The scale of men’s grooming brands such as Beardo and Ustraa didn’t grow during FY21 with The Man Company managing to grow its revenue marginally in the fiscal year ending March 2021. On the other hand, Bombay Shaving Company’s scale surged 2X in the fiscal marred by the pandemic.

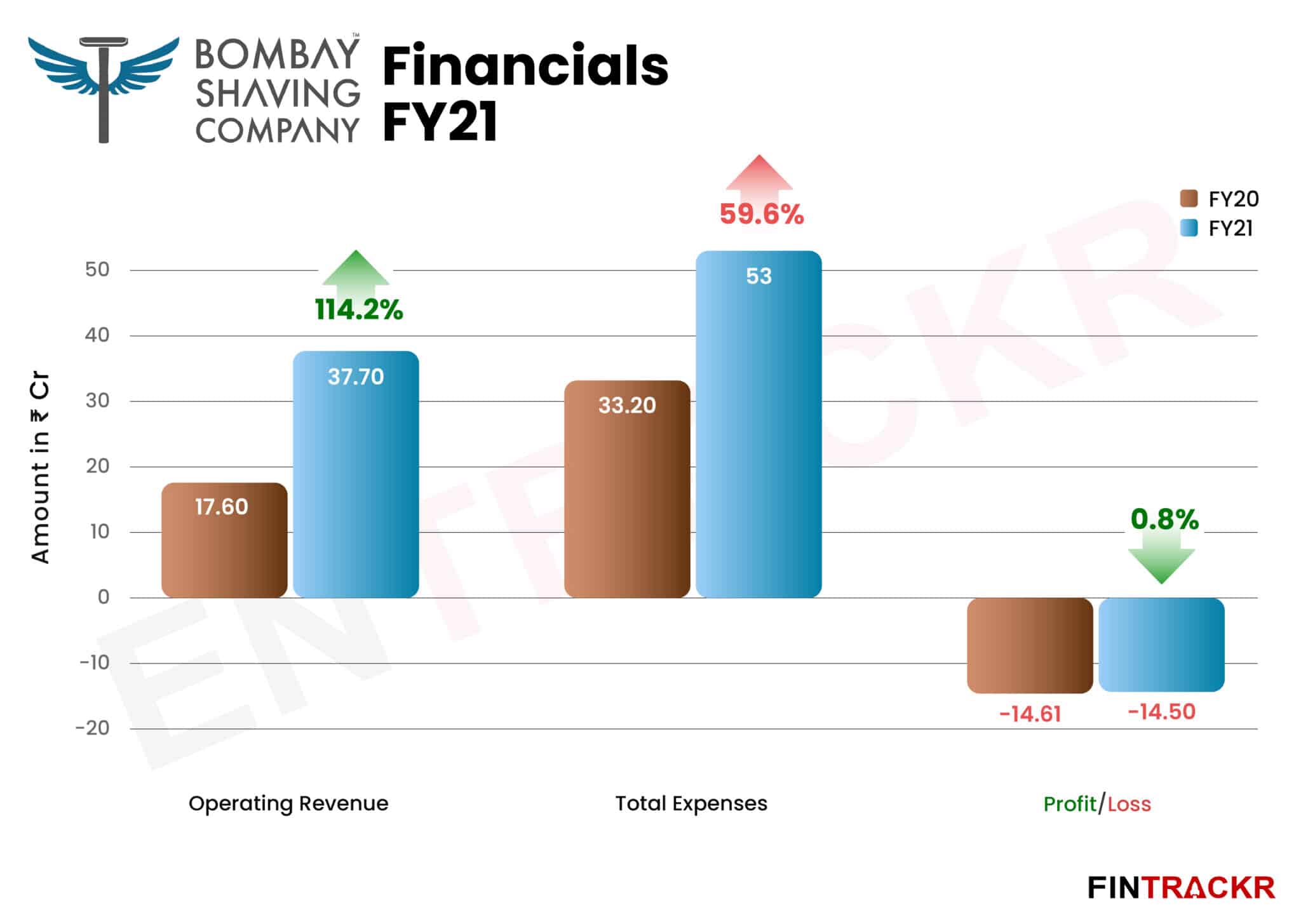

Bombay Shaving Company (BSC) has generated Rs 37.7 crore of operating revenue during FY21, increasing 114.2% from Rs 17.6 crore in FY20, its regulatory filings with the Registrar of Companies (RoC) show.

