Event-based trading platform Probo registered hyper-growth in the last fiscal year with its operating scale blowing up 32X in FY23. Significantly, the Peak XV-backed firm also turned profitable for the first time during the said period.

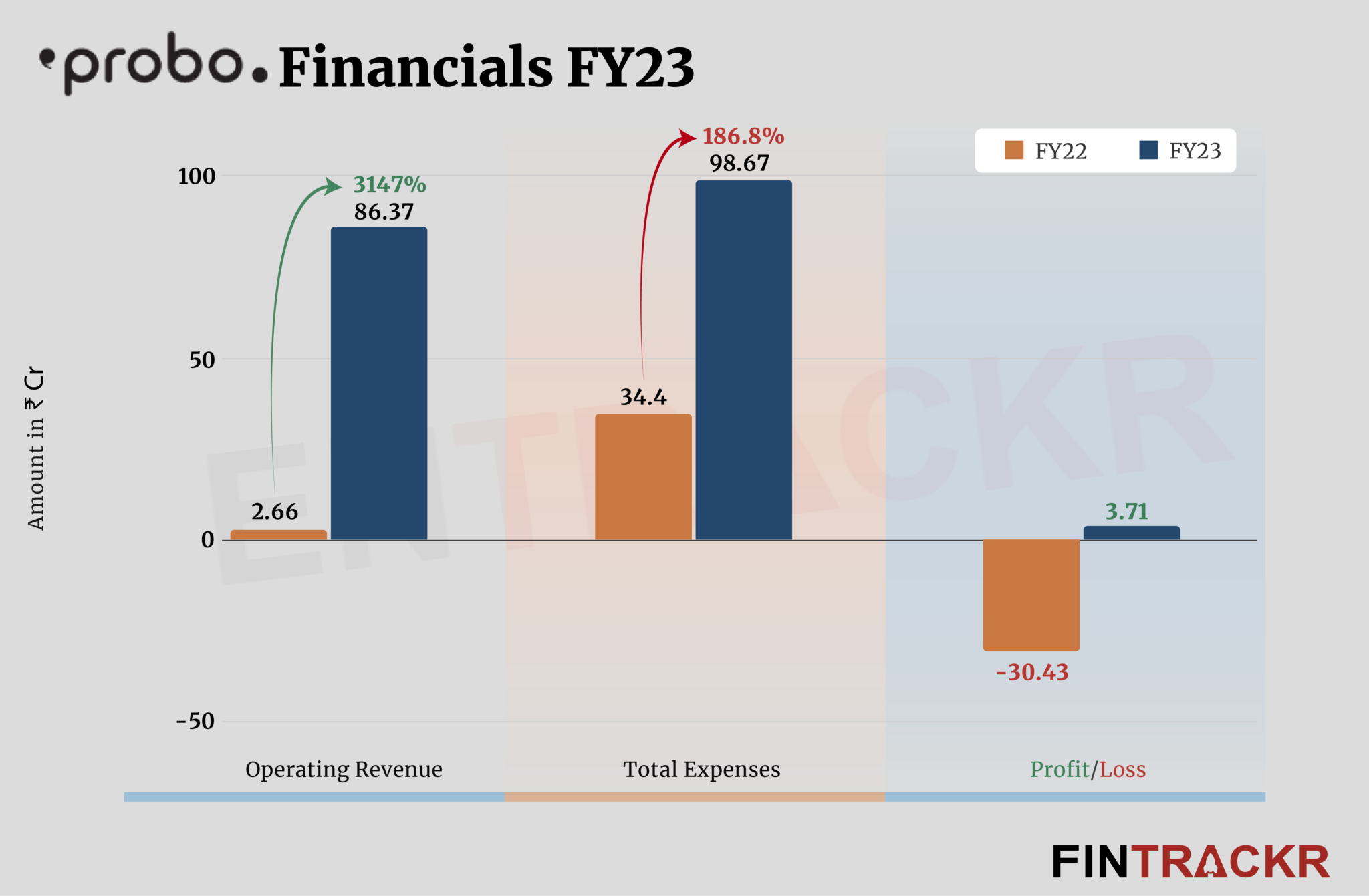

Probo’s revenue from operations skyrocketed to Rs 86.37 crore in FY23 from Rs 2.66 crore in FY22, according to its annual financial statements filed with the Registrar of Companies (RoC).

Founded by Sachin Gupta and Ashish Garg in 2019, Probo is an event trading platform that allows users to trade their opinions on future events in various categories such as cricket, politics, football, finance, entertainment, and startups among others.

Platform fees received from the users for participating in the contest were the primary source of income, accounting for 96% of the total operating revenue in the last fiscal year. Collection from this segment grew 34.2X to Rs 83 crore in FY23. Its allied services and interest income on long-term investments (non-operating activities) tallied Probo’s total revenue to Rs 93.83 crore in FY23 from Rs 3.97 crore in FY22.

It’s worth noting that this income didn’t fall under the new General Service Tax (GST) structure which mandates a charge of 28% GST on deposits. The new taxation regime is slated to eat up a significant margin of companies like Probo, MPL, and Dream11, among many others.

Revenue Breakdown

https://thekredible.com/company/probo/financials

View Full Data

Moving to the cost sheet, its advertising cum promotional cost formed around 52.75% of the total expenses which shot up 2.3X to Rs 52 crore in FY23. Probo also saw a 3.6X surge in its employee benefits.

The firm’s burn on information technology, legal/professional, conveyance, and other overheads led its overall expenditure up by 2.8X to Rs 98.67 crore in FY23 from Rs 34.4 crore in FY22.

Head to TheKredible for a detailed expense breakup.

Expense Breakdown

https://thekredible.com/company/probo/financials

View Full Data

https://thekredible.com/company/probo/financials

View Full Data

The multifold scale and controlled expenditure helped Probo to turnaround its fundamentals and register a profit of Rs 3.71 crore in FY23 as compared to Rs 30.43 crore loss in FY22. It’s worth highlighting that the company has booked a deferred tax of Rs 8.55 crore during FY23. Excluding this, Probo’s bottom line is still in red at Rs 4.84 crore.

Its ROCE and EBITDA margin recorded at -2% and -4.6% respectively. On a unit level, it spent Rs 1.14 to earn a rupee in FY23.

Probo has raised around $28 million across several rounds. According to the startup data intelligence platform TheKredible, Peak XV is the largest external stakeholder with 21.72% followed by Elevation Capital and The Fundamentum Partnership. Its co-founders Gupta and Garg cumulatively command 45.5% stake in the company.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | -761% | -4.6% |

| Expense/₹ of Op Revenue | ₹12.93 | ₹1.14 |

| ROCE | -17% | -2% |

The ‘prediction’ business remains a very young, although promising avenue for growth in India. As the market evolves, expect the industry to change too, creating many winners and losers, somewhat like their users like to predict. For Probo, the experience it has already acquired along with a user base, besides the obvious advantage of low to zero burn now, positions the firm very well to build on this base.