BlinkIt (previously Grofers) had pivoted from an inventory-led monthly stock-up platform to a ten-minute grocery delivery service last August. The pivot brought Zomato on board as an investor on BlinkIt’s captable but it has been burning money at a rapid clip to compete with other players like Zepto and Swiggy Instamart.

Amidst the turbulence, BlinkIt’s Singapore-based parent has filed their annual statements for the fiscal ended in March 2021, the last year of operations for the company during which it still operated with its traditional inventory-led model under the moniker of Grofers.

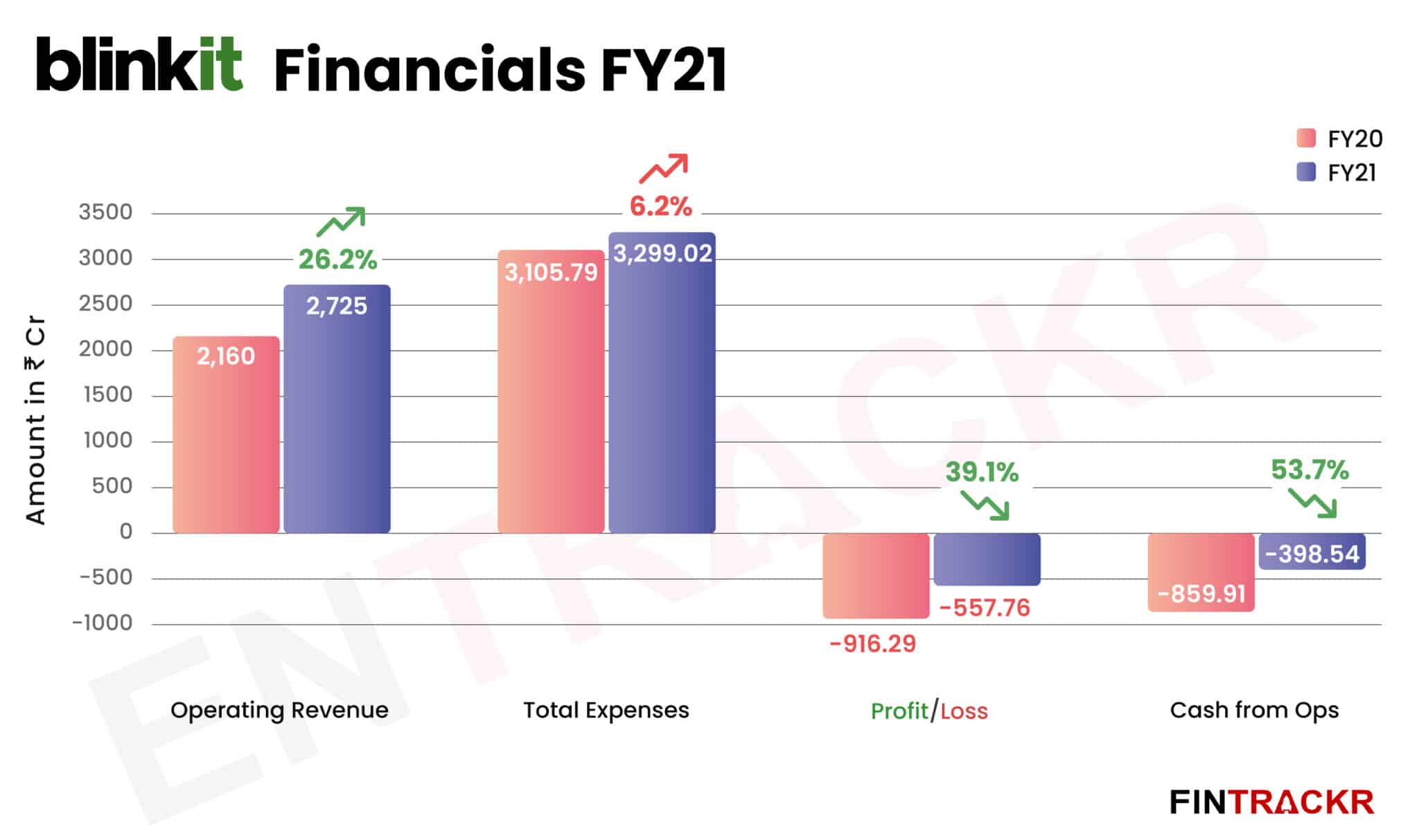

While the impact of pivot on BlinkIt’s business will be evaluated when the company files its FY22 results, it has managed to grow its scale by 26.2% during the last fiscal year (FY21). Its revenue from operations grew to Rs 2,725 crore in FY21 from Rs 2,160 crore in FY20, making it the highest-grossing fiscal for a decade-old firm.

Before August 2021, Blinkit was operating in a hybrid model, selling its self-branded grocery as well as acting as a sales channel for other prominent FMCG brands in India.

