Zomato witnessed stupendous growth in the financial year that went by even as it guzzled money to attain it. The online food delivery major registered a 98.4% surge in its collections during the fiscal ended in March 2020. Its revenue from operations grew from Rs 1312.6 crore in FY19 to nearly Rs 2,605 crore in FY20.

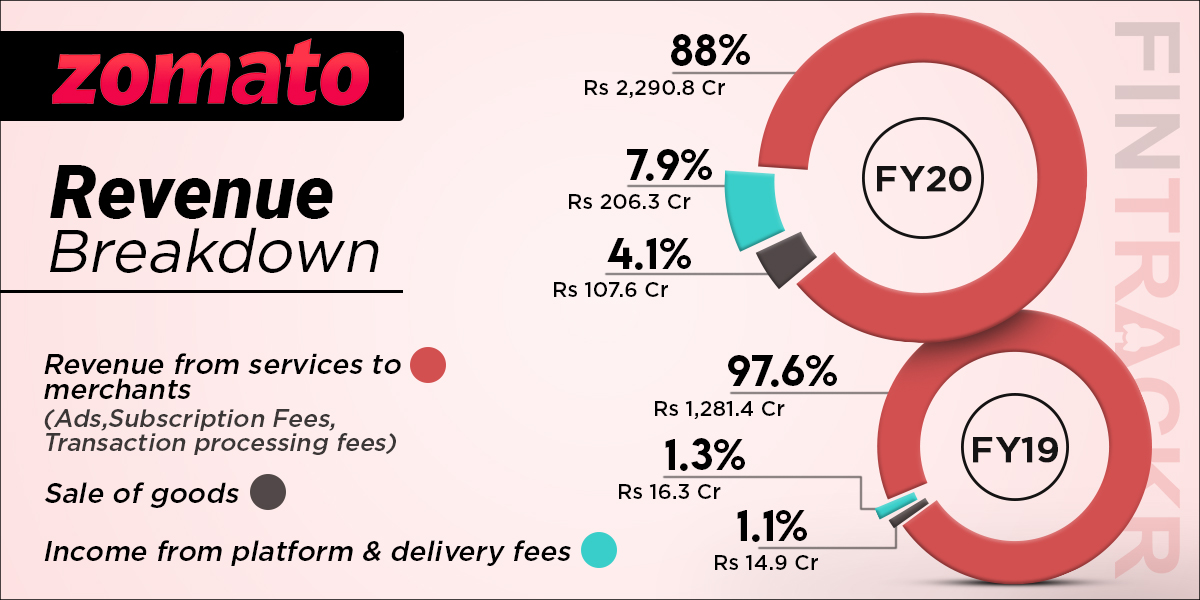

Let’s take a deeper look at how the food delivery unicorn registered this upsurge in income. Around 88% of its revenue was generated through the rendering of services to merchants on its platform including advertisement, subscriptions and transaction processing fees. This income grew by 79% to Rs 2,290.8 crore in FY20 from Rs 1,281.4 crore earned in FY19.

Sale of traded goods through its B2B raw material supply platform Hyperpure accounted for 4.1% of Zomato’s operating revenue, growing 7.2X from Rs 15 crore in FY19 to Rs 107.6 crore in FY20.

The operating segment which registered the biggest growth for Zomato was income from platform and delivery fees. This segment has increased its revenue share from 1.3% of total revenue in FY19 to nearly 8% in FY20. Zomato earned Rs 206.3 crore from this segment during FY20, growing 12.6X from Rs 16.3 crore earned through the same in FY19.

The Gurugram-based company earned another Rs 138 crore as income from financial instruments, pushing its topline to Rs 2,742.7 crore in FY20.

While the growth of scale is evident, Zomato burned through significant capital to achieve this trajectory. Its total expenditure grossed more than Rs 5,006.3 crore in FY20, growing by 39.1% from the Rs 3,598.04 crore spent in total during FY19.

