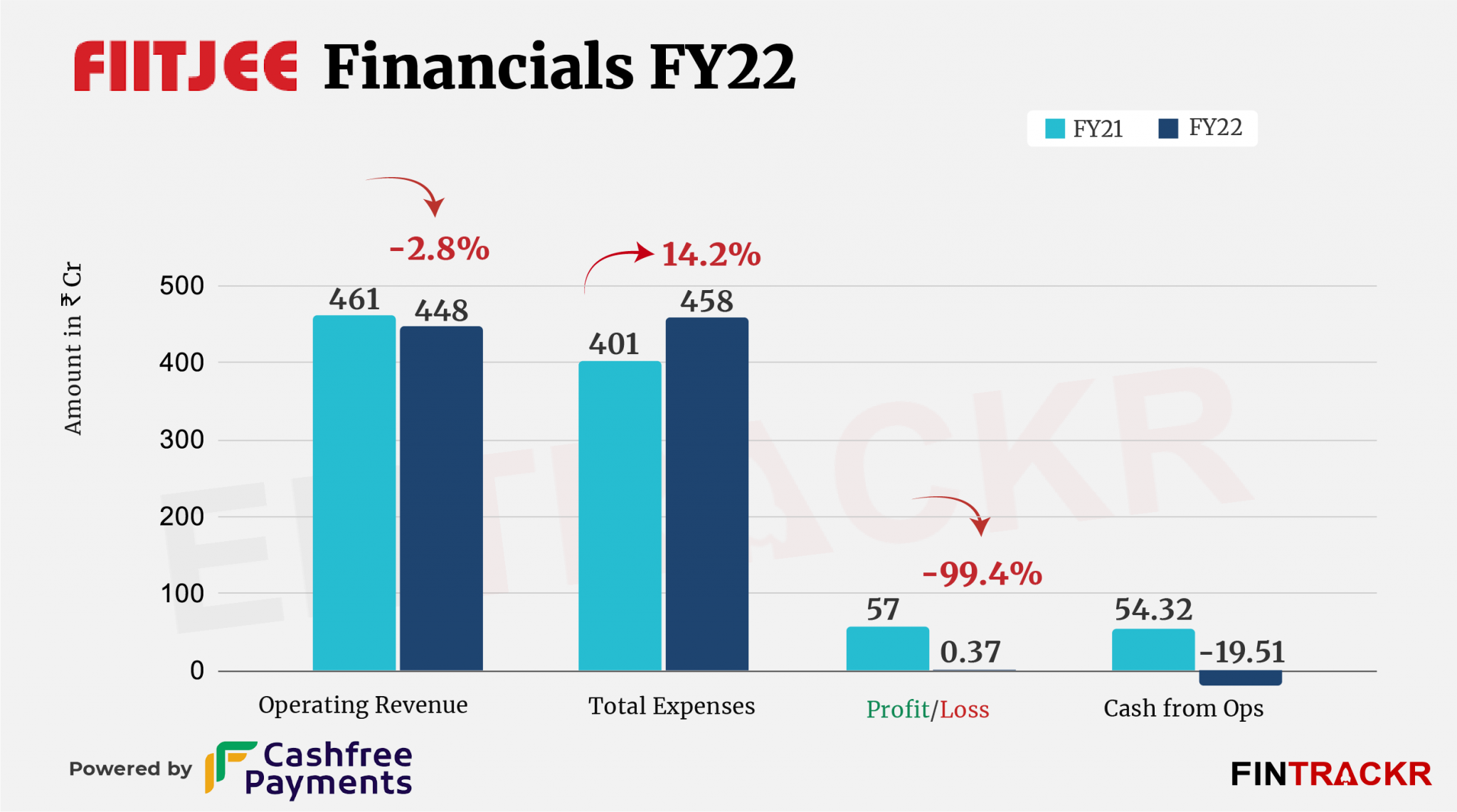

Decades old offline IIT-JEE test preparation platforms including FIITJEE, Allen and Bansal Classes are getting badly singed by the cash burn of deep-pocketed edtech companies such as Byju’s, Unacademy and Vedantu. While entry of venture capital-backed startups in offline test prep space would be evaluated when the ongoing fiscal year ends, FIITJEE’s scale remained flat during FY22 with a 99% dip in profit.

