Fact: Zomato is present in more than 300 cities, Swiggy in 175. Zomato is present in around 14 countries, Swiggy in 1.

Contention: Is geographical focus strategy the reason why Swiggy has a larger market share than Zomato?

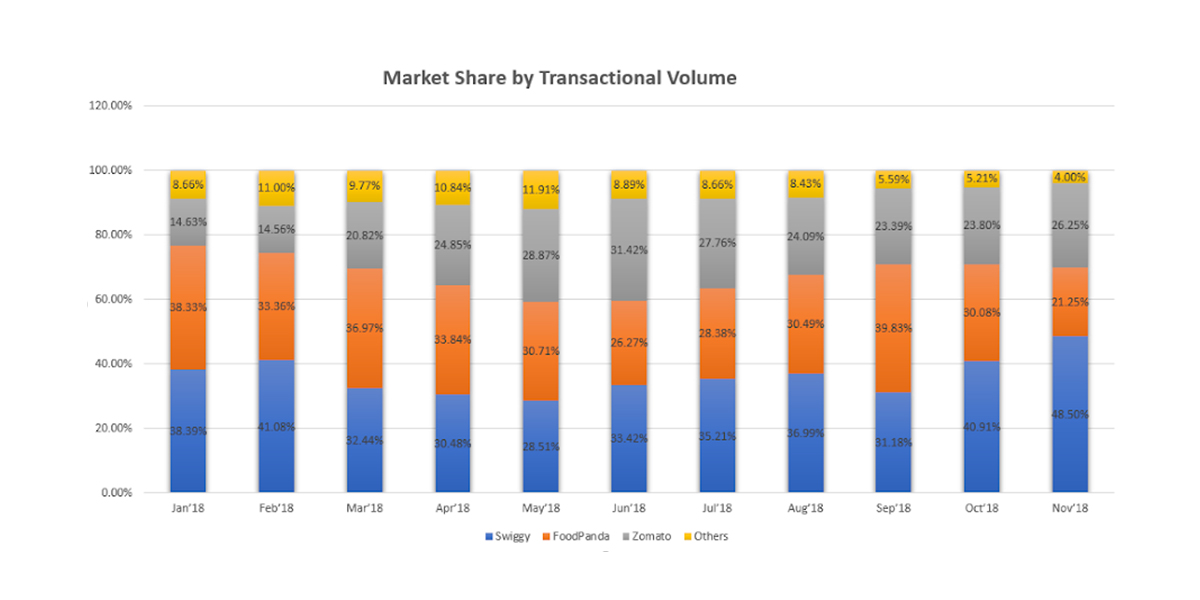

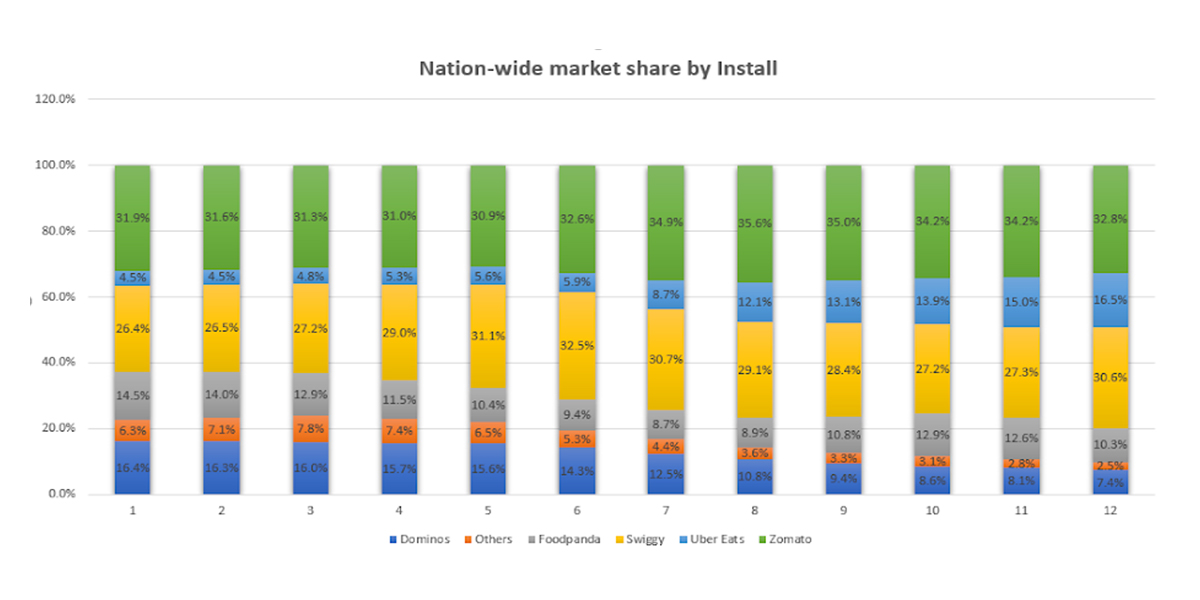

Transaction-wise? Maybe. But as far as installs are concerned, Zomato has a larger market share than anyone in the foodtech industry, both individually in all tiers as well as nationwide altogether. But that’s just a surface analysis at best.

