Managed accommodation provider Stanza Living raised $57 million in debt led by Kotak Mahindra and RBL Bank just before FY23. The fundraise helped the company hack around four-fold growth in the fiscal year ending March 2023.

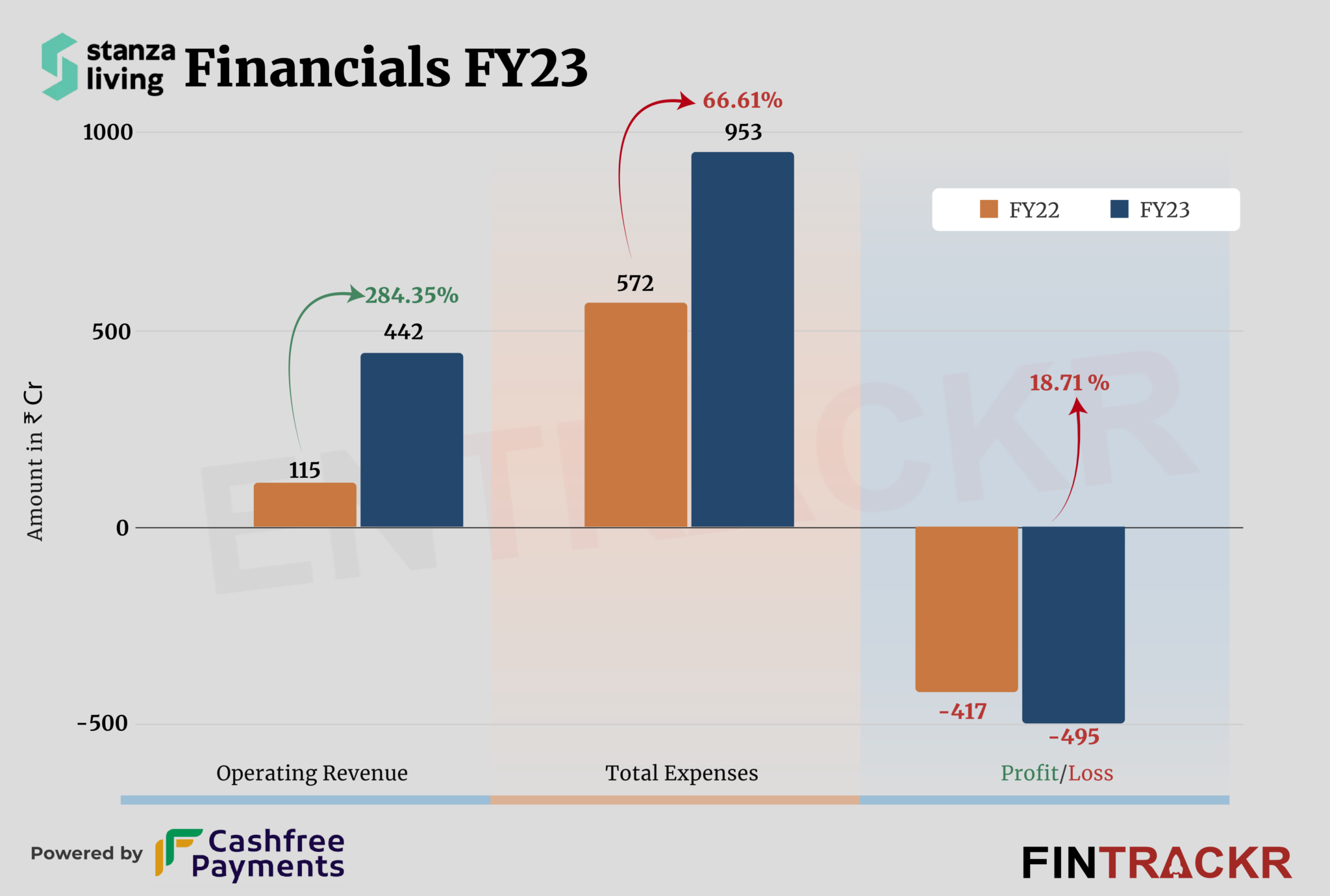

Stanza Living’s revenue from operations surged to Rs 442 crore in FY23 from Rs 115 crore in FY22, its consolidated financial statements filed with the Registrar of Companies show.

Stanza Living is a managed accommodation platform which provides co-living solutions for working professionals and students. The firm claims to have an inventory of more than 75,000 beds in 450 plus residences with a presence across 24 cities.

Rental accommodation was the primary source of revenue for Stanza Living. Income from food, annual maintenance charges, and other allied services are some other revenue drivers for the Delhi-based firm. The company also earned Rs 16 crore from interest on investments in FY23.

Turning to the cost side, its employee benefits emerged as the largest cost center forming 27% of the overall expense. This cost increased by 14.3% to Rs 255 crore in FY23 from Rs 223 crore in FY22. Due to the lease, its finance and depreciation costs grew to Rs 187 crore and Rs 218 crore respectively during the last fiscal year.

Stanza Living’s electricity, safety, legal-professional, marketing, and other overheads took its overall expenditure up by 66.6% to Rs 953 crore in FY23 from Rs 572 crore in FY22.

Expense Breakdown

https://thekredible.com/company/stanza-living/financials

View Full Data

https://thekredible.com/company/stanza-living/financials

View Full Data

- Employee benefit

- Depreciation

- depletion and amortisation

- Finance costs

- Electricity expenses

- Advertising promotional

- Legal professional and travelling

- Safety security

- Others

See TheKredible for the detailed expense breakup.

The decent scale helped Stanza Living control its losses which increased by 18.71% to Rs 495 crore in FY23 as compared to Rs 417 crore in FY22. Its ROCE and EBITDA margin improved to -21% and -19.7%, respectively. On a unit level, it spent Rs 2.16 to earn a rupee in FY23.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | -148% | -19.7% |

| Expense/₹ of Op Revenue | ₹4.97 | ₹2.16 |

| ROCE | -25% | -21% |

Stanza Living has raised over $180 million across rounds and was valued at around $430 million in its last equity round. According to the startup data intelligence platform TheKredible, Alpha Wave (formerly Falcon Edge) is the largest stakeholder with 26.62% shares followed by Matrix Partners and Accel.

With a strong available base of beds, a presence across 24 cities, and a well oiled system in place presumably, Stanza seems well placed to grow strongly now, in a market that is rated to be a high growth one for the coming decade. The formula really seems to be simply for it now. Increase occupancy levels, to take the average per bed figure up, and keep rightsizing operations carefully based on response.