Disney+Hotstar(D+H) has been the guiding light in Walt Disney Company’s Indian portfolio, becoming one of the market leaders among OTT platforms operating in the country with a monthly active user base of 227 million during the last fiscal (FY21). The app has also stood out for the clear lead over the competition, especially other OTT apps from Zee, Sony et al.

The company has enjoyed this viewership primarily due to the live streaming of cricket matches on its platform facilitated by Star India’s $944 million deal signed with BCCI back in 2018. While demand for streaming services was at an all-time high during the pandemic hit last fiscal year, Disney+Hotstar growth was almost flat during FY21.

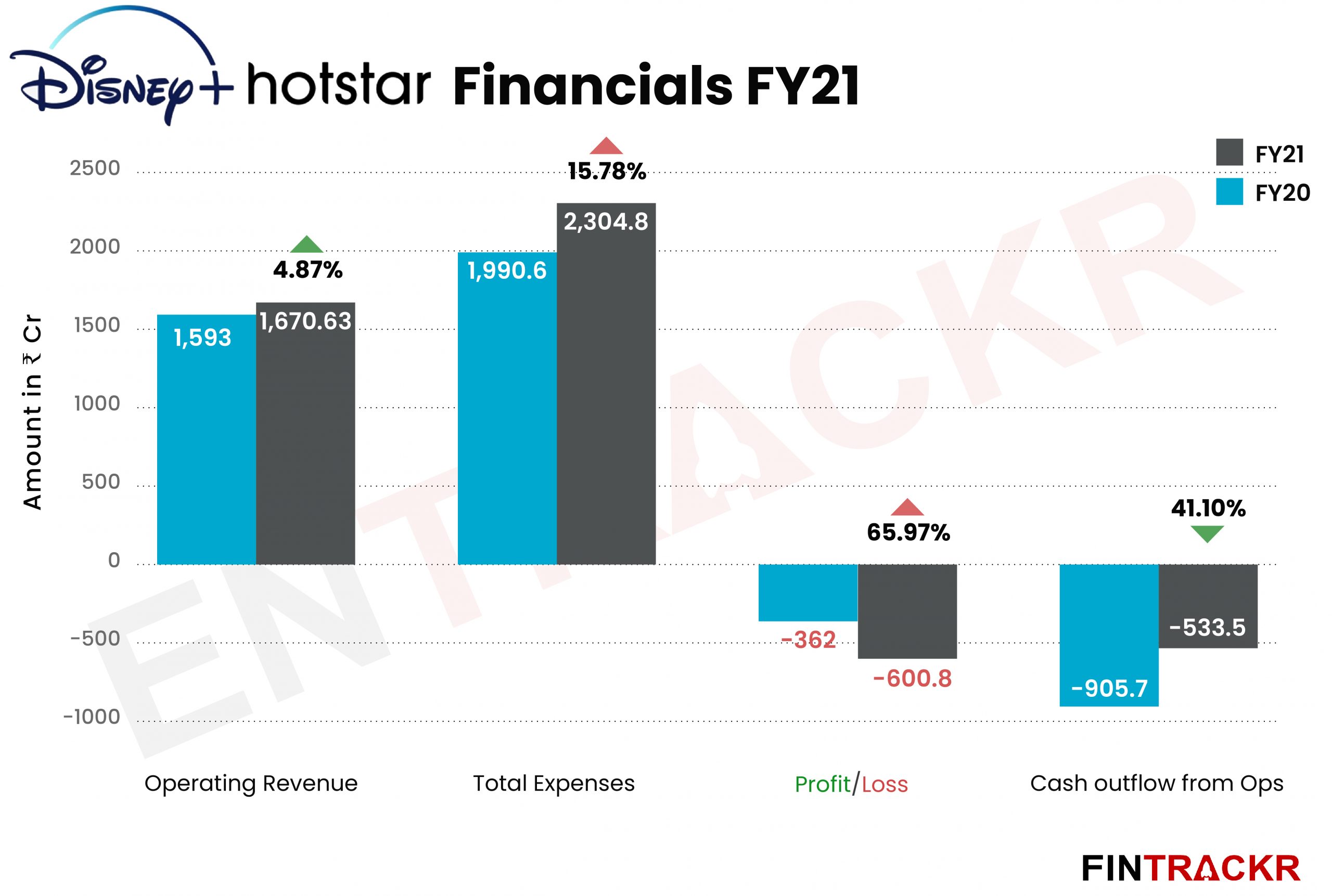

According to its financial statement filed with RoC, Disney+Hotstar has generated operating revenue of Rs 1,670.63 crore during FY21, registering a tepid 5% growth as compared to FY20 collections of Rs 1,593 crore.

