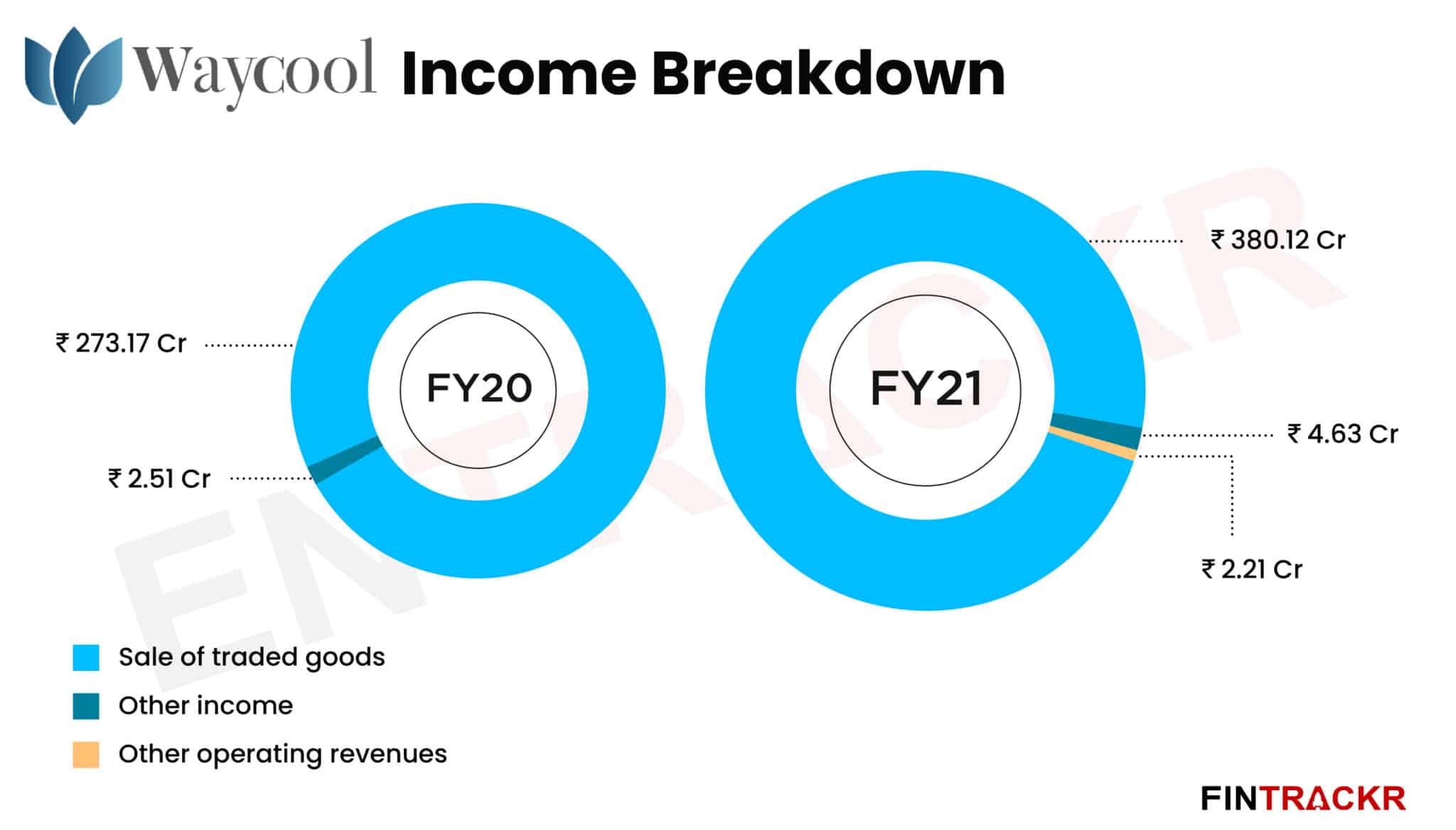

Almost 98% of Waycool’s income came through sales of traded goods which stood at Rs 380.12 crore.

Keeping in line with its income, the total expenses of the Lightrock-backed company also increased 42.5% to Rs 534.5 crore in FY21 from Rs 375.1 crore in the previous fiscal.

Keeping in line with its income, the total expenses of the Lightrock-backed company also increased 42.5% to Rs 534.5 crore in FY21 from Rs 375.1 crore in the previous fiscal.