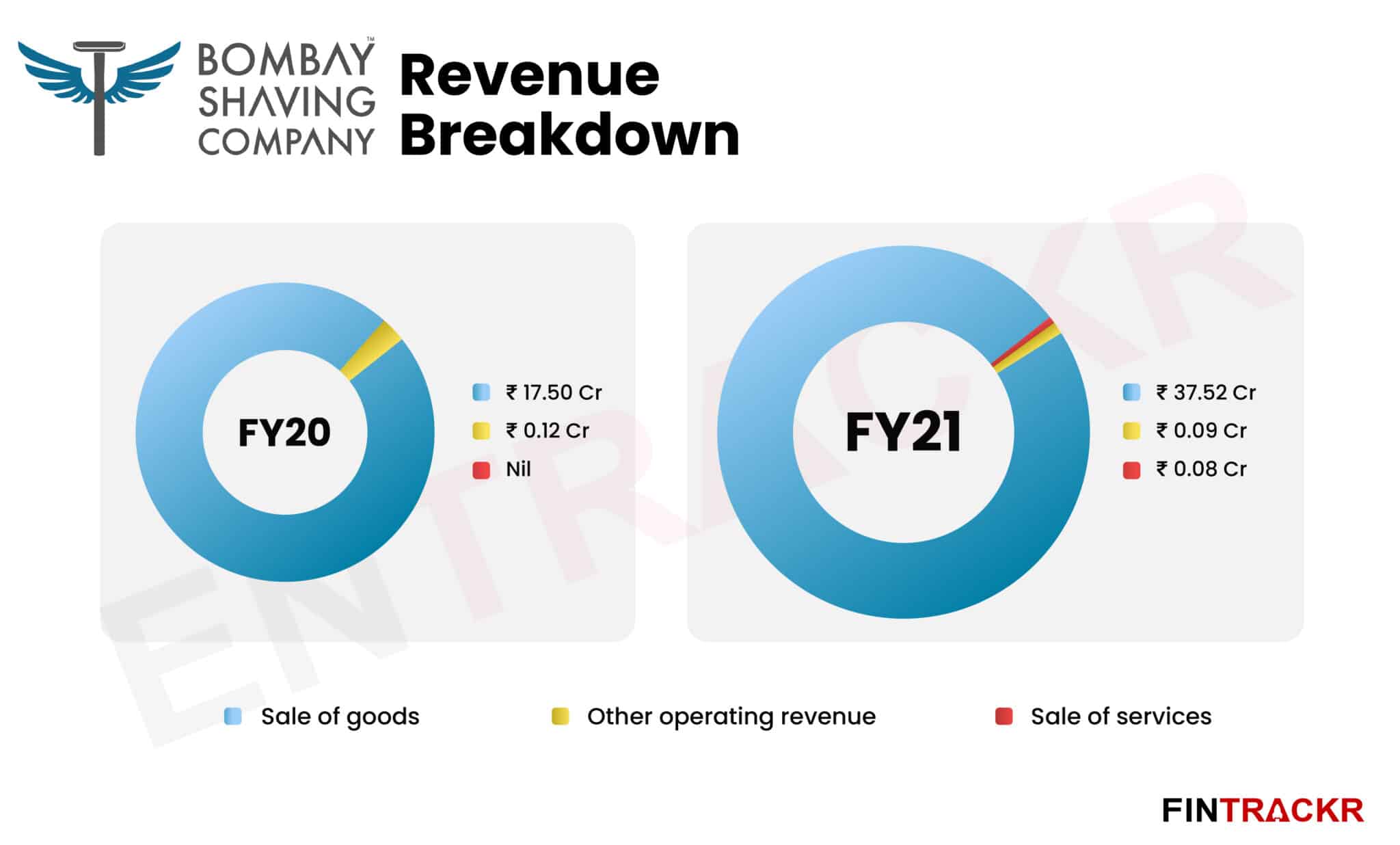

The men’s grooming brand booked around 99% of its revenue from the sale of products that include trimmers, skincare, beard care products, et al. This revenue jumped over 2X to Rs 37.52 crore in FY21 from Rs 17.5 crore in the preceding fiscal year (FY20).

During FY21, the company generated Rs 8 lakh from the sale of services (salon on wheels services) which was nil during the last fiscal year and Rs 9 lakh as other operating revenue. Bombay Shaving Company also reported Rs 76 lakh as non-operating revenue that includes profit on mutual funds, interest income, and forex gains.

Bombay Shaving Company is a premium personal care and grooming solutions brand with a portfolio of shaving cream, haircare, skincare, and beard care products.

