Covid-19 has disrupted the top line for many businesses but it also triggered growth for some segments. A large chunk of the population veered away from public transport and mobility as a service (cars, autos and scooters) on account of fear of infections and lockdowns, moving towards personal vehicle ownership. This shift along with the pent up demand was the major reason for the boom in automobile sales towards the end of 2020 and throughout 2021.

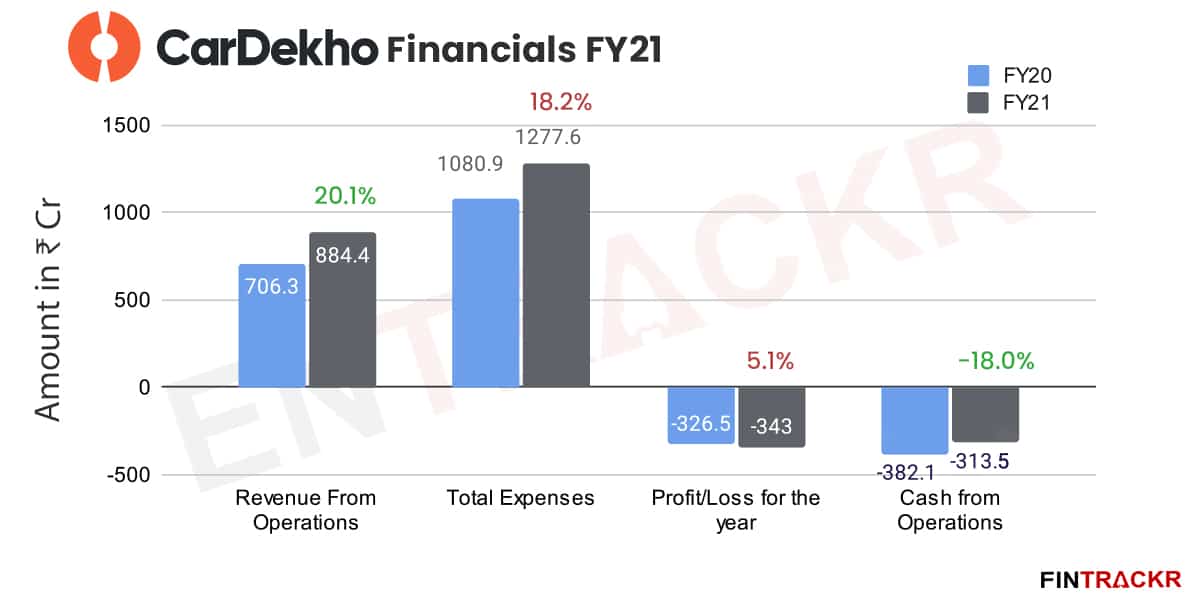

Since new car deliveries were marred by year-long waiting lists due to supply chain issues, a significant portion of car buyers turned towards used car platforms. CarDekho, one of the oldest players in the online space benefited from this surge in demand and saw its revenue from operations swell up by 20% to Rs 884.4 crore during FY21 from Rs 706.3 crore in FY20.

The fourteen-year-old company operates with 13 subsidiaries and associated companies, with domestic operations accounting for 94.4% of the collections and the rest from international operations. CarDekho has a presence in Indonesia and the Philippines under the brand names Oto and Carmudi respectively.

