BharatPe has been going through tumultuous times because of the issues around corporate governance, alleged fraud and internal feud between the promoters and backers. While the impact of these issues on the company’s business will be known when BharatPe will file financial results of FY22, FY21, when none of these issues had surfaced yet, has turned out to be the first year of meaningful revenues for the fintech unicorn after generating revenue of Rs 6 crore for FY19 and FY20 combined.

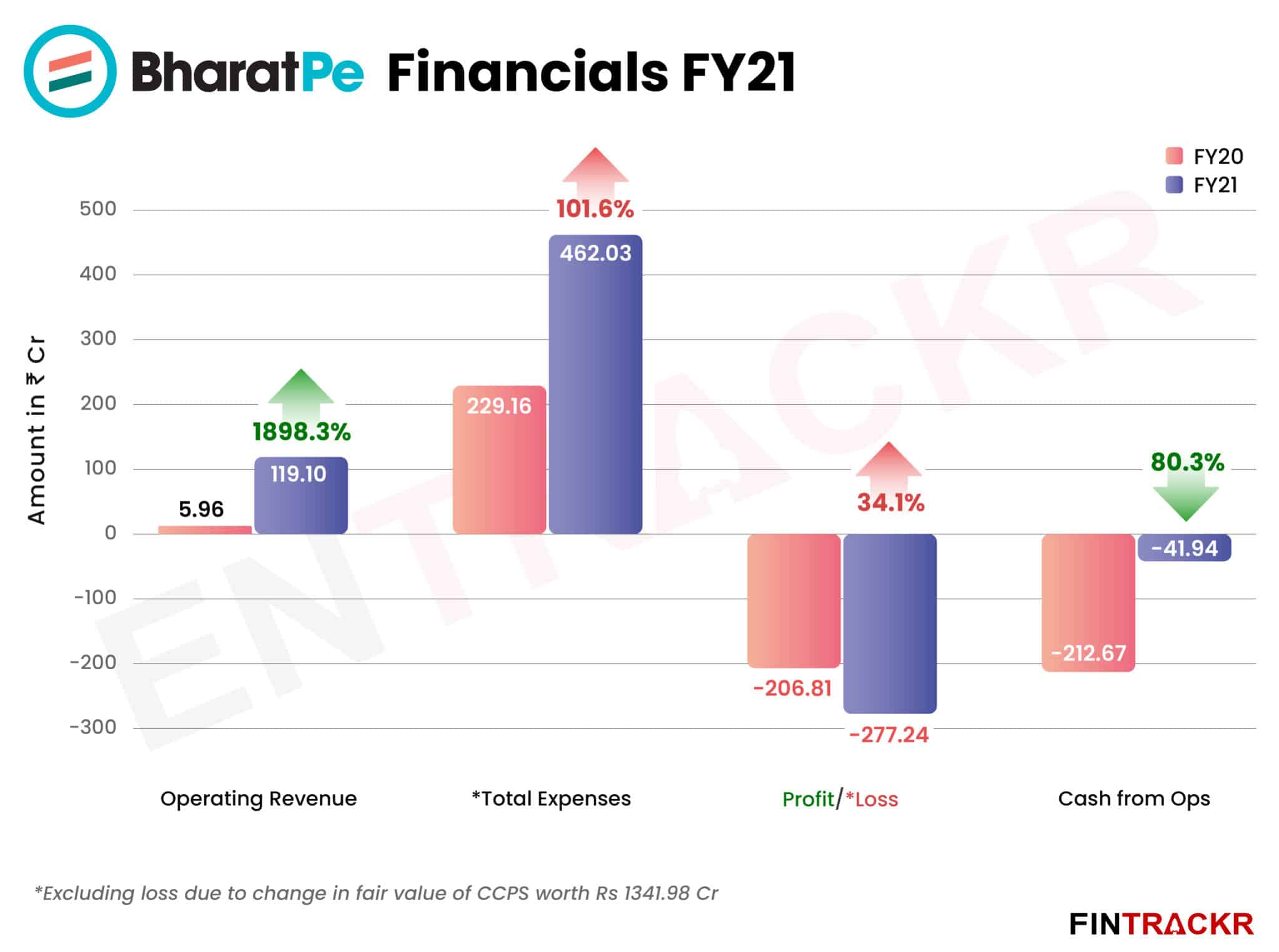

The Delhi-based company saw its revenue from operations shoot up around 20X to Rs 119.1 crore during FY21 as collections from its business loans segment grew significantly, its annual financial statements with the Registrar of Companies (RoC) show.

The Tiger Global-backed company is primarily engaged in the business of providing aggregator services to various merchants and business users, offering them a unified QR code for acceptance of push payments through third-party UPI applications.

BharatPe majorly acts as a facilitator for lending partners (financial institutions) to provide small-ticket loans for the daily working capital needs of vendors on its platform.

It collects commission income and processing fees on loans serviced through its lending partners. It does not charge transaction fees on its QR codes and point of sale card machines.

The fintech unicorn also collected financial income of around 66 crore during the fiscal ended in March 2021.

Gazing through the income statement, it appears that BharatPe’s annual expenses have surged to Rs 1,804 crore, adding up to a loss of Rs 1619.22 crore during FY21. So here’s the story behind those numbers.

The company has booked expenses worth Rs 1,341.98 crore on account of a “change in fair valuation of preference shares” for the fiscal ended in March 2021. As per IAS 32, compulsorily convertible preference shares (primarily used by the startup to raise funds) with a buyback clause are considered debt rather than equity.

BharatPe’s preference shares have significantly appreciated in value and that change was booked as a non-cash expense retroactively in the restated accounts for FY21 and FY20. Hence, the company’s actual expenses for FY21 stood around Rs 462.03 crore sans the non-cash regulatory expense as the preference shares will eventually convert to equity shares of the company.