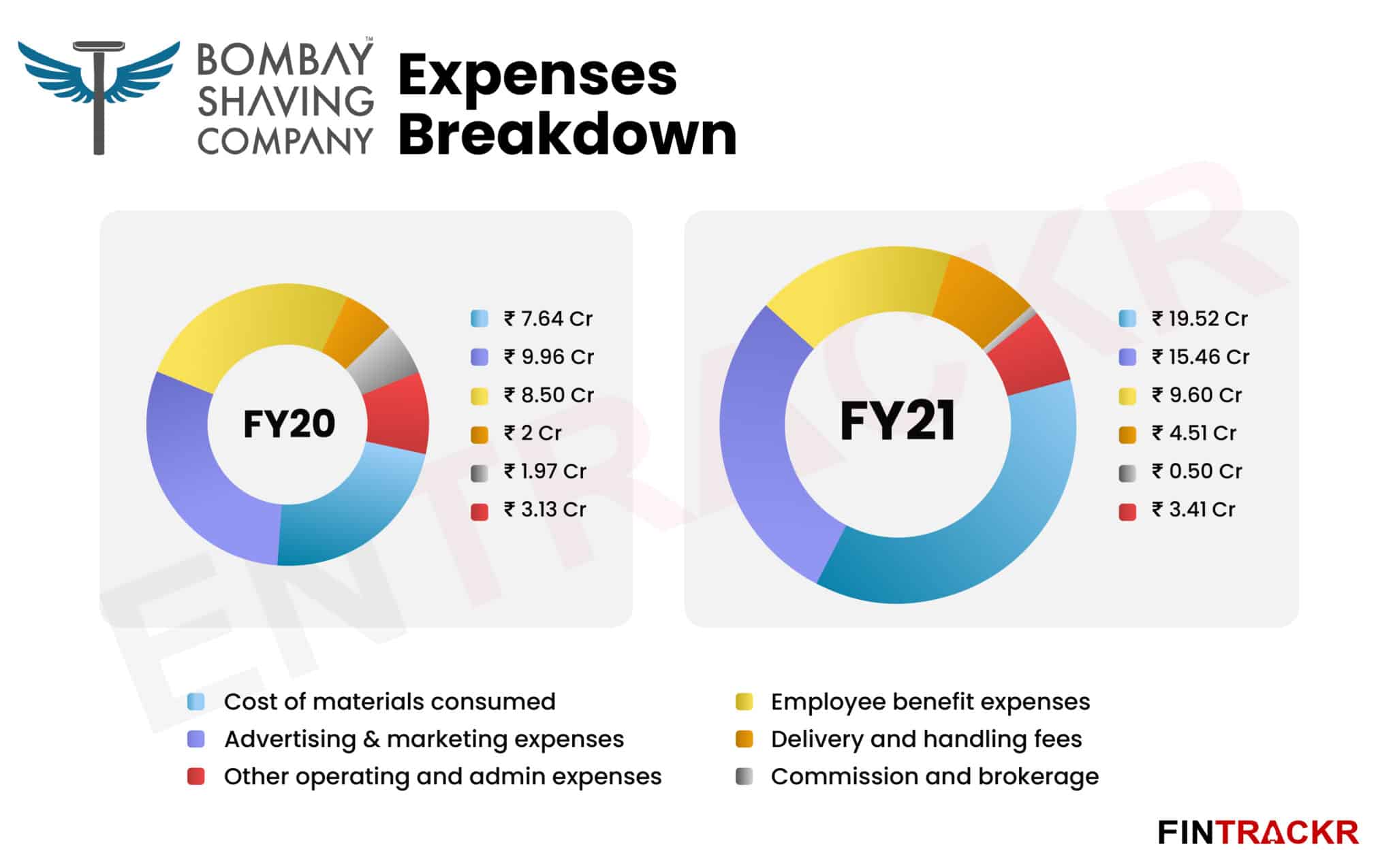

On the expense front, the cost of materials consumed contributed 36.8% of the total expenditure during FY21. Emerging as the largest cost centre, this cost surged 2.5X to Rs 19.52 crore in FY21 from Rs 7.64 crore in FY20.

Bombay Shaving Company runs a YouTube channel having over 70K subscribers to grab the attention of social media and to expand the customer base. That was presumably a very small part of its expenses of Rs 15.46 crore during FY21 on advertising and marketing, making it the second-largest cost for the year. This cost contributed 29.2% of total expenses and increased 55.2% from Rs 9.96 crore in the preceding fiscal year (FY20).