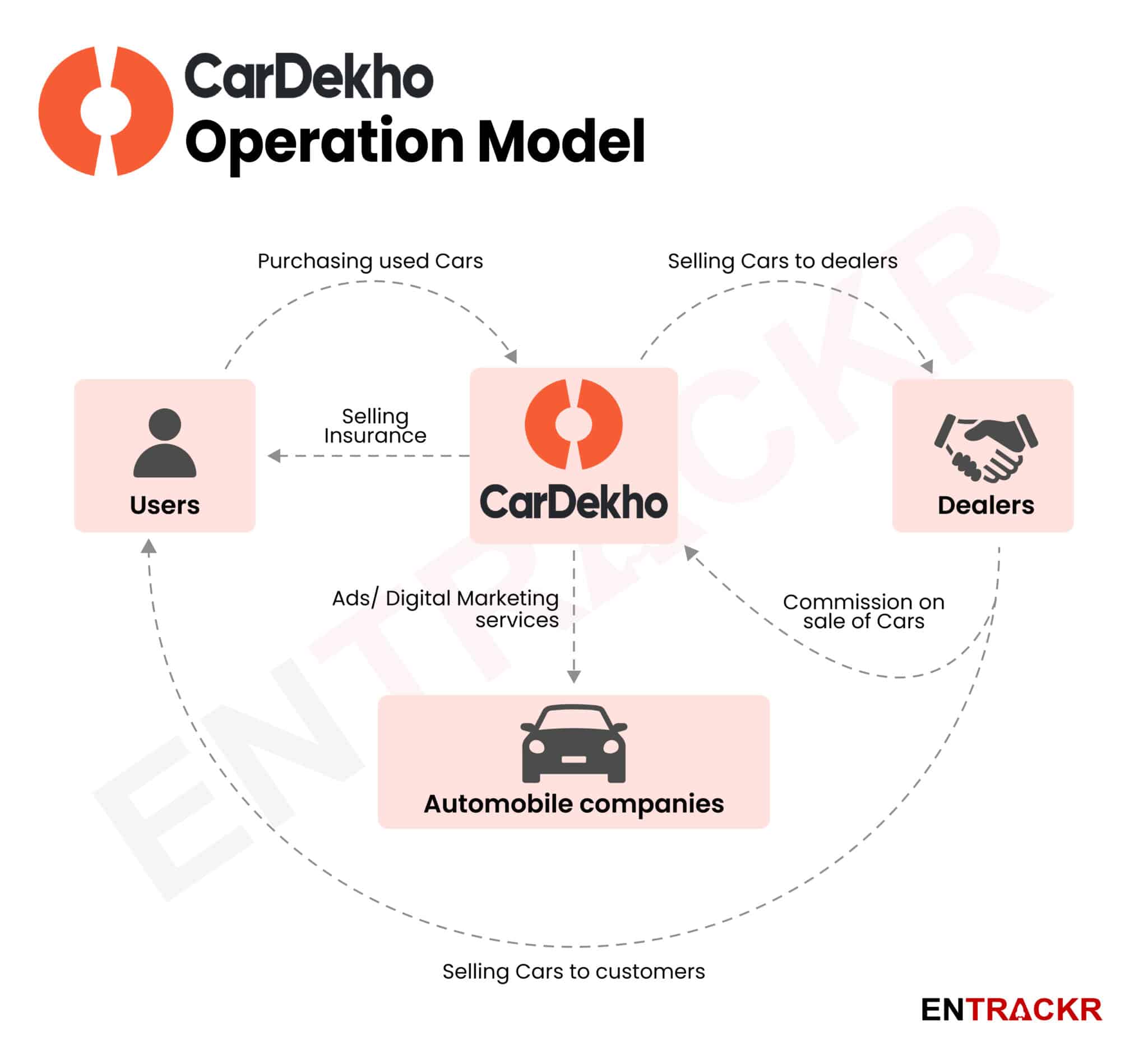

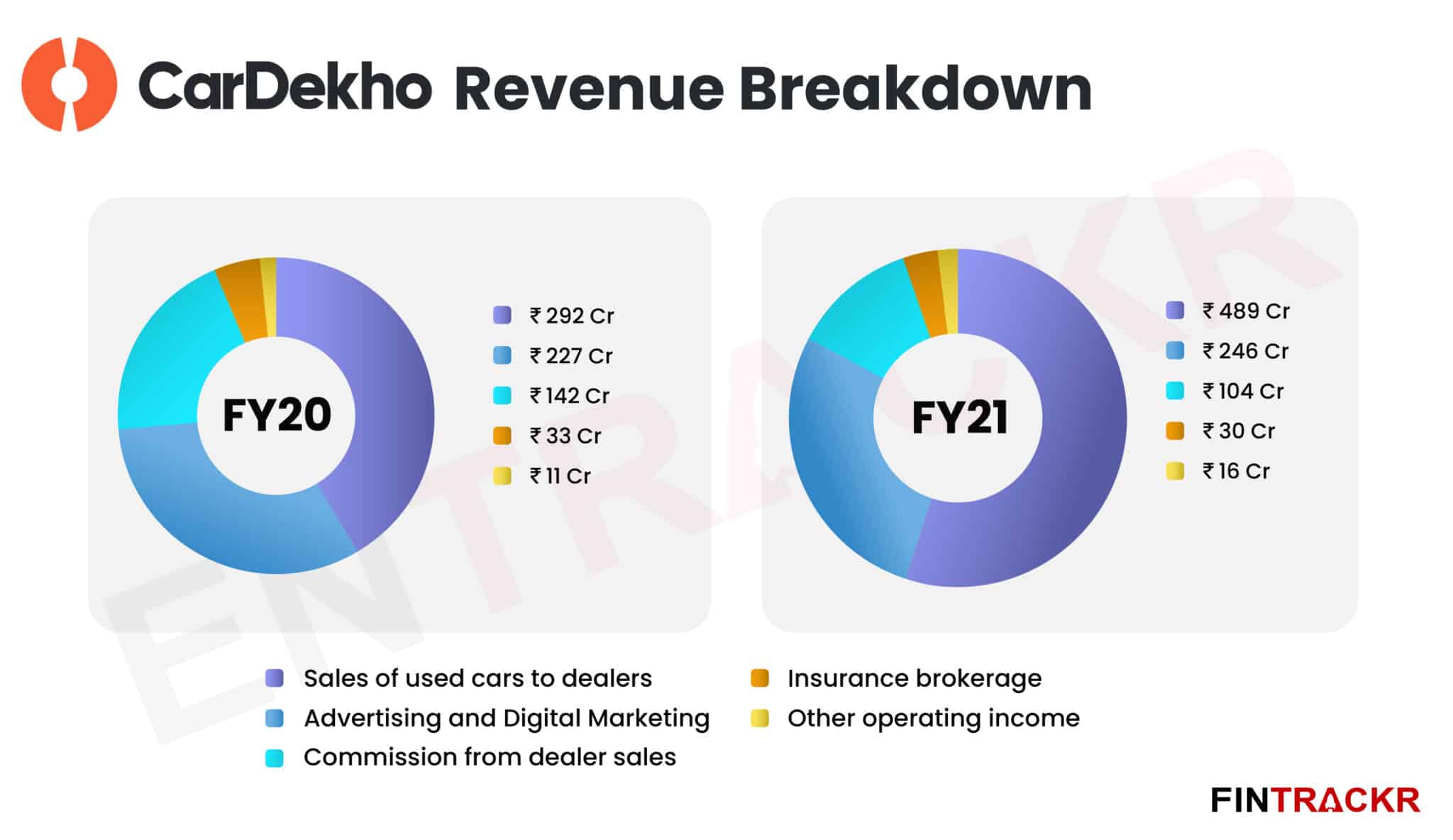

The Sequoia-backed company has multiple revenue streams around the sale and purchase of used cars and ancillary services. CarDekho purchases cars from the users of its platform to eventually sell them to user car dealers across India and this vertical accounted for 55.3% of total operating revenue. This revenue soared 67.4% to a little over Rs 489 crore during FY21 from Rs 292.3 crore in FY20.

Further, the company also provides lead generations and transaction facilitation services to used car dealers selling cars to end users on its platform. Commission earned from these sales accounts for 12% of annual revenues and dropped by 27% YoY to Rs 104 crore during FY21.

At the start of FY20, CarDekho had launched its own insurance brokerage vertical to sell insurance to users on its platform and this brokerage makes up around 3% of its annual revenues. The insurance vertical was also hit by Covid-19 disruptions and collections dropped by 10% to Rs 30 crore in FY21 from Rs 33 crore earned in FY20.

The company also provides advertising and digital marketing solutions to OEMs and dealers fetching 27.8% of the company’s operating revenue. Growth of this vertical remained flat, with collections increasing by only 8% to Rs 245.5 crore in FY21 from Rs 227.4 crore earned in FY20.

Along with the above-mentioned revenue sources, CarDekho also generated income from other ancillary services such as call centres and software development. Such revenue jumped 39.5% to Rs 15.96 crore in FY21 from Rs 11.44 crore in FY20. The company also earned Rs 51.7 crore from its financial assets, pushing total income to a little over Rs 936 crore during the fiscal ended in March 2021.