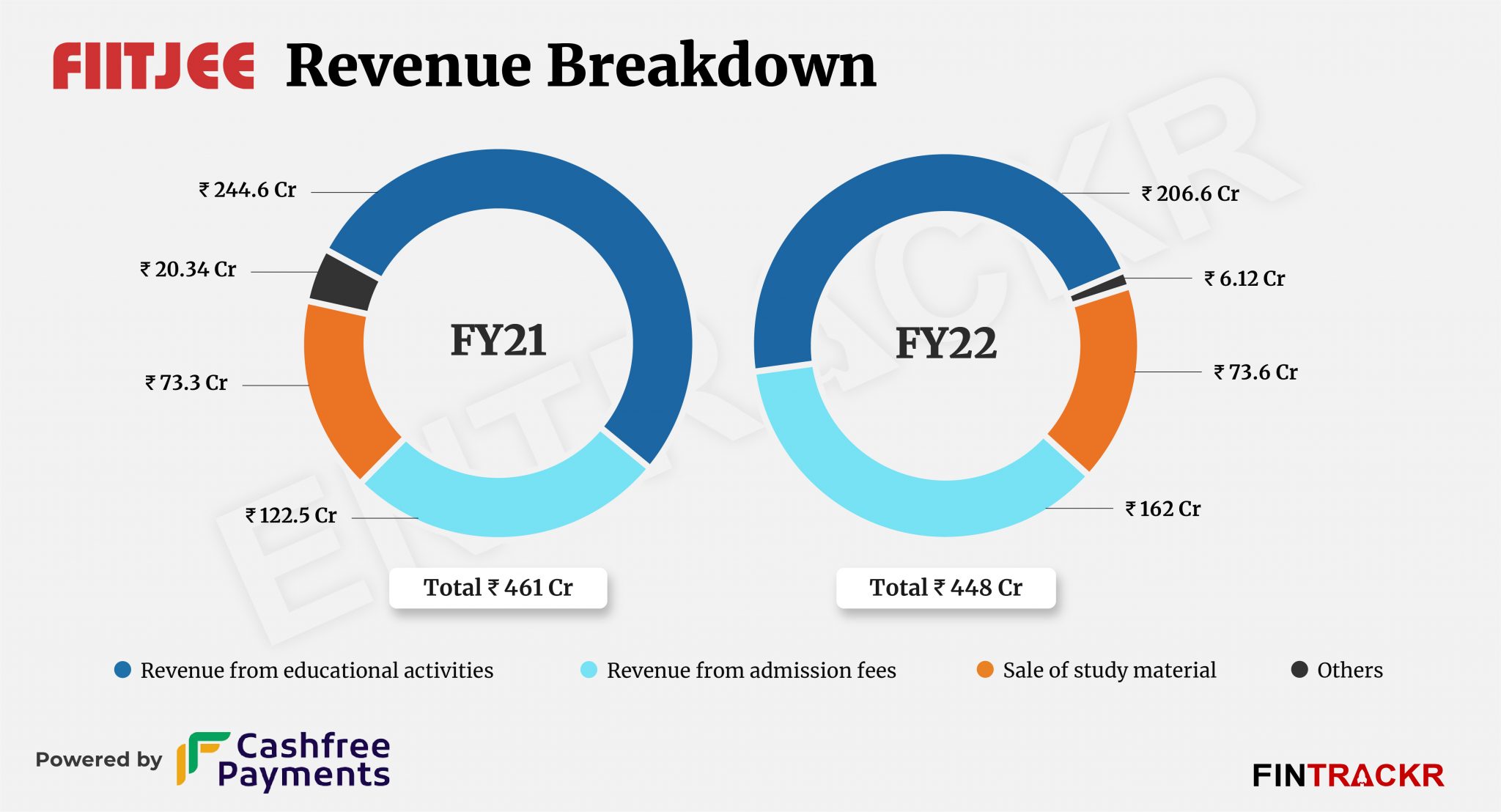

FIITJEE’s revenue from operations ended at Rs 448 crore during the fiscal year ending March 2022, according to its annual financial statement with the Registrar of Companies (RoC).

FIITJEE provides classroom, non-classroom, integrated school programs for several competitive exams and charges tuition fees, examination fees, infrastructure fees et al which constituted 46% of the total operating revenue. Collection from this vertical declined 15.5% to Rs 206.6 crore in FY22 from Rs 244.6 crore in FY21.

While collection from tuition fees saw a negative growth, revenue from admission fees grew 32.2% to Rs 162 crore during the year. Significantly, FIITJEE also generated Rs 73.6 crore from sale of study material in FY22.

