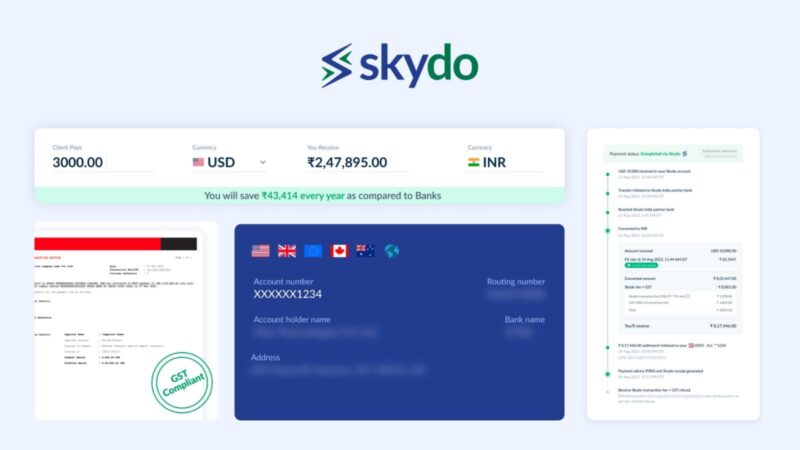

Bengaluru-based fintech firm Skydo makes cross-border B2B payments hassle-free and addresses the challenges of high processing fees and delayed settlements in overseas transactions.

Founded in 2022 by former Ola executives Movin Jain and Srivatsan Sridhar, the company aims to tap into the massive market of cross-border payments currently dominated by global players like PayPal and Stripe.

We spoke to Co-Founder and CEO Sridhar to learn more about Skydo, what distinguishes it from the competition and the roadmap ahead. Here are the edited excerpts

How did you come up with the idea of Skydo?

My co-founder Movin Jain and I used to work together at Ola. This was about six years back, and we’ve been good friends since then. I’ve worked with many companies. My first corporate role was with McKinsey, followed by working with startups and in between, for about six years, I ran my family-owned business. Movin has been an engineering and product guy and most recently, before we started, he was with PhonePe, leading the payments platform. So given that I have been a manufacturing exporter myself, I know the problems that exporters face in terms of receiving overseas payments while dealing with other business operations. But I never thought about it consciously until we started brainstorming about the space we had to build in.

Given Movin’s recent stint, he was very excited about the value of technology in improving payments. Combined with my experiences around overseas payments and the desire to solve them, we started digging deeper into the actual issues faced by exporters at the ground level. After our initial research, we realized that this real problem is worth solving and there is a large enough market for us. That led to the genesis of Skydo.

What are the key challenges in payments and exports, cross-border payments that have not been addressed yet and how do you plan to address them?

Until 20-30 years ago, inter-entity payments were slow and cumbersome, often involving manual processes like cheque writing. International wire transfers were particularly sluggish and document-heavy. However, the likes of PayPal are now facilitating online transactions globally.

Conventional banking systems have also significantly improved their infrastructure, with the inclusion of faster payment systems within the country. This robust infrastructure, coupled with various payment options, enables companies like us with the right tools to address unsolved customer challenges.

Moreover, consumers now expect instant payments, regardless of geography though varying regulations across countries cause confusion and complexity. Simplifying and standardizing compliance procedures can enable seamless international payments and business transactions.

While companies like Skydo are lowering costs, there still remains room to tackle margins through technological solutions. While issues like Forex hedging and treasury management exist, addressing these concerns should be the next frontier in the payments landscape.

Can you take us through Skydo’s performance since inception?

So we started the company exactly two years back in March of 2022. It took us about seven months to launch the product after our first set of partnerships and approvals came. We launched in November 2022 with a small pilot batch and since January of 2023, we have been gradually and systematically scaling the business.

Today, we have onboarded close to 2,500 businesses, and currently, our rate of acquiring new businesses is almost 500 to 600 every month. So the customer base has doubled at the end of March from what it was at the end of December 2023.

And I think this pace of growth is going to be sustained now. If I look at the total payments processed, we are currently processing about $50 million of payments. This again is growing quite strongly and I think by the end of next year, that is March of 2025, we hope to be processing over $750 million of payments annually. That is the kind of scale that we are looking at.

What are your goals in terms of product and business expansion?

In the short term, we want to really scale and hold a very large market share for Indian small businesses. I think that will keep us busy for the next couple of years at least. We will also follow this up with multiple product features that will be required to make this happen — more countries with local collections, enabling credit card payments, enabling two-way payments both from India to outward and export payments that exist today and so on. There’s an entire product roadmap that will support this growth in India.

We will also be looking for multiple licenses throughout the world. We have applied for and are awaiting the approval of the payment aggregator license that RBI gives for cross-border companies. In addition, we will be looking for multiple licensing in other geographies that will allow us to slowly and steadily expand to more corridors beyond India, which is a slightly longer-term plan. Apart from payments, the diversification is primarily into software to begin with. Over time, when we have a very large scale, we might diversify into commerce as well as working capital. But that is very long term.