With high promises to drive financial inclusion, three years ago Reserve Bank of India (RBI) came up with Payment Banks (PB). Even before the launch, it was termed as a ‘disruptor’ in the Indian banking space.

One of the main aims of Payment Banks was to speed up the penetration of the financial service in the country especially among the low-income consumers. Now, three years after the initiative is still far from realising what it set out to do.

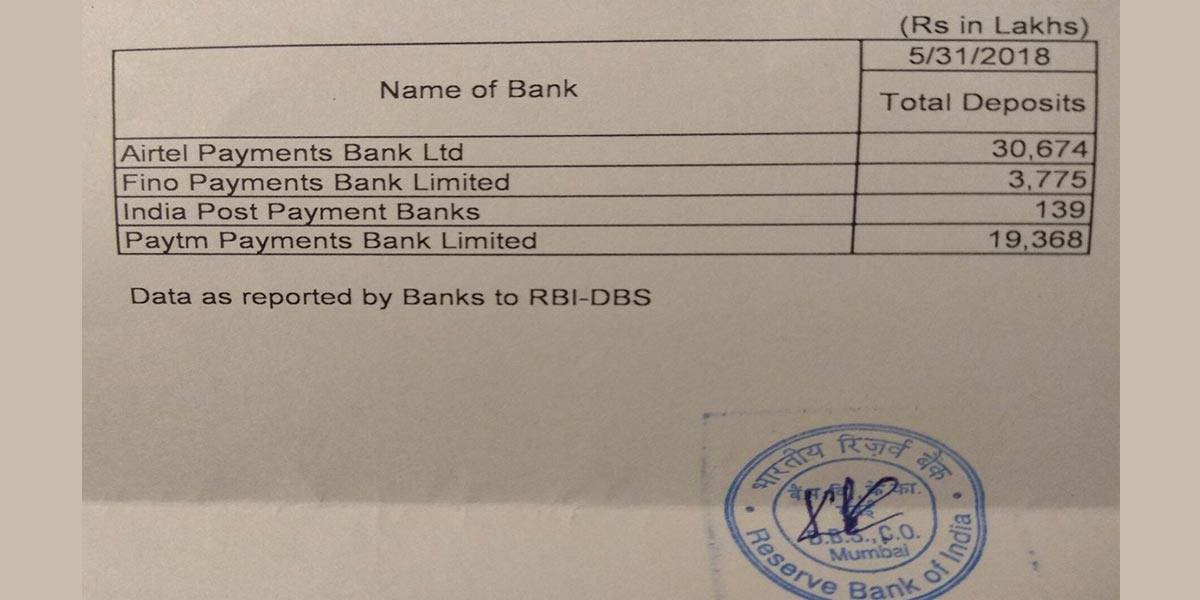

As on May 2018, in the four payment banks- Airtel Payment bank, Paytm payment bank, Fino Payment bank, and India Post Payment bank – the total deposits are just under Rs 540 crore. This is less than 0.005 per cent of overall bank deposits of Rs 115 lakh crore, according to RTI query filed by TOI.

Payment Banks still unknown to masses

There are multiple reasons for the Payment Banks, which initially promised to change the face of the banking sector, to lose its steam. First lack of proper awareness among people about the Payment Banks. Existing players in the space have not aggressively marketed it to spread the word among people leading to low-income consumers to adopt digital modes for financial transactions.

Out of 11 entities, only four payment banks are operational in the space.

Soon after the RBI’s approval in 2015, Tech Mahindra, Cholamandalam Finance, and the Dilip Shanghvi-IDFC Bank-Telenor joint venture dropped out. And in all likelihood, Vodafone too will surrender its PB licence.

Payment Banks were expected to kick off with basic digital transactions with payments banks and move on to more complex banking, including loans and investments, in the long run. But these plans are just remaining on the papers.

The offering by Payment Banks does not even cover the basic gambit of banking services.

For customers, the same services are offered by Banks and are in tune with customers traditional habits of doing the transaction. Initially, it was thought that telecom players user base will be translated into their bank customer base. But till date, it has not happened.

Their business model further adds to the woes. Payment banks cannot lend as per regulatory rule and are only allowed to accept savings and current deposits of up to Rs 1 lakh per customer. Besides, they are allowed to invest only in government securities, which offer lesser returns compared to other avenues such as mutual funds.

The limitation keeps the smaller enterprises away from PB.

Further, the segment needs more investment than the fund presently pumped in to serve low-income customers in the country. Apart from Paytm, which has announced $500 Mn to invest in its payment bank, there has hardly been any similar announcements by other players in the segment.

The lack of compliance on the part of PBs also adds to the woes. RBI had barred Airtel, Fino and Paytm from adding consumers.

RBI imposed a penalty of Rs 5 crore on Airtel Payments Bank for breaching operating guidelines and Know Your Customer norms. The bank allegedly opened payment bank accounts of mobile consumers without their informed consent. It also used customers’ Aadhaar number to do so.

Paytm also faced regulator’s wrath and was stopped to add any customer for its flawed process while Fino payment bank was found taking deposit exceeding the limit Rs 1 lakh.

Interoperability for the digital wallet is also expected to put PB at disadvantage. Wallets, with backing from RBI, will be able to offer a similar experience to their customer base.

The competition has turned fierce as government’s Post Payment Bank is also launched. Coupled with other financial inclusion schemes like the Pradhan Mantri Jan-Dhan Yojana, a large section of the unbanked population is already covered.

All these factors will narrow down the scope of PB. There is a need to fine-tune the PB business model and a strong business acumen is required for it to come close to becoming a ‘disruptor’ in the banking sector.

As the ride won’t be easy for Payment Banks, the question is whether it will realise its mission.

Clarification: The article has been updated with the RTI response