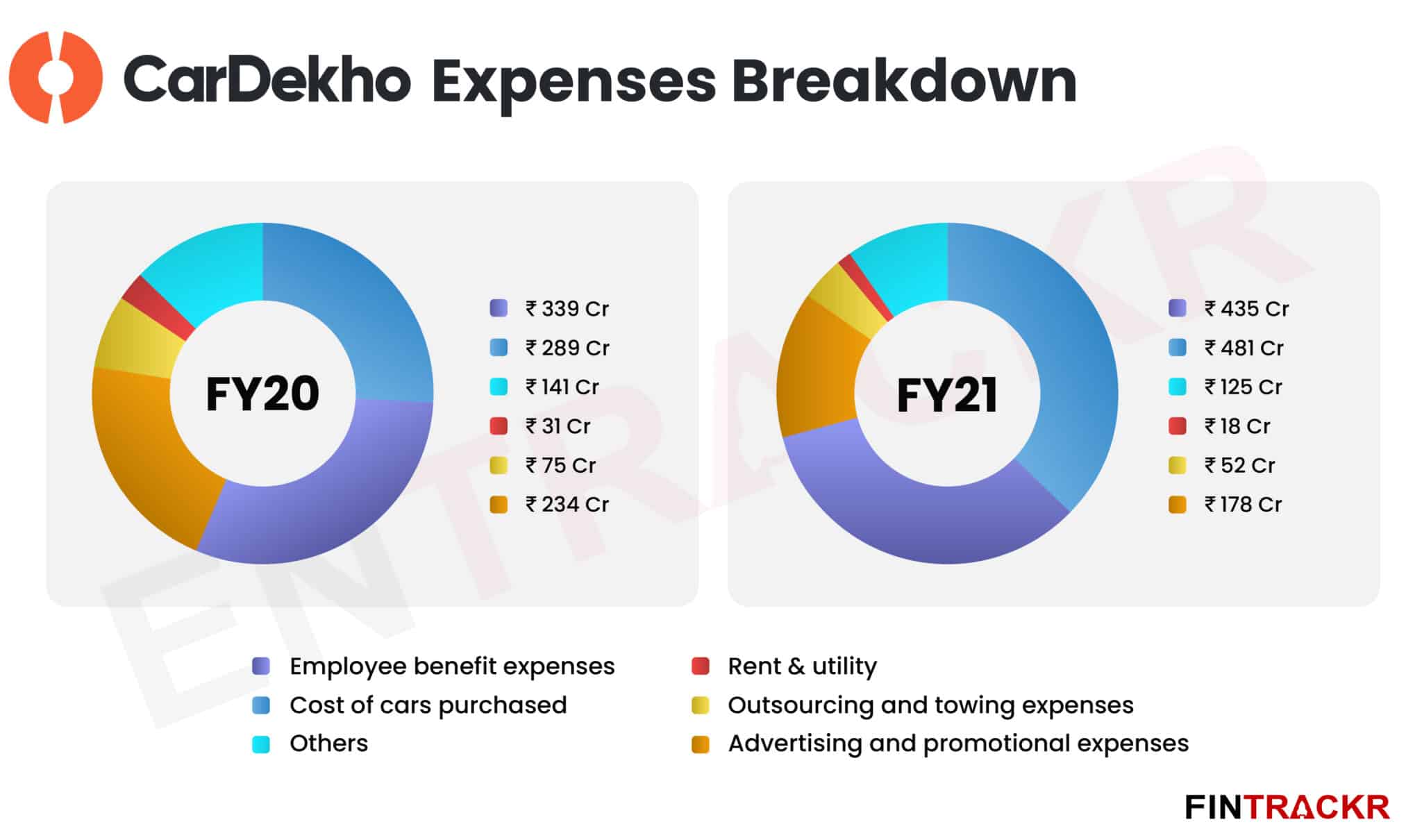

Its core activity, purchasing of used vehicles stood out as the largest cost centre for the company, accounting for 37.6% of the annual expenses. This cost of acquiring used car stock grew by 66.2% to nearly Rs 481 crore in FY21 from Rs 289.4 crore spent in FY20.

