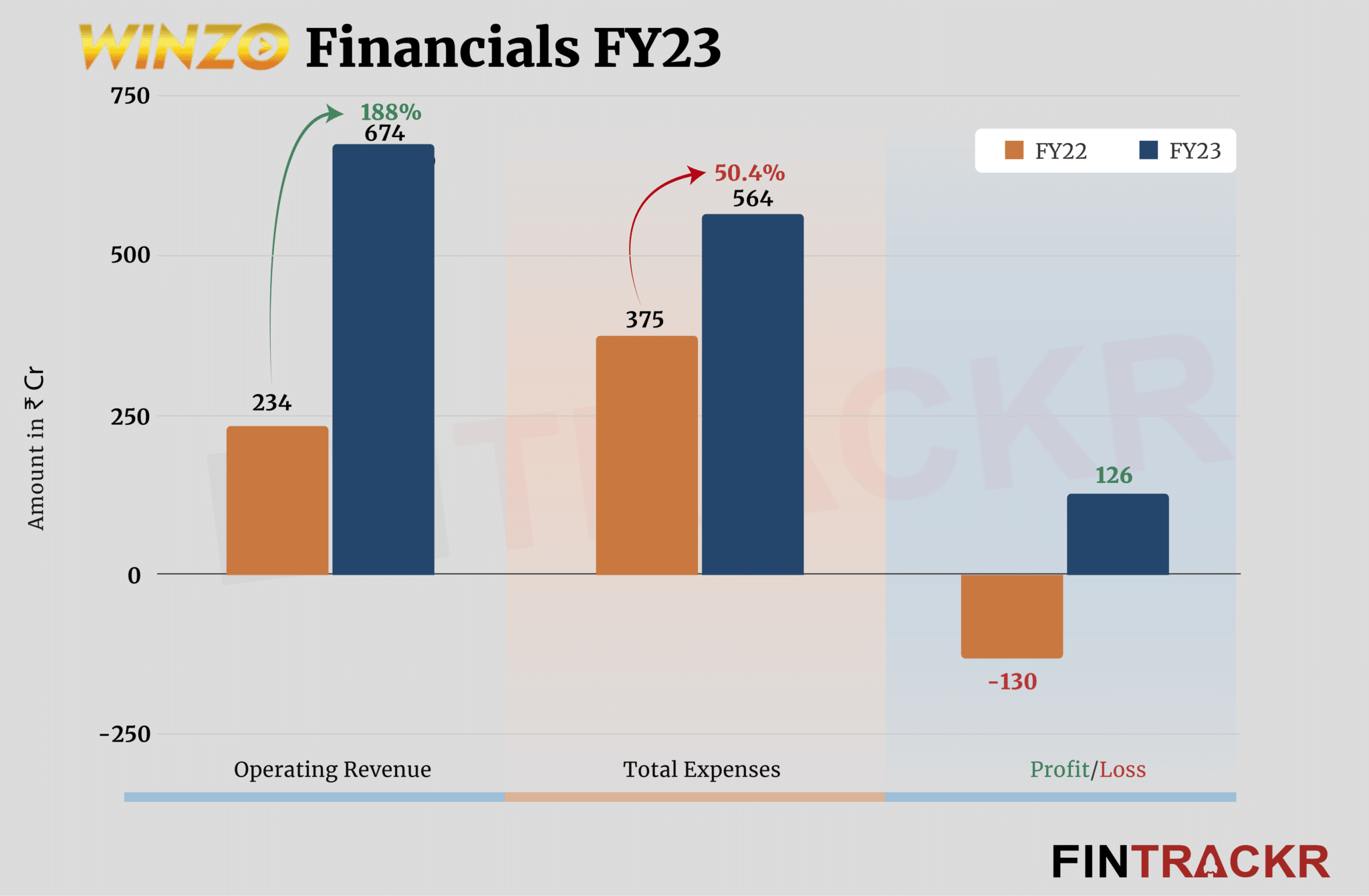

Online gaming startup Winzo registered 2.8X growth in its scale during the fiscal year ending March 2023. Significantly, the Delhi-based company also posted a hefty profit of Rs 126 crore in the same period.

Winzo’s revenue from operations surged to Rs 674 crore in FY23 from Rs 234 crore in FY22, its consolidated financial statements filed with the Registrar of Companies show.

Established in 2018, Winzo offers over 100 games across categories such as strategy, sports, casual, card, arcade, racing, action, and board games. The service fees levied on the total funds involved in real money games, and the sale of digital or in-app vouchers were the only revenue drivers for Winzo. The company also made Rs 16.78 crore from interest (non-operating), taking its total revenue to Rs 691 core in FY23.

Similar to every online gaming platform, Winzo spent a major chunk (46% of its total expenditure) on marketing (advertising cum promotions). This cost surged 29.6% to Rs 258 crore in FY23.

The firm’s burn on employee benefits, legal-professional, commission paid to agents, direct gaming costs, and other overheads catalyzed its overall expenditure to Rs 564 crore in FY23 from Rs 375 crore in FY22.

See TheKredible for the complete expense breakdown.

Expense Breakdown

https://thekredible.com/company/winzo-games/financials

View Full Data

https://thekredible.com/company/winzo-games/financials

View Full Data

- Employee benefit

- Information technology

- Legal professional

- Commission paid to other selling agents

- Advertising promotional

- Gaming related direct cost

- Others

Caveat: We have excluded the cost of financial liabilities designated at fair value through profit and loss (CCPS) while calculating the total expenses for both years (FY23 and FY22).

That said, a notable jump in scale helped Winzo report Rs 126 crore profit in FY23 as compared to a loss of Rs 130 crore in FY22. Its ROCE and EBITDA margin improved to 27% and 19% respectively. On a unit level, the company spent Rs 0.84 to earn a rupee in FY23.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | -53% | 19% |

| Expense/₹ of Op Revenue | ₹1.60 | ₹0.84 |

| ROCE | -39% | 27% |

Winzo has raised around $100 million to date including a $65 million Series C round led by California-based Griffin Gaming Partners in July 2021. According to the startup data intelligence platform TheKredible, Makers Fund is the largest external stakeholder with 15.77% followed by Griffin Gaming Partners and Courtside Ventures.

The significant jump in profits for Winzo underscores the best case scenario for most gaming platforms today. A high fixed cost business till it achieves critical mass in terms of users and fees, and post that, very low cost increases, as most of the incremental money goes to the bottomline. For Winzo, however, future investments will beckon soon, both in terms of new game development as well as the high marketing spends, which it will find tough to tamp down for now. But with a growing gamers user base across the country and with itself, next only to China, maintaining margins may not be as tough. You can be sure that if it does so in FY24, India will have its next high growth Unicorn from gaming to talk about.