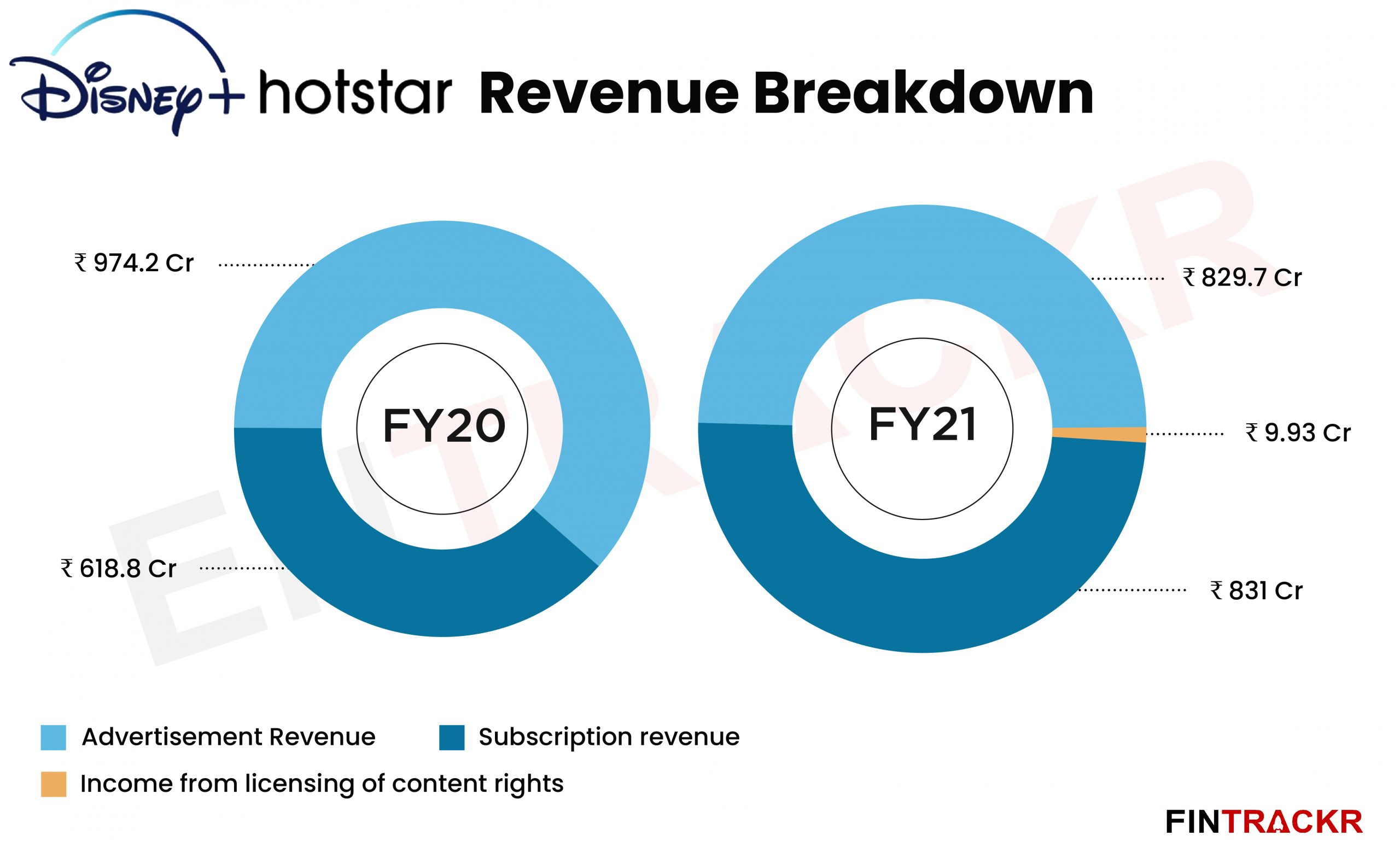

Disney+Hotstar is available for free download across app stores and boasts 400 million downloads but its exclusive content including sports streaming is only available to paid subscribers. Subscription revenue made up 50.04% of the company’s operating revenue, growing by 34.3% YoY to Rs 831 crore during FY21.

Disney+Hotstar is available for free download across app stores and boasts 400 million downloads but its exclusive content including sports streaming is only available to paid subscribers. Subscription revenue made up 50.04% of the company’s operating revenue, growing by 34.3% YoY to Rs 831 crore during FY21.

The fiscal year 2020-21 was the first financial year when Disney+Hotstar’s subscription revenue has outshone its revenue from advertising. Advertising revenue actually contracted by nearly 15% YoY to Rs 829.7 crore during FY21 as brands curtailed back on their advertising budgets during the fiscal affected by the Covid-19 pandemic.

Disney+Hotstar also earned Rs 9.93 crore from licensing of content rights during FY21.