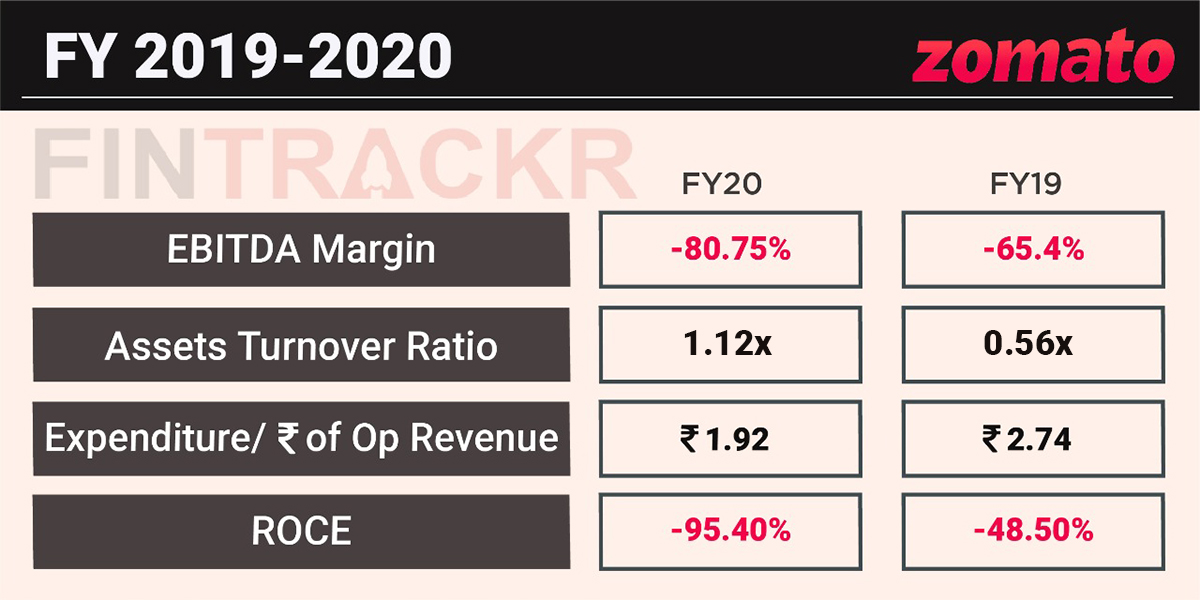

Zomato spent Rs 1.92 to earn a single rupee of operating revenue during the fiscal ended in March 2020.

The single biggest cost factor for Zomato was payments to outsourced labour or payment to delivery riders which accounted for nearly 42% of the total expenditure. These payments grew by 57.4% to nearly Rs 2,094 crore in FY20 from Rs 1,33.1 crore in FY19.

Costs related to advertisement and business promotion also made up a big chunk of costs, making up around 27% of the total expenditure. These expenses grew by 8.5% to Rs 1,341.3 crore in FY20 from Rs 1,236.5 crore in FY19.

Employee benefit expenditure surged by 33% to nearly Rs 800 crore during FY20 from the expenses of Rs 601 crore spent on the same in FY19.

Further, IT and server costs amounted to Rs 204.5 crore in FY20, growing by 84.4% from nearly Rs 111 crore spent in FY19. Another Rs 86.4 crore were incurred as finance costs pushing the net cash outflow from operations to Rs 2,143.7 crore in FY20, increasing by 21.8% from outflows of Rs 1,750.5 crore during FY19.

Even with the surge in topline, the significant jump in expenditure was reflected in the annual loss figure. Zomato’s losses grew 2.4X to Rs 2,385.6 crore in FY20. Its EBITDA margins also worsened by 1535 BPS to -80.75% in FY20 and outstanding losses mounted to Rs 4,666.4 crore at the end of fiscal in March 2020.

Zomato is sustaining the cash burn through the regular inflow of funds from investors. The company recently completed its Series J funding round at $660 million in December 2020 at a valuation of $3.9 billion.

New investors including Tiger Global, Kora, Luxor, Fidelity (FMR), D1 Capital, Baillie Gifford, Mirae Asset and Steadview Capital have joined the cap table during 2020 as the company looks to give a tough fight to its main competitor Swiggy, after acquiring Uber Eats in January last year.