FIITJEE made around Rs 12 crore via interest on current investments, rental income and other non-operating activities which collectively pushed its total revenue to Rs 460 crore in FY22.

FIITJEE was established in 1992 and offers coaching for IIT-JEE, NTSE, Olympiad, SAT and KVPY. It has over 65 branches in more than 40 cities in India, along with branches in Bahrain and Qatar.

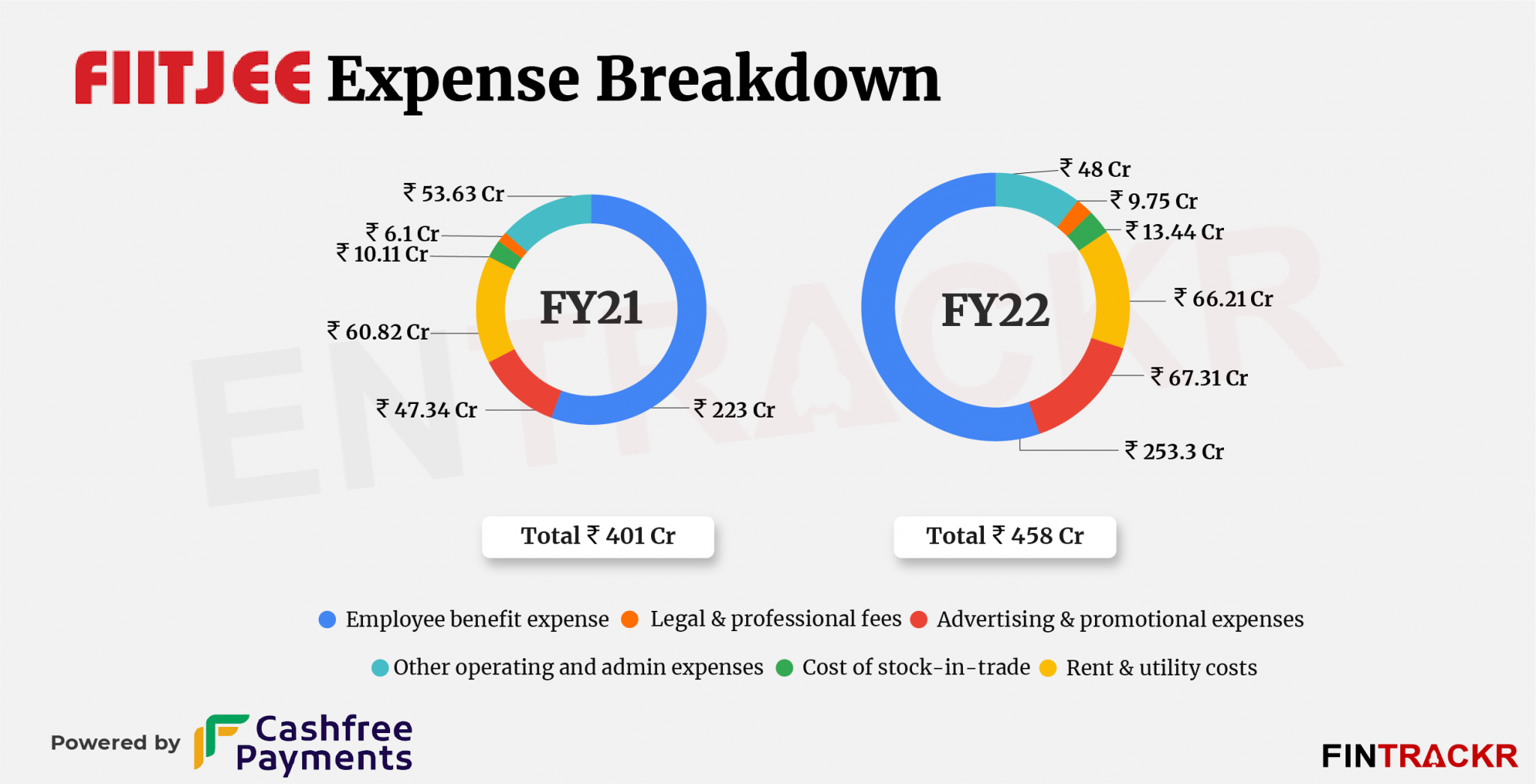

On the expense side, employee benefit costs accounted for 55.3% of the overall expenses which surged 13.6% to Rs 253.3 crore in FY22 from Rs 223 crore in FY21. The cost includes Rs 7 lakh as expense on employee stock option scheme and employee stock purchase plan.