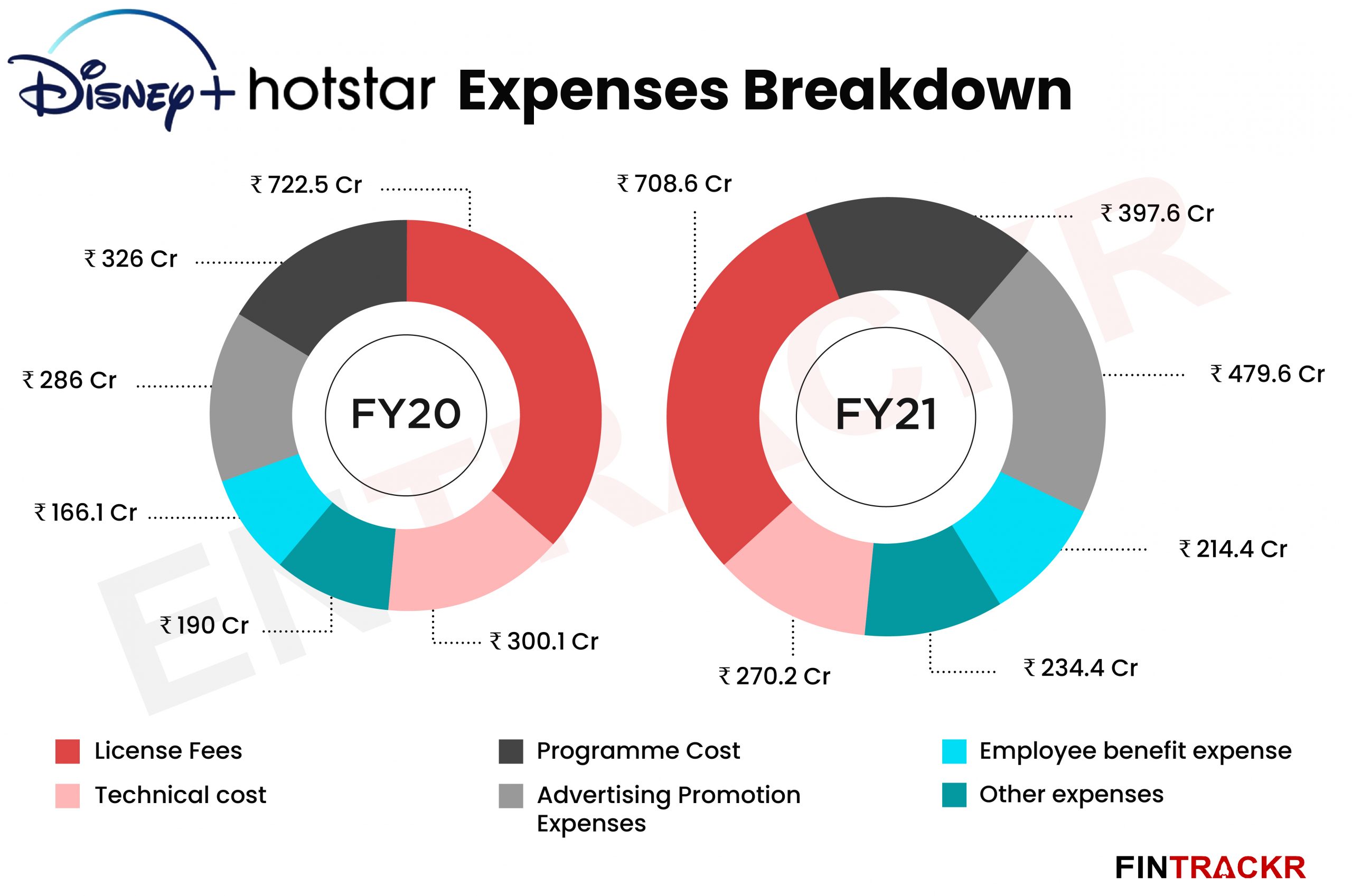

The OTT platform streams a large number of sporting tournaments in eight languages and naturally licensing fees was the largest cost incurred by the company in FY21. Such costs amounted to Rs 708.6 crore during the last fiscal year, making up 30.74% of annual costs.

Disney+Hotstar also claims to have over 100k hours of content spanning TV shows, short-form content through its ‘Quix’ feature. The company spent Rs 397.6 crore on producing content for its platform in FY21, 22% more as compared to Rs 326 crore in FY20. These costs accounted for 17.3% of annual expenses incurred by the company.

Disney+Hotstar spent 9.3% of its annual costs on employee benefit expenses which grew by 29.1% to Rs 214.4 crore during FY21 from Rs 166.1 crore paid out in FY20. Technical costs incurred by the streaming platform saw a 10% drop, reducing to Rs 270.2 crore during FY21.

A hike in nominal subscription prices also saw a huge push for acquiring subscribers through tie-ups with telecom operators and more to keep subscriber additions momentum. Accordingly, advertising and promotional expenses accounted for nearly 21% of the company’s annual expenditure and are the only cost that saw a substantial upsurge during FY21. Such costs blew up 68% to Rs 479.6 crore during FY21 as compared to Rs 286 crore in FY20.

A hike in nominal subscription prices also saw a huge push for acquiring subscribers through tie-ups with telecom operators and more to keep subscriber additions momentum. Accordingly, advertising and promotional expenses accounted for nearly 21% of the company’s annual expenditure and are the only cost that saw a substantial upsurge during FY21. Such costs blew up 68% to Rs 479.6 crore during FY21 as compared to Rs 286 crore in FY20.