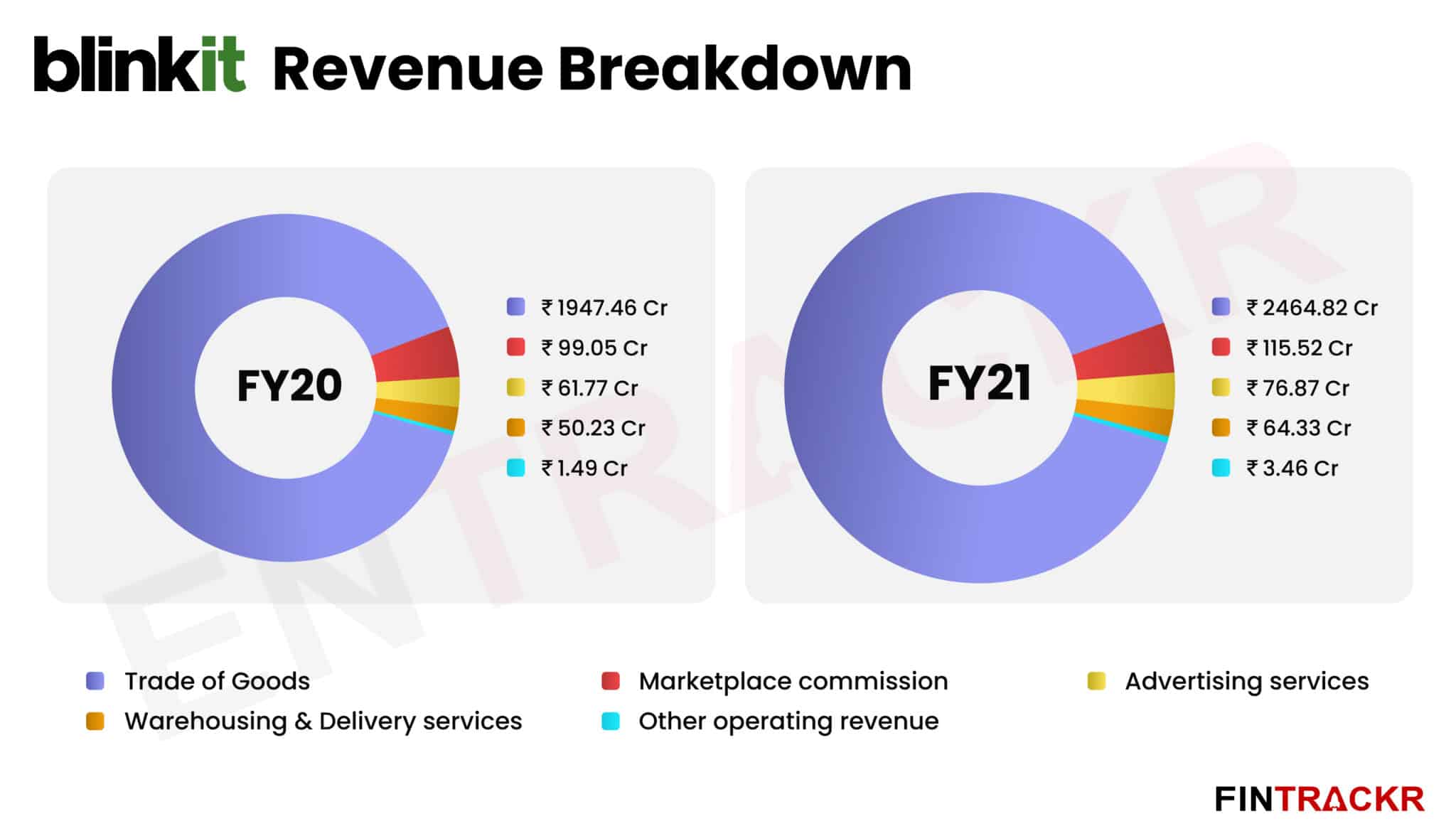

Around 90.5% of the company’s revenue came via sales of goods which grew by 26.6% to Rs 2,464.82 crore during FY21, compared to sales of Rs 1,947.5 crore in FY20.

BlinkIt also collected a marketplace commission from sellers on its platform for facilitating transactions and such fees account for a little over 4.2% of operating revenue. Commission income grew by 16.6% to Rs 115.52 crore during FY21 from Rs 99.05 crore collected in FY20.

Further, the company charges advertising fees from FMCG brands and sellers to promote their products on its platform. Advertising revenues grew by 24.4% YoY to nearly Rs 77 crore during the fiscal ended in March 2021.

Blinkit also offers delivery and freight services for FMCG products to third-party sellers and generated Rs 64.33 crore from this business during FY21, registering a 28.1% growth as compared to Rs 50.23 crore brought in from the same vertical in FY20.

BlinkIt also generated a non-operating income of Rs 16.3 crore from its financial assets and other sources during fiscal 2020-2021.