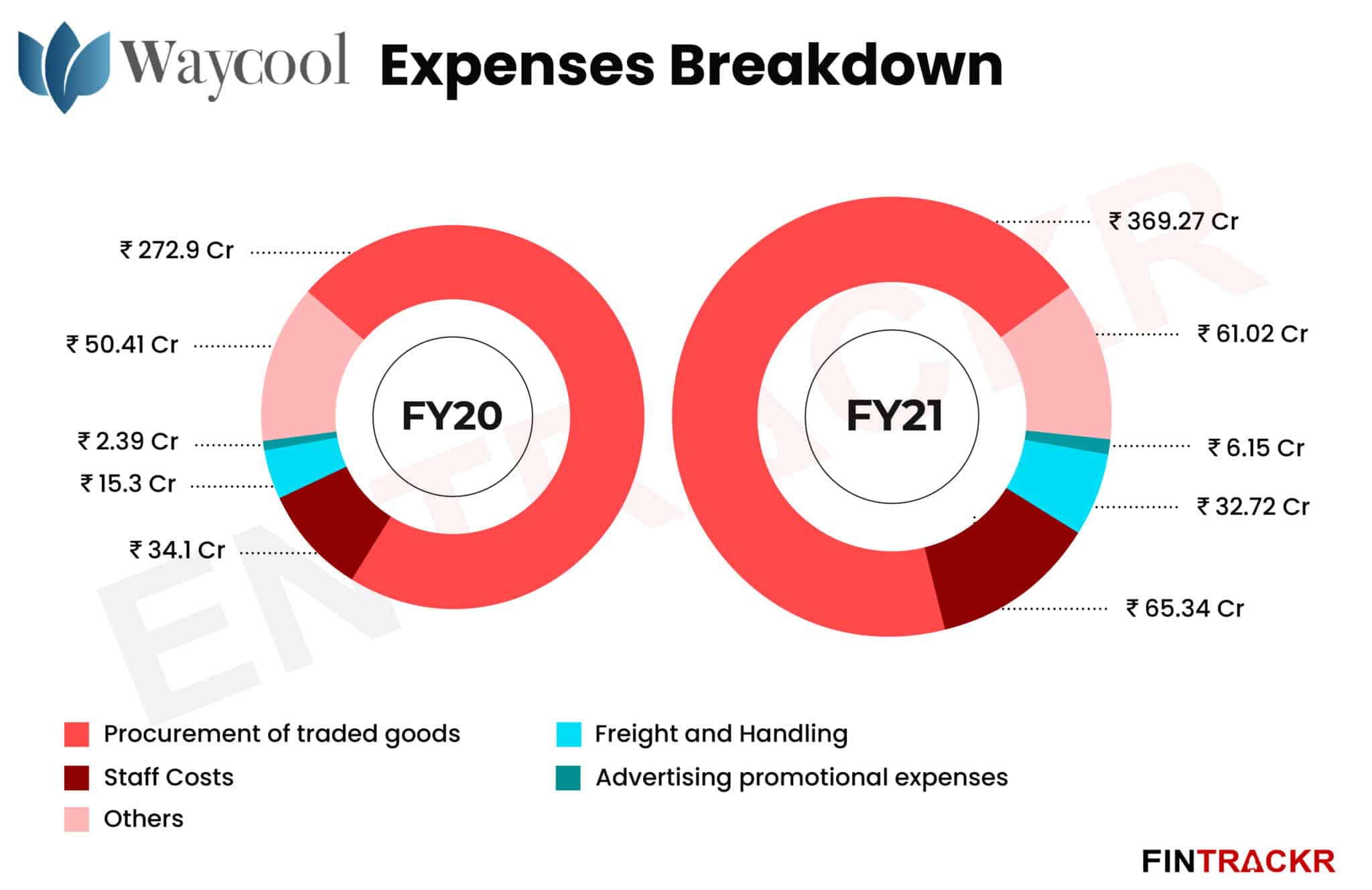

The procurement of traded goods is the major expenditure for Waycool which constitutes 69% of the total expenses. This cost shot up 35.3% to Rs 369.27 crore in FY21 from Rs 272.9 crore in FY20. The expenditure on procurement also outlines the fact that Waycool is largely an inventory-led play.

Staff cost turned out to be the second largest expenditure which formed 12.2% of the overall expenses. This cost increased 91.6% to Rs 65.34 crore in FY21 from Rs 34.1 crore in the preceding financial year (FY20).

Freight and handling charges also increased 2.13X to Rs 32.72 crore in FY21 from Rs 15.3 crore in FY20. Waycool’s advertisement and promotional expenses took a jump of 2.57X to Rs 6.15 crore in the last fiscal year from Rs 2.39 crore in FY20.

