Payments technology firm Juspay has been consistent in its scale with 85% YoY growth in the last two fiscal (FY23 and FY22). At the same time, the SoftBank-backed company kept a tight rein on its losses which remained almost unchanged in the fiscal year ending March 2023.

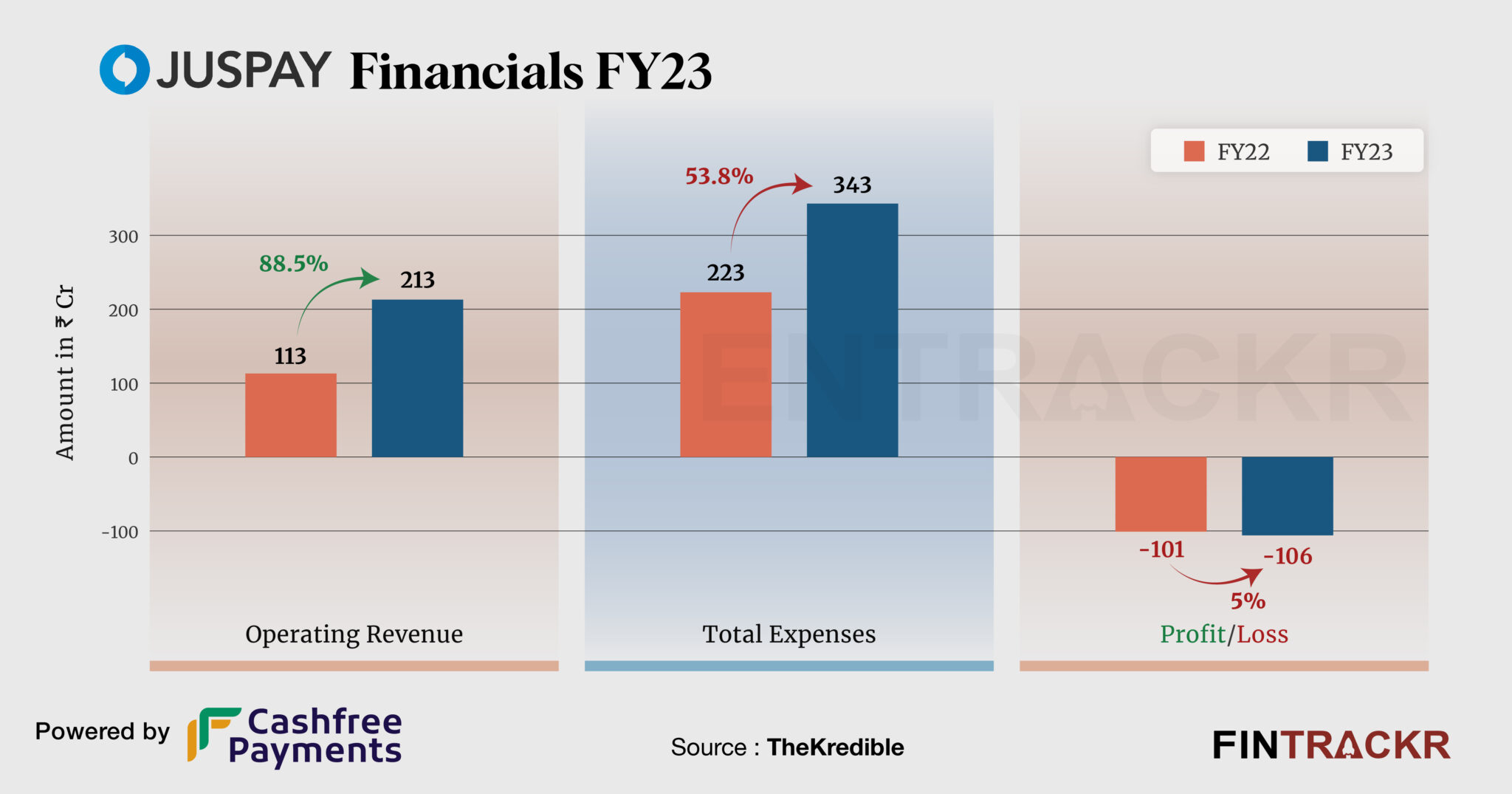

Juspay’s revenue from operations grew 88.5% to Rs 213 crore in FY23 from Rs 113 crore in FY22, its annual financial statements filed with the Registrar of Companies show.

Juspay offers payment processing technology to merchants and is working behind offline payment solutions. Its flagship products include Juspay Safe, HyperSDK, Express Checkout, and UPI in a Box.

It claims to process over 100 million transactions with an annualized TPV (total payment value) of more than $500Bn. Payment platform integration and related services were the primary source of revenue for Juspay. The company also earned Rs 24 crore from interest on non-current and current investments which tallied Juspay’s total income to Rs 213 crore during the previous fiscal year (FY23).

Similar to other payments companies, its employee benefits emerged as the largest cost center forming 62% of the overall expenditure. This cost surged 70% to Rs 214 crore in FY23 from Rs 126 crore in FY22. This includes 54 crore as ESOP cost which is non-cash in nature.

Juspay’s expenses on rent, information technology, legal professional, advertising, and overheads took its overall cost up by 53.8% to Rs 343 crore in FY23 from Rs 223 crore in FY22. Check TheKredible for a detailed expense breakdown.

Expenses Breakdown

https://thekredible.com/company/juspay/financials

View Full Data

https://thekredible.com/company/juspay/financials

View Full Data

- Employee benefits

- Rent

- Information technology

- Legal professional

- Others

The impressive scale with a tight control on expenses helped Juspay control its losses which increased only by 5% to Rs 106 crore in FY23 as compared to Rs 101 crore in FY22. Its ROCE and EBITDA margin improved -21% and -40.9% respectively. On a unit level, the Accel Partners-backed firm spent Rs 1.61 to earn a rupee in FY23.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | -80% | -40.9% |

| Expense/₹ of Op Revenue | ₹1.97 | ₹1.61 |

| ROCE | -24% | -21% |

The Bengaluru-based company secured over $85 million across rounds including a $60 million round led by SoftBank in 2021. According to the startup data intelligence platform TheKredible, Accel is the largest external stakeholder with 12.39% followed by VEF VC and SoftBank.