Foodtech major Zomato filed its red herring prospectus or RHP with the Bombay Stock Exchange on Thursday with details of its financial performance during the last fiscal year which was marred by disruptions due to the ongoing coronavirus pandemic.

Taking on the challenges during this period, the RHP shows that Zomato’s food delivery business suffered significantly and the total number of orders placed on its platform in India decreased by 40.7% from 403.1 million in FY20 to 238.9 million in FY21.

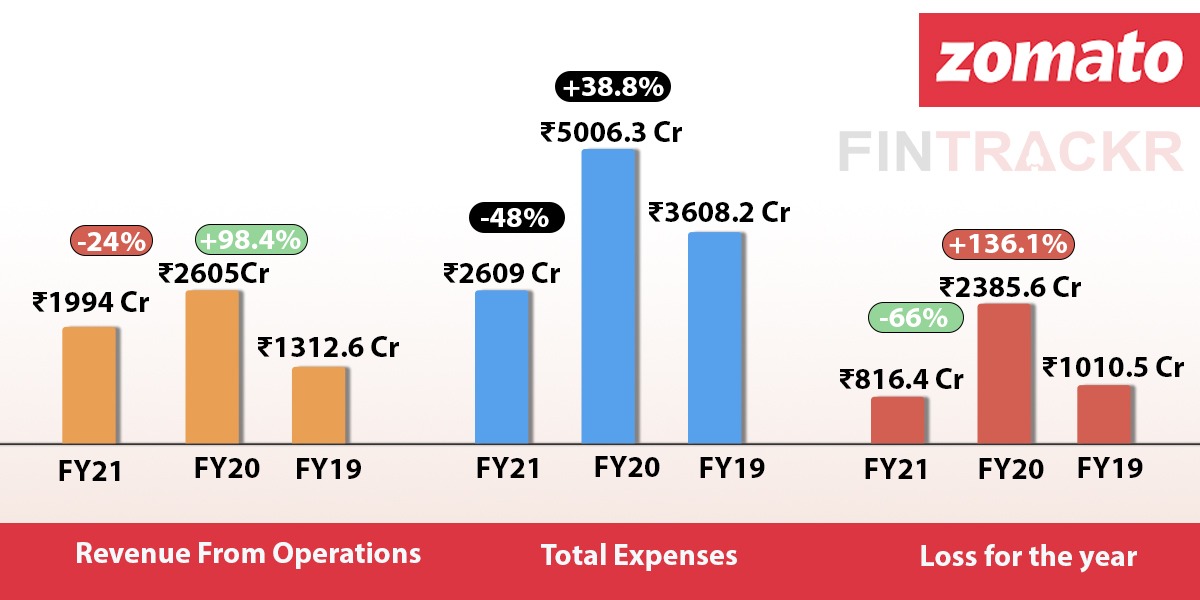

As a result, collections suffered and revenue from operations dropped by 24% to Rs 1,994 crore in FY21 from Rs 2,605 crore earned in FY20.

During the fiscal ended in March 2021, the Gurugram-based company made 86% of its operating revenue from food delivery services which stood at Rs 1,715 crore. Zomato’s B2B fulfilment vertical HyperPure was least impacted due to the lockdowns imposed and its sales grew by 86% from Rs 107.6 crore in FY20 to Rs 200.2 crore in FY21.

HyperPure accounted for 10% of the revenue collected by the firm during FY21.

Zomato also earns commission income from the restaurants listed on its platform and at Rs 78 crore, such revenues accounted for 4% of the annual collections during FY21.

Facing a significant reduction in its revenues, Zomato worked extensively to control the rate of cash burn and cut costs extensively throughout its verticals.