The company’s losses have outpaced its income and expense figures as they recorded maximum increase ~ 52.8% in FY21 to ~ Rs 148.69 crore as compared to Rs 97.32 crore in the preceding financial year.

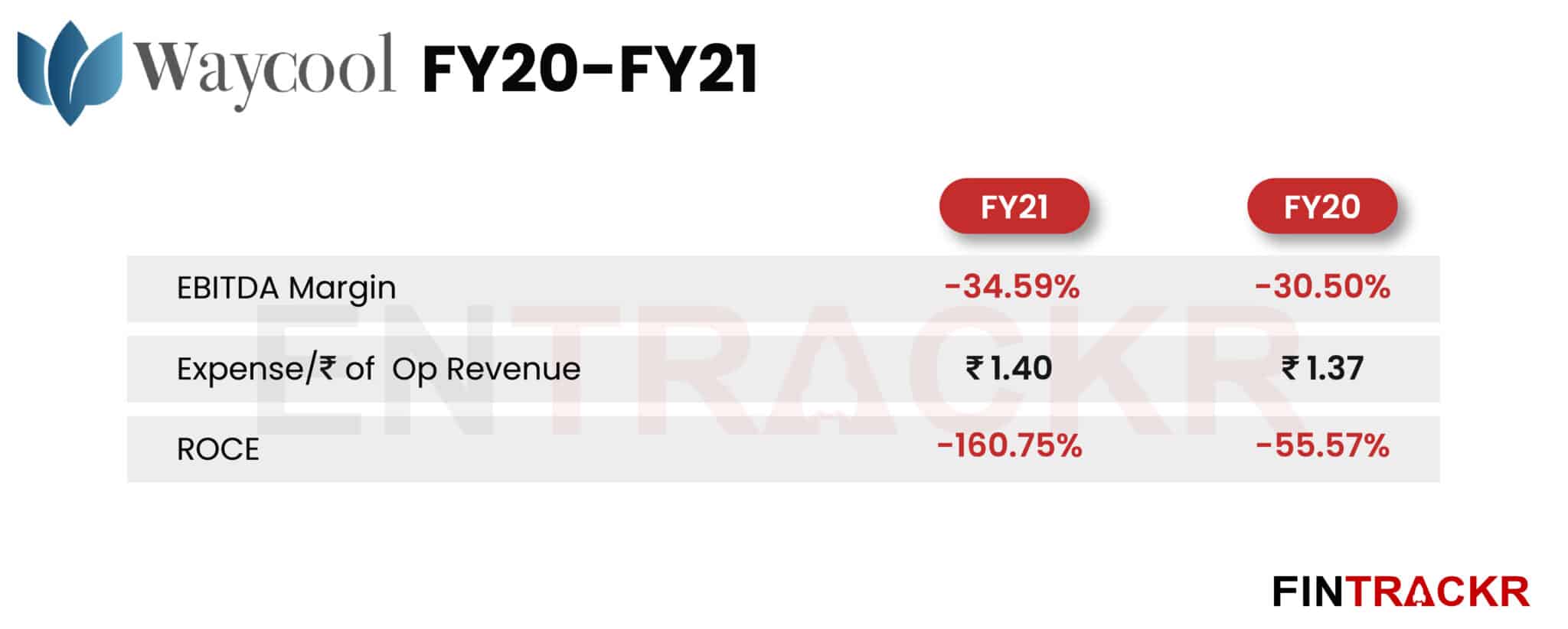

Due to a surge in losses, Waycool’s cash outflow saw an increase of 18.7% to Rs 122.91 crore in the last fiscal year from Rs 103.58 crore in FY20. On a unit level, the company has spent Rs 1.40 to earn a single rupee of operating revenue.

Waycool’s financial performance in FY21 hasn’t been impressive as the company’s scale didn’t grow at a fast pace. Meanwhile, its peer Udaan’s growth surged 6X as demand for online food and FMCG procurements grew multi-fold in FY21.

Waycool’s financial performance in FY21 hasn’t been impressive as the company’s scale didn’t grow at a fast pace. Meanwhile, its peer Udaan’s growth surged 6X as demand for online food and FMCG procurements grew multi-fold in FY21.

Unlike Ninjacart and Waycool, Udaan had managed to control losses in FY21 for the first time since its inception. Waycool’s losses surged over 52% during the same period whereas Ninjacart has seen a 90.5% jump in its losses in FY21. With the recent funding and expansion plan, the Karthik Jayaraman-led firm may grow at a rapid pace in the ongoing fiscal (FY22).