Also read: How Beardo, The Man Company and Ustraa performed in FY21

Delivery, handling fees and employee benefit expenses increased nearly 125% and 13% to Rs 4.51 crore and Rs 9.6 crore in FY21 from Rs 2 crore and Rs 8.5 crore respectively during FY20. Bombay Shaving Company also booked product display and listing fees of Rs 97 lakh. In total, the company reported expenses of Rs 53 crore, increasing nearly 60% from Rs 33.2 crore in FY20.

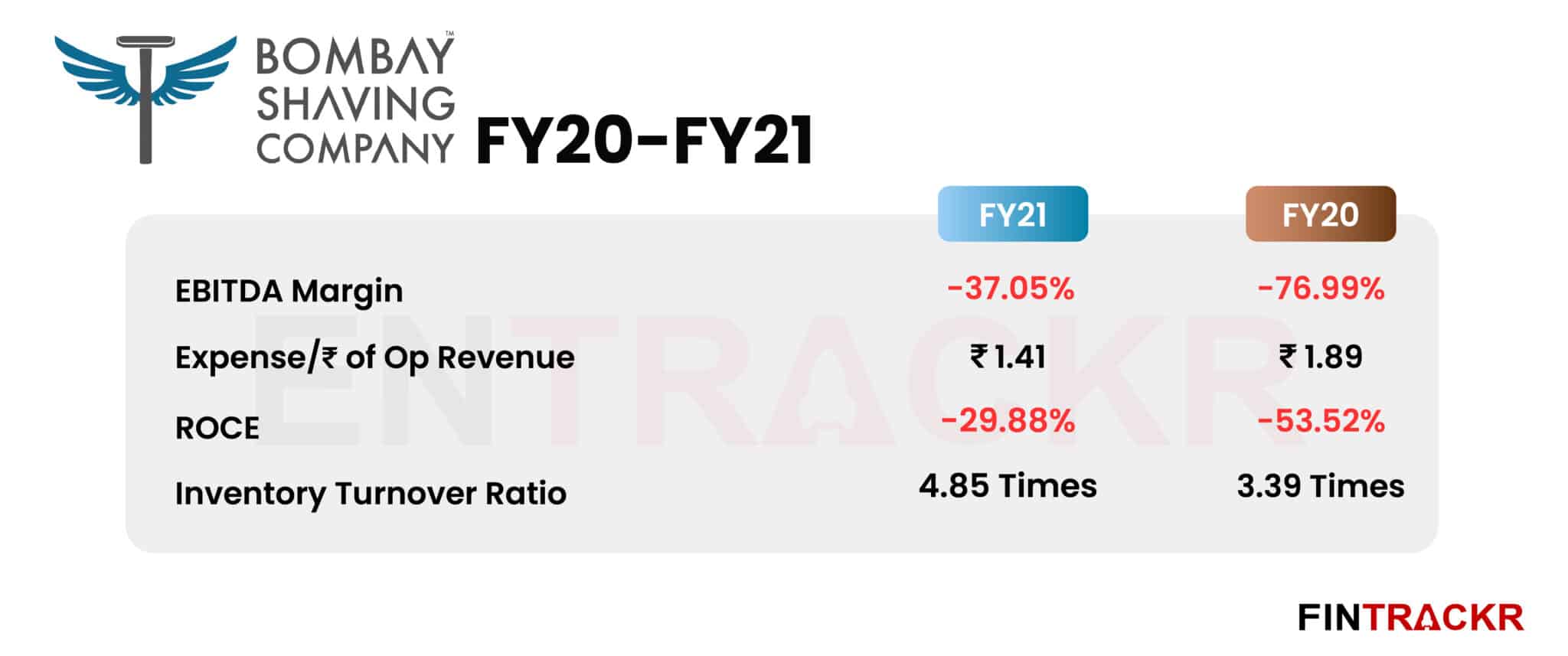

With over 2X growth in scale, the Delhi-based company managed to control its losses to Rs 14.5 crore in FY21 as compared to Rs 14.61 crore booked in FY20. On a unit level, Bombay Shaving Company spent Rs 1.41 to earn a single rupee of operating revenue.

While total expenditure of the company surged by nearly 60%, its EBITDA margin improved to -37.05% during financial year 2021 from -76.99% in the preceding fiscal (FY20). As revenue grew, inventory turnover also improved to 4.85 times, which implies the strong sales of the company during the financial year 2021.

Standing independently with some serious momentum could position the firm very well for a potential acquisition, even though the firm has done a recent fundraise to keep the growth going.