With increasing (and well funded) competition, the company’s advertising and promotion costs spiked 42.2% to Rs 67.31 crore whereas rent and utility costs (including power, fuel, repairs, insurance, safety & security) stood at Rs 66.21 crore in FY22.

FIITJEE also incurred cost of stock-in-trade and legal – professional fees of Rs 13.44 crore and Rs 9.75 crore which increased 33% and 60% respectively during FY22. In total, annual expenditure of the company increased 14.2% to Rs 458 crore as compared to Rs 401 crore in FY21.

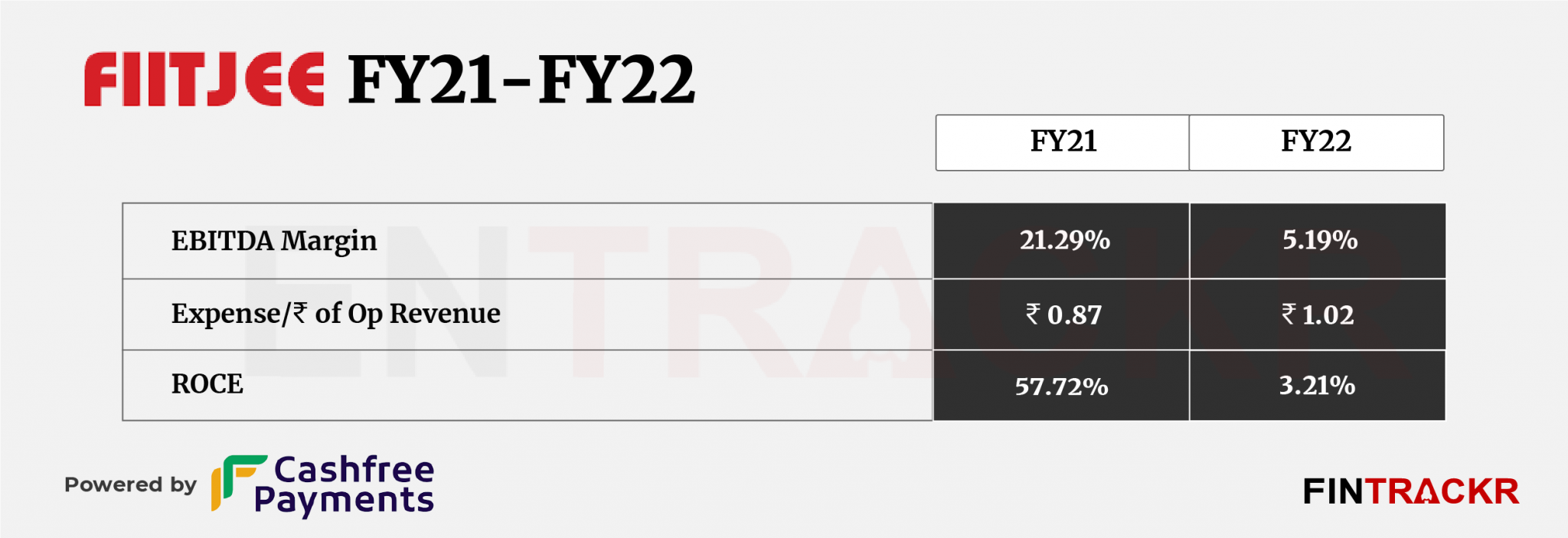

Arrested scale and the surge in expenses adversely affected the profitability of the company which slumped 99.4% to Rs 37 lakh in FY22 against Rs 57 crore in the preceding fiscal year. The cash burn also affected the operating cash outflows which went negative during FY22.

Coming to ratios, the EBITDA margin and ROCE shrank to 5.19% and 3.21% during the last fiscal. On a unit level, the New Delhi-based company spent Rs 1.02 to earn a rupee in FY22.

During July, FIITJEE launched the FIITJEE Accelerator Program to aid early-stage edtech, healthtech, and social impact startups by providing them mentoring and funding opportunities.

While the accelerator program might be a reflection of the founder’s views on opportunities, the fact remains that for the largest edtechs and test preparation platforms like FIITJEE, the days of fat margins seem to be over for now. More competition has meant higher acquisition costs of students, higher spends on teachers and intense pressure to deliver. Logically, they must seek to deliver more career enhancing services to their core student audience, be it teaching in more languages, expanding the scope of test preps they cover (CUET etc) or perhaps, hunker down to an even sharper focus on what they best, top IIT and Science based exams. Either way, evaluation will be tougher from a buyers market.