Direct to consumer (D2C) brands have been dominating the Indian e-commerce narrative in the past 18-24 months. The emergence of formidable brands in the beauty and wellness space such as MamaEarth and Sugar Cosmetics are testimony to the D2C growth story.

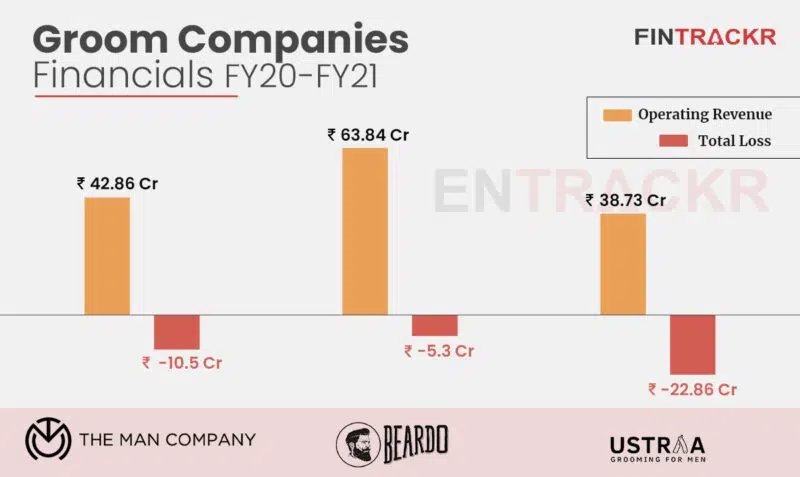

While the two women-focused beauty brands crossed the Rs 100 crore revenue mark in FY20, none of the male-centric grooming brands even came close to the three-digit revenue mark even in FY21. Fintrackr sifted through the filings of Beardo, The Man Company (TMC) and Ustraa to decode the true financial health of the D2C startups in the men’s grooming space.

Beardo emerges as a leader with Rs 64 Cr revenue

Beardo stands out as the revenue leader amongst the three brands during the fiscal year ending in March 2021. Even though it stood out ahead of the pack, the company which was acquired by consumer goods giant Marico last year didn’t have smart Covid recovery, with revenue from operations dropping nearly 19.8% to around Rs 63.8 crore in FY21 from Rs 79.6 crore in FY20.

This was the first year of demand contraction for the four-year-old company which had managed to scale up sales nearly 10X during FY20.

Following that, Emami-backed The Man Company came second amongst the three startups in terms of sales and is the only one whose revenue did not contract during the last year. It recorded operating revenue of Rs 42.86 crore during FY21, growing by 9.25% from Rs 39.23 crore in the previous fiscal.

Third is Wipro-backed Happily Unmarried which operates the grooming brand Ustraa — the company saw its revenue contract by a whopping 52% from Rs 59.8 crore in FY20 to only Rs 28.73 crore in FY21.

These numbers indicate a clear drop in demand during the pandemic where Beardo and Ustraa saw revenue plummet while The Man Company witnessed a marginal rise in revenue.

Beardo and Ustraa shaved marketing costs while TMC’s grew

When it comes to expenses, the three companies implemented austerity measures to reduce their cash-burn during 2020 as sales were restricted due to the pandemic. The procurement of stock in trade is the largest cost centre for all of these companies, accounting for the biggest share in their respective annual costs.

However, these costs have been reduced as demand contracted and the startups used existing inventories. Ustraa’s cost of consumption of raw material went down by 45% to Rs 11.9 crore, The Man Company’s procurement of stock in trade went down by 30.6% to Rs 17.4 crore.

Unlike these two companies, Beardo’s purchase of goods declined only by 9% to Rs 31.2 crore during FY21.

Apart from procurement of goods, advertisement and sales promotion expenses were the second-biggest costs for all of these D2C brands. Even as those were the second-highest expenses, the amount spent declined when compared to the year prior. Beardo’s advertising and promotion costs went down by 18.6% to Rs 22.31 crore whereas Ustraa reduced this cost by 60% to Rs 11.71 crore.

But that wasn’t the case with The Man Company whose advertising costs went up by 28.4% to Rs 16.3 crore in FY21. It’s worth noting that it’s the only among the three companies to record growth in sales in FY21 and it looks like the contribution of marketing in driving sales played a major role.

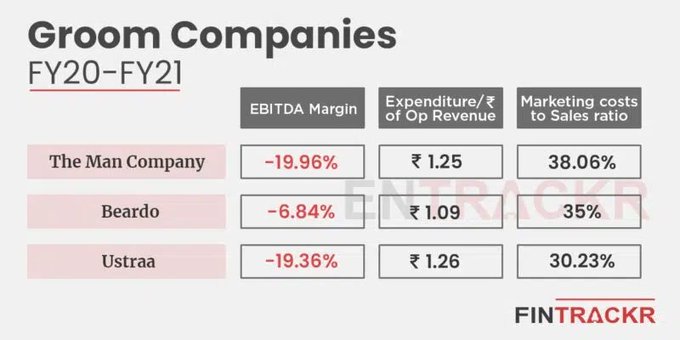

Overall, The Man Company’s marketing costs to sales ratio was the highest at 38.06%, followed by Beardo at 35% and at last Ustraa at 30.23%.

During pre-pandemic times, Beardo was one of the few profitable companies amongst the D2C brands in India, posting a profit of Rs 2.3 crore in FY20. However, this changed as it slipped into losses of Rs 5.3 crore in FY21. Backed by an increase in sales, The Man Company saw its losses contract by 29% to Rs 10.5 crore while Ustraa’s losses surged 30% to Rs 22.86 crore in FY21.

That said, Beardo has the best EBITDA margin amongst the three at -6.84% and will likely become profitable again as discretionary spending is picking up in Indian households during 2021 as the pandemic effects ease up across the country.

Will men’s grooming space cross the Rs 1,000 cr in market size in FY22?

Unlike D2C brands in the women’s beauty space, the growth of men focused grooming brands have been sluggish, as numbers of the three companies suggest. Experts believe that the men’s grooming market is growing but at a relatively slow clip as compared to the women-focused beauty and grooming space.

While the size of the market for men’s grooming space is a fraction of that of the women’s space, Beardo seems to be in a position to cross Rs 100 crore revenue mark in the ongoing fiscal (FY22). Considering that there was no significant D2C brand in the men grooming space five years ago,the emergence of a market worth Rs 600-700 crore is a huge credit to these brands.

Now with the advent of various marketplace roll-up platforms, the space is likely to cross Rs 900- 1,00 crore in FY22, according to industry experts.

Experts further estimate that with the advent of various marketplace roll-up platforms, the space is likely to cross Rs 900- 1,00 crore in FY22.