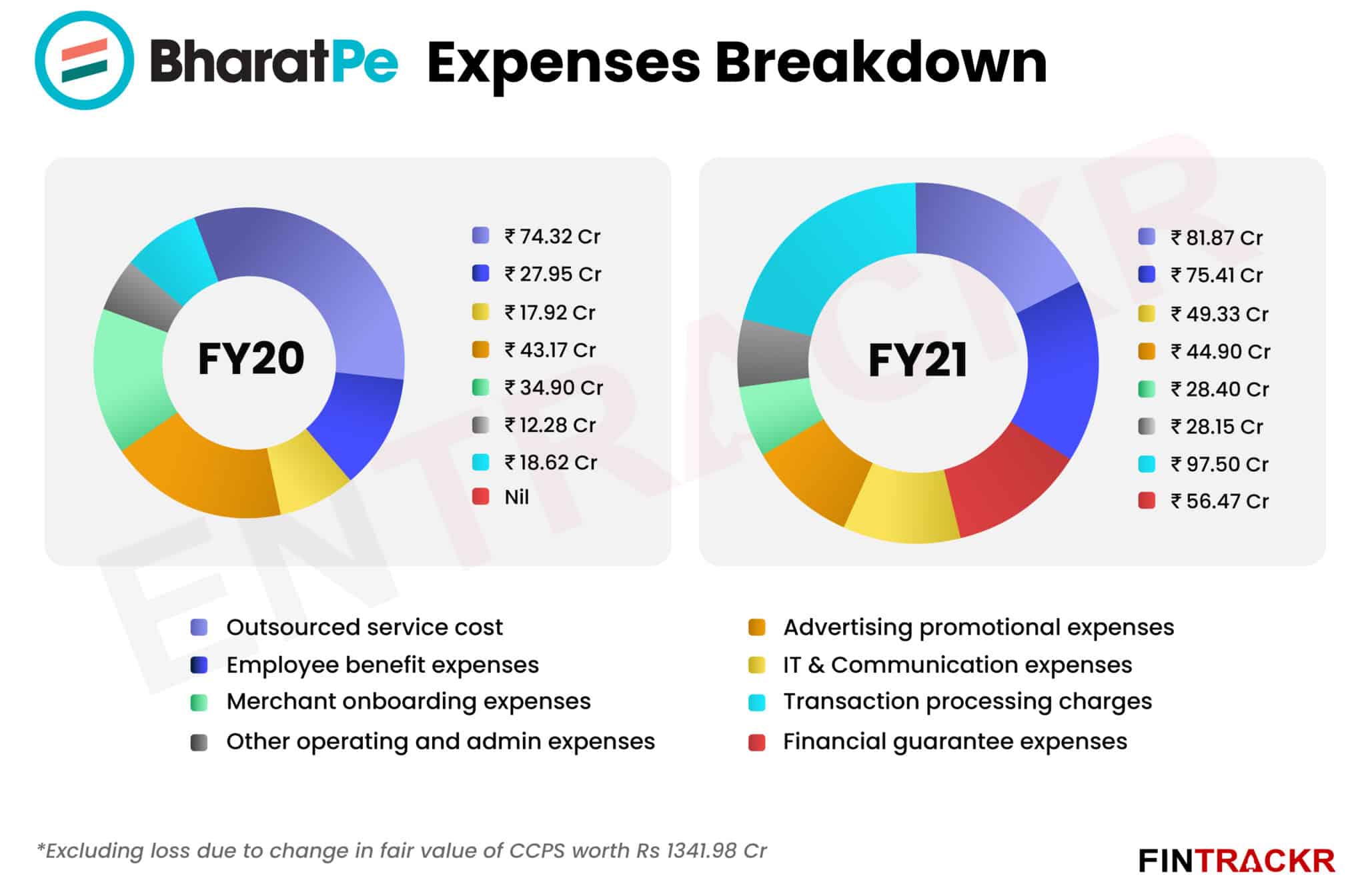

Moving over to the expense sheet, we found that the transaction processing charge that the firm absorbs for its merchants is the largest cost centre for the company accounting for 21.1% of BharatPe’s annual costs. Such expenses surged by 423.6% to Rs 97.5 crore during FY21 from Rs 18.62 crore incurred in FY20 indicating the multitude of growth in transaction volume on BharatPe’s platform.

The surge in scale is also evident from the 175.3% growth in IT infrastructure costs which amounted to Rs 49.33 crore in FY21 from Rs 17.92 crore in FY20. However, expenditure on new merchant onboarding dropped by 18.6% to Rs 28.4 crore during FY21 from Rs 34.9 crore in FY20 seemingly due to limited physical access to vendors due to Covid-19 restrictions.

While onboarding might have slowed, BharatPe expanded its team size rapidly during the last fiscal, especially technology, doing more to publicly showcase the challenge of finding tech talent than anyone else perhaps. This was done by employing unconventional talent acquisition strategies including offering high-end BMW bikes, gadgets and an overseas trip to new joinees. As a result, its employee benefits payments surged by nearly 170% to Rs 75.41 crore in FY21 from Rs 27.95 crore during FY20. Importantly, around 29.3% of these payments were settled via employee stock options.

BharatPe acts as the guarantor of loans provided from the balances of vendors on its platform and is responsible to reimburse losses on payment defaults by borrowers as per the terms of their contract. The liabilities from these financial guarantees amounted to Rs 56.5 crore during FY21 which essentially means that the company has lost around 47.4% of its revenues on bad loans.

Expenditure on advertising grew by merely 4% to Rs 45 crore while outsourced service expenses increased by 10.2% YoY to Rs 81.87 crore during FY21.