Going deeper, a KalaGato report based numbers from January 2018 till November 2018, is a conclusive document on how the loyalty programmes, discount, ‘Bharat’, and logistics as strategies shape the narrative of foodtech in India.

The strategized narrative

Foodtech, in the past year, has been the foreground of how discounting strategy becomes the driving force of orders and hence traction. But is that all there is to it?

Swiggy, despite offering lesser discounts than Zomato and Foodpanda has a larger market share than the two on the basis of transaction volume*. If discounts were the master of traction driving force, Foodpanda or Zomato would have been on the top. So what is it that makes Swiggy the king of all?

It’s purely a logistics play. It didn’t start as a discovery platform like Zomato, it didn’t divest the focus in several countries, and instead of caring about the number of cities and Tier-II and III, it cared about more about scaling up and dominating the market it was already present in and then gradually going to more cities.

Unlike Foodpanda, it had a consistent presence in the market, as well as a strong reliable market reputation to grow on.

Also, it has now launched a slew of products to keep leveraging the repeat use case strategy of making loyal customer, with several products like Swiggy Super, Swiggy Stores, Swiggy Daily, etc.

So how did the discounting work in foodtech? Well for one, in the 11 month period from January to November, the transaction value for all the companies went down significantly. For most, the average order value that used to be in 300s came down to smaller half of 200s (200-250).

For Foodpanda, the drop was even steeper to 100s. It’s worth noting that the Ola-owned firm ran several campaigns like Keventers shake at Rs 9 to win customers last year.

The final month, Nov’18 saw Foodpanda’s average order value at Rs 117, Zomato’s at Rs 223, and Swiggy’s at Rs 245.

Good thing? Not really. Lesser average order value just means higher costs for the company. And when we know that Swiggy had a greater market share wrt to transaction volume, it just meant that even with lesser order values, the Foodpanda and Zomato still lacked the scale required to balance the unit economics to go towards profitability.

Swiggy, smartly utilised its repeat use-case strategy, logistics play, and product variety to grow the transaction volume even at higher prices.

Yes, even in the average frequency of spend per user**, Swiggy won the match, where it started with the second highest (1.82) and ended with the highest (1.83). But, the growth here, isn’t that great here. The user behaviour on Swiggy reached the highest, but the growth in itself wasn’t much, reflecting a similar usage pattern all over, and strong customer loyalty.

Foodpanda, that had a much higher rate in Jan’18 (1.92) lost its plot by Nov’18 (1.67). Why? Failed discounting strategy, lesser restaurant variety, and significant scaling down due to lack of funds.

Zomato here, with the right discounting and marketing strategy, ample funds, and it’s saving grace Zomato Gold, was able to grow from 1.37 in Jan’18 to 1.54 in Nov’18.

Not just that, while Swiggy might be the king of order volume, Zomato is the king of installs. Nationwide, as well as, individually in Tier I, II, and III, Zomato has more than 30% of the market share when it comes to installs.

Here, what helps Zomato is the facts that it was a discovery platform, even before it was a delivery platform. People who might have a different app preference while looking to order, still check out restaurant ratings on Zomato. Further, Zomato runs on large discount strategies, and as pointed out by Aman Kumar, the CBO of KalaGato, its loyalty programme, Zomato Gold is one of the most preferred loyalty programmes among all food tech apps.

Moreover, the fact that Zomato is present in almost double the cities of all any delivery app, leaves people at the disposal of Zomato’s app in the cities where other apps aren’t present.

This definitely helps Zomato in driving subscriptions, MAU, and DAU numbers more than the transactional numbers.

Foodpanda by far lacks in all aspects, GTV, Installs, city presence, market reputation, reliability, as well as the average order value that decides the unit economics. Explains the downscaling decision, doesn’t it?

This report, even with the transactional metrics not showcasing UberEats figures, aptly signifies how the different strategies and strengths of these food tech apps go on to help their business models and metrics.

Note:

* Market Share as per transaction volume, average frequency of spend per user, and average order value metrics in the report did not include UberEats as a contender, and hence instead of giving ranks and mentioning the figures, Entrackr analysis is just focused on comparison between these three companies wrt their business models and monetization plays.

** Average frequency of spend per user means the average number of times a user spends on the platform in a month.