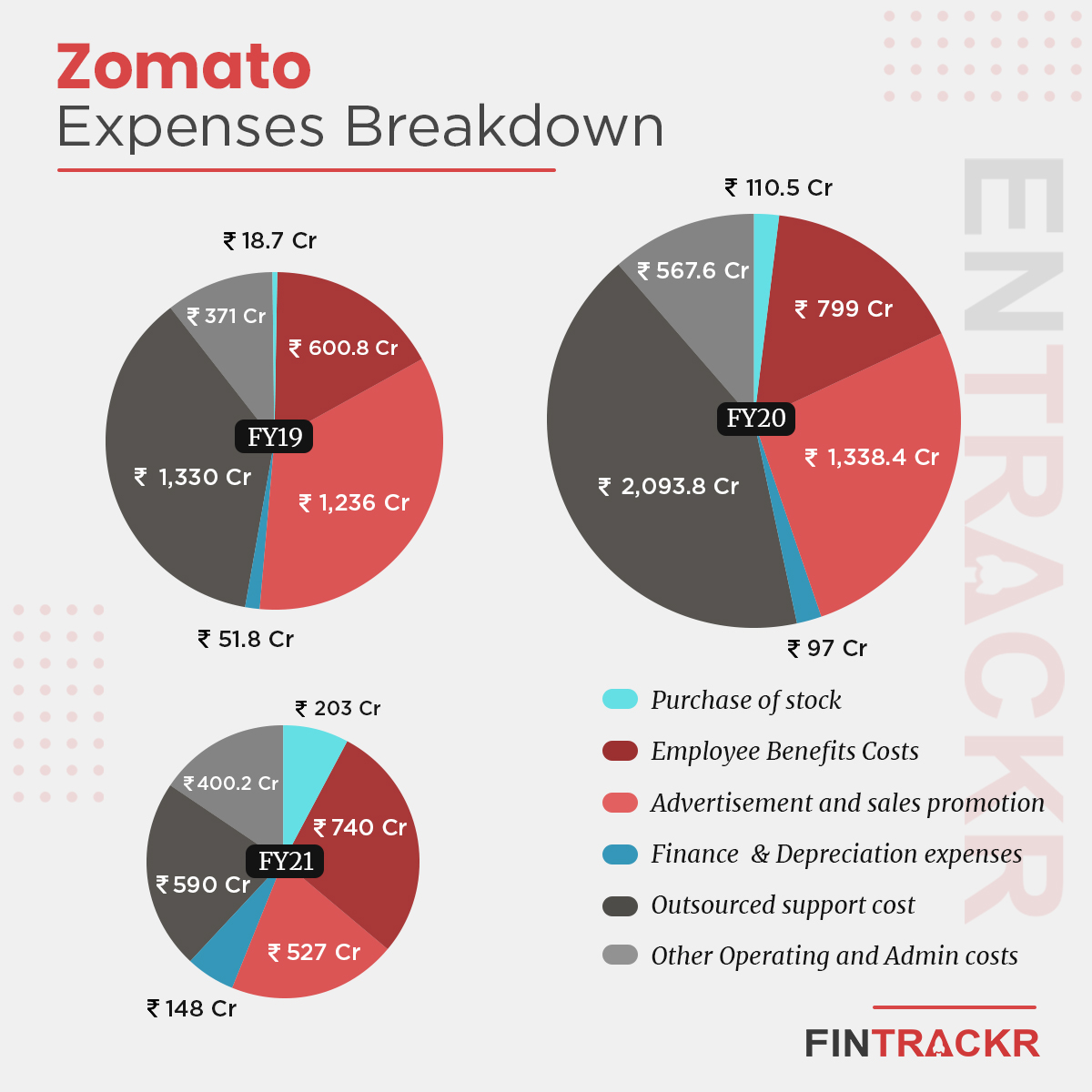

Employee benefit expenses stood out as the largest cost centre for the company, accounting for 28.4% of the annual expenses during FY21. At the beginning of last fiscal, Zomato laid off around 13% of its workforce – 520 employees – and reduced employee benefits costs by 7.3% to Rs 740.8 crore in FY21 from Rs 799 crore spent in FY20.

Further, expenses on outsourced support were also reduced significantly due to a 40.48% drop in the total food orders processed on its platform. Such costs dropped by nearly 72% from Rs 2,093.8 crore in FY20 to Rs 590 crore in FY21. Due to the reduction in volume, payment gateway charges also dropped by 14% from Rs 74 crore in FY20 to Rs 63.6 crore in FY21.

On similar lines, Zomato curtailed its cash burn on promotions, advertising and marketing. Such costs dropped by 60.6% to Rs 527 crore in FY21 from Rs 1,338.4 crore in FY20. As a percentage of total income, its advertisement and sales promotion expenses was 24.88% in FY21 compared to 48.80% in FY20.