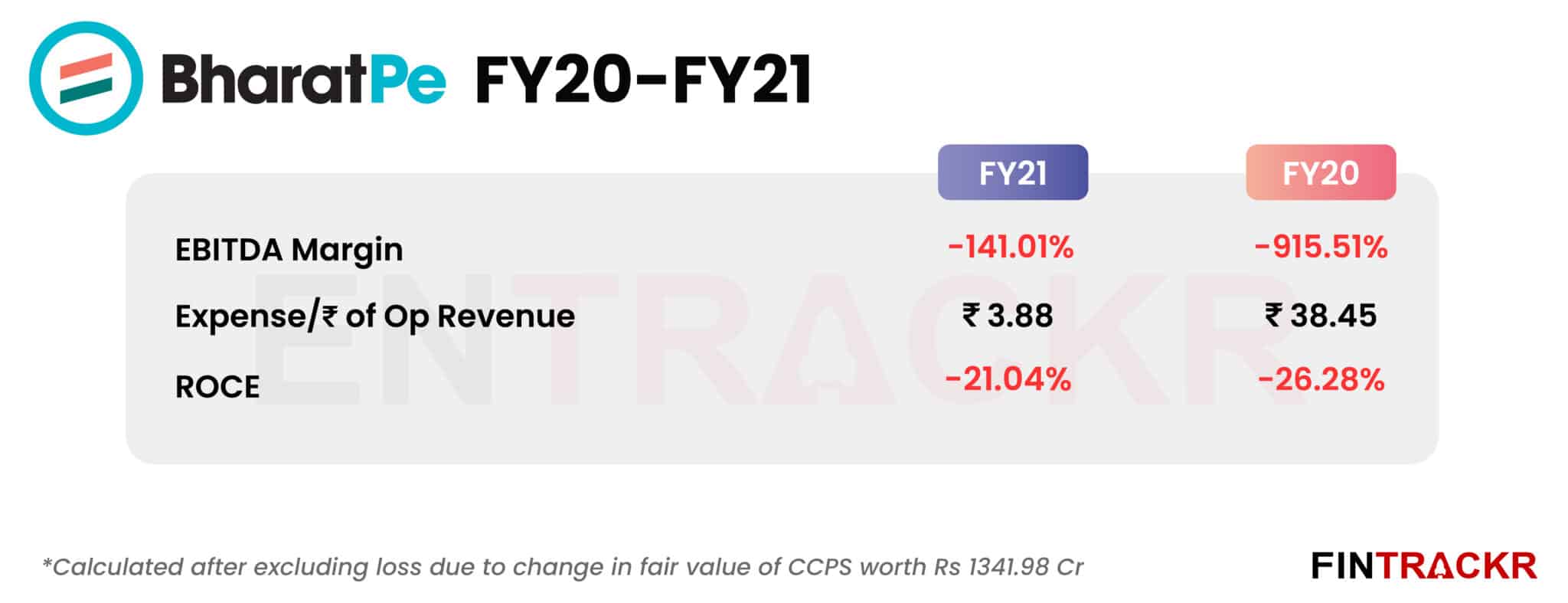

With FY21 being the first year of significant collections by the company, the EBITDA margin during the fiscal improved to -141.01% from -915.51% in FY20. The four-fold growth in finance income also eased the pressure and BharatPe’s annual losses grew by 34.1% to Rs 277.2 crore during FY21 from Rs 206.81 crore lost in FY20.

BharatPe has demonstrated a strong growth momentum in FY21 as its scale grew 20X with a tight control on expenses, but the key question now is: will BharatPe be able to repeat this kind of growth in FY22? While this would be only known when BharatPe files FY22’s results, the company’s chief executive Suhail Sameer recently claimed that despite the distractions of its internal feuds, the company would post Rs 700 crore in revenue in the ongoing fiscal year (FY22).

That number may or may not happen finally, but the bigger challenge for the firm is to regain its credibility and loyalty of the thousands of merchants it onboarded, besides the financial partners bankrolling the loans to these merchants. Too many regulatory flashpoints will not inspire confidence in either.