Omnichannel commerce startup Fynd which was acquired by Reliance in August 2019 and spent around eight months under Reliance in FY20, put a tight control on its expenses during that financial year. The company scaled back significantly which led to a drop in operating revenue and also a reduction of losses.

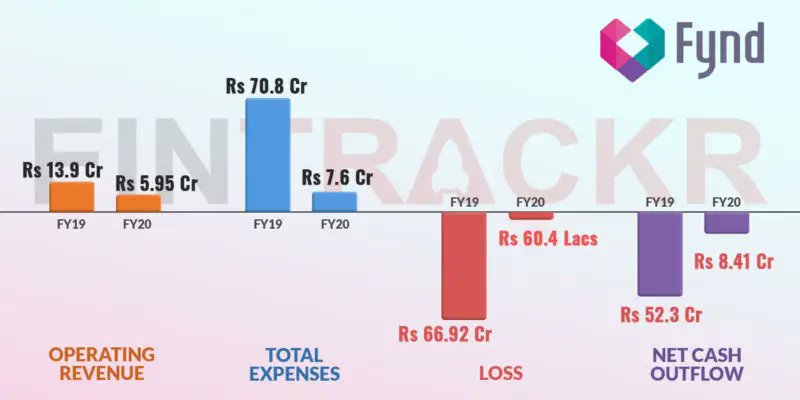

Fynd’s revenue reduced by 57.2% to Rs 5.95 crore from Rs 13.9 crore in FY19, according to the company’s financials filed with the registrar. The drop of 70.1% in its shipping charges also depicts a significant reduction in the scale of its operations and orders processed during FY20. These expenses reduced from Rs 6.35 crore in FY19 to Rs 1.9 crore in FY20.

With the reduction in scale, the total expenditure dropped by 89.2 % from Rs 70.8 crore in FY19 to Rs 7.66 crore.

The austerity measures continued to reflect throughout the expense sheet. Expenditure on advertising and promotion were slashed by 96.6% to only Rs 1.04 crore during FY20 from Rs 30.62 crore in FY19. Employee benefit expenditure also reduced by nearly 90% from Rs 17 crore in FY19 to Rs 1.72 crore in FY20.

This comes as the startup has been on stealth mode ever since the acquisition as it is expected to be working on a tech stack that can offer accurate visibility of a brand store’s inventory in real-time. This is in line with Reliance’s emphasis on bridging the gap between the physical and digital channels through Jio Platforms. The Mukesh Ambani-led group is likely to launch fashion vertical on JioMart by the next month and Fynd is expected to play a crucial role in it.

Fynd’s restructuring strategy seems to be working as its losses recovered by 99.1% to Rs 60.4 lakhs during FY20 from Rs 66.92 crore in FY19 and net cash outflow from operations reduced by 84% to Rs 8.4 crore. While outstanding losses piled up to nearly Rs 104 crore, EBITDA margins recovered from -403.3% in FY19 to only -0.97% during FY20.

The management has infused nearly Rs 42 crore to build its software infrastructure during the last fiscal and its total assets increased 4.7X to Rs 57.73 crore at the end of FY20 from Rs 12.24 crore in FY19. Return on capital employed also dropped drastically from -1182.3% in FY19 to -0.52% in FY20.

The company has raised Rs 50 crore through issue of shares while it borrowed another Rs 18.8 crore during the fiscal ended in March 2020.

RIL’s Reliance Industrial Investments and Holdings Limited(RIHL) became the promoter of Fynd with effect from September 24, 2019, by acquiring an 87.6% stake in the e-commerce company. Fynd’s cofounders Farooq Adam Mukadam, Harsh Shah and Sreeraman Mohan Girija diluted their stakes to 4.66% each.