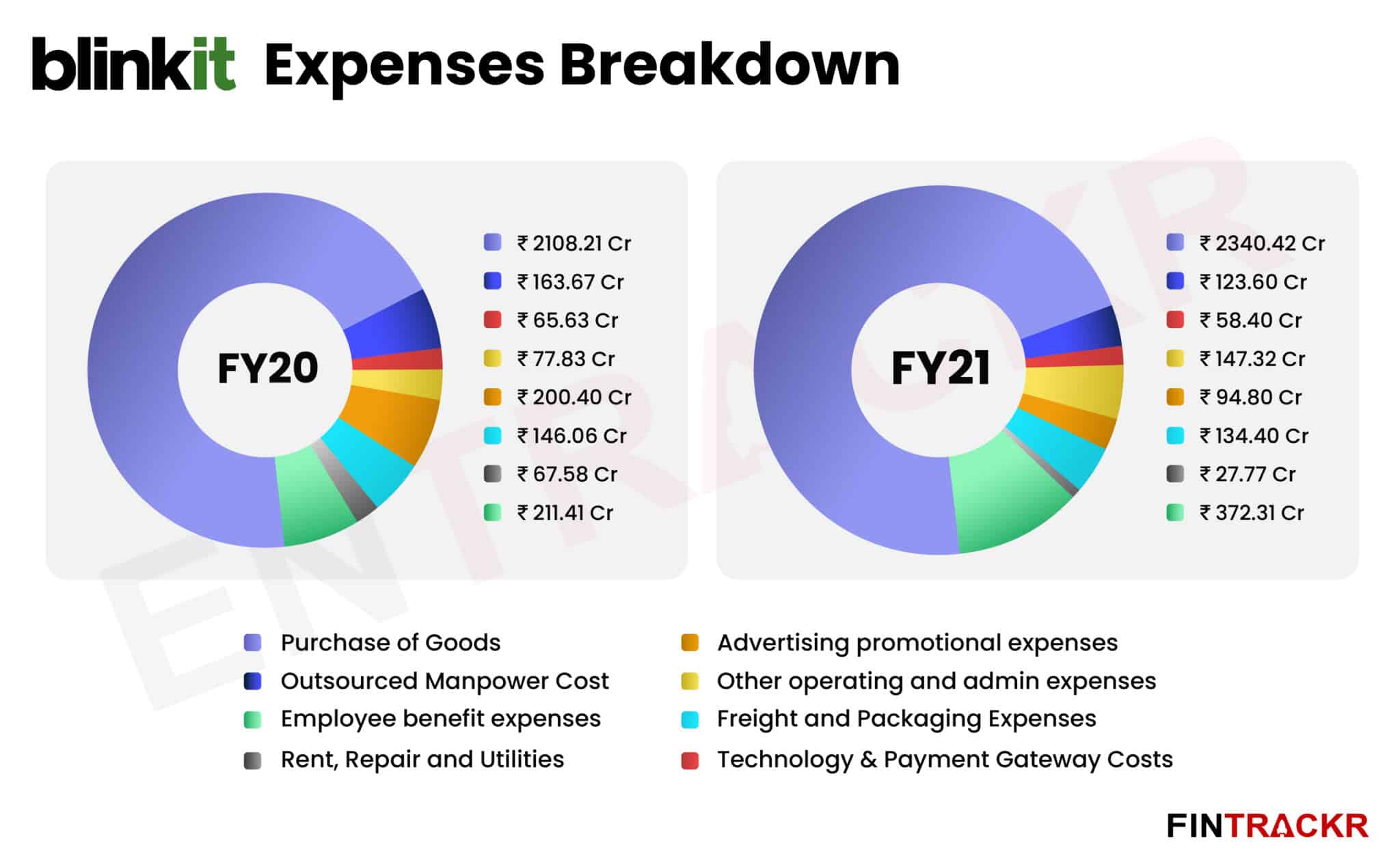

Moving on to the expense sheet, procurement of stock-in-trade, i.e. FMCG products was naturally the single largest cost for the grocery delivery company, making up around 71% of its annual expenditure.

Purchases grew by only 11% from Rs 2,108.2 crore made in FY20 to Rs 2340.42 crore during FY21. Freight and packaging expenses amounted to Rs 134.4 crore for the same period.

Payroll is the second largest cost for the Zomato backed company, accounting for 11.3% of annual expenses. While salaries and allowance payments remained stable, the company booked ESOP-related expenses of nearly Rs 189.6 crore for FY21, 6.2x more than the Rs 30.4 crore worth ESOP costs during FY20.

As a result, total employee benefits expenditure surged by 76.1% to Rs 372.31 crore during FY21 from Rs 211.41 crore booked in FY20.

The pandemic accelerated demand for e-grocery services, bringing in a new wave of customers. Management at BlinkIt observed the change in the behaviour of customers and made changes to the company’s sales funnel, cutting back on customer acquisition costs greatly.

For instance, the company reduced its expenditure on marketing incentives and cashback by 81.62% to only Rs 32.4 crore in FY21 from Rs 176.4 crore spent on the same during FY20.

On similar lines, austerity measures were put in place for advertising and promotional activities and the related expenses were brought down by 52.7% to Rs 94.8 crore in FY21 from Rs 200.4 crore spent during FY20.

Further, payments for rent and utilities were reduced by 59% YoY to Rs 27.8 crore, and outsourced manpower expenses were cut back by 24.5% YoY to Rs 123.6 crore during FY21.