At the start of FY21, CarDekho laid off over 200 employees to conserve resources but its overall staff costs still grew by 28.3% to Rs 434.7 crore in FY21 from Rs 338.8 crore during FY20. Importantly, this cost also included share-based payments of Rs 97.07 crore, making up 22.3% of employee benefit payments.

CarDekho also slashed its advertising and promotion budget by 24% which stood at Rs 177.6 crore in FY21 as compared to Rs 233.75 crore spent during FY20. Outsourced manpower and towing costs also shrank by 31% to Rs 52 crore in FY21 from Rs 75 crore in the preceding fiscal year whereas the company spent Rs 11.25 crore towards legal and professional fees.

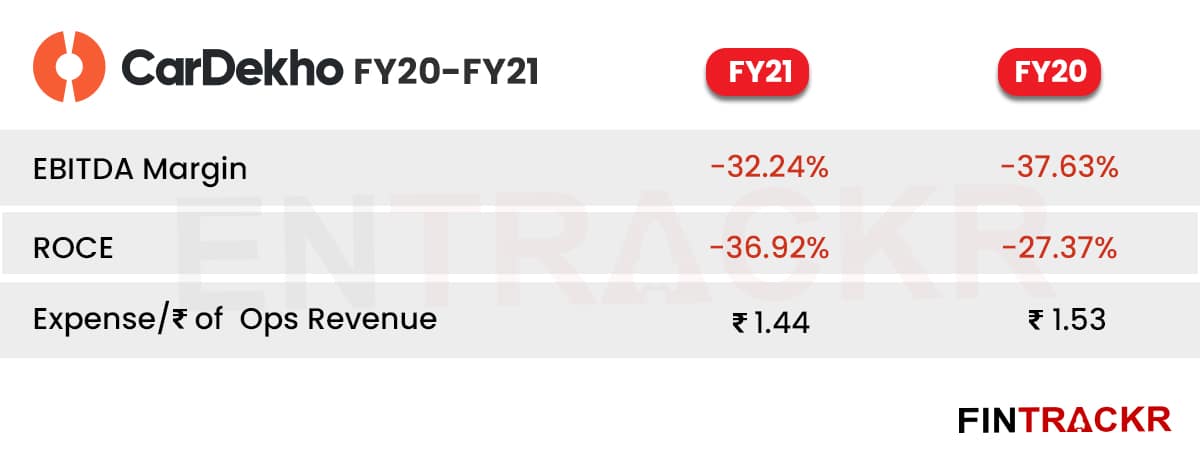

Keeping in line with the revenue, CarDekho’s expenses grew 18.2% to Rs 1,277.62 crore in FY21 as compared to Rs 1,080.93 crore in the previous fiscal year (FY20). With a slight improvement in its unit economics, the company spent Rs 1.44 to earn a single unit of operating income.

While CarDekho’s losses merely grew by 5% to Rs 342.87 crore in FY21 from Rs 326.46 crore in the previous financial year, its EBITDA margin stood at -32.25% and the firm still has a long way to breakeven.

The cash outflow from operations decreased 18% to Rs 313.45 crore and its balance sheet sported outstanding losses of Rs 1,126.61 crore by the end of March 2021.

CarDekho has managed to grow 20% in FY21 and this made the company different from its biggest rival Cars24 which saw 13% reduction in its scale. Cars24’s income in the last fiscal year stood at Rs 2,717.9 crore as compared to Rs 3,108.8 crore in FY20.

Droom is yet to file its annual financial statements for FY21 but the company had clocked less than Rs 15 crore in income in FY20. Spinny which turned unicorn with Tiger Global backing last year had grown 2.21X to Rs 25.28 crore in FY21 whereas its losses ballooned 44.8% to Rs 110.27 crore.

The used car or pre-owned market in India, despite the advent of so many well-funded startups, has remained a market with a poor reputation for prospective buyers. That’s one reason why the old-established offline brokers have not quite gone away, simply shifting their work to any of the online platforms they align with based on incentives. It’s a failure for so many of the unicorn startups that they haven’t quite managed to scale up to offer an end to end solution that is completely in their control, even as they continue to haemorrhage cash.

CarDekho has been aggressive in seeking direct business, as many people who have been called by their telecallers will confirm. But building a solid and profitable model remains a challenge for the foreseeable future, even as whole new categories like EV’s emerge to offer fresh opportunities.