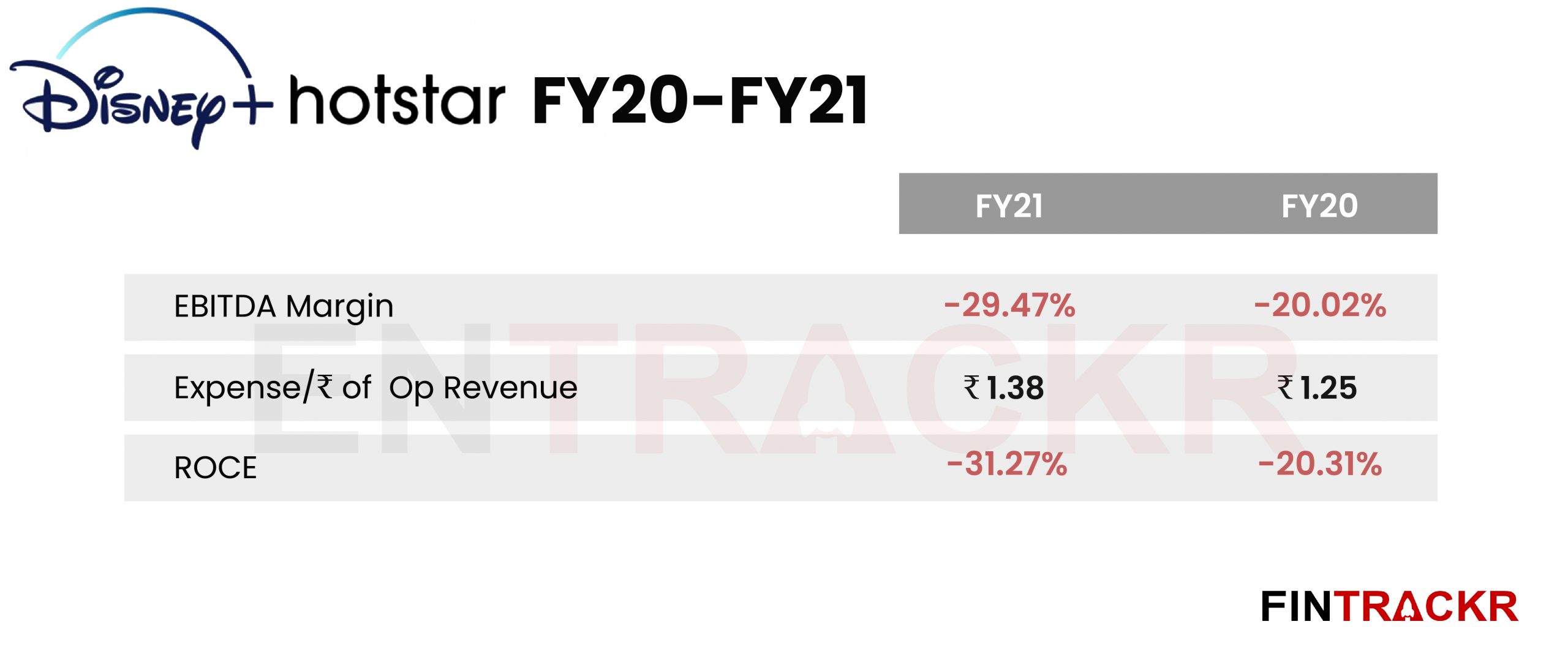

Overall, the company’s aggregate annual costs have inflated by 15.8% to Rs 2,304.8 crore during FY21 from Rs 1,990.6 crore total during FY20. On a unit level, Disney+Hotstar spent Rs 1.38 to earn a single rupee of revenue during FY21.

Due to the slump in growth, the OTT platform’s annual losses have inflated by 66% YoY to Rs 600.8 crore. One silver lining is that its cash outflow from operations has actually improved by 41.1% to Rs 533.5 crore in FY21 as compared to cash outflows of Rs 905.7 crore during FY20.

Disney+Hotstar’s EBITDA margins worsened by 945 BPS to -29.47% during FY21 and the balance sheet sported outstanding losses of Rs 2,888.6 crore as on 31 March 2021. In FY 22, the firm will count on renewals at the enhanced prices, an advertising surge from the ICC T20 World Cup, and overall cost control to keep the overall improvement going.

Disney+Hotstar’s EBITDA margins worsened by 945 BPS to -29.47% during FY21 and the balance sheet sported outstanding losses of Rs 2,888.6 crore as on 31 March 2021. In FY 22, the firm will count on renewals at the enhanced prices, an advertising surge from the ICC T20 World Cup, and overall cost control to keep the overall improvement going.