As mentioned above, orders processed through HyperPure were relatively unaffected and expenses on procurement of traded goods increased by 83.7% from Rs 110.5 crore in FY20 to Rs 203 crore in FY21.

Zomato’s depreciation and finance expense increased by 52.6% to Rs 148 crore in FY21 from Rs 97 crore booked in FY20 primarily due to the amortization of intangible assets as a result of the acquisition of the Indian business of Uber Eats.

Leadership at the IPO bound company implemented austerity measures throughout the Zomato group and the result is quite evident. The company managed to scale down its annual expenditure by around 48% to Rs 2,609 crore in FY21 from a little over Rs 5,006 crore spent during FY20.

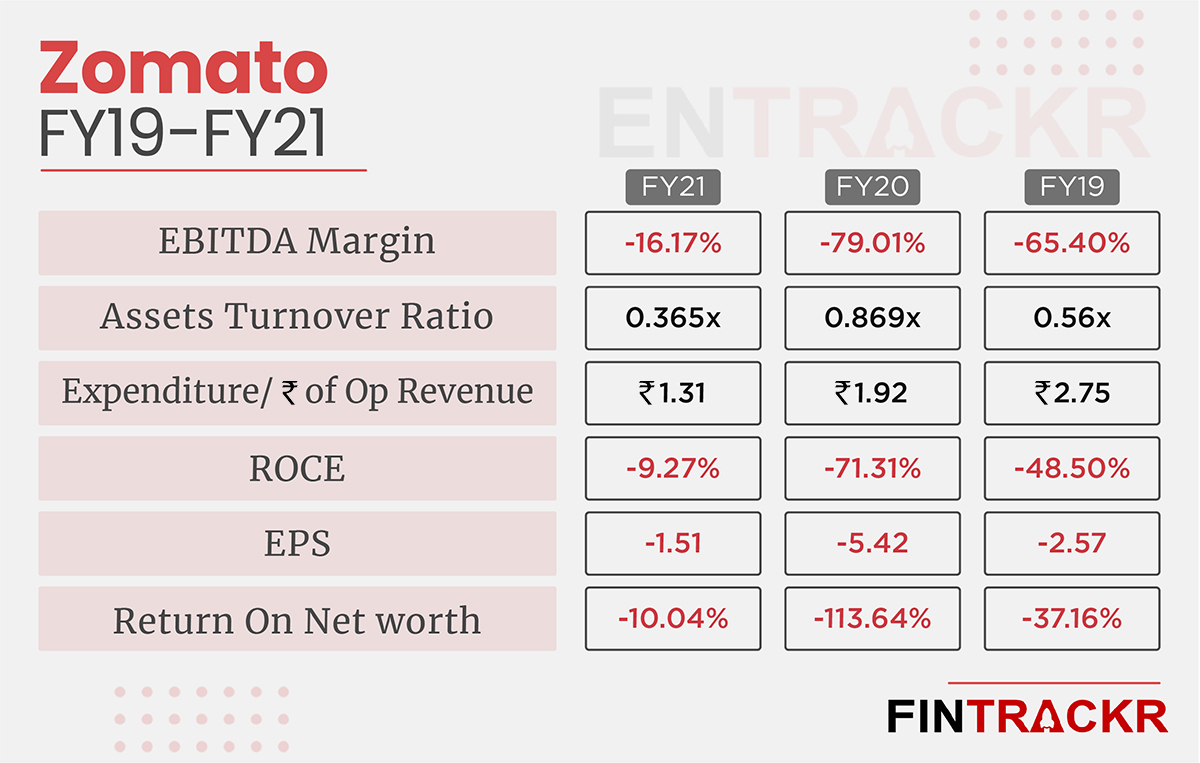

Zomato spent Rs 1.3 to earn a single rupee of operating revenue in FY21, improving from Rs 1.92 spent for the same in FY20.

Even with a 40% reduction in the number of orders, the company has managed to cut back on its losses by over 66% as its annual loss dropped from Rs 2385.6 crore in FY20 to Rs 816.4 crore in FY21. EBITDA margins also improved significantly, from -79.01% in FY20 to -16.17% in FY21.

While the company’s losses have come down sharply, there’s still a long road ahead for the Deepinder Goyal-led company. Its balance sheet sports outstanding losses of Rs 5,600.3 crore at the end of FY21 as it gears up for its public listing next week.