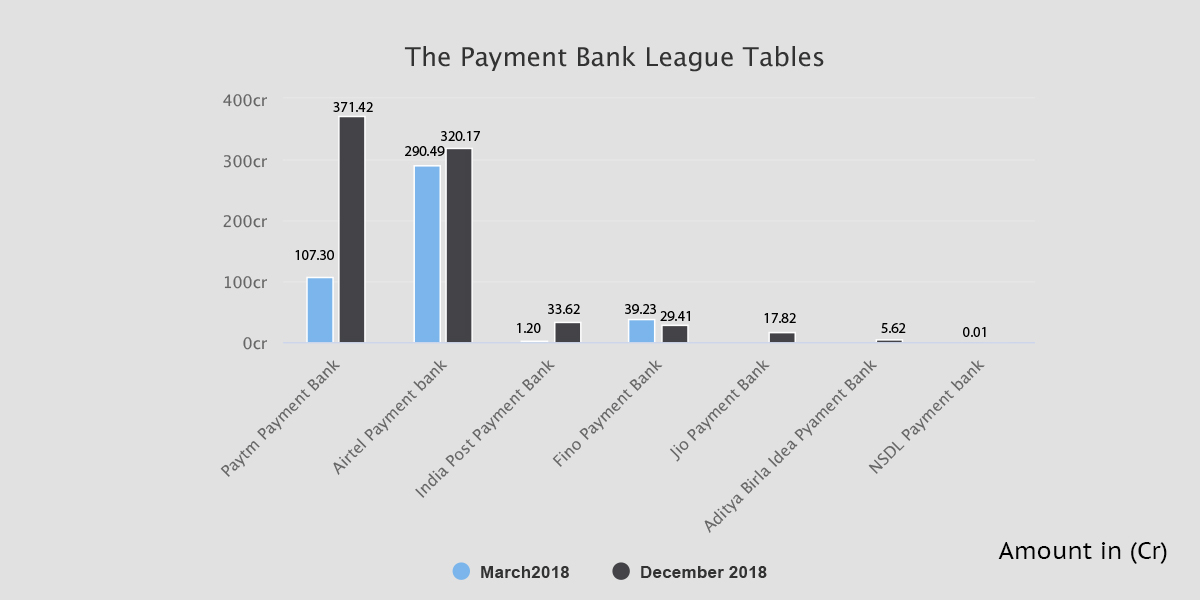

Out of seven payments banks, Paytm Payments Bank and Airtel Payments Bank together command over 88% of the deposits in payment banks in India in 2018.

In December last year, Paytm witnessed over 240% rise in deposit to Rs 371.4 crore (48% of total deposit) from Rs 107.3 crore in March, according to RBI data. Whereas Airtel Payments Bank saw 10% rise in deposits to Rs 320 crore (41% of total).

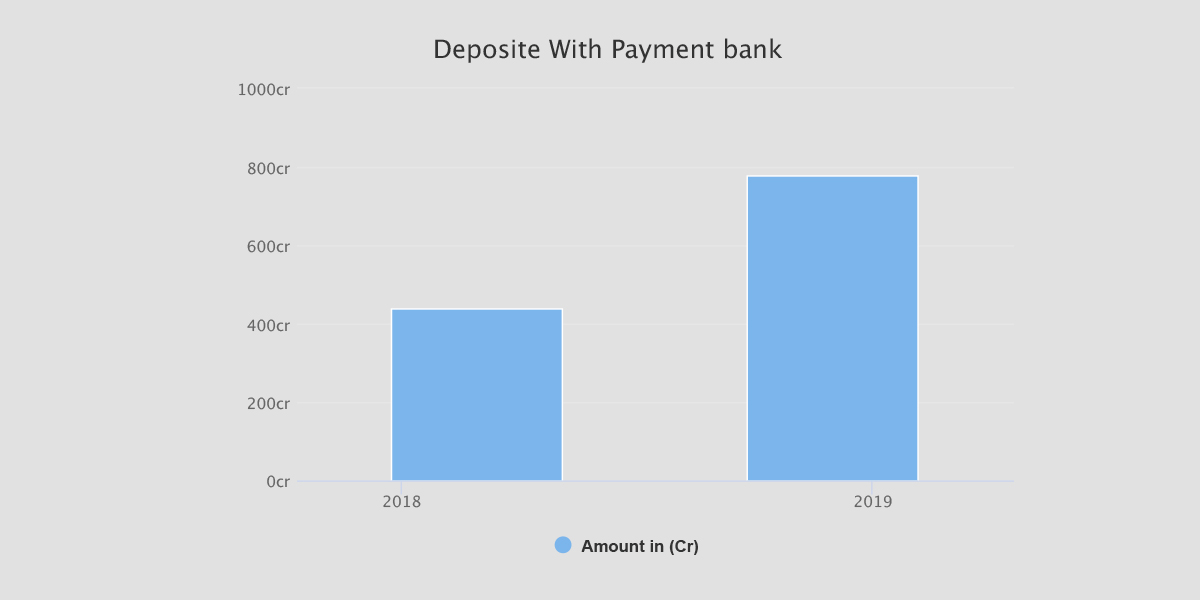

In total, payments banks hold around Rs 780 crore in deposits, including savings and current accounts till the end of last year. This is a growth of 78% compared to March figure Rs 438.22 crore.

Government-backed Post Payments Bank saw deposit of about Rs 33.6 crore.

Fino Payments Banks witnessed negative growth in deposit to Rs 29.41 crore from Rs 39.23 crore. In December 2018, Jio Payments Banks saw a deposit of Rs 17.82. Jio, Aditya Birla and NSDL Payments Banks did not have deposit figure from March 2018.

Some of the payments banks witnessed rise largely due to network utilisation and market awareness created by them, said Bloomberg report quoting industry observers.

Last year, the lack of compliance on the part of payment banks had also faced RBI penalties. RBI had barred Airtel, Fino, and Paytm payments banks from adding consumers.

RBI imposed a penalty of Rs 5 crore on Airtel Payments Bank for breaching operating guidelines and Know Your Customer norms. Paytm also was stopped from adding any customer for its flawed process while Fino payment bank was found taking deposit exceeding the limit Rs 1 lakh.

The imposed regulations led to slow down in deposit and opening of new accounts. Currently, the central bank placed a cap on deposits at Rs 1 lakh per customer on payments banks and does not allow them to lend directly.

Payment banks were introduced in India to speed up the penetration of the financial services. Though, large scale use case and profitability still remain elusive to them. They largely rely on income from the processing transaction fee. This alone cannot make them profitable, growth in transaction volumes is essential for them.