Coffee chain firm Third Wave Coffee secured $35 million led by homegrown private equity firm Creaegis in September last year. The funding was followed by its notable growth in scale during FY23.

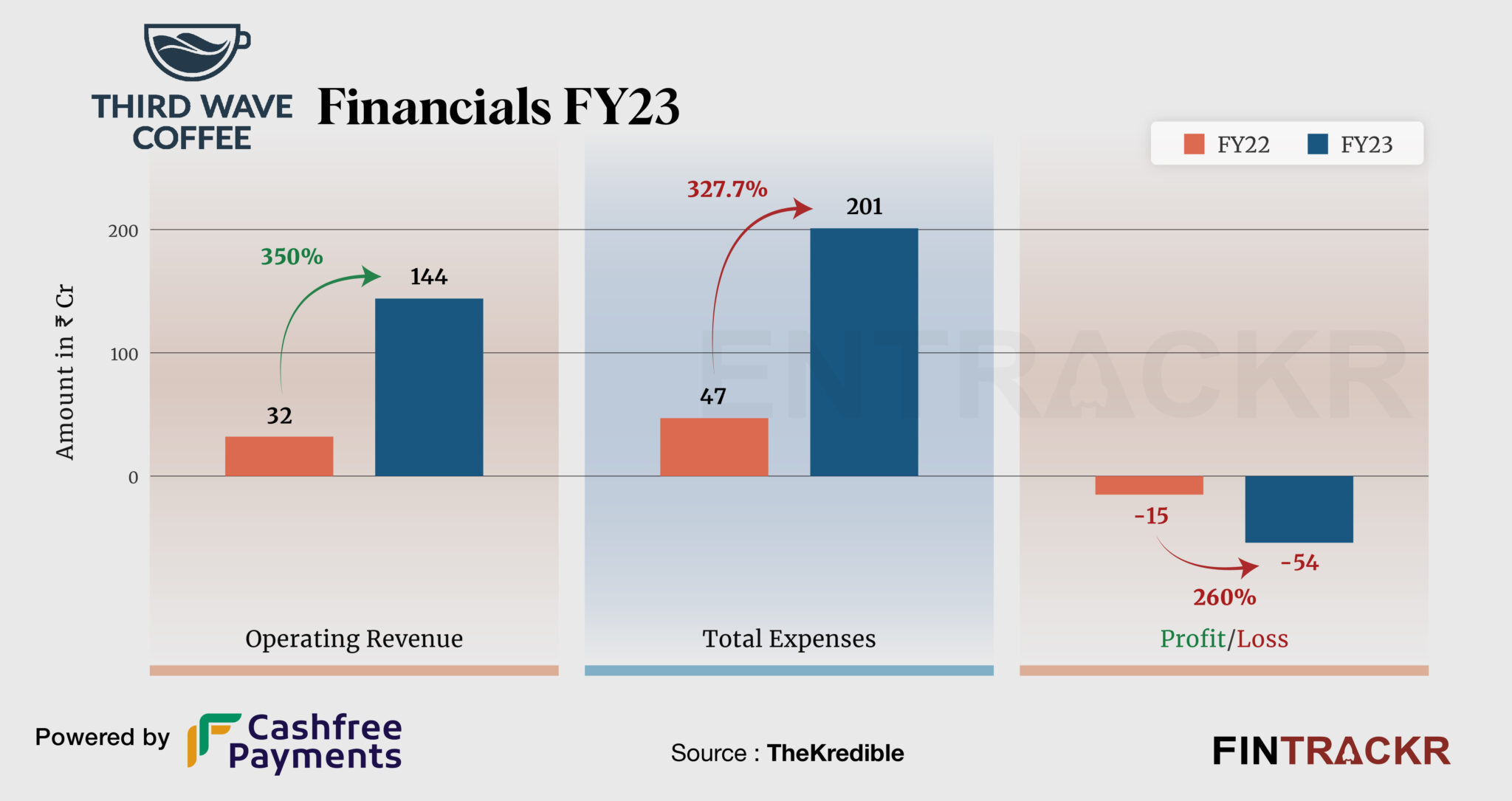

Third Wave’s revenue from operations surged 4.5X to Rs 144 crore in the fiscal year ending March 2023 as compared to Rs 32 crore in FY22, its annual financial statements filed with the Registrar of Companies show.

Just like StarBucks, Third Wave Coffee offers curated food menus and handpicked coffee, and has over 90 cafes across Hyderabad, Coonoor, Bengaluru, Delhi (NCR), Mumbai, Chandigarh, and Pune.

The firm claims to have about 109 stores, of which 50% are operational in Bengaluru.

Income from the sale of coffee and food items were the two revenue sources for TWC. The firm also made Rs 2 crore from the interest on bank deposits which took its total income to Rs 147 crore in FY23.

For Third Wave Coffee, its employee benefits emerged as the largest cost center accounting for 28.8% of the firm’s overall expenditure. This cost surged 3.8X to Rs 58 crore in FY23 from Rs 15 crore in FY22.

Third Wave Coffee’s costs of procurements (coffee and food materials), rent, legal, freight-logistics, marketing, and other overheads took its total expenditure to Rs 201 crore in FY23 from Rs 47 crore in FY22.

See TheKredible for the detailed expense breakup.

Expenses Breakdown

https://thekredible.com/company/third-wave-coffee/financials

View Full Data

https://thekredible.com/company/third-wave-coffee/financials

View Full Data

- Cost of materials consumed

- Employee benefit

- Rent

- Legal professional

- Travelling conveyance

- Transportation distribution

- Discounting charges

- Selling and marketing

- Others

The increase in employee benefits and rent led its losses to increase 3.6X to Rs 54 crore in FY23 from Rs 15 crore in FY22. Its ROCE and EBITDA margin improved to -38% and -25.9% respectively. On a unit level, TWC spent Rs 1.40 to earn a rupee in FY23.

Third Wave has raised over $66 million to date including its $35 million Series C round in September last year. According to the startup data intelligence platform TheKredible, WestBridge Capital is the largest external stakeholder with 32.62% followed by Creaegis. As per Fintrackr’s estimates, its enterprise value to revenue multiple is 8.86X as of FY23.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | -38% | -25.9% |

| Expense/₹ of Op Revenue | ₹1.47 | ₹1.40 |

| ROCE | -47% | -38% |

Towards the end of current fiscal year (FY24), Third Wave Coffee went through a tough phase as it laid off more than 100 employees soon after the $35 million fundraise. The company’s chief executive Sushant Goel also moved to a board role and Rajat Luthra, former head of KFC India and Nepal, was appointed as the new CEO. Goel had 7.89% stake in Third Wave Coffee.

It competes with Blue Tokai, Sabko Coffee, Rage Coffee, Slay Coffee, Sleepy Owl, and Seven Beans Co., among others. Its closest competitor Blue Tokai registered Rs 129 crore in revenue with Rs 42 crore loss in FY23.

While the mushrooming of coffee chains is not a surprise considering the rapid urbanization and aspirational whiffs around these, the sector has an unusual amount of volatility for the hospitality segment. Coffee chains by default seek the premium end of the market, leaving an opportunity for smaller setups to grab share in the lower price points, and perhaps even eventually add lower priced coffee to their offerings. Doing it all with an aura of cool can be a deadly combination for the newer coffee chains, and something they should watch out for.