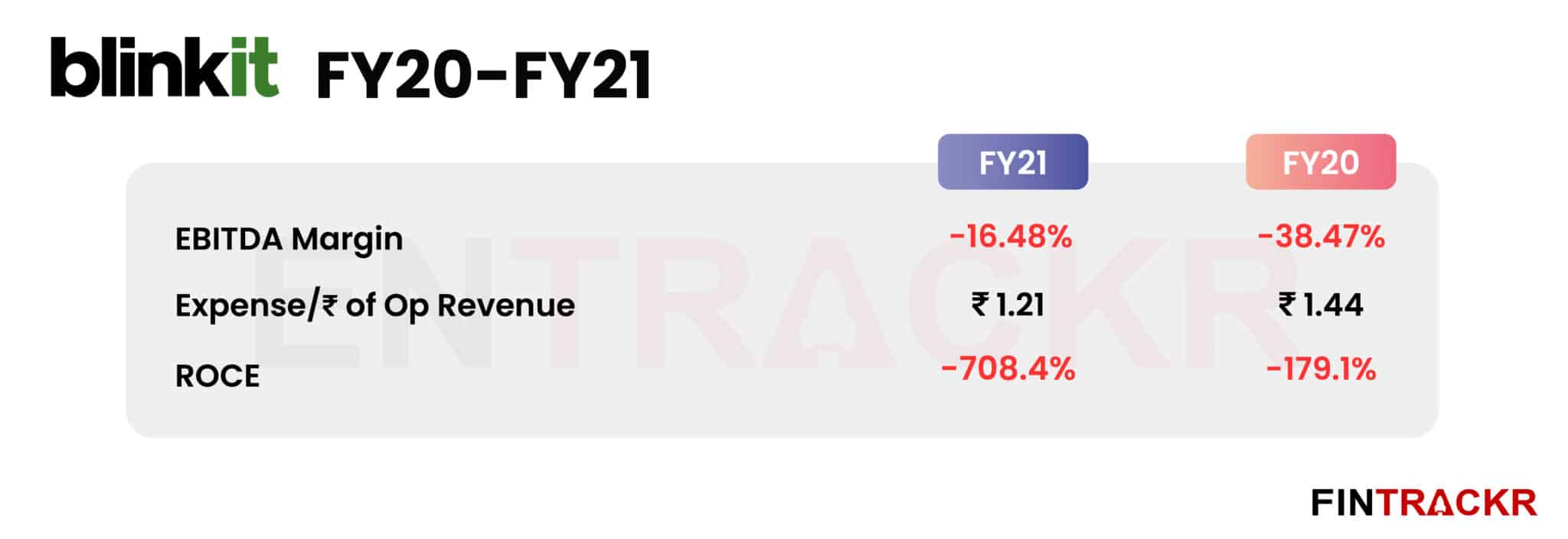

Technology and Payment gateway costs of Rs 58.4 core pushed annual expenditure to Rs 3,299 crore during FY21, 6.2% more than the Rs 3,105.8 crore spent in FY20. On a unit level, BlinkIt spent Rs 1.21 to earn a single rupee of operating revenue in FY22.

While the operational scale grew by 26%, austerity measures, especially on customer acquisition activities, helped the company bring down its annual losses by 39.1% to Rs 557.8 crore during FY21 from Rs 916.3 crore lost in FY20.

BlinkIt has also managed to improve its EBITDA margin to -16.5% in FY21 from -38.5% in FY20 but it accumulated losses of Rs 6126.6 crore ($817 million) on its balance sheet at the end of March 2021. For reference, the company is slated to be valued at $700-800 million in its share-swap deal with Zomato.

The Blinkit story of being always close enough to the kind of operational numbers that would justify more financial support is long and storied. The company has talked operational breakeven from 2016 onwards, if we consider its history. It took another six years, and perhaps one more story of the possibilities, for it to make its final move into Zomato’s arms. It faces a serious fatigue issue, from its key stakeholders, as we understand .

The last pivot from Grofers to BlinkIt indicates that even the all time high numbers of FY21 were not good enough possibly to sustain business as usual. The firm is clearly on borrowed time, as the listed Zomato will face intense scrutiny every quarter for the logic of the acquisition now. Expect the next 2-3 quarters to be truly make or break for Blinkit.